Most stock pickers underperformed in 2022's 'stock picker's market'

This post was originally published on TKer.co

It remains incredibly difficult to generate returns in the stock market that beat (or outperform) a passively managed fund tracking the S&P 500.

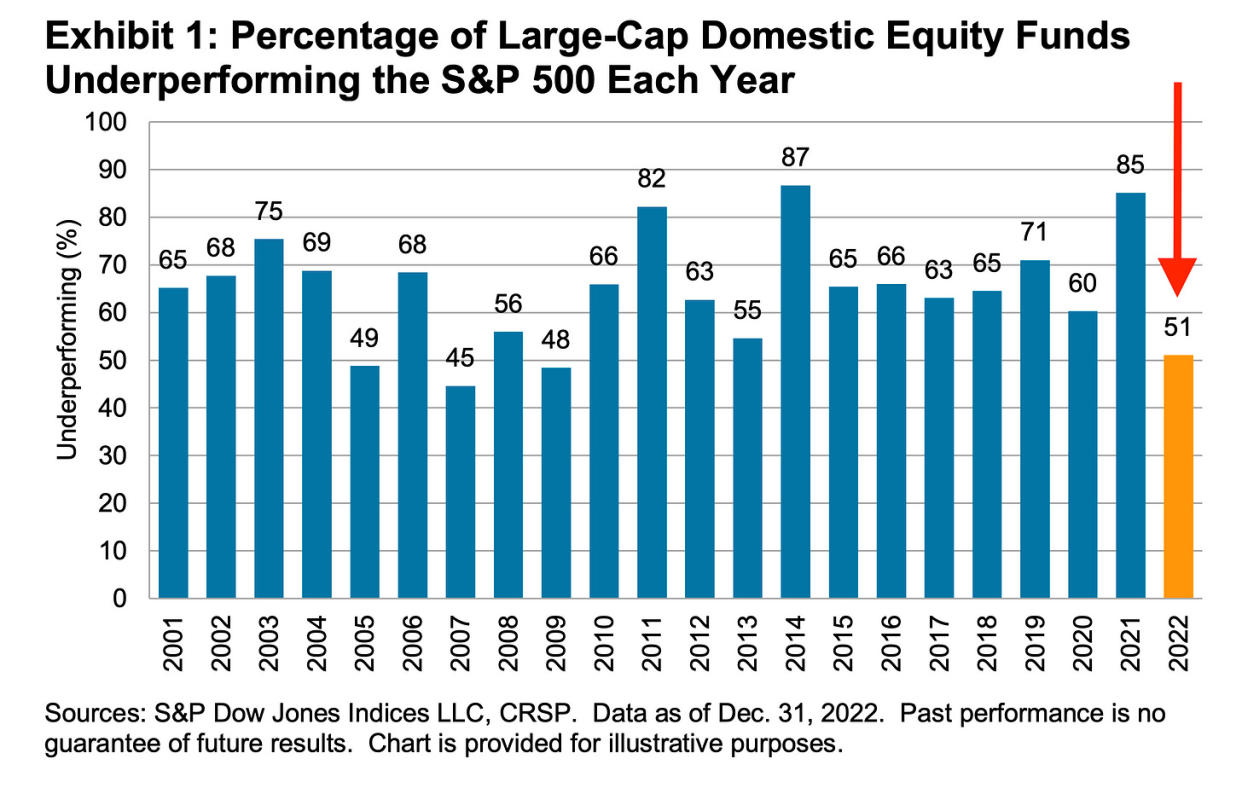

According to S&P Dow Jones Indices (SPDJI), 51.1% of U.S. large-cap equity fund managers underperformed the S&P 500 in 2022 — despite the fact that the S&P itself fell into a bear market during that period.

“Declining markets can make active management skills more valuable, and our 2022 scorecard identifies several fund categories in which a majority of active managers outperformed,” SPDJI analysts led by Tim Edwards wrote on Tuesday. “However, in the largest and most closely watched category, U.S. large-cap equities, a slim majority underperformed.”

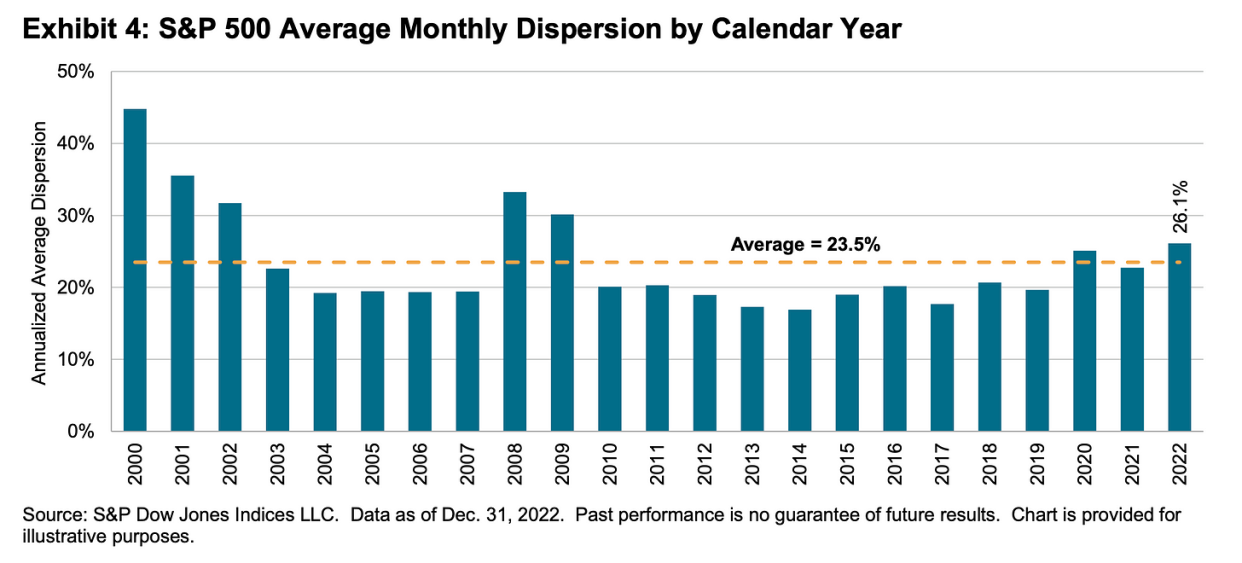

During the year, the dispersion of returns among S&P 500 constituents was relatively high.¹

In other words, S&P 500 stocks were moving more independently of each other than usual, a condition that you might characterize as a “stock-picker’s market.”

“Of course, higher dispersion does not guarantee better performance; it indicates a greater opportunity for embarrassment as well as glory,“ the analysts noted.

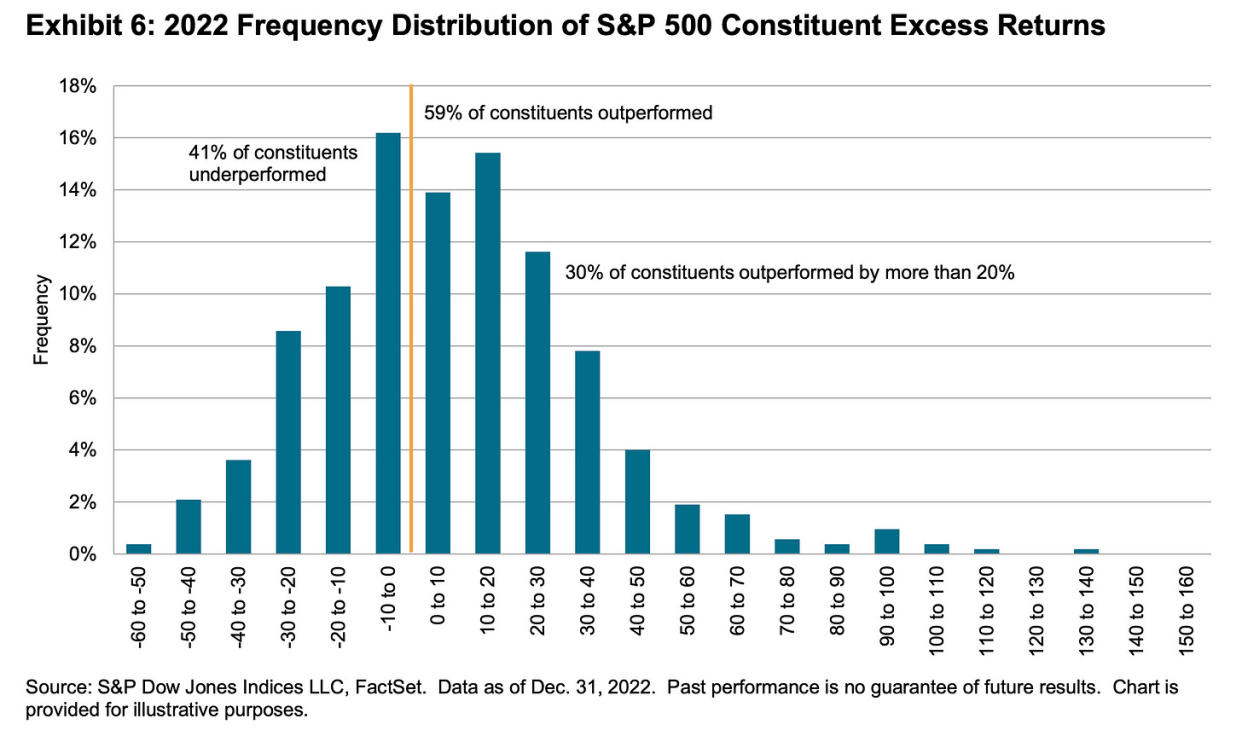

One thing that was particularly interesting about 2022 was that most constituents of the S&P 500 outperformed the index itself. This is unusual. From SPDJI (emphasis theirs):

Exhibit 6 provides a final perspective on the relatively abundant prospects for concentrated active U.S. large-cap “stock-pickers,” even for those hypothetically selecting stocks at random. In most years for the past two decades, and over the full period, a majority of S&P 500 constituents underperformed the index itself. In contrast, Exhibit 6 shows that in 2022, a manager selecting a random stock would have had a 59% chance of beating the S&P 500 and a 30% chance of outperforming the S&P 500 by 20% or better — compared with a 41% chance of selecting an underperformer and just a 15% chance of picking one that lagged by 20% or worse.

In other words, those picking stocks based on coin flips were statistically likely to beat the market in 2022. For better or worse, SPDJI’s data suggests most active fund managers weren’t picking stocks this way.

For what it’s worth, 2022 was a big improvement from 2021, when 85.1% underperformed.

Nevertheless, it follows 12 consecutive years in which the majority of fund managers in this category have lagged the index.

Past performance is no guarantee of future results 📉

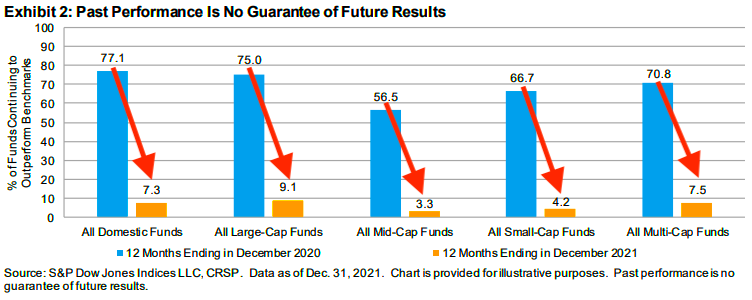

It’s great if you or your money manager are among the minority beating the market in recent periods.

However, outperformers rarely continue to outperform.

According to an SPDJI report published in April 2022, of the 29% of 791 large-cap equity funds that beat the S&P 500 in 2019, 75% beat the benchmark again in 2020. But only 9.1%, or 21 funds, were able to extend that streak of outperformance into 2021.

Mutual fund companies aren’t kidding when they publish that classic disclaimer: “Past performance is no guarantee of future results.”

One stat shows how hard it is to pick market-beating stocks 🎲

There are a lot of reasons it’s difficult to pick the right mix of stocks with the right weightings that’ll beat the market on a consistent basis.

One devastating reason is that it’s not a 50-50 shot that the stock you pick will outperform over time.

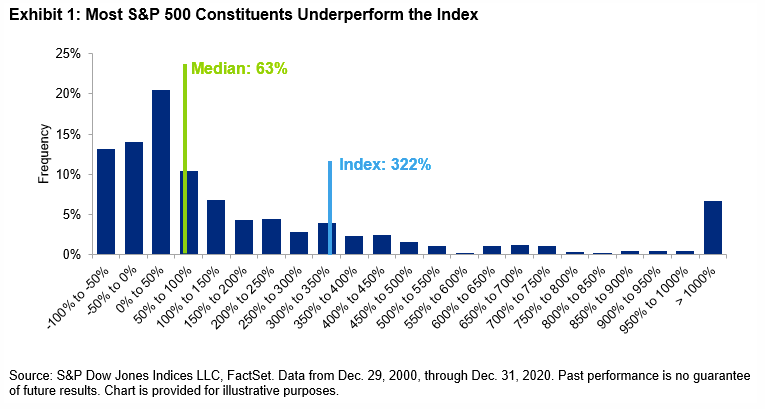

In a report published in 2021, SPDJI found that only 22% of the stocks in the S&P 500 outperformed the index itself from 2000 to 2020.

Over that measurement period, the S&P 500 gained 322%, while the median stock rose by just 63%.

It’s also worth noting that if you had a portfolio of stocks consisting of mostly underperformers and a few outperformers, this wouldn’t necessarily mean you’d be underperforming the index.

“This is because stock market returns tend to be positively skewed,” Craig Lazzara, managing director at SPDJI, wrote in that 2021 report. “Rather than being symmetrically distributed around an average, return distributions typically have a very long right tail; a relatively small number of excellent performers has a disproportionate influence on the market’s overall return.”

In other words, if your outperformers are way out on the right tail of the above chart, then they might be generating massive returns that more than offset all of the underperformance of the other stocks.

Unfortunately, very few² have a great track record at identifying the stocks that’ll become these “excellent performers.”

Maybe you can’t beat the market, but you can beat most pros 🤯

Taken together, everything you’ve read above makes a very strong case for passive investing, which can be pretty boring.

But in this particular context, boring can be sexy.

Barry Ritholtz, cofounder and CIO of Ritholtz Wealth Management, explained in a May 2022 blog post:

5. Consistent average returns turn into above-average returns over time. Howard Marks has discussed why typical managers who finish in the top 10% in any given year underperform over the long haul. They tend to be narrow and specific, and their sector/style/region goes in and out of favor. Bouncing between the top and bottom deciles is not a formula for long-term performance. Instead, consistently achieving a modest target in the middle will eventually turn in top quartile returns (or better).

This is a brilliant way of thinking about all these SPDJI studies. If only 9.1% of large-cap equity fund managers beat the S&P 500 from 2019 to 2021, then being in an S&P 500 index fund means you would’ve beaten about 91% of the pros during the period.

Managing expectations 😬

There’s nothing wrong with investing in specific businesses you believe in or stocks you think offer extraordinary value.

However, if your intention is to beat the market, you should manage your expectations.

Related from TKer:

Warren Buffett reminds us how picking winning stocks is extraordinarily hard 🤓

This disturbing S&P 500 stat actually makes the case for index investing 👀

How Warren Buffett’s disciples have evaded the ‘stealth bear market’ 🤌

¹ Here’s how SPDJI put it: “…the prospects for skilled stock-pickers in large-cap U.S. equities were above average and the tailwinds for even unskilled managers were unusually favorable. In demonstration of the former, Exhibit 4 shows that average S&P 500 monthly dispersion — a measure of the magnitude of differences among constituent returns and hence the opportunity set for skilled stock-picking — was at its highest annual level since 2009, which was also a year in which our scorecard reported relatively better underperformance rates among large-cap equity funds.“

² In his 2022 annual letter, stock-picking legend Warren Buffett explained: “Over the years, I have made many mistakes. … Our satisfactory results have been the product of about a dozen truly good decisions — that would be about one every five years.“

This post was originally published on TKer.co

Sam Ro is the founder of TKer.co. You can follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance