What Is a Money Order and How Does It Work?

A money order is a secure way to send up to $1,000. You can use this payment method as an alternative to cash, checks or payment apps. Whether you need to pay a bill or send money to a friend, money orders offer a safe, affordable way to do it.

Here’s what you need to know about money orders, including why you might need one, where to get one and how money orders work.

What Is a Money Order?

If you’ve ever needed to send a one-time payment to a business or government institution, you might have been asked to send a money order. This might sound like an outdated payment method, but it’s safe, affordable and easy to use. So, what’s a money order, exactly? And how do you get one?

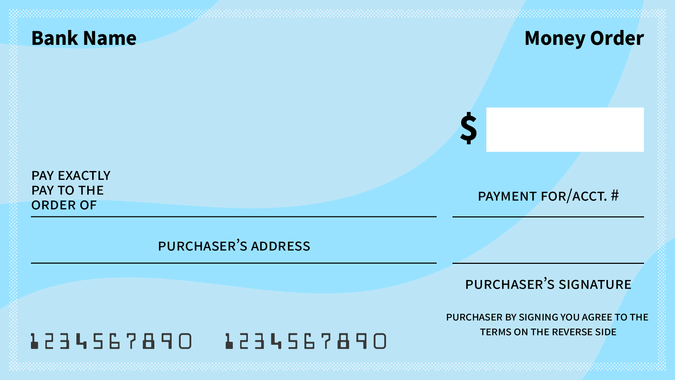

A money order is a form of payment printed on a piece of paper that looks similar to a check. Unlike a check, however, a money order is prepaid with cash or a debit card. You don’t need a checking account to send or receive a money order. That’s why it’s still one of the most commonly used payment methods among unbanked households in the U.S.

How Does a Money Order Work?

A money order functions like a check, with a few key differences.

To get a money order, you’ll have to go to a money order vendor, such as a post office, Walmart, bank or credit union. You pay the vendor in cash or with a debit card, and they will issue you the money order. Vendors charge a fee for this service.

Domestic money orders can be up to $1,000. If you need to send more, you may have to buy multiple money orders, each with its own fee. For international money orders purchased at post offices, limits vary by country but are generally no more than $700.

Once you have the money order in hand, you’ll fill in your name and the amount paid, then send or deliver it to the recipient. The recipient can cash or deposit the money order just like a check.

How Long Do Money Orders Take To Clear?

In some cases, a money order can post as soon as the same day it’s deposited in an account, with the funds available for next-business-day withdrawals.

When Do You Need a Money Order?

You may be wondering: What’s the advantage of a money order over other ways to send money? A money order may not be your first choice for payment, but it’s a secure, reliable option in many circumstances. Consider using a money order when:

You need to send a secure payment through the mail: Sending a money order is less risky than sending cash or a personal check. Unlike personal checks, money orders don’t have your personal information printed on them, so you can keep your identity safe.

A seller requires a money order as payment: Some sellers prefer money orders over other payment methods because they are safe, easy to cash and can’t bounce.

You don’t have a bank account: According to the Federal Deposit Insurance Corp., approximately 4.5% of American households are unbanked. Money orders are a secure payment option for unbanked or underbanked individuals.

You need to send money overseas: The U.S. Postal Service has agreements with many different countries to accept post office money orders as a form of payment. Your recipient can cash the money order in U.S. dollars or their local currency.

You’re worried about bouncing a check: A bounced check happens when you don’t have enough funds in your account to cover the amount on the check. Because money orders are funded in advance, they can’t bounce.

Pros and Cons of Money Orders

Just like other forms of payment, money orders have their advantages and disadvantages. Here are a few to consider.

Pros

Purchased amount is guaranteed

Easy to trace and possibly replace if stolen or lost

You don’t need a checking account to purchase one

Fees are generally inexpensive

Cons

Usually aren’t available in amounts over $1,000

Not as secure as a cashier’s check

How To Get a Money Order

You can buy a money order by visiting a bank, post office, Western Union or MoneyGram location, or a store that sells money orders. A quick search for “money orders near me” will show you where you can buy a money order in your area. Here’s what the process of buying a money order looks like:

Bring your money and identification to a bank branch or location that sells money orders.

Pay for the money order.

Fill out the money order. Spell the recipient’s name correctly and provide all requested information on the form.

Deliver or mail the money order to the recipient.

Keep the receipt until you confirm the recipient has cashed the money order. Your receipt can help you get a replacement if the money order is lost or stolen.

How Much Do Money Orders Cost?

The cost of a money order includes the actual amount of the money order plus a transaction fee. This fee varies depending on where you purchase the money order. Here are some examples of what a money order costs at different locations:

U.S. Postal Service: $2.10 for money orders up to $500; $3 for money orders up to $1,000

Kroger: Varies; typically $1 with a Shopper’s Card or $1.10 without a Shopper’s Card

Wells Fargo: $5 for all money orders

Walmart: Fees vary by location, with a $1 maximum fee

Where Can I Cash a Money Order?

You can cash a money order anywhere you would cash a check. Start with your bank or credit union — especially if you’re planning to deposit the funds. Supermarkets, convenience stores and check-cashing locations are other alternatives. Note that some stores will charge a fee to cash your money order.

Are Money Orders Safe?

Money orders are a safe alternative to cash, but that doesn’t mean they are risk-free. Here are a few ways to protect yourself when you choose to pay with a money order:

Completely fill out the money order: If you don’t fill out the name of the recipient, anyone can cash it.

Hold on to your receipt: You may need your receipt to track the money order or report it as lost or stolen.

Don’t cash money orders from people you don’t know: To protect yourself from scams, never accept a money order you aren’t expecting or from someone you don’t know. If you receive an unexpected money order, contact the sender before you cash or deposit it.

What Are Some Money Order Alternatives?

A money order is a helpful payment method in some situations, but it’s definitely not your only option. Here are a few safe, reliable money order alternatives. Note that some cost less than a money order but offer similar features.

Personal Checks

A personal check is a form of payment drawn on a bank account. Checks have some similarities to money orders but also offer some notable advantages, such as the following:

Convenience: You can write a check without leaving home.

Security: You can stop the payment of a check if it’s lost or stolen.

Record-keeping: Personal checks leave a paper trail, so you have proof of payment.

Cost: Many banks don’t charge customers for processing checks.

Cashier’s Checks

A cashier’s check is similar to a personal check or money order. Cashier’s checks are prepaid by the sender. They are issued by banks and can be purchased in higher amounts than money orders. Other advantages of cashier’s checks include:

Access: Cashier’s checks typically clear sooner than personal checks.

Security: Cashier’s checks usually have advanced security features like watermarks.

Wire Transfers

Wire transfers send money directly from one account to another. They are often used in real estate transactions and involve fees. Here are some advantages they offer:

Speed: The recipient has access to the money sooner than if you pay with a check or money order because it’s moved from one account to the other without interference.

Security: A wire transfer is more secure than sending cash.

Prepaid Debit Cards

Prepaid debit cards look and function like traditional debit cards. But the card isn’t linked to your checking account. Instead, you load money onto the card before you use it. Here are two advantages of this option:

Safety: Using a debit card is safer than carrying a large amount of cash.

Convenience: You can use a debit card to pay for purchases online or in contactless transactions.

Is a Money Order Right for You?

A money order is accessible and a safe choice for a one-time payment. However, it might not be the best choice if you want to instantly transfer funds or if you’re looking for a fee-free payment method for recurring bills.

If you think a money order is the best choice for your payment, head to your nearest money order provider to purchase one.

Quinlan Grim and Cynthia Measom contributed to the reporting for this article.

This article has been updated with additional reporting since its original publication.

This article originally appeared on GOBankingRates.com: What Is a Money Order and How Does It Work?