The missing pay raises

Help-wanted signs are up all over the country, and businesses say they can’t get enough workers. But there’s a missing piece in the nation’s so-called labor shortage: Rising pay.

The Labor Department's standard measure of pay, average hourly earnings, shows a 3.6% gain in pay during the last 12 months. That’s a bit higher than the trend prior to the coronavirus pandemic, but it’s also below inflation, which is 5.3%. Average hourly earnings have also been distorted by job losses during the pandemic, which were concentrated among lower-income workers. That caused an anomalous surge in earnings at the outset of the pandemic, because there was suddenly a larger portion of higher-paid workers. Then average earnings plunged as lower-income workers returned to their jobs.

[Do you run a business that can't get enough workers? Tell us about it.]

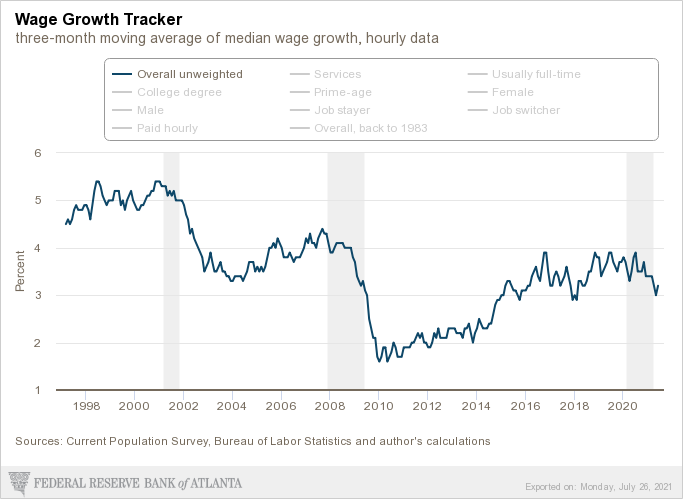

A more consistent measure, the Atlanta Federal Reserve’s wage tracker, shows wages up just 3.2% during the last year. Unlike the Labor Department measure, which surveys a different group of workers each month, the Atlanta Fed tracker follows the same workers over time. So it’s not affected by abrupt changes in the makeup of the labor force.

Labor shortages normally lead to rising pay, because companies have to boost wages to attract workers. And many big companies have said they’re raising starting pay. But there’s no sign of unusual pay gains in the Atlanta Fed’s data. As the chart below shows, wage gains have actually cooled off since last summer. And the latest average increase, 3.2%, is below the 5-year average from before the pandemic, which was 3.6%.

“If there were really a wage surge underway, you’d expect individual workers to be experiencing wage acceleration, as employers bid up pay in an effort to attract and retain workers,” Research firm TLR Analytics wrote in a recent analysis. “That’s not happening, at least for now.”

Another Labor Department survey shows 9.2 million job openings in May, a record in data going back to 2000. The number of workers quitting their jobs is also near a record high, which suggests workers are getting better offers and leaving one job for another that pays more. But the Atlanta Fed data undermines this narrative, as well.

The average pay increase for job switchers during the last 12 months is 3.6%—lower than the 5-year pre-pandemic average of 3.9%. The annual pay hike for workers staying in the same job is 3.1%, roughly the same as the 5-year average of 3%. These numbers counter the idea that workers are leaving current jobs for higher-paying ones. It’s possible the quit rate is elevated because workers are leaving the workforce instead of moving to another job.

These labor-market trends are important for several reasons. Rising labor costs often trigger worrisome levels of inflation, which is clearly a market concern now that annual inflation is more than 3 points above the Federal Reserve’s target of 2% or so. If inflation stays that high, the Fed may have to raise interest rates sooner than expected, to force inflation back down. But modest labor-cost increases could give the Fed more headroom to continue its easy-money policy.

There’s also the politically charged question of whether workers are getting ahead or falling behind as the economy recovers from the pandemic disruptions. Total economic output is probably back to pre-pandemic levels. But that’s with 6.7 million fewer workers than before the pandemic. And there are 9.5 million unemployed workers looking for a job, 66% more than before the pandemic.

With job openings and unemployed workers both around 9 million, it sounds as if there’s a job for everybody who wants one. It’s way more complicated than that. Many of the open jobs are low-paying retail or hospitality jobs that don’t require specialized skills. Many of the unemployed are looking for higher-paying jobs in fields where they have experience that should allow them to earn more. Job skills are not infinitely interchangeable.

Federal jobless benefits of $300 per week may be keeping some people out of the job market, but research by Yahoo Finance and many others suggests that critics overstate this problem. Subdued raises are another piece of evidence indicating the job market is lukewarm, not hot. There might be a lot of jobs, but nobody’s getting rich at them.

Rick Newman is the author of four books, including "Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. You can also send confidential tips, and click here to get Rick’s stories by email.

Read more:

Get the latest financial and business news from Yahoo Finance