A Miami Beach condo, an AI company and accusations of $100 million social media lies

Two Miami federal court actions, one to come Tuesday and one occurring last week, highlight the erratic flight, crash and investor burn of a Miami Beach AI advertising company.

▪ A Securities and Exchange Commission complaint filed last week accuses Alfi founder and CEO Paul Pereira of making public claims about current and future Alfi revenues that he knew weren’t true, including spreading the economic tall tales through a social media burner account.

The SEC said in one use of account “Uptix12” on Stocktwits, Pereira claimed “Alfi has $100 million of revenue inventory” when he knew Alfi had, at most, $4.3 million. And, when Pereira claimed a coming relationship with Outback Steakhouse on a live streamed YouTube stock traders interview, the SEC says he knew that wasn’t happening.

Reached by phone Monday, Pereira said he had no comment on the SEC complaint filed in Miami federal court last week, but would comment soon. The SEC wants a civil money penalty and an order barring Pereira from serving as an officer and director of any company with SEC-registered securities.

▪ There’s a settlement meeting Tuesday in a federal class action suit brought by Alfi investors against Alfi; Pereira; secretary John Cook, who started the company with Pereira; chief financial officer Dennis McIntosh; interim CEO Peter Bordes; board members Justin Elkouri, Allison Ficken, Frank Smith and Richard Mowser.

The plaintiffs say documents had so many “misleading statements” about the company and internal controls were so poor, “the company’s public statements were materially false and misleading at all relevant times.”

Investors’ problems included the buying of a one-bedroom, 1 1/2-bathroom South Beach condo for $1.1 million without board approval and a commitment of $640,000 to be the name sponsor of a tennis event in the British Virgin Islands.

READ MORE: Mystery $1M condo purchase sparked suspensions, firing at Miami Beach tech firm

What was Alfi all about?

State and federal records say Alfi was founded as Lectrify in 2018, became a publicly traded company on May 4, 2021, and filed for Chapter 7 bankruptcy on Oct. 14, 2022. It operated out of a commercial building at 429 Lenox Ave. in Miami Beach.

Alfi purported to use artificial intelligence in facial recognition technology to better target digital advertising. Also, the company wanted you to know, the technology could do this without collecting invasive amounts of personal information.

As Pereira explained on financial news outlet Benzinga’s YouTube show “ZingerNation Power Hour” on June 16, 2021, a bus stop with rotating digital ads shows the same ads no matter how many people are there, the gender breakdown or what they’re wearing.

“Alfie would detect, let’s say a 25-year-old female wearing a pair of yellow sunglasses and our machine learning models using the computer vision will detect all those metrics,” Pereira said. “Alfi would then turn around and look in its portfolio and say, ‘Well, we’re not going to serve the 25-year-old female a bunch of ads on retirement homes or wheelchairs. We’re going to serve up maybe the Louis Vuitton, the Prada, the Gucci sunglasses that we have there.’”

Later in that interview, Pereira would make some of the claims that found their way into the SEC complaint.

READ MORE: 3 companies, 1 Midtown Miami apartment, 0 employees: A $735,000 fraud setup

Misstatements about Outback Steakhouse founder

“One key element of Alfi’s business strategy was contracting with Uber, Lyft, and taxi drivers and distributing Alfi-enabled devices to their vehicles to play advertisements and generate revenue,” the SEC complaint said. “By November 2020, however, the company had generated no revenue and was running out of funds to operate the business.”

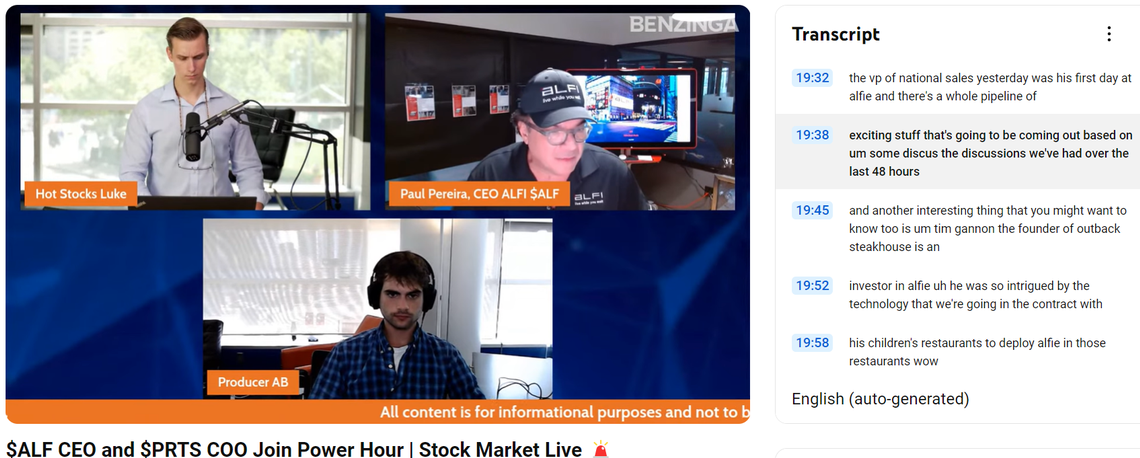

Pereira claims Alfi was the first Miami-based tech company to go public on NASDAQ. The complaint says Aldi’s common stock price opened at $3.60 per share on May 4, 2021. Alfi was rising on June 16 when Pereira made his aforementioned ZingerNation appearance with ‘‘Hot Stocks’‘ Luke Jacobi.

After explaining Alfi, Pereira discussed the company’s business prospects.

“Another interesting thing that you might want to know is Tim Gannon, the founder of Outback Steakhouse, is an investor in Alfi,” Pereira said. “He was so intrigued by the technology that we’re going into contract with his children’s restaurants to deploy Alfi in those restaurants.”

The SEC complaint said, “...Pereira knew, or was reckless in not knowing, that no such contract had been contemplated by the parties. [Gannon] never discussed a contract to deploy Alfi technology in his restaurant chain with Pereira or any other Alfi personnel. In fact, by the time he met Pereira, [Gannon] had retired from the restaurant business and was not authorized to bind any restaurant chain to a contract.”

Alfi reached $9.22 per share that day and rocketed to $22 per share by June 28, 2021.

While Pereira did interviews on shows such as ZingerNation, the complaint said he stressed to Alfi employees the importance of talking up Alfi stock on social media. The boss, the complaint said, didn’t ask his employees to do something he wasn’t willing to do himself.

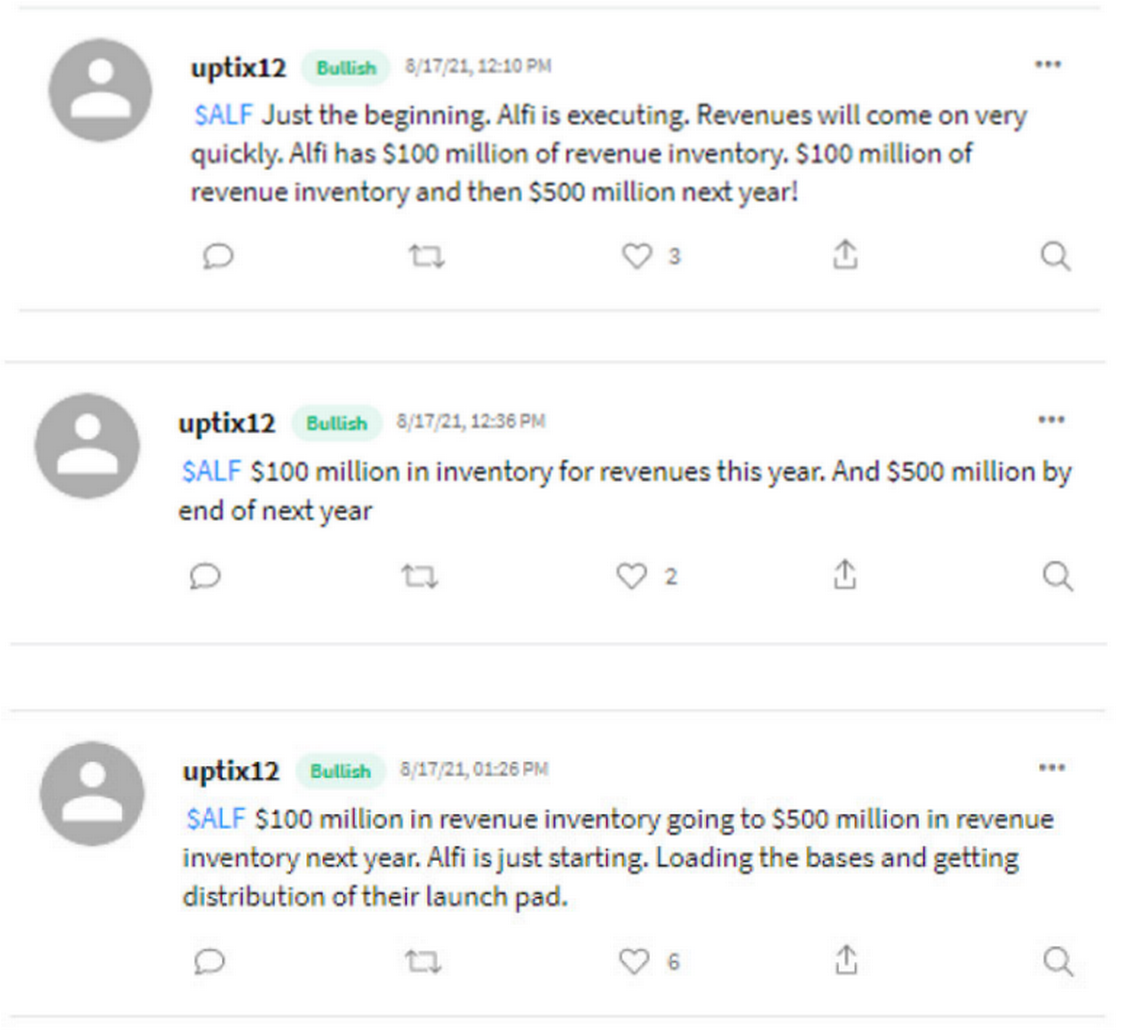

The complaint said Pereira created the Stocktwits account “Uptix12” on May 18, 2021, but didn’t disclose his position as Alfi CEO as “Uptix12” posted on June 3, 2021: “Read between the CEO lines. Focused execution. They know exactly what they are doing. I wouldn’t doubt that ALFI have $10 mm to $20 mm in revenues already in their back pocket!”

Alfi would report $936 revenue for the quarter that ended June 30, 2021. For the fiscal year that ended Dec. 31, 2021, Alfi reported only $26,465 in revenues.

An Aug. 17 Alfi press release declared the company planned to be in rideshare vehicles in 14 cities and contained a quote from Pereira that “Our available advertising inventory by the end of 2021 is expected to be in excess of $100 million and by the end of 2022 in excess of $500 million.”

Two “Uptix12” posts within two hours of the press release parroted those numbers. But, the SEC complaint says, that math didn’t add up and Pereira knew it.

“At the time, Alfi had distributed, at most, 1,500 Alfi-enabled devices, and internal company estimates provided to Pereira showed that the company expected to generate approximately $238.63 per month from each device,” the SEC complaint said. “Far short of $100 million, as of Aug. 17, 2021, the company only had, at most, $4.3 million of revenue inventory.”

That didn’t stop Alfi from dropping $1.1 million on a Miami Beach condo just before the press release and posts.

A South Beach condominium and Richard Branson’s tennis event

Alfi’s quarterly filing said the company agreed on July 12 to buy office space for $1.1 million. Miami-Dade property records say the sale closed Aug. 12 for unit TH-A5, a 1,207 square foot, 1 bedroom, 1. 5 bathroom condo in Murano at Portofino, 1000 South Pointe Dr.

Also, Pereira had told the Miami Herald Alfi would be the name sponsor of the Necker Cup, a tennis tournament in the British Virgin Islands hosted by billionaire Richard Branson. Alfi’s Nov. 1 SEC filing said sponsoring the Necker Cup would cost the company $640,000, some of which would be paid through common stock. Also, if those shares sold under a certain price, Alfi would have to make up the difference.

“These transactions were undertaken by the company’s management without sufficient and appropriate consultation with or approval by the Board,” the Nov. 1 filing said.

These sparked an internal investigation, during which Pereira, McIntosh and Charles Pereira, Alfi’s chief technology officer and Paul Pereira’s son, were placed on administrative leave. In a protest supporting Pereira, Mowser resigned from the board on Oct. 27, 2021.

“The Board’s special committee found that, in addition to corporate governance abuses and related misconduct by Pereira, inaccurate social media posts were made from a pseudonymous account using Pereira’s computer,” the SEC complaint said.

Pereira resigned as Alfi’s president and CEO on Feb. 2, 2022. Alfi filed for Chapter 7 bankruptcy on Oct. 14, 2022.

By that time, investor lawsuits had started. They’ve been combined into one lawsuit.

Settlement documents submitted by attorneys from Boca Raton’s Saxena White, Los Angeles’ Glancy Prongay & Murray, New York’s The Rosen Law Firm, and Los Angeles’ Frank Cruz say $1,725,000 will be returned to investors.

“Defendants raised credible arguments that the fall in stock price following certain of the alleged disclosures quickly recovered and that the stock price rose following more pertinent disclosures,” the settlement says. “If Defendants had succeeded on these...arguments, it would have significantly reduced—if not eliminated—the total amount of potential damages.”

While the $1,725,000 represents only 15.1% of the possible maximum damages, the settlement says, it’s “favorable” for investors and “exceeds the average recovery in similar situations.”