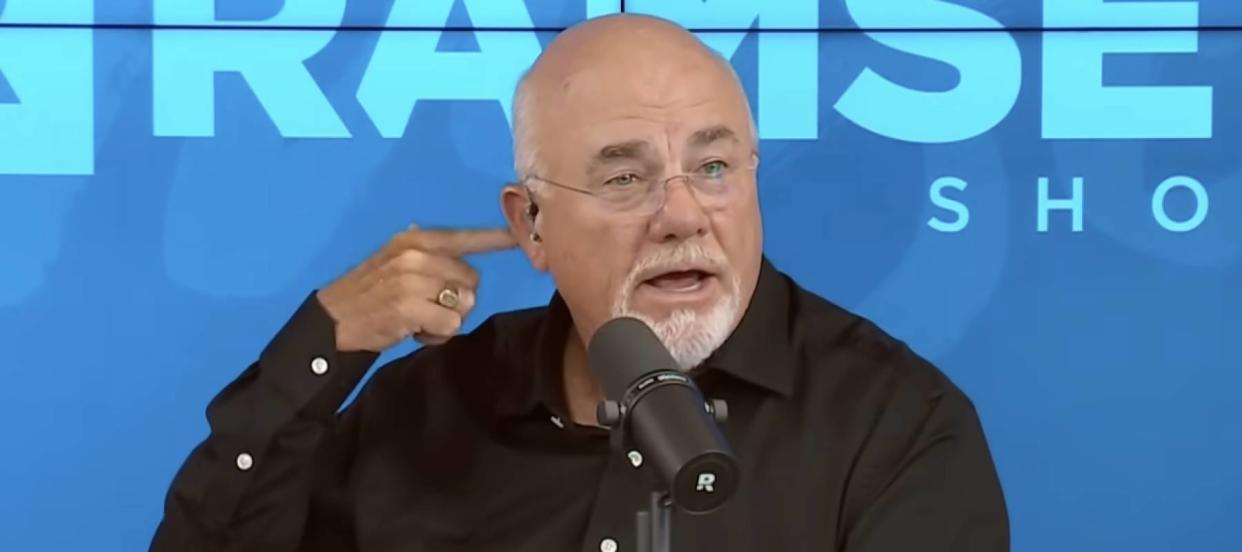

'It may level out and become a thing’: Has crypto-skeptic Dave Ramsey changed his tune when it comes to Bitcoin? Here’s what he told a recent caller

Nearly 16 years after it was created, Bitcoin continues to divide investors and financial pundits alike. On one side, major corporations and financial institutions have added this volatile asset to their operations. On the other side, financial gurus and market veterans remain as skeptical as ever.

Dave Ramsey has firmly established a spot in the latter camp. He has previously described crypto assets as “risky” and “stupid investments,” often mocking investors and advising his audience to stay away from this segment of the market.

Don't miss

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Jeff Bezos told his siblings to invest $10K in his startup called Amazon, and now their stake is worth over $1B — 3 ways to get rich without having to gamble on risky public stocks

Which is why viewers of The Ramsey Show were surprised to hear Ramsey strike a more measured tone in recent comments about the crypto asset. Here’s what he said.

Bitcoin is a currency

Jason from Connecticut wanted to know Ramsey’s thoughts on Bitcoin, given its recent rebound. Each unit of world’s most famous cryptocurrency is currently trading at $67,459 — roughly four times higher than its value in late 2022.

“An asset with a trillion-dollar market cap is not a beanie baby,” Jason said in his email to Ramsey. Surprisingly, Ramsey didn’t aggressively push back as he has in the past on this question about crypto assets. Instead, he struck a more measured tone.

“Bitcoin is a currency,” Ramsey admitted, seemingly agreeing with some of the most loyal members of this community. However, Ramsey went deeper into his explanation: “Currencies have no value except for their track record that indicates that two people are willing to fight over them,” he said.

He compared BTC to other major assets such as the yuan and Japanese yen. However, he was quick to point out that major global currencies were backed by the economic power of their issuing countries and had much longer track records. “Of all the currencies, Bitcoin has the least faith,” he laughed. “Someday, it may level out and become a thing, but Jason, it’s not there.”

He predicts that the asset will continue to be volatile and that he wouldn’t invest in it for the same reason he wouldn’t invest in “the Iraqi dinar.” Ramsey and his co-host argue that Bitcoin is not an “investment” because it doesn’t produce cash flow. “I wouldn’t wish bitcoin investments on somebody I really dislike,” Ramsey said, perhaps proving he hasn’t changed his stance on the asset.

Warren Buffett and his business partner, the late Charlie Munger, had a similar argument — “[Bitcoin] is a gambling token and it doesn’t have any intrinsic value,” Buffett once said.

With this in mind, investors may have better opportunities within asset classes that generate tangible income.

Read more: Suze Orman says Americans are poorer than they think — but having a dream retirement is so much easier when you know these 3 simple money moves

Better investment opportunities

Based on the principle that cash flow is the key to a good investment, sophisticated investors like Buffett and Ramsey have always preferred real estate and stocks.

However, perhaps traditional value investors and cryptocurrency advocates can both agree that chip maker Nvidia (NVDA) provides some value. During the previous crypto bull run, Nvidia saw a boost in earnings due to a scramble for its GPU units that were ideal for cryptocurrency mining.

Now that Bitcoin is rallying again, Nvidia could see a similar boost. However, this time the boost is supercharged by the ongoing artificial intelligence battle. Tech giants are spending billions of dollars to secure the company’s H100 chips, which are a key resource for their large language models.

In its most recent fiscal year, Nvidia generated $29.7 billion in net income, which means it’s profitable enough to attract the attention of traditional investors who may be skeptical of cryptocurrencies.

What to read next

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.