Marshfield's 2024 budget proposal funds firefighter/paramedic positions, employee raises

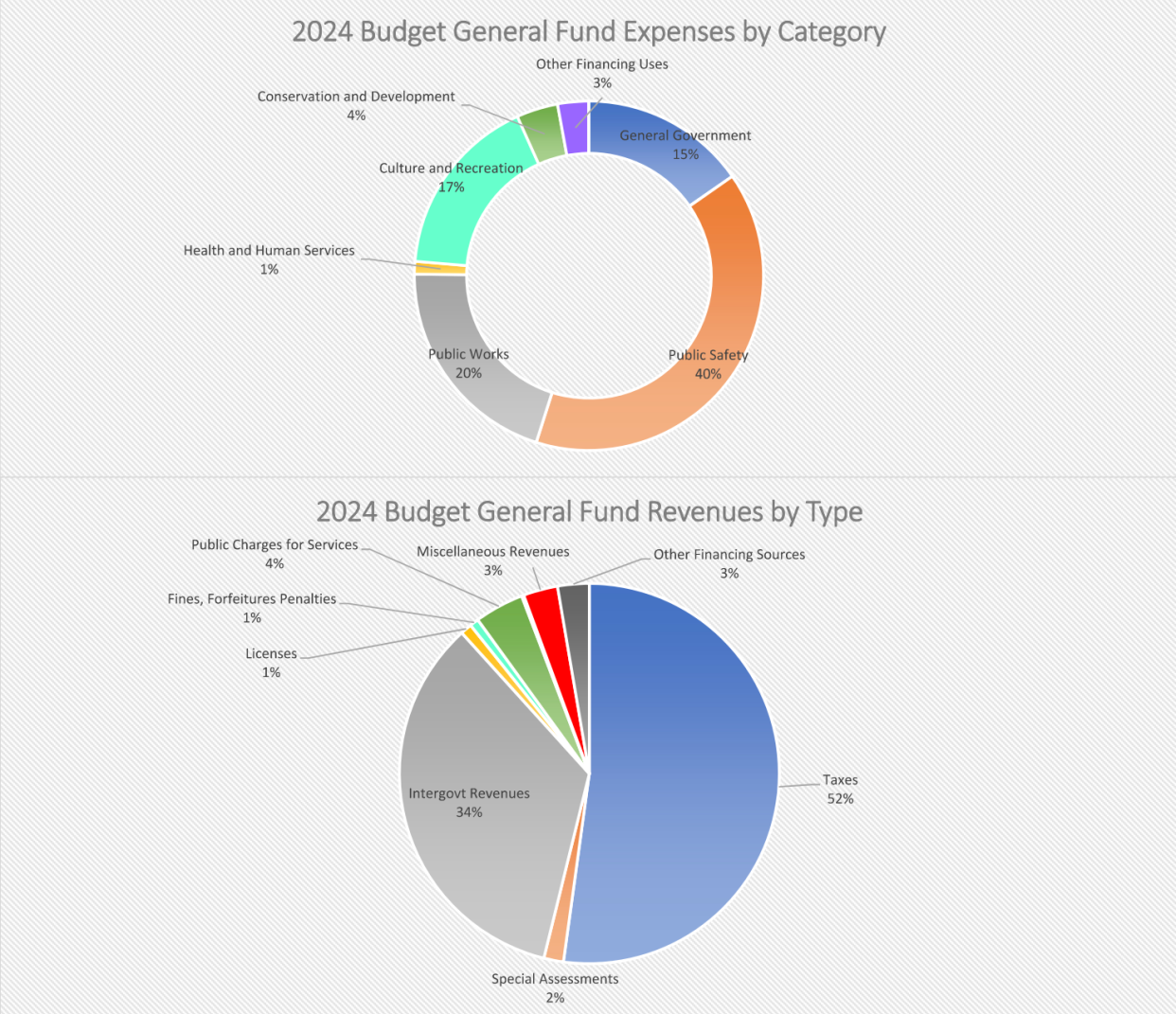

MARSHFIELD − As next year's budget takes shape, city leaders held several meetings in October to share the $13 million 2024 budget proposal with Marshfield residents.

City Administrator Steve Barg and other city staff put the proposal together, presented it and gathered more information and opinions from alderpeople and department heads through the course of the month.

The budget is available for viewing on the city website and the Common Council is scheduled to vote on adoption of the budget on Nov. 21 following a final public hearing at 6 p.m.

Here are some of the highlights and changes in the proposed 2024 budget proposal.

Budget highlights include firefighter/paramedic positions, increase in city employee wages

The city is routing over $300,000 into the Emergency Medical Services Fund to hire three Marshfield Fire and Rescue firefighter/paramedic positions that have been unfilled since 2021. This is following a failed public safety referendum during the spring 2023 election that asked voters to approve an estimated $1.1 million annual increase to the tax levy, which would have indefinitely funded nine firefighter/paramedic positions and three other public safety positions in the Marshfield police and fire departments.

These positions were lobbied for by the former Fire Chief Peter Fletty, who said the department had received a record number of 4,074 calls in 2022. In August, he said the department was on pace to receive a number nearly as high in 2023.

Other highlights include a 1% increase to city employees' wages and the creation of an assistant city administrator/community development director position.

New revenue sources include increase in shared revenue aid, street light user fee

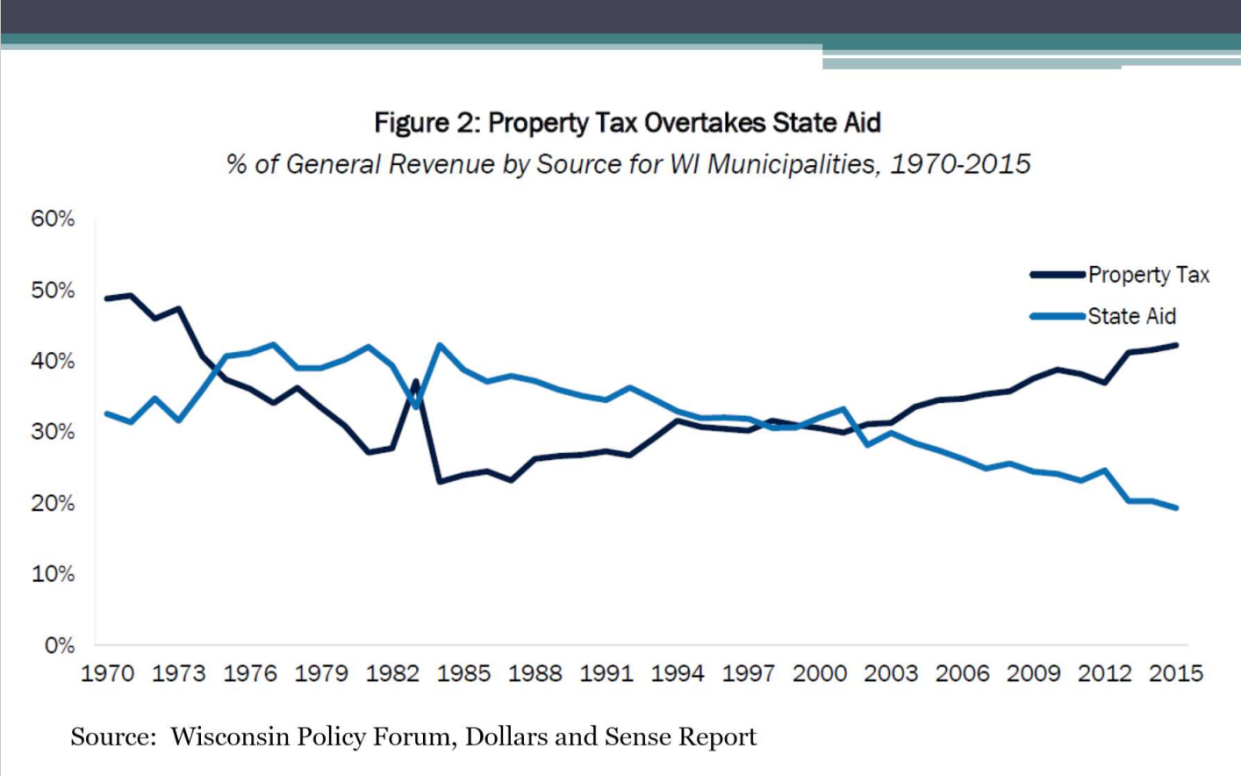

Municipalities across the state are receiving an increase in shared revenue aid for next year’s budget. Shared revenue aid is the state’s over 100-year-old strategy to reduce property tax burden. The increase is due to Wisconsin Act 12, which Gov. Tony Evers signed in June.

Marshfield is set to receive an increase of a little over $1 million, raising its total shared revenue aid to roughly $5.4 million.

The city is also implementing its new street light user charge in 2024. This new fee will cover the almost $200,000 annual cost of street lighting and will apply to property owners, including nonprofits.

The city is set to receive an additional $90,000 in transportation aid.

It is also increasing its levy by the maximum allowed based on net new construction in the city in the previous year. That amount was only 0.73%, which works out to about $80,000.

Act 12 requirements for public safety raise concerns

In the August Common Council meeting, Interim Fire Chief Jody Clements explained some other changes Act 12 made to the shared revenue program.

In particular, the part Clements explained and alders had questions and comments about is called “maintenance of effort requirements.” These requirements have to do with police, fire and emergency medical services spending by the city. If the city does not meet the requirements, it loses 15% of the shared revenue payment or about $810,000 for 2024.

For police, one of three things cannot decrease:

Number of sworn officers employed

Amount of property tax levy dollars spent on employment of sworn officers

Percentage of property tax levy spent on employment of sworn officers

For fire and EMS, two of four things cannot decrease:

Expenditures for fire protective services and EMS

Number of full-time equivalent firefighters and EMS personnel employed

Level of training of and maintenance of licensure for fire fighters and EMS personnel

Response times for fire and EMS adjusted for call location

The expenditures referred to are actual expenditures and not budgeted expenditures, meaning, if there is an unexpected increase or decrease in actual expenditure, the city may find itself in a tough spot at the end of the year.

The increases to shared revenue come from a percentage of statewide sales tax collections and is often referred to as “supplemental.” Several alderpeople expressed concerns about whether the city can expect to see the same amount of aid in future budgets.

“Hopefully we get it every year and it goes up every year, but we can’t guarantee that,” District 8 Alderperson Rebecca Spiros said. “I think it’s absolutely essential that we meet at least two of these four ("maintenance of effort") categories so that we don’t receive an overall reduction in shared revenue.”

More local news: Thomas House Restaurant was ‘magical little gem’ | Marshfield restaurants our readers miss most

Wood County inspections: One Marshfield restaurant with 11 violations, six ace reports

Erik Pfantz covers local government and education in central Wisconsin for USA-TODAY NETWORK-Wisconsin and values his background as a rural Wisconsinite. Reach him at epfantz@gannett.com or connect with him on Twitter @ErikPfantz.

This article originally appeared on Stevens Point Journal: Marshfield 2024 budget funds firefighter/EMS positions, staff raises