When markets get scary, play the long game: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Tuesday, September 13, 2022

Today's newsletter is by Sam Ro, the author of TKer.co. Follow him on Twitter at @SamRo.

When uncertainty in the world spikes, it’s easy to let fear take over and allow doubt to poison your investment decisions.

This year, high inflation and geopolitical tensions have been among the fear factors that have sent stock prices lower.

But the stock market has an impressive track record of overcoming almost insurmountable odds.

Barry Ritholtz, co-founder and CIO of Ritholtz Wealth Management, recently shared an insight he attributed to David Booth, co-founder of Dimensional Fund Advisors:

“25 years ago, your crystal ball reveals: Russian debt default, LTCM fail, DotCom implosion, 9/11 attacks, Financial Crisis+Great Recession, Pandemic killing millions, 3 market crashes. Would you put your money into stocks? No? You missed a 10X return.”

At Monday’s close of 4,110, the S&P 500 is down significantly from its January high of 4,818. But the index is still way above 481, which it last saw in 1995.

The quote reminded me of something Warren Buffett said in a New York Times op-ed during the depths of the Global Financial Crisis:

“Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

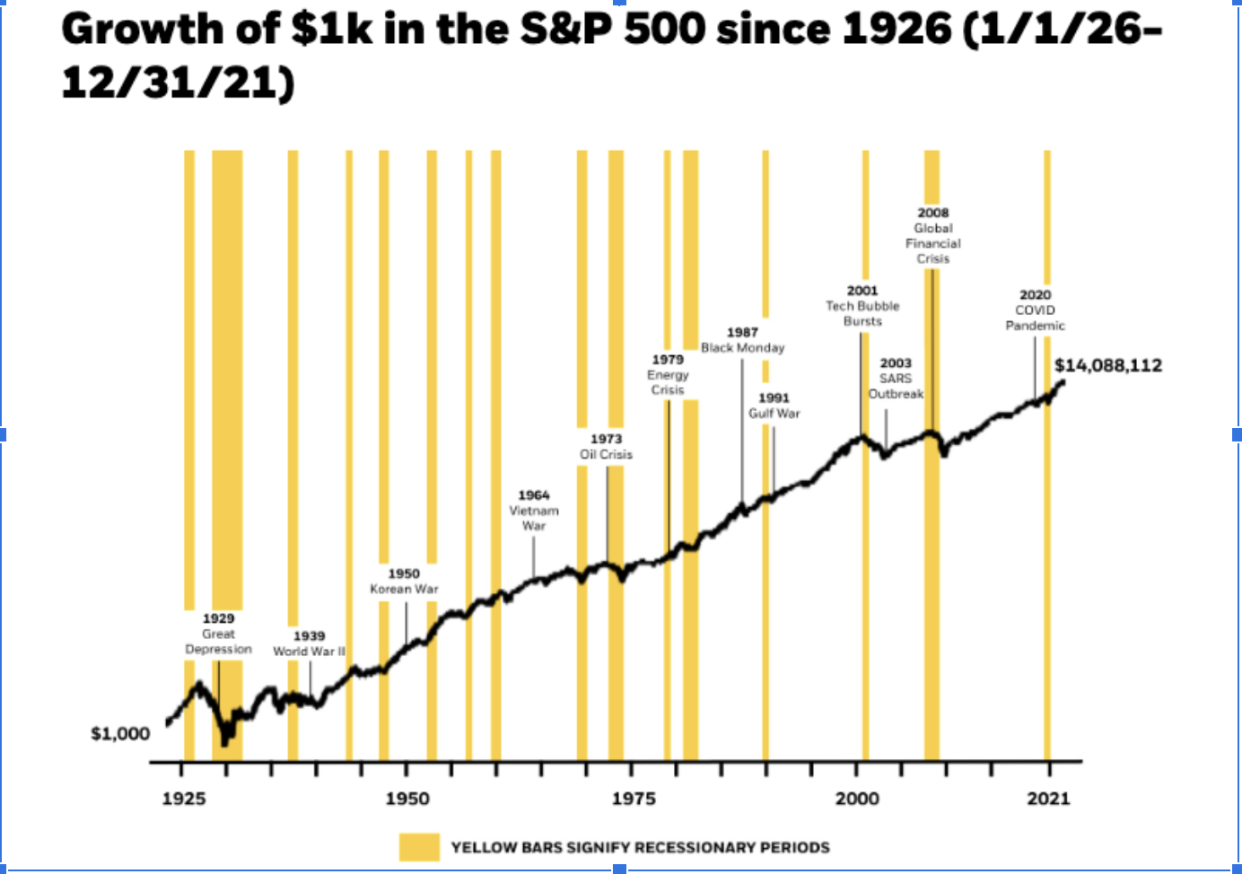

Earlier this year, BlackRock’s Daniel Prince shared what’s effectively an illustrated version of these quotes in this annotated, long-term chart of the S&P 500.

”When times are tough, we want to limit our losses,” Prince wrote. “Even when things are going well, we wish we had invested more. We all fear missing out.”

“But when you’re investing, giving in to fear is often a losing strategy,” he added. “More often than not, investors with this mindset tend to buy high and sell low as they invest more in a rising market and pull money out in a falling market.”

Investing means understanding that there will be unexpected bumps along the way to achieving longer-term financial goals. And those bumps can be substantial. But it’s part of the deal. In fact, this risk is exactly why returns in the stock market can be relatively high.

It’s almost impossible to ignore the barrage of headlines that’ll have you second guessing your investment decisions. So, if you do find yourself getting preoccupied with short-term worries, make sure to also remember the stock market’s long-term history of triumphs.

What to Watch Today

Economic calendar

7:00 a.m. ET: NFIB Small Business Optimism, August (90.1 expected, 89.9 during prior month)

8:30 a.m. ET: Consumer Price Index, month-over-month, August (-0.1% expected, 1.3% during prior month)

8:30 a.m. ET: CPI excluding food and energy, month-over-month, August (0.3% expected, 0.3% during prior month)

8:30 a.m. ET: CPI, year-over-year, August (8.1% expected, 8.5% during prior month)

8:30 a.m. ET: CPI excluding food and energy, year-over-year, August (6.1% expected, 5.9% during prior month)

Earnings

Core & Main (CNM)

Yahoo Finance Highlights

Inflation: Consumer prices likely moderated for a second-straight month in August

Twitter whistleblower; Nikola founder; and ex-Uber exec trial: legal stories to watch

Energy stocks 'look extremely attractive,' says portfolio manager

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube