What the market needs from the Fed before sustained upside

Joseph Fahmy is the Managing Director of Zor Capital, LLC.

For most of 2022, I’ve consistently said that the markets will not see any sustained upside until the Fed stops or at least pauses its current rate-hiking cycle.

The major indexes have failed to see any consistent upside as the Fed’s hawkish stance continues to put pressure on the markets. Going forward, I still think we need verbal confirmation from the Fed that they are pausing interest rate hikes before the market sees any sustained trend upward.

Historically, the market rallies when the Fed shifts its policy stance or provides some form of accommodation to the markets.

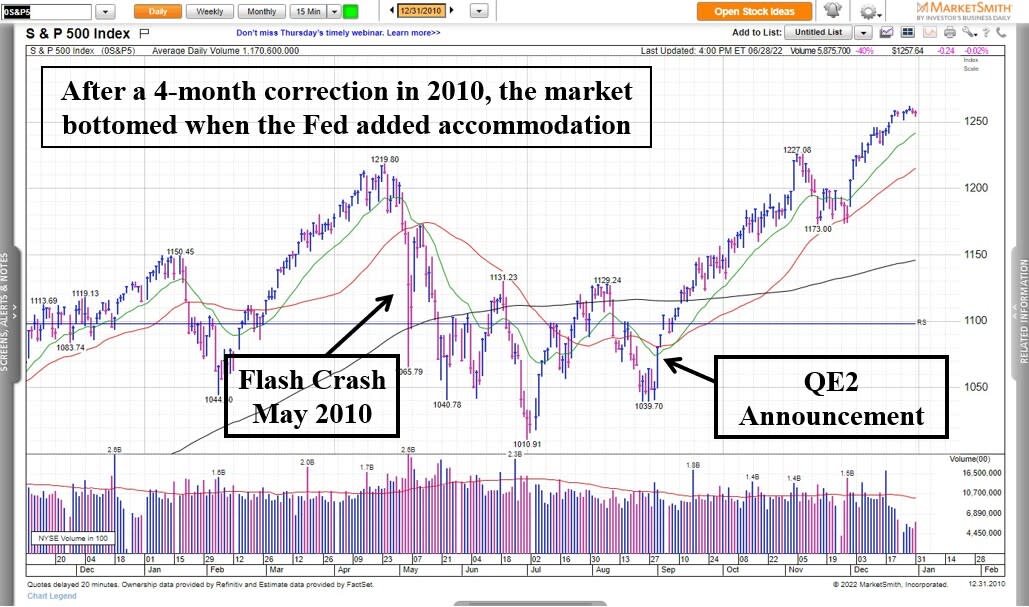

For example, in May 2010, there was a Flash Crash that put the market into a four-month correction.

As indicated by the chart below, we didn’t get a confirmed bottom until Fed Chair Ben Bernanke announced quantitative easing 2 (QE2) on September 1, 2010, at the Jackson Hole Symposium. This provided significant accommodation and liquidity for the markets.

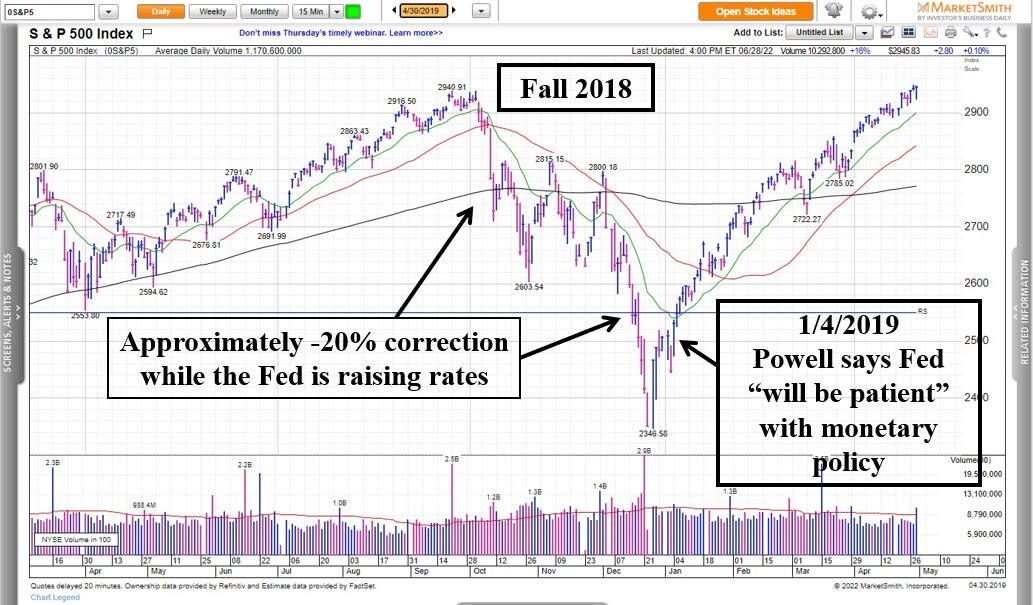

And in 2018, the Fed raised rates, took liquidity out of the system, and talked about reducing its balance sheet. This led to an approximately 20% correction in the Fall of that year.

The market didn’t bottom until Fed Chair Jerome Powell verbally said on January 4, 2019, that the Fed would be “patient” with future rate hikes. From there, we saw a new sustained uptrend.

Now, the big question is when might we see the Fed pause this time around?

Their next two meetings are in July and September. The best-case scenario would be if the Fed raises rates by 75 basis points in July, gets the Fed Funds Rate back to its 2018 highs (around 2.25%-2.50%), and then announces they will be patient with future raises because they want to see all their recent hikes settle into the financial system.

The more likely scenario is the Fed waits until their September meeting to pause rate hikes. I can’t see them continuing to be hawkish into the Fall, especially because they don’t want to look like they are interfering with the midterm elections.

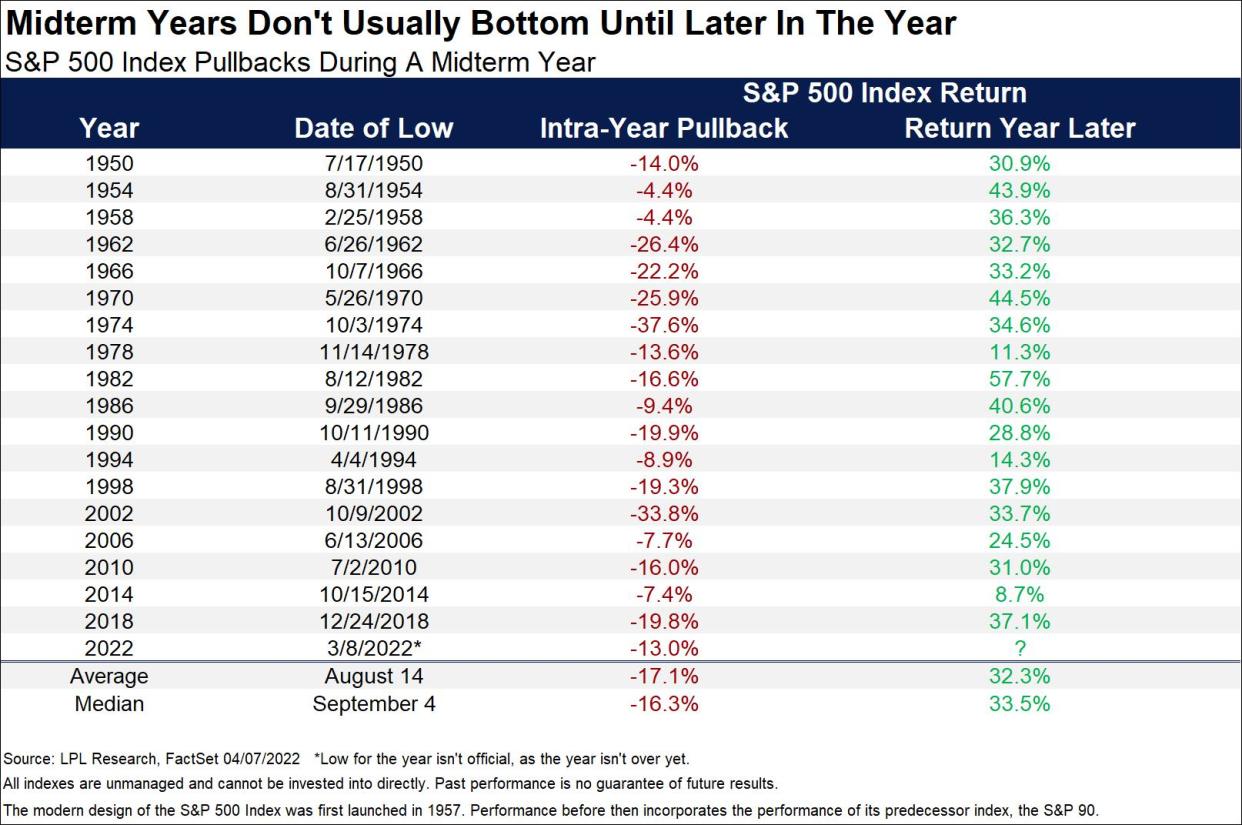

In addition, according to Ryan Detrick at LPL Financial, markets historically bottom around August or September during midterm election years.

As I mentioned in an article earlier this year, we not only need to see the Fed pause its rate hikes, but we also need the overall technicals to improve. This includes seeing the big institutions consistently accumulating shares on the up days.

We also need growth stocks to start acting better, showing that we’re resuming a “risk-on” environment.

Finally, the major indexes need to get above the key moving averages normally seen in a healthier market. I think all this will likely happen when the Fed pauses and institutions feel more confident in putting money to work.

If I can offer some words of encouragement, there are: There will be tremendous opportunities when market conditions improve.

They will mostly be in the stocks and sectors that show strength relative to the market — in other words, the stocks that are closer to new highs and survive this correction as the market is coming off its lows.

One sector that has the potential to outperform in the second half of the year is the biotech sector. Many stocks in this sector are already starting to recover, and Big Pharma has tons of cash available for potential M&A.

It will simply require some patience and discipline until the Fed pauses its current rate-hiking cycle and overall market conditions improve.

Joe Fahmy can be reached at: jfahmy@zorcapital.com

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube