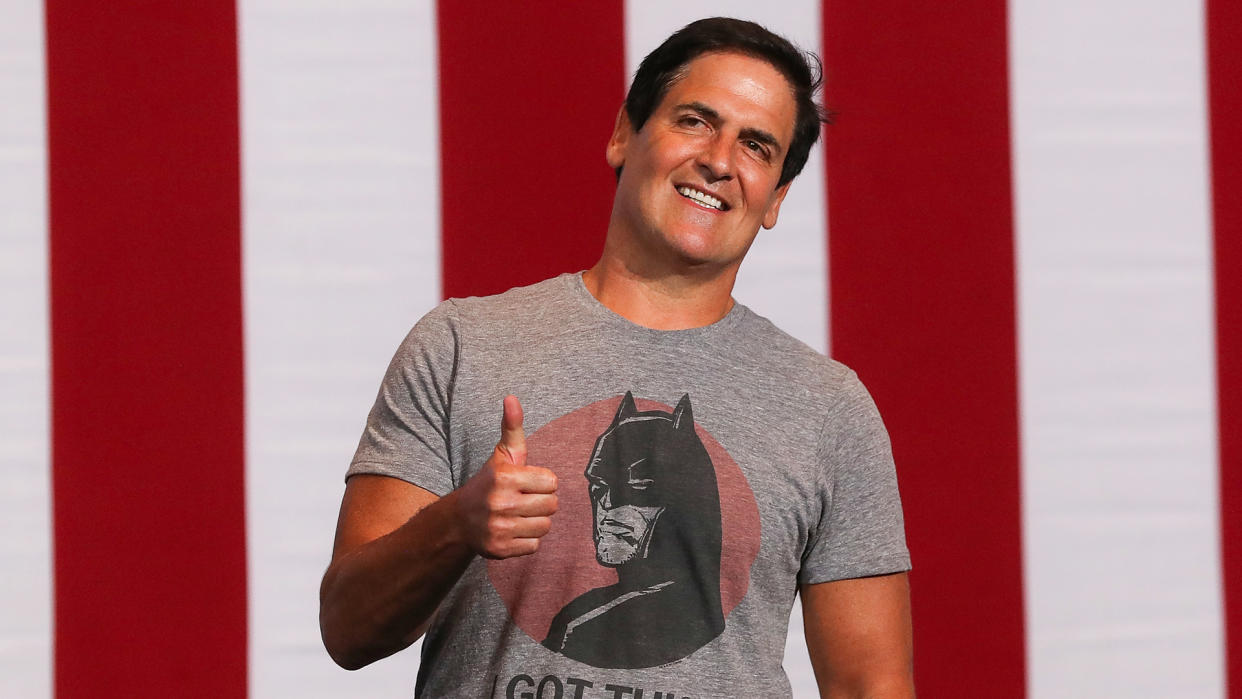

Mark Cuban’s 5 Best Passive Income Ideas

Mark Cuban is well-known for his outspoken views and advice on topics that range from politics to investing. The self-made billionaire doesn’t hold back when it comes to sharing his two cents on how folks can improve their finances and even get rich.

This borrows a page from billionaire Warren Buffett’s playbook, as the “Oracle of Omaha” has long said, “Diversification is a protection against ignorance. [It] makes very little sense for those who know what they’re doing.”

Read More: Frugal People Love the 6 to 1 Grocery Shopping Method: Here’s Why It Works

Try This: 7 Unusual Ways To Make Extra Money (That Actually Work)

Cuban has been known to endorse investment opportunities that either run counter to the majority of analysts or are considered downright aggressive. But Cuban believes that if you know what you’re doing, it greatly diminishes the risk.

While Cuban isn’t known as a passive investor per se, he does pick investments that can grow in the background while he focuses on his businesses, some of which provide extra income in the process.

Here’s a look at the types of things that Cuban invests in himself. And, if you’re looking for some tips to start earning passive income, check this out.

Dividend-Paying Stocks

According to Cuban, dividends put actual cash into investors’ pockets, giving them real-world value by generating passive income right off the bat. With non-dividend stocks, according to Cuban, value is only a vague notion derived from various market metrics.

Dividend-paying stocks are likely the closest investment Cuban has to true “passive income.” In addition to the capital gains that these stocks generate, they also pay dividends every quarter, guaranteeing an income even if the markets are down.

Read Next: 5 Unnecessary Bills You Should Stop Paying in 2024

Discover More: 6 Genius Things All Wealthy People Do With Their Money

AI Companies

For the most part, Cuban isn’t a big believer in owning individual stocks. As he’s put it, “I believe non-dividend stocks aren’t much more than baseball cards. They are worth what you can convince someone to pay for them.”

However, he changes his tune when it comes to AI-related companies. This is because Cuban knows the field well and is a big believer in AI’s future, suggesting that every company will need it to thrive or even survive in the future. Thus, a big part of his selection process when it comes to individual stocks is how capable they are in the field of AI.

AI stocks aren’t known for generating current income, but if they explode in value, they can turn into a generous source of income when you need it. In the meantime, you can simply invest in them passively in your portfolio, waiting for them to perform.

Discover More: 6 Things Minimalists Never Buy — and You Shouldn’t Either

Cryptocurrency

Cryptocurrency isn’t a true source of “passive income,” but rather a swing-for-the-fences that’ll either flame out or pay huge dividends. As Cuban tells it, cryptocurrency has value because it’s based in part on smart contracts.

This underlying technology, Cuban believes, eventually creates applications that have universal utility. In turn, cryptocurrencies that are based on functional smart contracts should have significant value. Unlike many individual investors, the billionaire isn’t simply speculating blindly – he understands the underlying technology and sees its value.

That being said, Cuban cautions investors that they should only put money they’re comfortable losing into crypto. Cuban goes so far as to say that you should only invest in cryptos like Bitcoin and Ethereum “if you’re a true adventurer and you really want to throw the hail mary.”

S&P 500 Index

Although Cuban and Buffett disagree strongly on crypto, with Buffett calling Bitcoin “rat poison squared,” they’re definitely on the same page when it comes to the use of low-cost, S&P 500 index funds for the majority of investors.

However, the index as a whole has a long-term total return of about 10% annually. With long-term, consistent investment, the index may provide a significant source of passive wealth.

Private Companies

As one of the primary investors on “Shark Tank,” Cuban regularly invests in small, private companies. This is another form of high-risk, high-reward investment and to be frank, Cuban has access to more of these types of opportunities than the average investor.

However, Cuban also generally has to put in more blood, sweat and tears than you might if you invested in a private company via a crowdfunding platform or mutual fund.

In other words, your investment in a private company can be truly passive — and it may even generate income.

More From GOBankingRates

Why Florida's Retirees Are Fleeing -- And Where They're Going Instead

Here's How to Add $200 to Your Wallet -- Just For Banking Like You Normally Would

This article originally appeared on GOBankingRates.com: Mark Cuban’s 5 Best Passive Income Ideas