Many insured older Americans face unpaid medical bills

Medical debt for older Americans with health insurance is on the rise.

New research published by the Consumer Financial Protection Bureau (CFPB) Office for Older Americans finds that while most people 65 and older (98%) are covered with health insurance through enrollment in programs like Medicare, many are still swamped with debt.

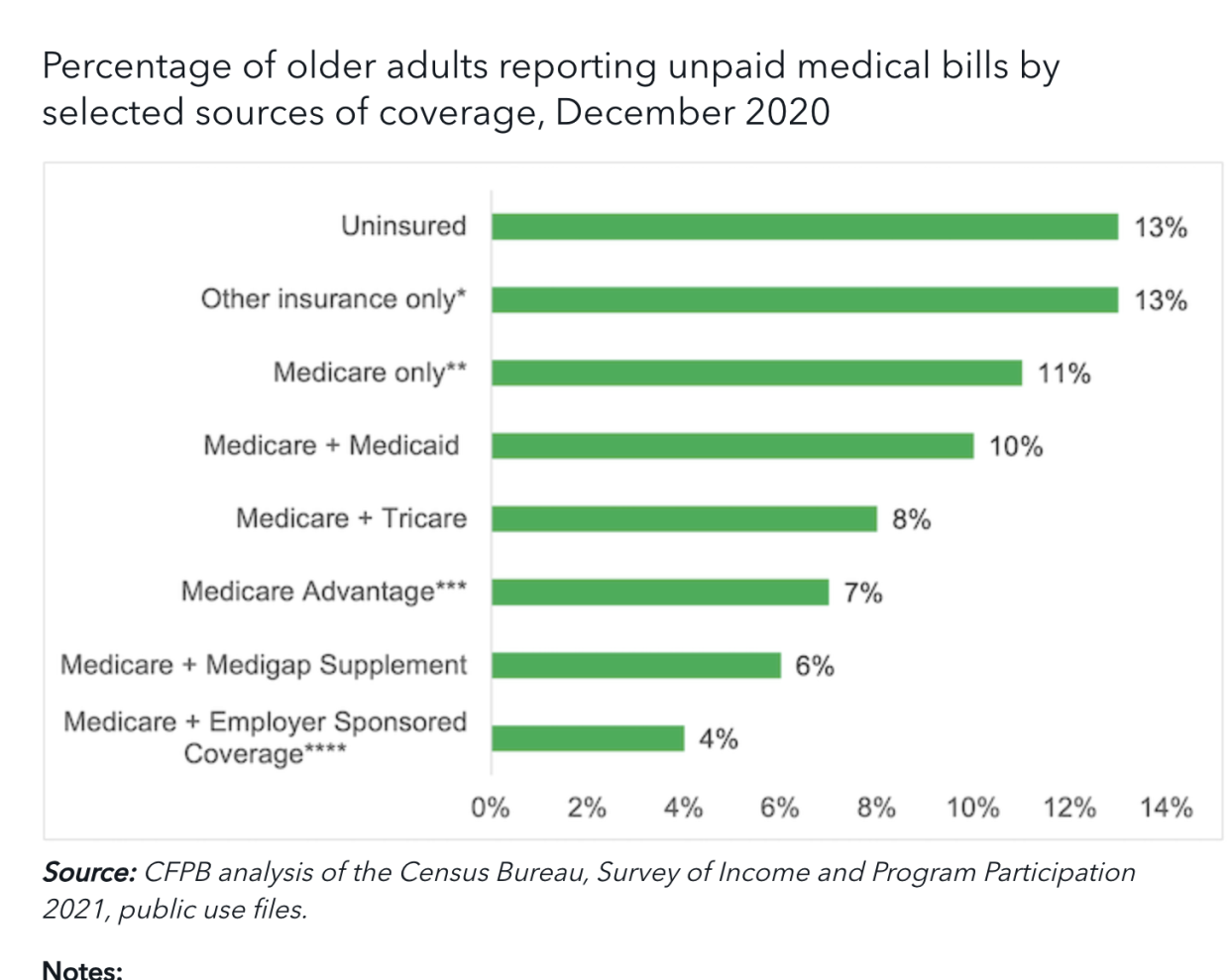

The bottom line: nearly four million older adults could not pay their medical bills in full in 2020, the latest year that such data is available, per the report. Over two-thirds of those with unpaid bills had coverage from more than one source such as Medicare, Medicare Advantage, Medicaid, Medigap, employer-based coverage, or Tricare, the overall military health plan.

The average amount in unpaid medical bills reported by older adults in that period was $13,800, up 20% from $11,700 in 2019. The big picture: that translates to an increase in unpaid medical bills among older adults from $44.8 billion in 2019 to $53.8 billion in 2020.

The agency declined to comment on current debt levels.

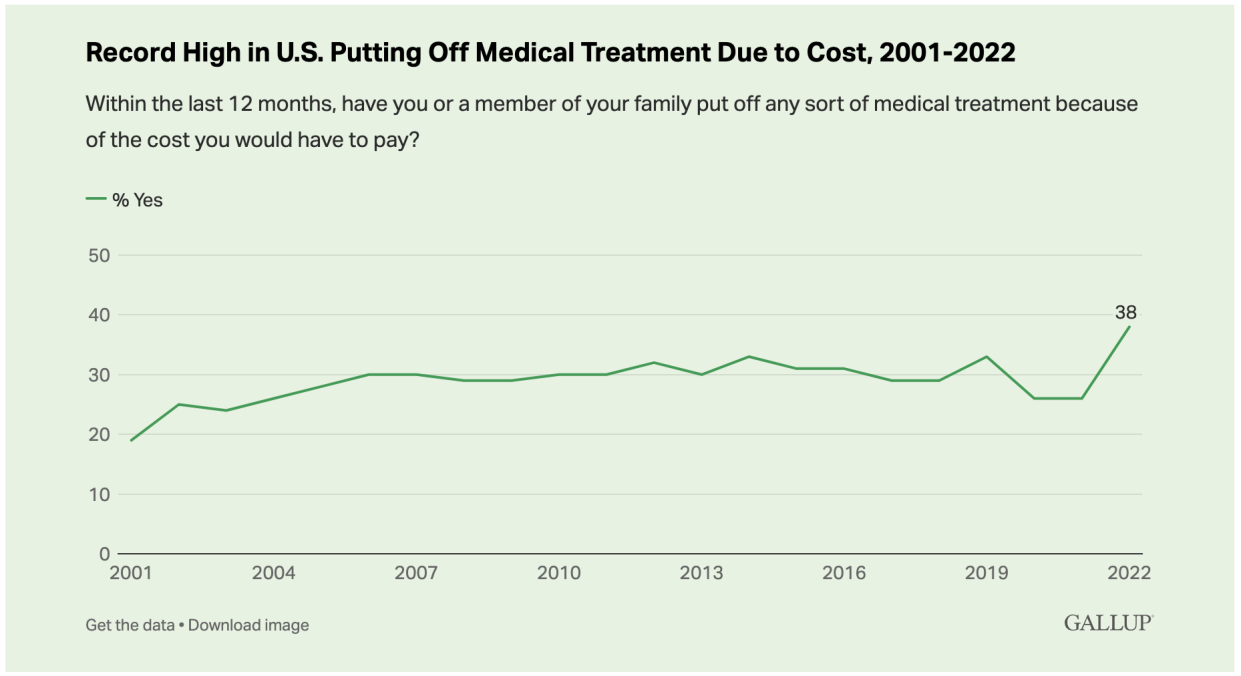

But the problem persists. In a 2022 survey of nearly 1,429 adults over 65, the Senior Citizens League found that nearly a quarter had borrowed money via credit cards, tapped a home equity account, or had to borrow from a bank or family or friends to pay medical bills. And last year, more than a third of Americans said they or a family member postponed medical treatment due to cost, up from 26% in 2021, according to Gallup, which was the highest percentage in two decades.

What’s happening? The core culprits are out-of-network charges, deductibles and other cost-sharing, services that are not covered by Medicare, in addition to frequent and complex medical care, and limited income, according to the researchers.

But the biggest reason for falling behind: medical billing errors.

"The burden of resolving inaccurate medical bills often falls to patients, many of whom are older adults facing functional limitations or living on fixed or low incomes," Senior Policy Analyst Hector Ortiz, co-author of the CFPB report, told Yahoo Finance. The report is based on data from the 2021 Survey of Income and Program Participation (SIPP), a survey of 13,300 adults ages 65 and older, conducted by the US Census Bureau between February 2020 and June 2021.

It also includes complaints to CFPB between January 2020 and December 2022, including approximately 1,100 debt collection grievances and more than 300 credit reporting complaints about Medicare billing.

Why so many billing snafus? One problem: Older adults are more likely to have chronic health needs, which require a higher level of documentation — and depend on coverage from multiple sources. "This can lead to delays in payment, errors in who is billed for what services, and providers seeking inappropriate reimbursement from patients," per the researchers.

"The Medicare billing process is wicked complicated," said Philip Moeller, a Medicare and Social Security expert and principal author of the "Get What’s Yours" series of books about Social Security, Medicare, and health care.

For older adults, the cost of healthcare is significant and errors just make it more expensive. According to the most recent survey of 1,742 older adults by The Senior Citizens League, nearly half report spending more than $400 per month on Medicare premiums and out of pocket costs, including costs not covered by Medicare. The survey was conducted between January and May 2023.

"That’s sobering," Mary Johnson, a policy analyst for the seniors group, told Yahoo Finance.

Doesn’t Medicare cover everything?

There’s the misconception that once an older adult is covered by Medicare that health coverage is free. "Traditional Medicare does not have a maximum limit on what people have to spend out-of-pocket every year," Claire Noel-Miller, a senior strategic policy advisor at the AARP Public Policy Institute, previously told Yahoo Finance.

Many Medicare beneficiaries purchase Medigap or enroll in Medicare Advantage plans to help offset these costs. They also enroll in Part D prescription drug plans. But the premiums for supplemental coverage and out-of-pocket expenses can add financial stress on Medicare beneficiaries.

Furthermore, once the unpaid medical bills are referred to debt collectors and reported to credit bureaus the fallout can have significant repercussions. In CFPB credit reporting complaints, for example, older adults describe how inaccurate medical information on their credit reports have affected their access to affordable credit and even employment opportunities.

One effort to ease that domino effect: The three major credit bureaus stopped reporting medical collection debt that had been paid off. In the past, this debt could have stayed on credit reports for up to seven years. They also stopped reporting medical debt in collections below $500, or medical debt in collections for under one year.

So what are the solutions?

"If possible, work with your health care providers to make sure a procedure is covered before you receive the care," Moeller said. "People with original Medicare should go online to download their Medicare Summary Notices (MSNs), and learn about any rejected claims and the reasons for them. Step two is to work with their medical providers to file an amended claim and follow up as needed."

People with Medicare Advantage plans usually must have care authorized in advance, so it's less likely they will encounter rejected claims. But "they still need to be careful, especially if they want a doctor or other caregiver who is not in their plan's provider network," Moeller said.

Moreover, there are programs that help people with limited resources pay for their premiums and cost-sharing, but many people who are eligible are not enrolled. To find out if you’re eligible, start by contacting your State Health Insurance Assistance Program (SHIP).

To avoid getting caught in medical debt, pay attention to your MSNs and provider claims, Diane Omdahl, co-founder of the Medicare advice website 65 Incorporated, told Yahoo Finance. "They generally note whether information has been submitted to insurance and any insurance payment. And keep accurate, complete documentation of appointments, providers seen, and procedures, plus calls including dates, names, what was discussed, and any resolution or follow up."

But the biggest remedy needs to come from the medical providers and insurers themselves. "Our work indicates that the medical billing system needs to invest more resources in preventing and correcting billing errors, and ensuring that inaccurate bills are not referred to debt collectors and credit reporting companies," the CFPS’s Ortiz said.

Don’t hold your breath.

Kerry Hannon is a Senior Reporter and Columnist at Yahoo Finance. She is a workplace futurist, a career and retirement strategist and the author of 14 books, including "In Control at 50+: How to Succeed in The New Work of Work" and "Never Too Old To Get Rich." Follow her on Twitter @kerryhannon.

Read the latest financial and business news from Yahoo Finance