Macy's and Target boosted by beauty sales as consumers splurge on feel-good items

When the economy outside is turning frightful, consumers are dolling up to feel delightful.

In Macy’s (M) and Target’s (TGT) recent quarterly reports, beauty sales were a bright spot for the retail giants as consumers remain under pressure from headwinds like higher interest rates, return of student loan payments, credit card debt, and dwindling savings.

Read more: Tips and tricks for quickly paying off student loans

Macy’s net sales dropped 7.9% in the third quarter, while same-store sales dropped 6.7%. However, the overall results came in better than expected “with strength in beauty, particularly fragrances and prestige cosmetics," incoming CEO Tony Spring said on a call with investors.

He added that the team aims to evolve the 160-year-old retail giant to be “an accessible luxury beauty destination.”

Its cosmetics business, Bluemercury, which it acquired around 2015, continues to perform well. In Q3, it saw its 11th consecutive quarter of growth with net sales flat, but same-store sales up 2.5%.

“Customers responded well to skin care and color cosmetics, which are our largest categories,” said Spring.

Over at Target, the company saw same-store sales drop 4.9% year over year, while total sales increased 2.7%.

“Third quarter comparable sales decline reflected continued softness in discretionary categories, partially offset by growth in Beauty," Target chief growth officer Christina Hennington said on a call with investors.

Target's beauty business saw sales increase high-single digits, partially driven by its Ulta Beauty offerings, which it launched in 2021.

Shoppers flock to affordable, feel-good items

If consumers’ wallets are strained, why do they need new bronzer, moisturizer, and lip gloss?

“[Beauty is] almost like a consumer staple,” CFRA analyst Zachary Warring told Yahoo Finance over the phone. “It's not something that people are going to stop spending on. They use it every day.”

When people are struggling financially and things seem a “bit doom and gloom,” they still want to feel good and look good, Dr. Cathrine Jansson-Boyd of Anglia Ruskin University told Yahoo Finance over the phone.

They’re heading to retailers that provide smaller, cheaper beauty brands for a treat in lieu of more expensive items like a coat, said Jansson-Boyd, a consumer psychologist.

She calls it a “two-for-one” effect that consumers use to justify their purchase. The two thoughts include “it's going to make me look good, which makes me feel better” and that they “spent less than ... if I went off to buy bigger items.”

In a similar anecdote, McKinsey partner Tamara Charm said, “Consumers are picking and choosing ... saying I might actually not need that new sweater … but I still want to treat myself … I'm going to reach for that lipstick, I'm going to reach for that mascara in the store because it makes me feel fantastic.”

Retailers that have frequent discounts like Macy's or provide value products like Target benefit from this, per Jansson-Boyd.

Consumers are easily influenced by their environment. If everyone around them is going for little splurges like face masks, it's easier to justify shelling out for another perfume.

It’s also a sign of the times, as people return to working and socializing in person. However, the pandemic provided an initial boost to the cosmetics industry; Target's beauty sales shot up 19% in 2020.

Many remote workers went for beauty products to spruce up for Zoom meetings during the shutdown, said Charm.

Since then, growth in the category has remained strong. It has now slowed down a bit but won’t go away anytime soon as self-care and wellness trends “are strengthening,” according to Charm.

Beauty products get shoppers in the door too, which then leads to more sales of other items.

For example, Kohl’s formed a partnership with Sephora back in 2021 in an attempt to attract new customers.

On a call with investors in August, CEO Tom Kingsbury said Sephora at Kohl's is "exceeding" expectations — with a 90% uptick in total beauty sales compared to last year — and is "bringing in new customers that are shopping more frequently."

Kingsbury added that Sephora customers are typically a younger and more diverse crowd. The beauty store is going to be in 900 of Kohl’s locations by the end of 2023. Kohl’s is set to report its third quarter earnings results on Tuesday, Nov. 21.

Consumers 'will do anything' to feel like a celebrity

People may say they are over celebrity endorsements and want more authenticity, but shoppers often end up gravitating towards the big star names.

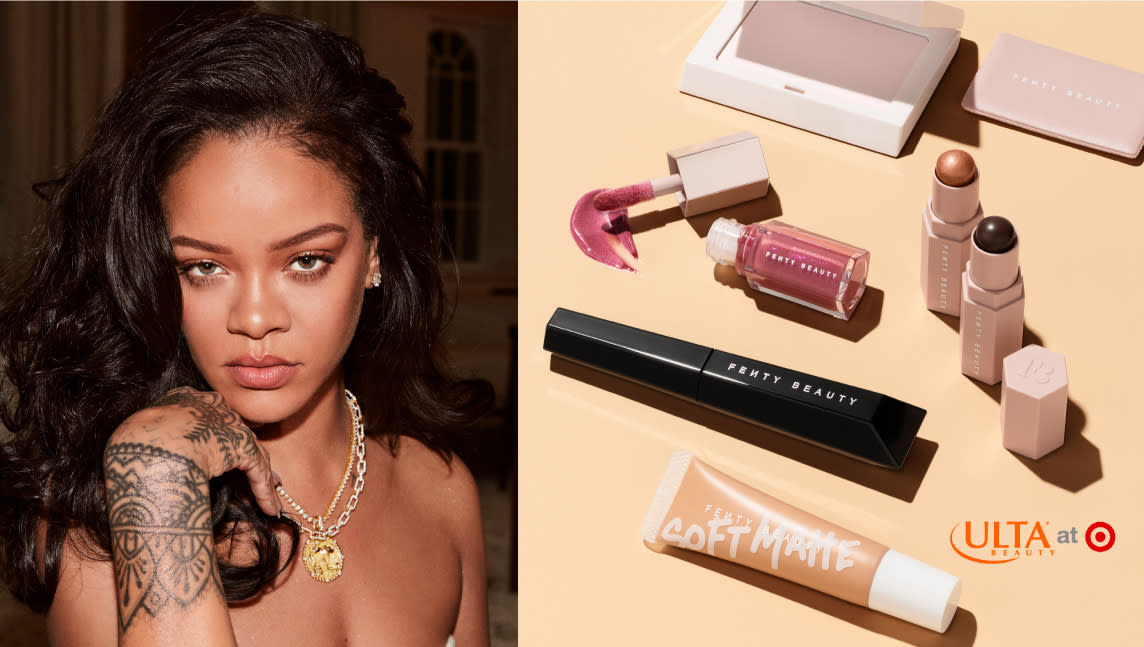

"When we look up to someone, we want to be like them ... we will do anything to be like them," said Jansson-Boyd. "If Rihanna is selling makeup ... [consumers will] think, 'Oh, I can be like her and that's going to make me feel better.'"

In Target's third quarter, Hennington said Fenty Beauty by Rihanna quickly became one of Target's top-selling beauty brands after its Oct. 1 launch.

Macy's hopes to see similar success with its new offerings, Spring said on the call, including a partnership with JLO Beauty, Jennifer Lopez's skin care line.

When it comes to celebrity products, consumers will keep coming back for more, according to Jansson-Boyd.

"You are never going to be Rihanna ... there's one Rihanna ... that's just the way it is," she said. "That's often what spurs the cosmetic industry ... we keep engaging in repeat purchase over and over and over and over again because we don't feel content with what we have bought, because we are engaging in a comparison that's impossible to reach."

—

Brooke DiPalma is a senior reporter for Yahoo Finance. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance