Will your Louisville home value be reassessed this year? Want to appeal? What to know

Homes from Butchertown to Jeffersontown are set to see changes in their home’s assessed value — and later, their property tax bill — thanks to this year’s round of reassessments.

The Jefferson County Property Valuation Administration is reassessing about 90,000 residential parcels stretching southeast from Butchertown, past Jeffersontown, and down to the county line, roughly between Bardstown Road and Interstate 64.

Nearly 6,900 commercial parcels were also reassessed, including business corridors in Nulu, the Highlands, and St. Matthews and along Frankfort Avenue, South Hurstbourne Parkway, and Taylorsville, Bardstown, and Brownsboro roads.

Colleen Younger, Jefferson County Property Valuation Administrator, encouraged homeowners to appeal if they don’t believe the PVA’s calculations fairly represent their home’s value.

“We do not create the market,” she said. “We interpret the market, and it has slowed down some. Although there is still a demand for market listings due to fewer homes available, so prices are still up.”

Here’s what to know about this year’s reassessments.

Where can I see my home's new assessed value?

The PVA’s office mails out postcards with new values on April 26. For more immediate information, values are searchable on the PVA’s website starting at noon on April 26.

Which areas are being reassessed?

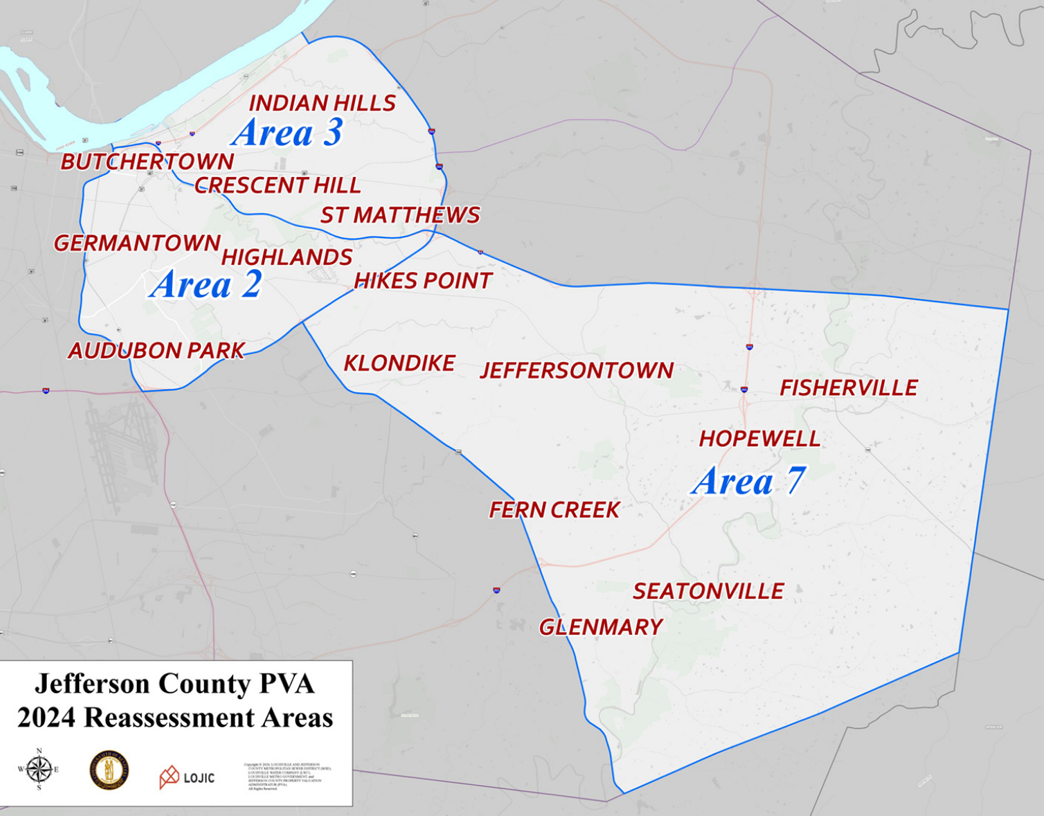

The PVA’s office divides Jefferson County into nine smaller geographic areas. A few areas are reassessed every year. The 2024 reassessment covers the following areas:

Area 2: Audubon Park, Butchertown, Germantown, Highlands, Nulu, Phoenix Hill, Schnitzelburg, Shelby Park

Area 3: Clifton, Crescent Hill, Indian Hills, St. Matthews

Area 7: Beuchel, Fisherville, Jeffersontown, Klondike, Hikes Point

These areas were last reassessed in 2021, though they were originally scheduled to be reassessed in 2020 but were delayed due to the COVID-19 pandemic.

South and south-central Jefferson County are scheduled to be reassessed next year, and eastern Jefferson County is next in 2026.

How much will my home's assessed value rise?

While Younger didn’t share by how much assessments rose, she did suggest rising home sale prices in a housing market marked by tight inventory would lead to a bump in assessed values.

“In a rising market in a rising market, which we've seen in the last five, really last 10 years, we've seen these median values climbing,” she said. “Those rising assessments convert to a higher tax bill in November.”

The PVA did share home sales figures for July 2022-December 2023 for the three reassessment areas:

Area 2 saw 1,182 home sales ranging from $55,000 to $2.5 million with a nearly $282,000 median.

Area 3 had 771 residential sales ranging from $105,000 to $2.54 million and a median of $385,000.

Area 7 had the most activity with 1,901 residential sales, ranging from $106,000 to $1.79 million. The median sales price was $290,000.

Why did my property get reassessed?

Chances are your home was reassessed because it’s located in one of the three areas in Jefferson County that were due for new values.

Under state law, properties are to be reassessed at least once every four years. The Jefferson County Property Valuation Administration is tasked with assessing the “fair-market” value, or the price your home would fetch on the open market, of properties.

These values become the basis for property taxes, assessed later in the year.

This year’s assessment adds about $9 billion to the assessment roll, bringing the county total to $92.5 billion.

Properties that were recently sold or renovated are also reassessed.

How did the PVA’s office calculate my property’s new value?

New valuations are based on recent “fair arms-length” sales, or sales of similar house types in the area, according to the PVA office.

The analysis looks at 18 months of sales, from mid-2022 through 2023.

The PVA says it only compares similar home types and won’t compare a newly renovated house to a similar untouched house nearby.

Are there any exemptions to property value reassessments?

There are two property tax exemptions, both of which are not automatic and must be applied for.

The exemption amount for 2023-2024 is $46,350.

This figure gets subtracted from a property’s assessed value, lessening the amount taxed. That translates to $533-$630 in savings, depending on which taxing jurisdiction a person lives in.

Homeowners age 65 and older: The homestead exemption applies to a primary home owned and occupied on Jan. 1 of the reassessment year. Eligibility starts the year a homeowner turns 65. Only one exemption can be claimed on a property.

Those with disabilities: Homeowners declared totally disabled by the U.S. government or any public or private retirement system for the previous 12 months may qualify for an exemption on their primary home which they owned and occupied on Jan. 1 of the reassessment year.

Parents and legal guardians of disabled children may qualify for this exemption if they put the property in a legal trust for the benefit of the disabled individual.

Property owners can apply for the exemptions on the PVA’s website, jeffersonpva.ky.gov. There’s both an online form and a printable form on the “Forms & Tools” section of the website. Area Social Security offices and local government centers should have the form, as well.

How can I appeal my property value reassessment?

Appeals are time-sensitive, as the window lasts only 23 days.

Between April 26 and May 20, homeowners can appeal if they think the new assessment value doesn’t reflect the fair market value of their property.

“Because our office does not know every detail of your property, we want to make it easy for you to seek your appeal,” Younger said at a Thursday press conference.

Supporting documentation is needed for appeals. Examples include photographs of interior or exterior deferred maintenance and estimates for repairs. More details on the appeal process can be found on the PVA website.

Appeals will be accepted via jeffersonpva.ky.gov between noon on April 26 and 4 p.m. on May 20. The online tool works best on mobile devices.

Limited teleconferences for those lacking technological access with limited mobility. Call 502-574-6224 by May 13 to schedule a teleconference.

In-person help is also available at these locations:

PVA office, 815 W. Market St., suite 400

When: 8 a.m. to 4 p.m. weekdays April 26-May 20; 9 a.m. to 1 p.m. May 11 and May 18.

St. Matthews City Hall, 3941 Grandview Ave.

When: 5-7 p.m. May 7

Jeffersontown City Hall, 10416 Watterson Trail

When: 5-7 p.m. May 14

Help is also available at three libraries in the reassessment areas. All locations will be open on the first day of the appeal window, from 12-4 p.m. April 26, and from 10 a.m. to 4 p.m. May 20. Other hours are as follows:

Jeffersontown, 10635 Watterson Trail

When: 10 a.m. to 4 p.m., weekdays April 29-May 20

Highlands/Shelby Park, 1250 Bardstown Road

When: 10 a.m. to 4 p.m. Mondays, Wednesday, and Fridays from April 29-May 20

St. Matthews, 3940 Grandview Ave.

When: 10 a.m. to 4 p.m., Tuesdays and Thursdays from April 30-May 16

Growth & development reporter Matthew Glowicki can be reached at mglowicki@courier-journal.com, 502-582-4000 or on Twitter @mattglo.

This article originally appeared on Louisville Courier Journal: What Louisville homeowners need to know 2024 property reassessments