Lost home equity: San Francisco homes are selling for $220,000 less than a year ago

In many cities across the country, homes are selling for tens of thousands of dollars less — sometimes hundreds of thousands of dollars less — than just one year ago.

In San Francisco, the median sales price was $220,000 lower than at the same time last year — the largest decline by dollar amount — wiping out 13.4% in equity. Prices in Oakland, California, saw the biggest drop percentage-wise, falling 16.1% or $174,500 less year over year, according to data published by Redfin.

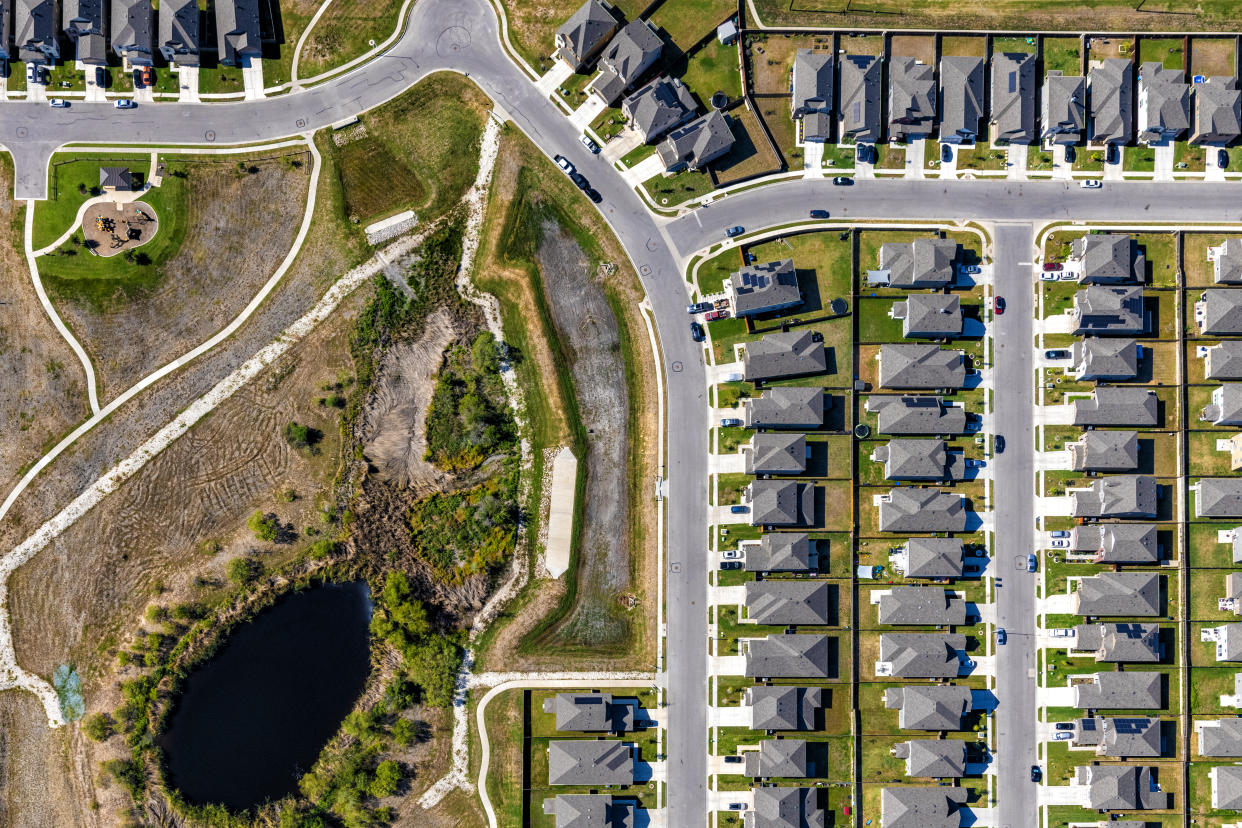

The other notable declines occurred in Austin, Texas, where median prices fell 15.3% or $85,000; Boise, Idaho, where prices lost 15.1% in value or $80,000; and Salt Lake City, where the median decreased 10.9% or $60,000.

The declines reflect both macroeconomic elements such as elevated mortgage rates and a recessionary outlook plus local factors that are reversing some of the big run-ups in prices seen in the past few years.

"Home prices are moderating, pending sales are holding strong and homes on the market last month are selling closer to list price. These are all signs of a market that is still balancing and doing so in a healthy way," Ashley Jackson, 2023 Austin Board of Realtors, was quoted in its recent release.

Cities prices decline three to four times national average

The median US home price fell 4.1%, or $17,603, year-over-year in April to $408,031, according to Redfin. That’s the biggest drop on record in dollar terms and the largest decline since January 2012 in percentage terms. April marked the third consecutive month of year-over-year declines following roughly a decade of increases.

However, the national year-over-year decline of $17,603 is statistically different from what San Francisco, Oakland, Austin, or Boise are experiencing. These cities have price reductions that are four to five times the national average of 4.1%.

"Home prices are firming up this spring on continually scarce for sale inventory, but there are a number of markets where prices remain off their recent peaks," Andy Walden, vice president of Black Knight, a mortgage technology and data provider, wrote to Yahoo Finance. "This is primarily occurring along the west coast and so called 'pandemic boomtowns' that saw significant migratory inflow during Covid."

Prices in tech towns plunge

Although inventory and new construction are limited in San Francisco, shrinking wealth and plunging demand are plaguing the housing market even more there and its adjacent cities.

The number of closed sales, or the final transfer of ownership from seller to buyer, have nearly halved in recent months across the Bay Area. For instance, April’s year-over-year closing transactions decreased 48.2% in San Jose, 44% in San Francisco, 43% in Stockton, and 42.8% in Oakland, according to Redfin.

"So we have this combination of macro economic factors that were affecting every place in the country, like interest rates going up and so forth," Patrick Carlisle, Compass's San Francisco senior market analyst, previously told Yahoo Finance, "And then you've had these very specific factors like high tech layoffs, the highest home prices in the country, work from home affecting our industries more than others."

Pandemic boomtowns bust

Aside from high interest rates and a depressed real estate market, Austin median prices are coming down from near all-time highs.

During the height of COVID housing boom, Austin prices ballooned. The city’s median home prices surged 40% in one year, compared to the average U.S. home’s 18.6% gain. Prices increased to $590,000 in June 2021, a 42.2% year-over-year increase. But that’s not all. Median prices continued to climb throughout 2021 and 2022, reaching $670,000 in May of last year. This marked an almost 74% rise in two years, compared with January 2020 prices of $385,000, two months before pandemic overtook the nation.

"Austin was overpriced last year, so a correction was definitely in store," Daryl Fairweather, Redfin’s chief economist, said.

The rising cost caught up with the city. In-bound migration took a dive at the end of 2022. Austin saw a net-outbound moving pattern in September 2022 (0.94), and ended the year with only a slight increase (1.26), according to data released by Movebuddha.

The supply is also approaching a healthier level. City of Austin’s home inventory increased to 3.2 months in April compared to 0.7 months just a year ago, according to the Austin Board of Realtors. Although a balanced market should have six months of supply, the city of Austin’s inventory level is higher than the national average of 2.6 months. Supply looks like it will only increase as luxury homes pile up.

"Markets like Austin that are seeing the largest home price declines are also among a very small handful where inventory has returned to near pre-pandemic levels," Walden said.

Buyers in the vibrant city known for its live music are now contending with far fewer multiple-bidding situations. The share of offers facing competing bids fell by half year over year to 36.3% in Aprilfrom 72.4%, Redfin found.

On a similar note, Boise, Idaho — another boomtown during the pandemic — is seeing a reversal in fortunes.

Last year, one analysis showed that Boise and Austin had the most overpriced real estate. Pricing history showed 2022 median homes should cost around $299,202 in Boise, but they were selling for 72% higher at $516,548; Austin homes were selling for 67.70% higher, according to data from Florida Atlantic University.

Now, year-over-year pending sales in April fell by 70.8% in Boise, the highest out of any metro Redfin analyzed. Boise’s new listings also fell by 50.2% in April, slightly behind Allentown, Pennsylvania’s 58%.

"Boise home values soared too close to the sun during the pandemic," Fairweather said, "and now that mortgage rates are more than double what they were, home values have fallen back to earth."

Rebecca Chen is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA).

Read the latest financial and business news from Yahoo Finance