15 Retirement Cities You Won’t Be Able To Afford and Cities You Should Consider Instead

It’s important to retire somewhere that you love living, and it’s easy to get your heart set on a location that seems like it has everything you’re looking for. The problem is, many of those ideal cities come at a very steep premium. However, rather than getting disheartened by what you can’t afford, consider cities that offer similar qualities but are much more affordable.

Check Out: These 5 Cities Are Becoming Popular With Baby Boomers: Should You Consider Them for Your Retirement Years?

See More: Do This To Earn Guaranteed Growth on Your Retirement Savings (With No Risk to Your Investment)

A study from GOBankingRates drew from key data from Zillow, Sperling’s Best Places, and the Bureau of Labor Statistics to give you some much more affordable options when you’re considering where to retire. Considering the median listing price for a home and the average expenditures for someone 65 and older, the study has identified which of the country’s cheapest places to live also offer a similar lifestyle to the pricier options that might spring to mind first.

So, before you immediately assume that you’ll need to work into your 70s to afford the retirement you want, you might find that these cheap places to retire have everything you want at a much lower price, giving you more financial flexibility and an easier time making ends meet on a fixed income. As you’ll see, it doesn’t necessarily take a lot to retire in a great city.

Don’t Retire in Miami, Florida

Miami has long been one of America’s best-known cities — gaining fame for its active nightlife and large Cuban-American community, among others. However, making this city your home in retirement comes at a steep cost, with the median list price for a house reaching $603,128.78 and annual expenditures coming in at $80,192.86.

Look At: Why Florida’s Retirees Are Fleeing — And Where They’re Going Instead

Read More: 10 Ways for Retirees To Cut Back on Expenses in 2024

Instead, Choose Largo, Florida

Instead of Miami, look to Largo, a community where the median list price is $368,435.23 and the cost of living is $89,786.80. If you’re interested in Florida retirement but don’t want to pay Miami prices, this could be your ticket.

Up Next: Retirement Planning: How Much the Average Person 65 and Older Spends Monthly

Don’t Retire in Los Angeles, California

The City of Angels offers nice weather year-round and a wide variety of amenities. However, America’s second-largest city is also among its most expensive. The median list price for a home is $982,256.73 and the cost of living each year is about $66,636.20.

Instead, Choose Clovis, California

Good thing Clovis offers many of the same benefits at a fraction of the price. The median home list price of $494,085.74 is an astonishing $488,171 less than Los Angeles and the average cost of living each year is $59,336.46.

Don’t Retire in Oakland, California

The cost of living anywhere in the San Francisco Bay Area has been spiraling out of control in recent years. While Oakland might be the retirement spot of your dreams, the median list price of $893,756.81 is followed by an average cost of living that is $88,066.15. All told, for most Americans, retiring in Oakland is either well out of reach or would require major compromises elsewhere.

Instead, Choose Glendale, California

Instead of Oakland, consider the southern California city of Glendale. Glendale’s median list price — $398,469.06– is less than half that of Oakland, the average cost of living is $66,323.35.

Trending Now: 7 Best Cars for Retirees on a Budget

Don’t Retire in Naples, Florida

Deciding to retire in Florida is a cliche for a reason: The Sunshine State has a lot to offer people in retirement. As such, it’s understandable that retirement in Naples would stand out as a goal for many. Unfortunately, you might not have such a sunny disposition when you get done shelling out $698,637.47 for a home based on the median list price.

Instead, Choose Cape Coral, Florida

Cape Coral could offer you the retirement on Florida’s west coast that you want at a price you can afford. You’ll be nearby to Clearwater Beach with a median list price of $398,701.16 – that’s over $299,000 under that of Naples. That amount would cover several years’ worth of expenses.

Don’t Retire in Santa Ana, California

Santa Ana might be best known for its association with the Santa Ana winds, but it also has a lot to offer potential retirees. However, that would mean entering a blazing inferno of a housing market where the median list price is $778,862.28 and the average annual expenditure is $75,500.17.

Instead, Choose Pembroke Pines, Florida

Instead of the beachy, warmth of Southern California, look to the beachy warmth of Pembroke Pines, Florida. The median list price for a home there is $541,007.02, and in addition to saving over $237,855 on a house, you’ll be saving on your annual costs as well: The average annual expenditures are almost $15,000 a year lower.

Social Security: 9 Ways Frugal Retirees Spend Their Social Security Checks

Don’t Retire in Anaheim, California

Anaheim is located just south of Los Angeles and is home to Disneyland, making it a potentially attractive spot for plenty of retirees. However, some of the costs of living there will make you think you’ve wandered into the park without realizing it. The average annual expenditure is $80,192.86, while the median list price comes in at $856,143.87.

Instead, Choose Centennial, Colorado

Instead of Disneyland, opt for the great plains of Colorado. And while you might have access to amusement parks, it’s worth noting that you’ll save over $10,000 per year in annual expenditures here.

Don’t Retire in San Francisco, California

If you want to spend your golden years in the shadow of the Golden Gate Bridge, be prepared to pay, well, golden prices. The median list price for a home is a mind-boggling $1.4 million and paying out that small fortune will only secure the privilege of paying another fortune for expenses as the average senior spends over $127,000 a year.

Instead, Choose Carlsbad, California

Carlsbad, California offers a cost of living that’s much more in line with what most people can sustain in their retirement. Although the median home price is actually higher than San Francisco by a bit, at $1.46 million, the cost of living is almost $25,000 cheaper annually.

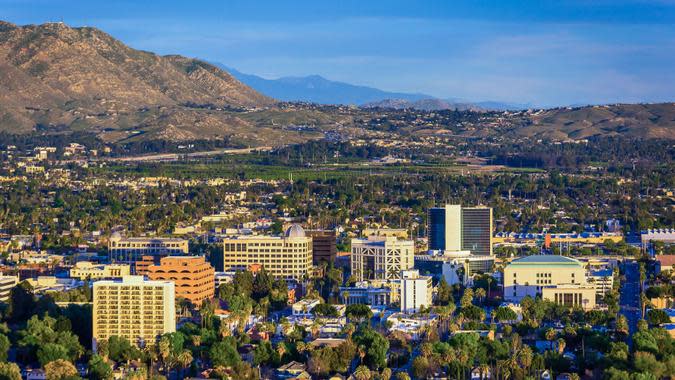

Don’t Retire in Riverside, California

Riverside is one of the largest cities in Southern California’s inland empire, and it could be just the place to retire to enjoy California’s year-round sunshine and warm weather. Unfortunately, you wouldn’t be the first person with that idea. The average price of a home is $601,108.85 and the average annual expenditure for retirees is $69,921.08.

Hobby Rich: How Rare Coins Can Fund Your Early Retirement Dreams

Instead, Choose Henderson, Nevada

Not too far across the California state line is Nevada, and you’ll find a wonderfully affordable town in Henderson. The over $124,000 you’ll save buying a home or more than $8,000 a year should sweeten the deal.

Don’t Retire in San Jose, California

San Jose currently sits in the middle of the tech-driven housing bubble of the San Francisco Bay Area, meaning that the decision to retire there is going to come with pretty significant costs. While not quite San Francisco-level bad, it’s not far behind, with the median list price of more than $1.4 million, and average annual expenses of $112,103.15, which probably means it’s not a realistic destination for most retirees.

Instead, Choose Vallejo, California

Vallejo, however, is less than a 90-minute drive from San Jose but offers a cost of living that’s actually realistic for someone on a fixed budget. The median list price of $555,384.18 is almost a third of San Jose’s while the average annual expenditure of $67,991.86 is more than $44,000 cheaper.

Don’t Retire in Denver, Colorado

While some might want to live near the water in retirement, plenty of others will find the mountains are more their speed. But if you’re hoping to find a place in Denver to spend your retirement, you might want to reconsider: The median list price in the Mile High City is $624,233.38 with another $85,533.98 in average annual expenditures.

Read Next: 7 Ways Shopping at Costco Helps Retirees Stick To a Budget

Instead, Choose Fort Collins, Colorado

But why set yourself up in pricey Denver when the cute college town of Fort Collins is another option for retirement in the Rocky Mountains that won’t hurt your wallet in quite the same way. The median list price is just $590,507.21. The average expenditures are $78,104.98, and also you’ll save over $33,726 on the cost of a home.

Don’t Retire in Seattle, Washington

If you don’t mind the rain, the natural beauty of the Pacific Northwest can be downright breathtaking. However, if that and a love for coffee have you circling Seattle in red as your destination in retirement, you should know that it comes at a steep cost. The median listing price for a home is $921,038.98, while the average retiree spends over $87,492.60 a year.

Instead, Choose Vancouver, Washington

The median listing price of $502,799.86 is over $418,000 cheaper than Seattle. And the city’s average annual expenditure of $61,526.38 is almost $26,000 cheaper as well.

Don’t Retire in Long Beach, California

Retiring by the ocean is a dream plenty of people harbor, but life by the Pacific Ocean in Long Beach might mean having to figure out how to live at low tide, so to speak. The median listing price of $848,913.35 is a nonstarter for many, and even those who can afford it might still find themselves struggling to come up with $82,956.33- the city’s average annual expenditure– every year thereafter after blowing their budget on such a pricey home.

Instead, Choose Santa Clarita, California

This lovely California town is a better option for people retiring on a budget. The median list price in the city is $816,936.86, and the nearly $32,000 you’ll save by not buying in Long Beach will stretch that much further in a city where the average retiree shells out just $76,907.98 in expenses each year.

Find Out: 3 Ways Upper-Middle-Class Retirees Stay Rich in Retirement

Don’t Retire in Honolulu, Hawaii

Plenty of people want to retire to Hawaii because… well, the reasons for that should be obvious. If you’ve haven’t been there yet, visit Hawaii and you should be able to figure it out. Of course, the only issue is that this island paradise comes with some positively outrageous prices to match. The more than $1.3 million that a median home lists at is paired with an average annual expenditure for seniors that hits over $88,066.15 a year.

Instead, Choose Pearl City, Hawaii

You can still take advantage of Hawaii’s lovely climate in Pearl City, where the median list price of $977,816.22 may not seem cheap, but is several hundred thousand dollars cheaper than Honolulu. The annual expenditures, however, are a bit higher in Pearl City than Honolulu, at $96,148.00.

Don’t Retire in San Diego, California

San Diego is an ideal city for retirement in many ways, boasting sunshine and ocean access that will keep retirees warm, tan and having fun well into their golden years. Of course, the prices might mean you’ll be warm, tan and flat broke. The median list price for a home in this Southern California locale is not cheap, at $1,011,533.22 and you’ll still need over $83,634.16 a year just to cover basic expenses.

Instead, Choose Yucca Valley, California

If you’re okay with swapping the Pacific time zone for Eastern, Jacksonville might be the better option for you. Jacksonville touts itself as among America’s top 20 art destinations, has the largest urban park system in the country and features 1,100 miles of navigable water between its 22 miles of beaches and the beautiful St. Johns River. And all that comes at a major discount compared to San Diego, with the price of your home coming in at over $655,000 lower and a year’s worth of expenses running you around $63,000 on average.

Don’t Retire in Reno, Nevada

The biggest little city in the world might seem like a great place to retire… until you see the biggest little costs in the world that come with that plan. Reno’s median list price for a house is $537,069.91, and you’ll also need to shell out over $63,000 every year thereafter to cover expenses, on average.

Instead, Choose Enterprise, Nevada

Reno might be more well known, but Enterprise offers a much more affordable lifestyle for retirees. The median list price in Enterprise is a mere $200,648.72 and the average annual expenditure is $59,336.46 — giving you plenty of spare cash.

Jordan Rosenfeld contributed to the reporting for this article.

Methodology: To find affordable places to retire GOBankingRates examined a list of common cities to retire in as well as alternative options using the following criteria; [1] Zillow Median Home Listing Price for 2023 sourced from the Zillow Home Value Index for Single Family Homes, [2] Cost of Living in the city sourced from Sperlings’ BestPlaces, multiplied by [3] Average Annual Expenditure Cost sourced from the Bureau of Labor Statistics Consumer Expenditure Survey for people aged 65 and over, giving an annual average cost of living in each city to retire. All data was collected and is up-to-date as-of June 16, 2023.

More From GOBankingRates

Social Security: Can Debt Collectors Garnish Your SSI Payments?

5 Things You Forgot To Do With Your Money in 2023 (and How to Do Them in 2024)

This article originally appeared on GOBankingRates.com: 15 Retirement Cities You Won’t Be Able To Afford and Cities You Should Consider Instead