Here’s How Much the Living Wage Is in Your State

Making a livable wage can be a lifelong struggle. The mounting costs of living and other necessities add up quickly, leaving you scraping to make ends meet rather than saving and building wealth. How far your money goes depends on where you live, too.

Find Out: A Look at Tax-Filing Options and Costs

Read More: Owe Money to the IRS? Most People Don’t Realize They Should Do This One Thing

That’s why GOBankingRates conducted a study to identify the annual living wage needed to live comfortably in each of the 50 states, and it revealed that even if you’re living comfortably in one region, you could be living paycheck to paycheck in another.

GOBankingRates surveyed annual living expenses in all 50 states, using the 2022 Consumer Expenditure Survey (latest available) data from the Bureau of Labor Statistics. The itemized costs of living evaluated were housing, groceries, utilities, healthcare and transportation, collectively termed “necessities.”

“Living wage” is defined as the income required to cover 50% of necessities, 30% discretionary/luxury spending and 20% for savings. GOBankingRates also found the median household income of each state from the 2022 American Community Survey and compared the difference between the living wage and median income of each state.

Check out how much you need to earn to cover all your expenses in all 50 states.

Alabama

Living Wage: $63,074

Alabama is among the least expensive places in America to live but earning a median wage would still leave inhabitants of the YellowHammer State $3,465 short of a living wage.

Read Next: The 7 Worst Things You Can Do If You Owe the IRS

Trending Now: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

Alaska

Living Wage: $97,546

Life in the last frontier state comes at a cost, with housing, groceries, utilities, healthcare and transportation in Alaska all fairly expensive. The northernmost state ranks 46 in the country, with the difference between a living wage and median income at $11,176.

Check Out: Trump-Era Tax Cuts Are Expiring — How Changes Will Impact Retirees

Arizona

Living Wage: $83,561

Arizona’s cost of housing is $18,685, over $4,000 more than the national average. Here the difference between the living wage and the actual median income is $10,980.

Arkansas

Living Wage: $62,976

Arkansas is one of the states where your dollar will stretch pretty far, ranking it second in the nation. Many residents of the Razorback State, though, are still struggling to hit the annual living wage mark as the average household income is just $56,335.

California

Living Wage: $110,333

The nation’s most populous state is also among the most expensive, with a living wage translating to nearly six figures if you’re planning on following the 50/30/20 rule. Even for a state with an annual median income of $91,905, those are costs that are hard to bear.

Colorado

Living Wage: $80,652

Residents of the Rocky Mountain State have some money to spare. With a median income of $87,598, the average Coloradan can bank $6,946 at the end of the year.

Check Out: Top 7 Countries With Zero Income Tax

Connecticut

Living Wage: $87,380

Connecticut’s relatively high cost of living means you would need to earn just over $90,000 to follow the 50/30/20 formula. A big chunk of that ends up going to housing, with an average annual bill of $17,844 for Connecticut residents.

Delaware

Living Wage: $74,285

While Delaware residents enjoy overall costs that generally aren’t too far above the national average, they are paying $135 (per month) more for their groceries than the average American, translating to $1,620 every year for food at home.

Florida

Living Wage: $76,410

The median income in the Sunshine State isn’t quite enough to make it easy on the average resident, who earns $67,917 a year. That leaves a gap of nearly $8,493 between the typical annual salary and a living wage. Still, Florida is considered one the best states for the middle class.

Georgia

Living Wage: $66,261

Georgians have an easier time financially than residents of some other states. Expenses are quite a bit below the national average and their median income is above the living wage at $71,355.

Read Next: IRS Increases Gift and Estate Tax Exempt Limits — Here’s How Much You Can Give Without Paying

Hawaii

Living Wage: $148,683

Hawaii is the most expensive state in the country, mostly due to housing costs that run at nearly $44,435 a year. As such, despite a median income of $94,814 a year, the typical Hawaiian is still nearly $53,869 short of a living wage — the largest such gap in this study.

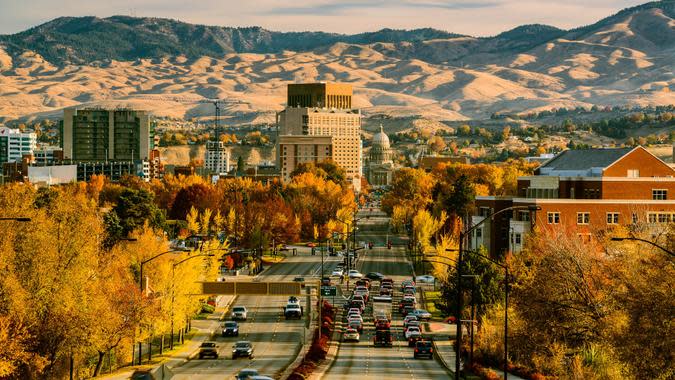

Idaho

Living Wage: $73,594

Idaho is a state that comes close to matching a living wage to actual earnings, able to afford residents to meet expenses and beyond, but it still has a median income of $70,215, leaving a gap of $3,380. The annual utilities cost in Idaho is among the lowest in the study.

Illinois

Living Wage: $67,424

Residents of this midwestern state are earning a median salary of $78,433. That puts the average income $11,009 above the living wage and making it 14th in the nation.

Indiana

Living Wage: $67,728

Indiana is one of the cheaper states to live in, with the median income coming to $67,173 for residents and the gap between a liveable wage is only $555.

Find Out: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

Iowa

Living Wage: $66,360

The median salary in Iowa is $70,571 — $4,211 above the annual living wage, meaning that residents of the state have several thousand dollars extra in their bank accounts every year.

Kansas

Living Wage: $64,254

Kansas is one of several Midwestern states where mid-range median salaries are matched by a low cost of living, putting money back in the pockets of many residents. With a median salary of $69,747, the typical Jayhawk earns $5,493 more than the living wage in the state.

Kentucky

Living Wage: $66,829

While Kentucky has a low cost of living that’s largely in line with states such as Indiana, Illinois and Iowa, the median salary of just $60,183 leaves a $6,646 gap in a living wage despite below-average costs.

Louisiana

Living Wage: $66,399

Louisiana has a median salary that is just $57,852, and a wage gap of $8,547. This means that while residents might be paying less for the cost of living, they’re also more likely to be struggling to afford everyday expenses.

Check Out: 6 Things Minimalists Never Buy — and You Shouldn’t Either

Maine

Living Wage: $84,628

Residents of Maine are much more likely to be struggling with higher costs than the rest of the country. The annual living wage of over $84,000 is among the highest in the country, but the median income there is just $68,251. That leaves a $16,377 gap between a median salary and a living wage.

Maryland

Living Wage: $87,865

Maryland’s living wage of nearly $87,865 is among the top 10 highest in the country. Although Maryland is one of the nation’s most expensive places to live, the median annual salary of $98,461 covers the living wage and leaves over $10,000 extra for residents each year.

Massachusetts

Living Wage: $120,416

Massachusetts residents can expect that the cost of their basic necessities will run significantly higher than the national average when totaled, leaving a sky-high living wage of $120,416. And while it’s a state of high earners, the average annual housing cost of $32,945 keeps most residents of the Bay State from meeting the living wage.

Michigan

Living Wage: $67,589

The median income in Michigan is $68,505. Average housing costs of just $11,286 a year help Michigan residents meet the living wage while giving them just over $900 to spend on annual cost of living expenses.

Be Aware: 10 Best Cheap Gym Memberships: Break a Sweat but Not Your Budget

Minnesota

Living Wage: $70,115

The term “Minnesota Nice” generally refers to the state’s cordial residents, but it could also be describing the nexus of decent wages and affordable costs in the state. That’s because the median annual salary of $84,313 leaves Minnesotans with an excess of $14,198 a year above the living wage.

Mississippi

Living Wage: $63,408

Mississippi has the lowest cost of living in the country. But before anyone starts thinking about making a big purchase, it also has a bottom-barrel annual median income of just over $52,985 — that results in a gap of more than $10,423.

Missouri

Living Wage: $65,152

Residents of the Show Me State have a median annual income of $65,920 — which just covers their living wage, and in general, it’s a state where a dollar goes farther. Missouri is one of the 10 least expensive places to live.

Montana

Living Wage: $77,424

Some residents of the Big Sky State might grumble that it could just as easily be called the “Big Cost of Living State,” with average annual housing costs of $14,870. There is a gap of more than $11,000 between the median annual income of $66,341 a year and the average annual living wage.

Explore More: Frugal People Love the 6 to 1 Grocery Shopping Method: Here’s Why It Works

Nebraska

Living Wage: $66,972

While the median annual salary of $71,722 might mean that the typical Cornhusker isn’t exactly rolling in the dough, it’s still enough to exceed the annual living wage costs and keep an extra $4,750 in their savings account each year.

Nevada

Living Wage: $78,851

Nevada is a relatively expensive state where residents don’t appear to be earning enough to cover costs. With an annual median income of $71,646, the average resident falls close to $7,205 short of the living wage.

New Hampshire

Living Wage: $84,394

While the cost of living in New Hampshire is high, the state also has a lot of residents with higher incomes, leading to a median salary of $90,845 a year. The resulting gap between the two is $6,451.

New Jersey

Living Wage: $84,278

The Garden State comes with higher wages than a lot of other East Coast states. The median income is a whopping $97,126 and enough to surpass the living wage by over $12,000 per year.

Discover More: 10 Expenses Most Likely To Drain Your Checking Account Each Month

New Mexico

Living Wage: $69,539

It doesn’t cost as much to get by in New Mexico, but the state’s very low median income — just $58,722 — means most residents are still probably struggling to make ends meet. That median salary is $10,817 short of a living wage.

New York

Living Wage: $100,205

Is it the Empire State or the Expensive State? While the median salary is a healthy $81,386, the $18,819 gap between paychecks and a living wage in New York puts it as the third most expensive state to live in the nation.

North Carolina

Living Wage: $71,690

Tar Heel State residents have significantly lower housing costs than most — paying about $13,390 a year on average. However, despite this, a low median income in the state leaves the typical resident earning $5,504 less than they need for a living wage.

North Dakota

Living Wage: $70,793

The annual cost of living in North Dakota is pretty on par with the national average, putting it right in the middle ranking at 25 of all states. With a median annual salary of $73,959 a year, the state’s typical resident earns almost $3,166 above the living wage.

Find Out: 5 Frugal Habits of Mark Cuban

Ohio

Living Wage: $68,307

Ohioans come out just about even in the survey. The median income for the Buckeye State is $66,990, meaning the average resident is about $1,317 short of what they need by year’s end.

Oklahoma

Living Wage: $63,893

Housing costs in Oklahoma are fairly low — just $10,314 on average — contributing to low overall costs. With a median income of $61,364, the average resident will come up $2,529 short of the living wage.

Oregon

Living Wage: $90,851

While Hawaii’s astronomical gap of more than $50,000 between its median salary and its living wage is No. 1, Oregon’s gap is pretty sizable, at $14,219. The housing cost is one of the biggest reasons, with the average Oregonian needing more than $19,497 a year for a place to live.

Pennsylvania

Living Wage: $70,008

Pennsylvania has housing costs currently at $11,910 a year. And the median salary of $73,170 in the Keystone State is over $3,000 more than the living wage.

Try This: 7 Grocery Items To Avoid While on a Retirement Budget

Rhode Island

Living Wage: $81,866

Unfortunately for Rhode Islanders, living in the smallest state carries a big price. Housing costs there are higher than the national average, costing the typical resident just about $17,510.

South Carolina

Living Wage: $68,221

The median annual salary in the Palmetto State is $63,623, while the living wage is still about $4,598 higher than what the average South Carolinian makes.

South Dakota

Living Wage: $68,687

The average annual housing costs of $12,447 in South Dakota are about $2,000 lower than the national average. With a median income of $69,457, residents are $770 up in terms of a living wage, on average.

Tennessee

Living Wage: $65,750

The gap between the median income of $64,035 and the $65,750 living wage in Tennessee is $1,715, but that’s driven more by lower wages than higher costs. The costs of housing and every other category considered in the survey are lower than the national average in Tennessee.

Read Next: 5 Unnecessary Bills You Should Stop Paying in 2024

Texas

Living Wage: $68,211

With a median income of $73,035 in the state, many Texans’ earnings exceed the annual living wage. That’s helped by average housing costs of $12,220 a year.

Utah

Living Wage: $79,127

A median income of $86,833 in the Beehive State makes Utah the state with one of the highest positive gaps between living wage and median income — a total of almost $7,706 a year.

Vermont

Living Wage: $88,598

Living in New England can get expensive, and the Green Mountain State has a high cost of living that’s not matched by what residents earn. With a median income of $74,014, Vermont residents fall well below earning the annual living wage for the state with a difference of $14,584.

Virginia

Living Wage: $76,264

While the cost of living is slightly higher than the national average in Virginia, the state’s high earning power helps to make it an affordable place to live. The median income in Virginia is $87,249.

Learn More: 10 Things Frugal People Always Buy at Yard Sales To Save Money

Washington

Living Wage: $90,480

While life in Washington is pretty expensive when compared to the rest of the country, salaries are high as well. With the median income in the state reaching $90,325, there is only a $155 gap in between.

West Virginia

Living Wage: $61,842

West Virginia’s median annual salary is $55,217, and while the cost of living there is relatively low, a living wage is still $6,625 more than the typical salary.

Wisconsin

Living Wage: $71,524

Wisconsin is just about even when comparing the living wage and the median income. With a median salary of $72,458, the average resident of the Badger State is in a relatively good financial spot.

Wyoming

Living Wage: $68,563

Wyoming is one of a few states where income exceeds the living wage. With a median income of $72,495, the average Wyoming resident has enough to get by.

Jami Farkas, Jordan Rosenfeld and Joel Anderson contributed to the reporting for this article.

Methodology: GOBankingRates surveyed annual living expenses in all 50 states, using the 2022 Consumer Expenditure Survey (latest available) data from the Bureau of Labor Statistics. The itemized costs of living evaluated were housing, groceries, utilities, healthcare and transportation, collectively termed “necessities.” Based on each state’s respective cost of living index for each category, sourced from the Missouri Economic Research and Information Center’s 2023 Q3 Cost of Living Data Series, the study calculated the annual cost of each necessity and summed them up to find total annual expenditure on necessities. Using the 50-30-20 budget rule, which allocates 50% of income for necessities, the study doubled the total annual expenditure on necessities in order to determine the “living wage” in each state. “Living wage” is defined as the income required to be able to cover 50% necessities, 30% discretionary/luxury spending and 20% for savings. GOBankingRates also found the median household income of each state from the 2022 American Community Survey and compared the difference between the living wage and median income of each state. All data was collected on and up to date as of April 17, 2024.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Here’s How Much the Living Wage Is in Your State