Retiring with Student Debt: What Are Your Options?

Congratulations on being ready to retire! You’ve spent a lifetime working hard, and it’s just about time to sit back and relax.

Before you do, though, you’ll want to make sure you can afford to retire. If you have outstanding debts, these could put a damper on your plans.

If you’re still paying your student loans, you probably are wondering: do you have to pay student loans after retirement? And if so, how does that debt negatively impact your plans to retire?

Keep reading to learn more on paying back student loans in retirement, including options for forgiveness and how to save money on your loans.

Paying Back Student Loans After Retirement

You’ve been saving for retirement for years, and you’re ready to reap the rewards…except you’ve got student loan debt hanging over your head.

Student loans, just like any kind of debt, are financial obligations you must take care of. If not, you risk negative marks on your credit report.

If you’re planning to retire soon, make sure to factor that monthly student loan payment into your budget, as you will still be obligated to make your payments in retirement.

Pros of Paying Back Student Loans After Retirement

The first benefit to paying off student loans after retirement is keeping your credit report squeaky clean. When you pay your loan each month, the positive behavior of an on-time payment and a reduction in your debt is reflected on your credit report. This could help your score rise, which could help you qualify for better interest rates on mortgages, personal loans, and credit cards.

Also, you want to pay off your student loans as quickly as possible to minimize the interest you pay. The sooner you pay off the loan, the less interest you’ll pay overall.

And of course, clearing any debt you have will leave you with more disposable income. Take a cruise with a loved one, pay off your house, or do anything else you’ve always dreamed of doing in retirement!

Cons of Paying Back Student Loans After Retirement

Things get tricky when it comes to student loans and retirement. Because you now have a limited income, it may be challenging to make those monthly payments or to pay off the loan in its entirety.

However, just like the benefit to paying back your loan was positive marks on your credit report, skipping payments or making late payments could have a negative impact on your credit.

And making those payments to your student loan will limit what you can afford to spend your money on. You may have to defer some of your retirement plans until your student loans are paid off.

At What Age Can You Stop Paying Student Loans?

Unfortunately, there is no age when you can stop paying your student loans. Retirement has no impact on the requirement for you to pay off your student loan debts, and your monthly payment will continue to be due each month until the loan is paid off.

Student Loan Forgiveness Options

There are several student loan forgiveness programs offered by the U.S. Department of Education. One is the Public Service Loan Forgiveness, which forgives student loans for professionals who work in public services (teachers, government employees, and nonprofits, for example). There are also income-driven repayment (IDR) plans that also may qualify for loan forgiveness.

Check with your student loan account holder to see if you qualify for any loan forgiveness options.

Options for Paying Off Student Loans During Retirement

When it comes to student loans and retirement, the sooner you pay off your loan, the sooner you can enjoy retirement. It’s important to get a plan for how you’ll pay off your student loan when preparing for retirement.

Start with a student loan calculator so you know how much you owe and how much you’ll pay in interest over time. Then, explore the following options.

Lump Sum

If you can afford to do so, pay off your loan all at once. You’ll cut out the interest you would have paid if you paid it out over time, and you’ll immediately have access to more monthly disposable income since it won’t be going toward a monthly loan payment.

Consolidate Your Loans

If you have multiple student loans from different providers, consider student loan consolidation. With this option, you combine multiple federal student loans into one new loan with one new monthly payment. The interest rate is typically the average of the interest rates on the loans you’re consolidating. While consolidating student loans streamlines your monthly payments, it typically won’t save you money overall.

Note: You can only consolidate federal student loans that qualify. You aren’t able to consolidate private student loans.

Refinance Student Loans

If you have private student loans, or a combination of federal and private loans, you might want to consider refinancing your student loans. This involves taking out a new loan you can then use to pay off your outstanding student loans. Ideally, you’ll receive a lower interest rate or shorten your loan term.

Keep in mind, though, that if you refinance federal loans, you lose eligibility for federal benefits, such as income-driven repayment plans and student loan forgiveness.

The Takeaway

Student loans and retirement may not go hand-in-hand, but you’re far from alone if you’re still struggling with your debt when you’re ready to retire. The important thing is to get a plan for paying it off, either all at once or over the shortest period possible.

One way to reduce your student loan debt is to refinance your student loans. By refinancing, you may be able to secure a lower interest rate or shorter loan term, enabling you to pay off your debt faster.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Student Loan Refinance

If you are a federal student loan borrower, you should consider all of your repayment opportunities including the opportunity to refinance your student loan debt at a lower APR or to extend your term to achieve a lower monthly payment. Please note that once you refinance federal student loans you will no longer be eligible for current or future flexible payment options available to federal loan borrowers, including but not limited to income-based repayment plans or extended repayment plans.

More from MediaFeed:

These States Had The Highest Foreclosure Rates in March

In the ever-evolving landscape of real estate, the U.S. foreclosure market often unveils key trends that will shape the future of home ownership. According to property data provider ATTOM , the number of housing units with foreclosure filings in March was 32,878, a drop of less than 1% from the previous month and a 10% decline from the previous year. Rob Barber, CEO of ATTOM, highlights that this ongoing “persistently hot” housing market is likely due to sizable homeowner equity.

Foreclosure starts increased nationwide by 2%, with notable spikes in states like New Hampshire, Illinois, and Florida. Moreover, while there was a 7% increase in bank repossessions from the previous quarter, there’s a notable 20% decline compared to a year ago, indicating some stabilization in the REO (Real Estate Owned) sector. The average time to foreclose showed a slight increase from the previous quarter, but continues a downward trend observed since mid-2020, with states like Louisiana, Hawaii, and New York having longer foreclosure timelines, contrasting with states like Montana, Virginia, and Texas, which boast shorter timelines. Borrowers should stay up to date on their mortgage payments and work closely with their lenders to explore options for assistance if needed.

Read on for the foreclosure rates in March 2024 – plus the five counties, or county equivalents, with the highest rates within those states.

As previously noted, foreclosure rates saw a negligible drop compared to last month and to last year. Read on for the March foreclosure rates for all 50 states — plus the District of Columbia — beginning with the state that had the lowest rate of foreclosure filings per housing unit.

Related: The safest cities in the US

DepositPhotos.com

Ranking in population between Vermont and Alaska, the country’s second and third least populous states, Washington, D.C. observed 167 foreclosures in March, up about 17% from the previous month. With a total of 350,372 housing units, the foreclosure rate of the nation’s capital was one in every 2,098 households, putting it above the state of Illinois (#1).

In 49th place for population, the Green Mountain State ranked 50th for its foreclosure rate in March. Of the state’s 335,138 housing units, 11 homes went into foreclosure at a rate of one in every 30,467 households. Only four counties in the state saw foreclosures. They were (from highest to lowest): Rutland, Windsor, Washington, and Chittenden.

Listed as 44th in population, the Treasure State rated 49th again for its foreclosure rate this month. With 24 foreclosures out of 517,430 housing units, Montana’s foreclosure rate was one in every 21,560 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Wheatland, Chouteau, Deer Lodge, Richland, and Carbon.

The Mount Rushmore State nabbed the 48th spot once more for its foreclosure rate in March. Having 393,150 total housing units, the fifth-least populous state had a foreclosure rate of one in every 17,870 households with 22 foreclosures. The counties with the most foreclosures per housing unit were (from highest to lowest): Aurora, Codington, Minnehaha, Brown, and Meade.

Ranked 39th in population, the Mountain State claimed the 47th spot for the second month in a row. It has a total of 859,142 housing units, of which 58 went into foreclosure. This means that the foreclosure rate was one in every 14,813 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Hancock, Tyler, Fayette, Berkeley, and Cabell.

The 27th most populous state ranked 46th for highest foreclosure rate in March. Of the Pacific Wonderland’s 1,818,599 homes, 124 went into foreclosure, making for a foreclosure rate of one in every 14,666 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Jefferson, Clatsop, Douglas, Clackamas, and Coos.

The Sunflower State ranked 45th for highest foreclosure rate this month. With 1,278,548 homes and a total of 100 housing units going into foreclosure, the 35th most populous state’s foreclosure rate was one in every 12,785 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Morton, Clark, Logan, Kearny, and Bourbon.

The eighth-least populous state placed 44th for highest foreclosure rate in March. A total of 38 homes went into foreclosure out of 483,053 total housing units, making the foreclosure rate for the Ocean State one in every 12,712 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Kent, Bristol, Washington, Providence, and Newport.

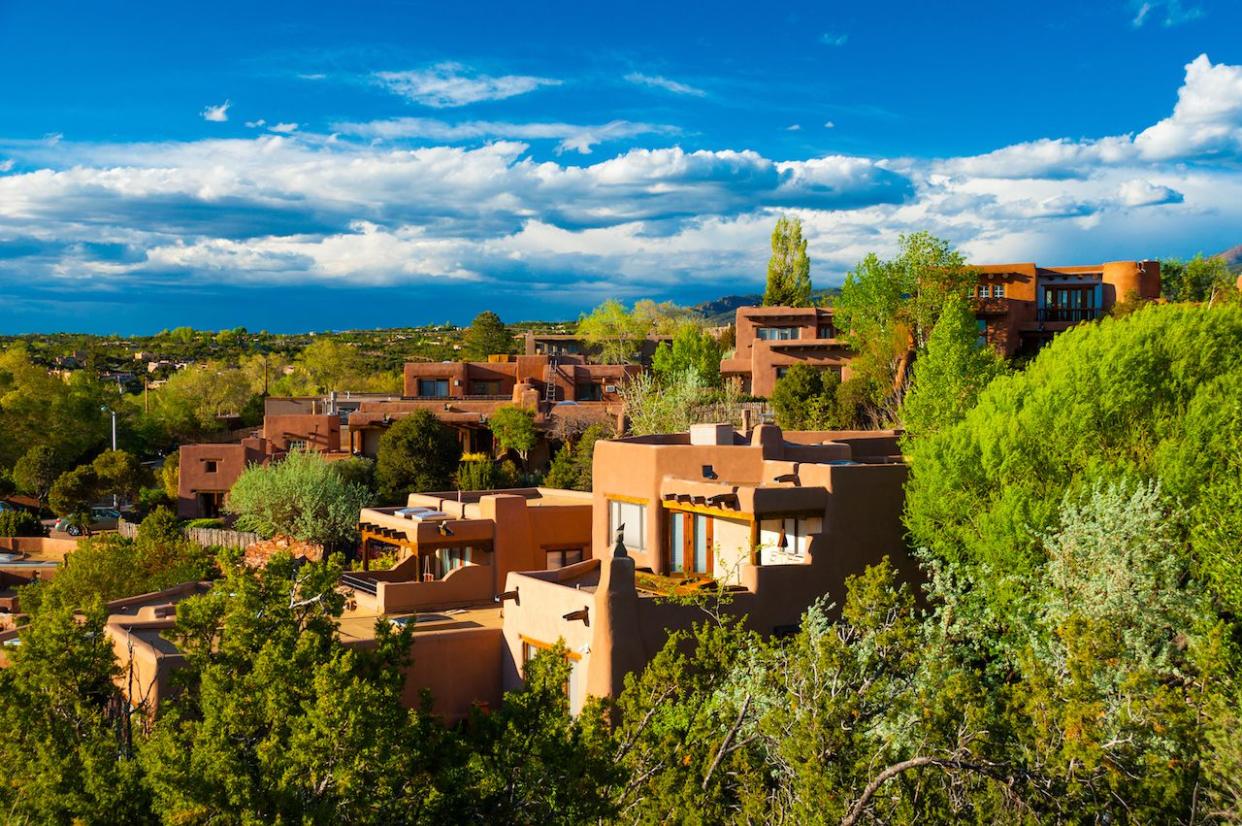

The 36th most populous state claimed the 43rd spot for highest foreclosure rate this month. Of the Land of Enchantment’s 943,149 homes, 82 went into foreclosure, making for a foreclosure rate of one in every 11,502 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Chaves, Eddy, Socorro, Lincoln, and Sandoval.

Ranked 34th in population, the Magnolia State experienced 121 foreclosures out of 1,324,992 total housing units. This puts the foreclosure rate at one in every 10,950 homes and into the 42nd spot this month. The counties with the most foreclosures per housing unit were (from highest to lowest): Grenada, Simpson, Union, Copiah, and Lee.

Sorted as 13th in population, the Evergreen State ranked 41st for its foreclosure rate in March. Of its 3,216,243 housing units, 323 went into foreclosure, making the state’s foreclosure rate one in every 9,957 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Pacific, Lewis, Pierce, Cowlitz, and Grays Harbor.

Recommended: Tips on Buying a Foreclosed Home

danlogan

The Granite State, and the 41st most populous state in the U.S., ranked 40th for highest foreclosure rate. New Hampshire saw 66 of its 640,335 homes go into foreclosure, making for a foreclosure rate of one in every 9,702 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Belknap, Coos, Sullivan, Merrimack, and Carroll.

With 326 foreclosures out of 2,734,511 total housing units, America’s Dairyland and the 20th most populous state secured the 39th spot with a foreclosure rate of one in every 8,388 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Juneau, Iron, Rusk, Taylor, and Trempealeau.

The country’s least populous state claimed the 38th spot for highest foreclosure rate this month. With 273,291 housing units, of which 33 went into foreclosure, the Equality State’s foreclosure rate was one in every 8,282 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Carbon, Sweetwater, Campbell, Sublette, and Big Horn.

The Peace Garden State’s foreclosure rate was one in every 8,275 homes. This puts the fourth-least populous state — with 372,376 housing units and 45 foreclosures — into 37th place. The counties with the most foreclosures per housing unit were (from highest to lowest): Pembina, Hettinger, Kidder, Grant, and Bottineau.

Coming in at 19th in population, the Show-Me State took the 36th spot for highest foreclosure rate this month. Of its 2,795,030 homes, 348 went into foreclosure, making for a foreclosure rate of one in every 8,032 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Caldwell, Mississippi, Laclede, Dunklin, and Barry.

With 455 homes going into foreclosure, the 12th most populous state ranked 35th for highest foreclosure rate in March. Having 3,625,285 total housing units, the Old Dominion saw a foreclosure rate of one in every 7,968 households. The counties and independent city with the most foreclosures per housing unit were (from highest to lowest): Franklin City, Lexington City, King And Queen, Dickenson, and Halifax.

The Last Frontier saw 40 foreclosures this month, making the foreclosure rate one in every 7,938 homes. This caused the third-least populous state, with a total of 317,529 housing units, to claim the 34th spot. The boroughs with the most foreclosures per housing unit were (from highest to lowest): Anchorage, Matanuska-Susitna, Kenai Peninsula, Juneau, and Fairbanks North Star.

Ranking 37th in population, the Cornhusker State placed 33rd in March with a foreclosure rate of one in every 7,640 homes. With a total of 848,023 housing units, the state had 111 foreclosure filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Garfield, Nemaha, Scotts Bluff, Webster, and Sherman.

The Paradise of the Pacific, and the 40th most populous state, came in 32nd for highest foreclosure rate. Of its 560,873 homes, 80 went into foreclosure, making for a foreclosure rate of one in every 7,011 households. Only four of the five counties in the state saw foreclosures. They were (from highest to lowest): Hawaii, Kauai, Honolulu, and Maui.

Ranked 16th in population, the Volunteer State endured 442 foreclosures out of its 3,050,850 housing units. This puts the foreclosure rate at one in every 6,902 households and in 31st place for the second month in a row. The counties with the most foreclosures per housing unit were (from highest to lowest): Lake, Hardeman, Houston, Meigs, and Hardin.

Recommended: What Is a Short Sale?

Swarmcatcher

Ranked 10th in population, the Wolverine State secured the 30th spot with a foreclosure rate of one in every 6,706 homes. With a total of 4,580,447 housing units, the state had 683 foreclosure filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Clare, Shiawassee, Gratiot, St. Joseph, and Jackson.

With a total of 1,999,202 housing units, the Bluegrass State saw 301 homes go into foreclosure, thus landing in 29th place in March. This puts the foreclosure rate for the 29th most populous state at one in every 6,642 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Powell, Greenup, Clinton, Bath, and Jefferson.

Ranked 38th in population, the Gem State received the 28th spot due to its 119 housing units that went into foreclosure this month. With 758,877 total housing units, the state’s foreclosure rate was one in every 6,377 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Custer, Bingham, Bonneville, Caribou, and Bonner.

Ranked 22nd for most populous state, the Land of 10,000 Lakes obtained the 27th spot for highest foreclosure rate in March. It has 2,493,956 housing units, of which 396 went into foreclosure, making the state’s foreclosure rate one in every 6,298 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Mille Lacs, Lac Qui Parle, McLeod, Redwood, and Isanti.

The 21st most populous state ranked 26th for highest foreclosure rate this month. Of the Centennial State’s 2,500,095 housing units, 401 went into foreclosure, making for a foreclosure rate of one in every 6,235 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Phillips, Logan, Pueblo, Morgan, and Elbert.

Jacob Boomsma / istockphoto

The Sooners State landed the 25th spot in March. With housing units totaling 1,751,802, the 28th most populous state saw 285 homes go into foreclosure at a rate of one in every 6,147 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Nowata, Caddo, Garfield, Custer, and Murray.

Sorted as 25th in population, the Pelican State placed 24th for highest foreclosure rate this month. Louisiana had a foreclosure rate of one in every 5,747 households, with 362 out of 2,080,371 homes going into foreclosure. The parishes with the most foreclosures per housing unit were (from highest to lowest): Richland, Terrebonne, Plaquemines, Iberville, and West Baton Rouge.

The ninth-most populous state claimed 23rd place for highest foreclosure rate. Out of 4,739,881 homes, 863 went into foreclosure. This puts the Tar Heel State’s foreclosure rate at one in every 5,492 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Perquimans, Gates, Anson, Northampton, and Vance.

Listed as 24th in population, the Yellowhammer State came in 22nd for highest foreclosure rate this month. Of its 2,296,920 homes, 428 went into foreclosure, making for a foreclosure rate of one in every 5,367 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Hale, Calhoun, Mobile, Jefferson, and Walker.

Sorted as 14th in population, the Grand Canyon State withstood 596 foreclosures out of its total 3,097,768 housing units. This puts the foreclosure rate at one in every 5,198 homes and into the 21st spot in March. The counties with the most foreclosures per housing unit were (from highest to lowest): Graham, Navajo, Yuma, Pinal, and La Paz.

Recommended: 4 Signs You May Be Ready to Buy

Listed as the 33rd most populous state, the Land of Opportunity ranked 20th for highest foreclosure rate this month. The state contains 1,371,709 housing units, of which 264 went into foreclosure, making its latest foreclosure rate one in every 5,196 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Prairie, Arkansas, Desha, Hot Spring, and Union.

Ranked 42nd in population, the Pine Tree State placed 19th for highest foreclosure rate in March. With a total of 741,803 housing units, Maine saw 143 foreclosures for a foreclosure rate of one in every 5,187 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Aroostook, Androscoggin, Oxford, Waldo, and Penobscot.

Ranked eighth in population, the Peach State took the 18th spot for highest foreclosure rate this month. Of its 4,426,780 homes, 910 were foreclosed on. This puts the state’s foreclosure rate at one in every 4,865 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Lanier, Crawford, Henry, Haralson, and Johnson.

The Beehive State placed 17th for highest foreclosure rate in March. Of its 1,162,654 housing units, 245 homes went into foreclosure, making the 17th most populous state’s foreclosure rate one in every 4,746 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Emery, Tooele, Wasatch, Juab, and Washington.

The Keystone State had the 16th highest foreclosure rate for the second month in a row. The fifth-most populous state saw 1,266 homes out of 5,753,908 total housing units go into foreclosure, making the state’s foreclosure rate one in every 4,545 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Philadelphia, Delaware, Wayne, Fayette, and Bucks.

The Hawkeye State had the 15th highest foreclosure rate in March. With 325 out of 1,417,064 homes going into foreclosure, the 31st most populous state’s foreclosure rate was one in every 4,360 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Audubon, Keokuk, Monroe, Clinton, and Jasper.

The Lone Star State withstood 2,885 foreclosures this month. With a foreclosure rate of one in every 4,040 households, this puts the second-most populous state in the U.S., with a whopping 11,654,971 housing units, into 14th place. The counties with the most foreclosures per housing unit were (from highest to lowest): Liberty, Madison, Atascosa, Jones, and Kaufman.

With 2,144 out of a total 8,494,452 housing units going into foreclosure, the Empire State claimed the 13th spot in March. The fourth-most populous state’s foreclosure rate was one in every 3,962 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Orange, Greene, Suffolk, Nassau, and Rensselaer.

The 15th most populous state ranked 12th for highest foreclosure rate this month. Of the Bay State’s 2,999,314 housing units, 775 went into foreclosure, making for a foreclosure rate of one in every 3,870 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Hampden, Plymouth, Worcester, Berkshire, and Essex.

The country’s most populous state ranked 11th for highest foreclosure rate in March. Of its impressive 14,424,442 housing units, 3,975 went into foreclosure, making the Golden State’s foreclosure rate one in every 3,629 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Lake, Mendocino, Madera, Kern, and Shasta.

Recommended: Your 2023 Guide to All Things Home

mlauffen

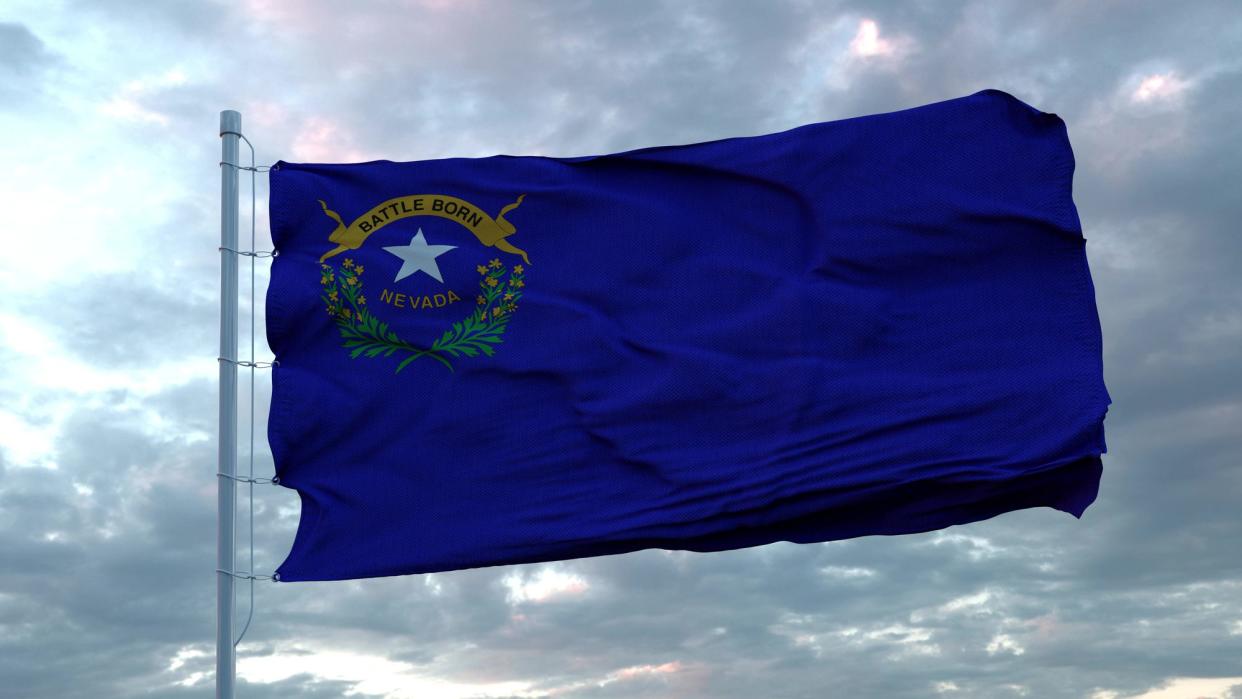

Ranked 32nd in population, the Silver State took the 10th spot for highest foreclosure rate this month. With one in every 3,181 homes going into foreclosure, and a total of 1,288,357 housing units, the state had 405 foreclosure filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Lyon, White Pine, Clark, Lander, and Nye.

The Buckeye State placed ninth in March with a foreclosure rate of one in every 3,167 homes. With a sum of 5,251,209 housing units, the seventh-most populous state had a total of 1,658 filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Knox, Cuyahoga, Shelby, Preble, and Defiance.

The 17th largest state by population, the Crossroads of America landed the eighth spot this month with a foreclosure rate of one in every 3,129 homes. Of its 2,931,710 housing units, 937 went into foreclosure. The counties with the most foreclosures per housing unit were (from highest to lowest): Scott, Perry, Clinton, Howard, and Sullivan.

Ranked 18th for most populous state, America in Miniature took seventh place for highest foreclosure rate in March. With a total of 2,531,075 housing units, of which 815 went into foreclosure, the state’s foreclosure rate was one in every 3,106 households. The counties and independent city with the most foreclosures per housing unit were (from highest to lowest): Kent, Dorchester, Prince George’s County, Baltimore City, and Calvert.

The sixth-least populous state in the country, the Small Wonder nabbed sixth place this month. With one in every 3,051 homes going into foreclosure and a total of 451,556 housing units, the state saw 148 foreclosures filed. Having only three counties in the state, the most foreclosures per housing unit were (from highest to lowest): Kent, New Castle, and Sussex.

The 23rd most populous state had the fifth highest foreclosure rate in March with one in every 2,867 homes going into foreclosure. Of the Palmetto State’s 2,362,253 housing units, 824 were foreclosed on this month. The counties with the most foreclosures per housing unit were (from highest to lowest): Fairfield, Hampton, Dorchester, Darlington, and Spartanburg.

The third-most populous state in the country has a total of 9,915,957 housing units, of which 3,568 went into foreclosure. This puts the Sunshine State’s foreclosure rate at one in every 2,779 homes and into fourth place this month. The counties with the most foreclosures per housing unit were (from highest to lowest): Hernando, Citrus, Wakulla, Osceola, and Charlotte.

With a foreclosure rate of one in every 2,638 homes, the Garden State ranked third for highest foreclosure rate this month. The 11th most populous state contains 3,756,340 housing units, of which 1,424 went into foreclosure. The counties with the most foreclosures per housing unit were (from highest to lowest): Cumberland, Warren, Sussex, Salem, and Atlantic.

With 587 of its 1,531,332 homes going into foreclosure, the Constitution State had the second highest foreclosure rate at one in every 2,609 households. In this 29th most populous state, the counties that had the most foreclosures per housing unit were (from highest to lowest): Windham, New Haven, New London, Tolland, and Fairfield.

The Land of Lincoln had the highest foreclosure rate in all 50 states in March. Of its 5,427,357 homes, 2,130 went into foreclosure, making the sixth-most populous state’s foreclosure rate one in every 2,548 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Gallatin, Jasper, Whiteside, Schuyler, and Massac.

Of all 50 states, California had the most foreclosure filings (3,975), and Vermont had the least (11). As for the states with the highest foreclosure rates, Illinois, Connecticut, and New Jersey took the top three spots, respectively.

Two regions – the Great Lakes and the Mideast – tied for having the largest presence among the 10 states that ranked the highest for foreclosure rates. The states in the Great Lakes region were (from highest to lowest): Illinois, Indiana, and Ohio. The states in the Mideast region were (from highest to lowest): New Jersey, Delaware, and Maryland.

Four regions – the Far West, Southeast, Plains, and New England – tied for having the largest presence among the 10 states that ranked the lowest for foreclosure rates. The states in the Far West region were (from highest to lowest): Washington and Oregon. The states in the Southeast region were (from highest to lowest): Mississippi and West Virginia. The states in the Plains region were (from highest to lowest): Kansas and South Dakota. Finally, the states in the New England region were (from highest to lowest): Rhode Island and Vermont.

Learn More:

This article originally appeared on SoFi.comand was syndicated by MediaFeed.org.

SoFi Loan Products

SoFi loans are originated by SoFi Lending Corp. or an affiliate (dba SoFi), a lender licensed by the Department of Financial Protection and Innovation under the California Financing Law, license # 6054612; NMLS # 1121636. For additional product-specific legal and licensing information, see our disclosures.

SoFi Home Loans

Terms, conditions, and state restrictions apply. SoFi Home Loans are not available in all states. See our criteria for more information.

External Websites: The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.