China’s First Commercial Jetliner Has a Domestic Body and Foreign Guts

"Hearst Magazines and Yahoo may earn commission or revenue on some items through these links."

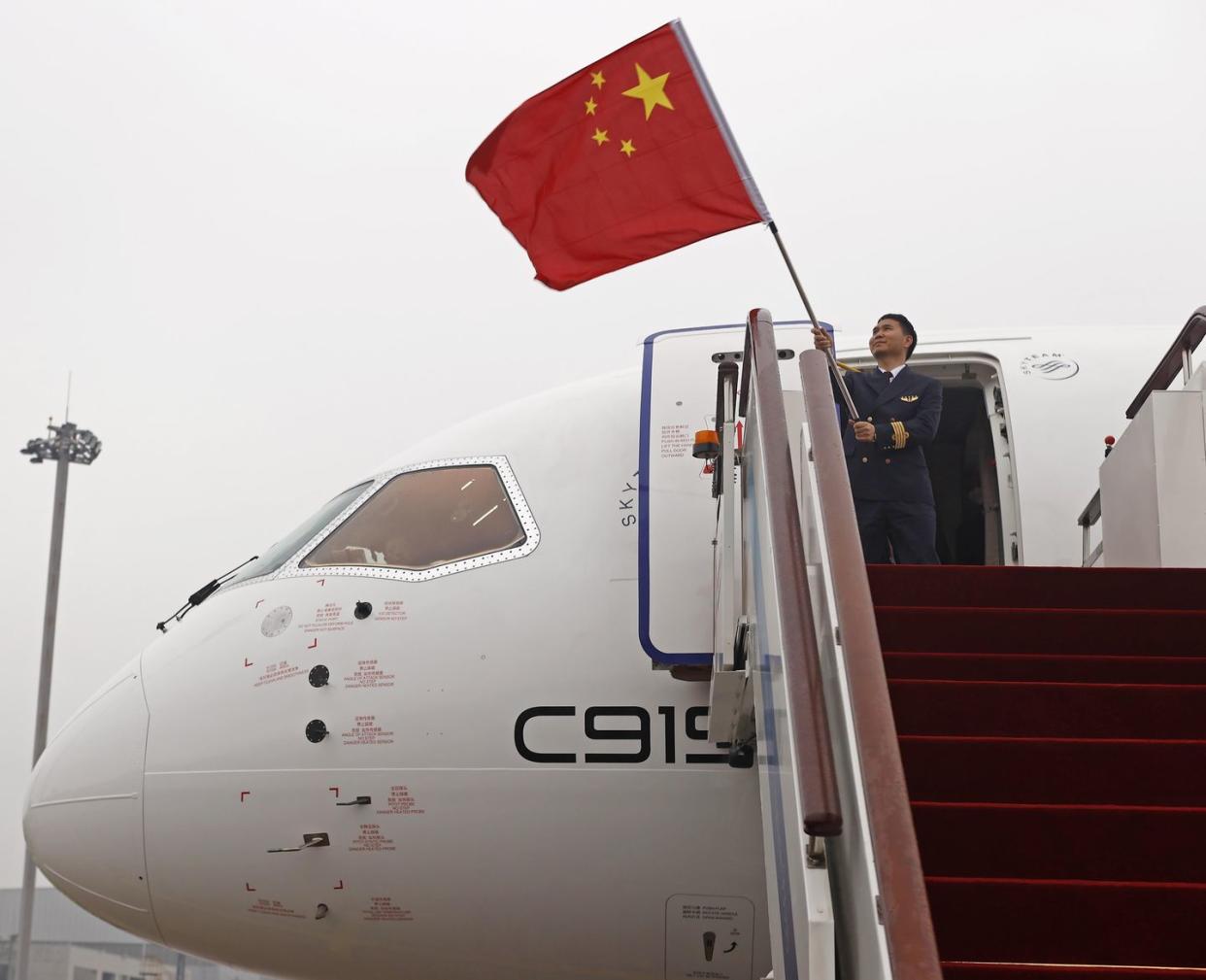

On the morning of May 28, China Eastern Airlines undertook the first commercial flight of a narrow-body jetliner built in China called the C919—a project built by COMAC (Commercial Aircraft Corporation of China) and long in the works. Aviation enthusiasts even bought tickets on Flight MU9191 in advance, just for a shot at being onboard the historic two-hour flight from Shanghai’s Hongqiao International Airport to Beijing’s Capital International Airport.

Comac previously broke new ground with its smaller ARJ-21 regional jet (similar class to the A220 or Embraer E190 series), which entered commercial service in 2016. But while China has long built military aircraft domestically, the market for large commercial jetliners must satisfy more stringent safety and cost efficiency requirements if commercial carriers are to purchase them.

However, thanks to the sway of buying domestically, the C919 already has over 1,000 domestic orders or options for orders, even though it’s entering service seven years later than intended.

Production of the C919 is an important milestone for China, but still falls short of the whole enchilada. While the airframe is built in China, most of the most complicated components—including the engines, in-flight avionics, sensors, landing gears, etc.—are still sourced from abroad.

Spies and Super Computers: Designing the C919

Like other sectors of Chinese industry, China’s aviation sector has historically relied on importing or license-building foreign designs (or more recently, acquiring schematics through hacking and/or espionage) and reverse-engineering them to eventually develop substitute domestic models tailored to Chinese characteristics. This approach has encountered limitations, however, when it comes to certain particularly complicated technologies—notably, high performance jet engines.

When first conceived in 2008, the C919 was projected to make its first flight by 2014 and enter service in 2018. Despite the use of the Tianhe-2 super computer for digital modeling, the first flight date was moved back three years to May 2017. Then, it was many more months before a second flight was performed due to problems with the elevators. By one estimate, funding from China’s government totaled between $49 billion and $72 billion in then-equivalent USD by 2020.

By 2018, western intelligence agencies began reporting that Turbine Panda, a hacking group associated with China’s Ministry of State Security, was implicated in stealing specifications and technology for use in the C919 from 13 Western companies. And contractors like GE, Honeywell and Safran actually provided parts used in the C919. In addition to trojan-based hacking, intelligence agents also sought to recruit inside sources in GE and the U.S. Army Reserves. Four agents and recruits were arrested on U.S. soil, with another six indicted in absentia.

In 2020, the C919 finally made a public overflight at the Zhuhai airshow, leading to its first commercial flight in May.

C919 by the Numbers

The C919 is a single-aisle airliner (ie. only two lines of seats) built for medium-distance operations, with a capacity for between 158 to 174 seats depending on how they’re configured. The design is, in many ways, rooted in Airbus’s similar A320 airliner, without seeking to match efficiencies achieved in its most recent incarnation. For example, wings made of lighter carbon-fiber composites had to be substituted for aluminum.

The standard C919 is specced for operations out to over 2,200 miles, a distance few domestic flights exceed within China. That said, an extended range variant is planned that could go out to 3,450 miles.

Much of the airframe is indeed domestic, with parts produced from AVIC factories across China: the nose (Chengdu), tail control surfaces (Shenyang), parts of the wings (Xi’an), the flaps (Changhe) and the fuselage (Hongdu). Final assembly takes place in Shanghai.

But beyond that, nearly all of the remaining C919 components come from overseas or from a partnership between a Chinese and foreign company.

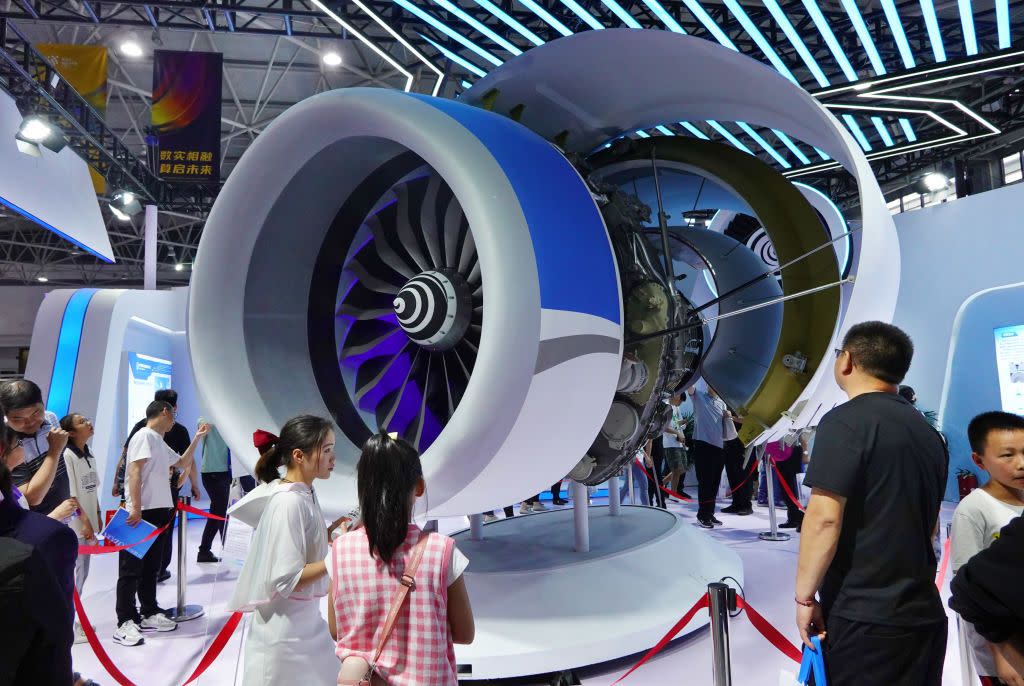

Two CFM LEAP 1C high-bypass turbofan engines co-built by General Electric and French company Safran provide propulsion, generating up to 15 tons of thrust and allowing for a cruising speed of 521 miles per hour. Earlier submodels of the LEAP 1 engines are also used on Airbus 320neo and Boeing 737 MAX series of aircraft.

Licensing export of LEAP engines caused controversy in the U.S., with hawks advocating for an export ban on the grounds that exporting the engine could be a risk to national security interests due to China’s historical predilection for reverse-engineering aircraft parts. But others argued that the engine wasn’t truly that militarily sensitive, and that a U.S. embargo would invite retaliation and cause massive losses to U.S. commercial aviation sales and flights in China.

In theory, a domestic engine called the CJ-1000A, built by AVIC, could eventually replace the LEAP turbofans. Under development since 2009, ground tests began on the engine in 2018, while a flight test mounted on a Y-20 ‘Chubby Girl’ transport plane reportedly took place in March of 2023. Certification and commercial use of the engine are not projected sooner than 2027 and 2030 respectively—at the earliest. The CJ-1000 is believed to be heavily informed by stolen data on the LEAP engine, which it is appears to match in dimensions.

Other foreign components in the C919 include:

landing gear from French company Liebherr Aerospace

Auxiliar Power Units built in a partnership between GE and China’s AVIC

fly-by-wire controls system (which automatically translate pilot input to manipulate flaps, stabilizers and so forth) by Ohio-based Parker Aerospace and AVIC

Communications, navigation systems by Collins Aerospace (U.S.)

Brakes by Honeywell (U.S.)

National Champion Airliner

The C919 was originally projected to cost around $50 million per plane—a highly competitive rate. China Eastern Airlines later claimed, in 2022, that it paid $60-70 million per C919—still quite advantageous. By comparison, current models of Boeing’s narrow-body 737-700 and 800 MAX airliners which use LEAP-1 engines reportedly cost $100-135 million, depending on capacity.

However, other reports indicate the C919’s price roughly doubled to $99 million—a much smaller price advantage. Perhaps subsidies or other measures to artificially deflate the price could explain the discrepancy. It is also worth keeping in mind that the C919 isn’t cheaper to operate per flight hour than the latest 737s and A320, and due to smaller fuel tanks, it has a significantly shorter range than the A320’s 3,300+ miles.

Even an article in state-owned China Daily proclaiming the “advantages” of the C919 over its foreign rivals only ends up listing its “homefield advantage” in China’s growing air travel sector.

That said, in China, home-field advantage can carry one far. Already, Comac claims to have 1,200 C919s order from numerous companies, though only a small fraction are fully confirmed.

The biggest preorders come from HNA Group (200 aircraft), followed by Chinese megabanks ICBC (100), Agricultural Bank of China (65), and China Construction Bank and Ping’an (50 each).

The C919 is clearly a “national champion” product, and if it performs closely enough to a 737 or A320, that may be enough given political pressure for domestic airlines to buy the national plane.

U.S.-based engine supplier GE Capital also has placed an order for 10, probably for R&D purposes. There have been indications of interest abroad from Nigeria Air and Ryan Air. But major obstacles remain: slow production and a lack of certifications outside of China with the U.S.’s FAA or Europe’s EASA—though applications have been made.

In five years, Comac hopes to be building C919s at a rate of 150 per year—equivalent to just two months of A320 production. According to one analysis, the next 20 years could credibly see production total 1,000-1,500 C919s—at most taking up 20-30% of China’s domestic aviation market, which is expected to rise to around 8,500 airliners and cargo jets by 2041. That leaves Boeing and Airbus plenty of room to continue their business in China.

China is also building a prototype of the CR929 wide-body jetliner with Russia’s United Aircraft Corporation, but this project’s viability will be adversely affected by Russia’s collapsing access to Western markets for sales and components, due to sanctions.

Predicting the Future

James Fallows, who wrote about China’s civil aviation sector in his 2012 book China Airborne, notes in a 2022 article that he correctly predicted a few key things regarding the C919—that the plane would rely mostly on domestic buy-in, would struggle to match Boeing and Airbus’s globally distributed sales, supply, maintenance and training infrastructure, and would continue to depend on components and avionics from Europe and North America.

The C919 does not yet insulate China’s commercial air travel sector from dependence on foreign airliners and aircraft components. And its overseas buyers are likely to mostly be close allies with Western states or have limited access to Western markets—that is, unless Comac truly can deliver aircraft at the cheaper $60-70 million price point.

Nonetheless, it’s an important step for China toward building an independent commercial aviation sector that will be carried aloft by Beijing’s ability to ensure domestic procurement of a fledgling national champion. There are a lot of bells and whistles to get right in order to assemble safe and economically viable jetliners, and the difficulties of today are prerequisite for broader successes tomorrow.

Over time, more of the C919’s foreign-built insides will likely be gradually substituted by domestic systems once sufficiently matured. Perhaps that will one day parallel the experience of other Western industries that have found their presence in China once indigenous rivals have been adequately nurtured. But for now, the C919’s insides point to industry domination being a long way off.

You Might Also Like