Leaders of Florida’s largest homeowners association charged in $2 million fraud scheme

The former president of one of the largest homeowners associations in Florida, along with her husband and three others, were accused Tuesday of plundering millions of dollars of monthly maintenance fees and diverting it for personal use.

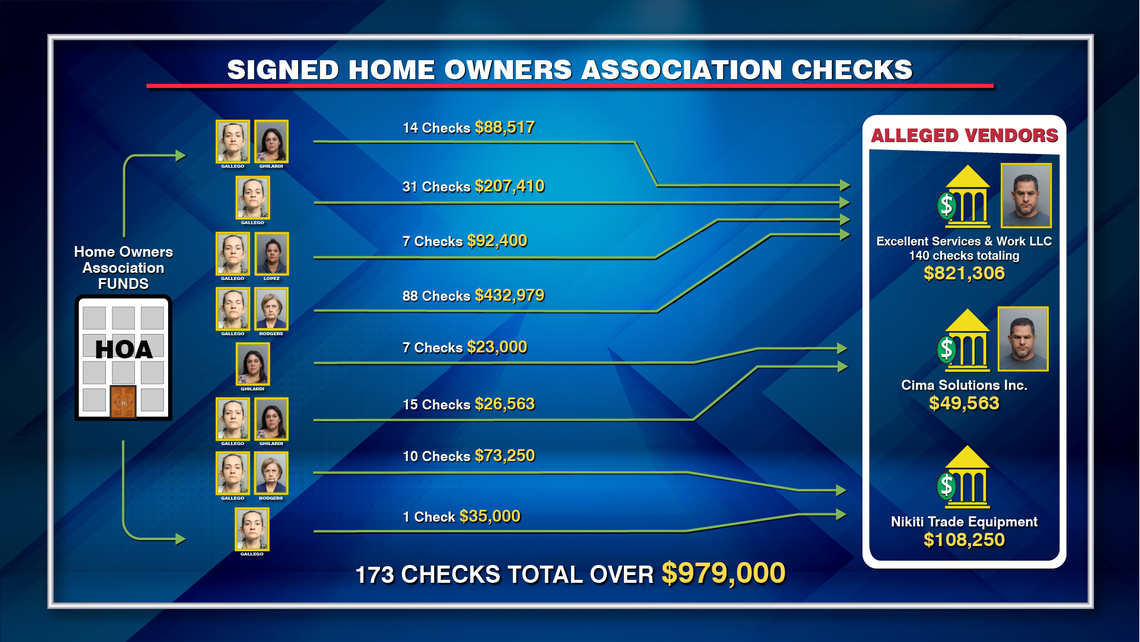

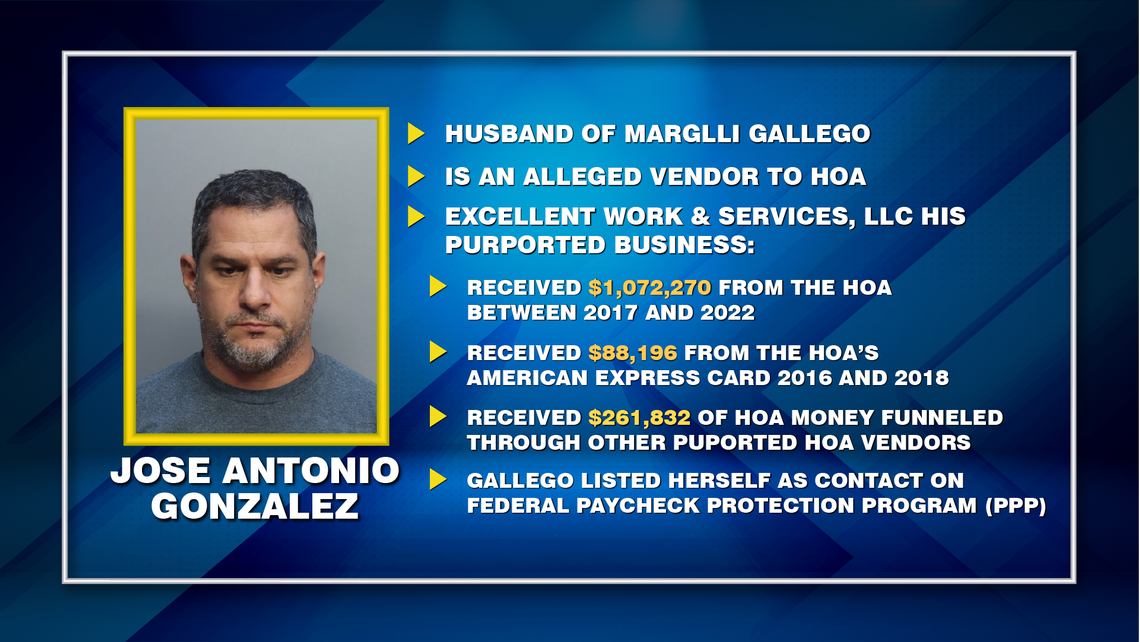

Prosecutors say the group, which also included three past and present board members, at West Kendall’s Hammocks Community Association engaged for years in a complicated, multi-layered scheme that included the creation of several “shell companies” — including one listed under the name of former HOA President Marglli Gallego’s husband — that netted more than $1.4 million between 2017 and 2022.

In all, prosecutors say they know of five companies run by the president’s husband and a former board member that they believe siphoned as much as $2 million from a residential community the size of Key Biscayne or Miami Springs. The Hammocks Community Association consists of more than 18,000 people, in 6,500 homes, townhouses and apartments, on almost 4,000 acres. This year, to the ire of many residents, association leaders implemented a 400 percent increase in monthly maintenance fees.

“They transferred the HOA into a criminal enterprise intended to benefit some members,” said Miami-Dade State Attorney Katherine Fernandez Rundle at an afternoon press conference announcing a slew of charges. “They diverted the money of hard-working families into the pockets of Ms. Gallego and her husband.”

The five had their first appearance in Miami-Dade bond court late Tuesday. Gallego, 41, the former HOA president, was charged with several counts of racketeering, organized scheme to defraud, money laundering, grand theft and fabricating evidence. She remained in jail while a judge weighed arguments on how much bond to set for her release. Her attorneys asked for $200,000 while prosecutors seek $1 million, calling her a flight risk.

Her husband Juan Antonio Gonzalez, 45, was charged with racketeering, money laundering and grand theft.

Gallego’s attorney Frank Quintero said the state has presented no proof — even after today’s 49-page arrest warrant was issued — that his client stole any money from the association.

“Where is the evidence? These are allegations. A warrant doesn’t mean it’s true,” he said.

Quintero said he met with prosecutors earlier in the year and told them if charges were forthcoming, Gallego would turn herself in.

“They ignore our request and go out to arrest her,” Quintero said. “Why? Because the state attorney needs a press conference. All they had to do was pick up the phone and we’d surrender her.”

Her husband’s attorney John Priovolos called the charges “meritless.”

“Any allegation that he was involved in a criminal conspiracy concerning his services is absurd. We look forward to defending him and holding the state to its burden,” said Priovolos.

Also charged Tuesday were current board member Myriam Arrango Rogers, 76, who is facing racketeering and grand theft charges, as is 52-year-old Monica Isabel Ghilardi, the current HOA president. Yoleidis Lopez, another former board member, is facing a single count of grand theft.

According to Tuesday’s arrest warrant, investigators found that more than 200 checks were written from the homeowners association to a company run by Gallego’s husband called Excellent Work & Services totaling $207,410 over the past five years. They went into two company bank accounts, one at JP Chase Morgan, the other at Regions Bank. Investigators say Gallego was the sole signatory on 31 of the checks and that the three other women arrested also wrote “numerous” checks to Gonzalez on behalf of the association.

The warrant called Gallego’s husband Gonzalez the company’s “sole” employee. Rundle said investigators aren’t certain what if any services were provided and they’re not sure where all the money went. She said she expects more arrests in the future.

“It appears that most of those funds and millions in homeowners association reserves are gone,” Fernandez Rundle said.

As president, the warrant also says Gallego wrote checks for just under $1 million to three companies owned by a man named Roberto Trueba. One company was a body shop. According to investigators, Trueba would cash them, keep 10 percent, then return the rest of the money to Gallego.

Trueba, according to the warrant, originally told investigators that the money was for cleanup and car repairs after Hurricane Irma. But his sister-in-law told them at least one of the companies wasn’t functioning and had no equipment or employees. Trueba, the warrant claims, later admitted lying and said the invoices were fake and that he didn’t do any work for the association. He said Gallego gave him $5,000 for a lawyer. He was not charged with any wrongdoing on Tuesday.

“Check after check after check went to her husband’s company and all that money was used for their personal living expenses,” said Assistant State Attorney John Perikles, who oversees economic crimes cases.

Is fraud occurring in your HOA? Red flags to watch for and how to file a complaint

The latest charges stem from a long-running probe that last year resulted in the arrest of the Hammocks president Gallego. Since her arrest, the sprawling planned community has been in turmoil, its coffers depleted, homeowners hit with 300 to 400 percent hikes in maintenance fees and the launching of a contentious recall effort against the board.

Homeowners felt vindicated Tuesday after fighting what they call the “Gallego Mafia” for years. They tried to oust the board at a chaotic Jan. 3 election when hundreds of voters standing in line were not allowed to vote because of a fake phoned-in bomb threat and again during a July recall election when the board threw out two thirds of the ballots cast.

“Justice can be slow to prevail but we are ready to declare a holiday for the Hammocks today,” said Don Kearns, a 28-year resident, former board president and a leader of the Justice for the Hammocks coalition. “I encourage the state attorney’s office and police to continue to go down the rabbit hole because we believe it will lead to more arrests and the discovery of more stolen money.”

Florida homeowners rebelled, hope to see justice after years of battling HOA board

While the arrested board members must resign, three of Gallego’s allies will remain in power, Kearns said. “The fear is they will raise fees again so they can bail out their arrested fellow board members and keep using our money for their legal defense.”

It was in April 2021 that prosecutors first charged Gallego on accusations she stole nearly $60,000 from the association — including money spent on a private investigator to spy on her perceived enemies in the neighborhood.

Prosecutors said that between November 2016 and March 2018, Gallego improperly used an HOA credit card for a wide array of personal purchases, including at supermarkets, bakeries and fast food restaurants such as Pollo Tropical, Panera Bread and Little Caesars. Her trial is pending.

An arrest warrant depicted her as using HOA resources to go after enemies, ordering the community’s security to “harass” rival association members and filing lawsuits against people she felt were “targeting her unjustly.”

Investigators say she and the board repeatedly ignored subpoenas, failing to turn over thousands of financial records while fighting with prosecutors over tens of thousands of dollars in reimbursement for the time and expense of gathering the records. At one point, she even filed lawsuits against a Miami-Dade economic crimes investigator who was leading the criminal probe that led to her arrest.

But as her criminal case wound through the legal system, the State Attorney’s Office embarked on a wider fraud probe into the HOA — and again found itself stymied by the board while trying to subpoena financial documents.

Despite judges ordering the HOA to produce financial documents, the association refused to comply, even appealing one judge’s ruling. An appeals court threw out the appeal. At one point earlier this year, an attorney for the board told a Miami-Dade judge the board voted to ignore the judge’s order because “the board doesn’t trust the state.”

The board last held a public meeting four and a half years ago and has worked in secret since, Kearns said. The board admitted at a recent hearing it does not have audited financial statements for six of the past seven years. Homeowners are asking a judge to appoint a receiver to take over the board, examine the financial damage and supervise a new election.

Justice for the Hammocks also wants the state Legislature to rewrite statute 720, which regulates HOAs.

“All victims of rogue HOAs need to pressure the state to put teeth into 720 and give the Department of Business and Professional Regulation real enforcement authority,” Kearns said. “Otherwise, it’s a Wild West free-for-all. When you’ve got unscrupulous characters running your community, 720 is a sieve.”

Circuit Judge Diane Vizcaino, who then was presiding over the legal fights, even ordered the board’s “custodian of records,” an association employee, to come to court to explain himself. The employee, Kevin Alzate, a cousin of Gallego’s, insisted he had never been the records keeper. When shown an affidavit he signed saying he was, Alzate claimed he signed the document without reading it closely.

The HOA’s efforts to stonewall the investigation are still continuing — recently, the board filed a federal lawsuit against the State Attorney’s Office to block enforcement of subpoenas. That case is still pending.