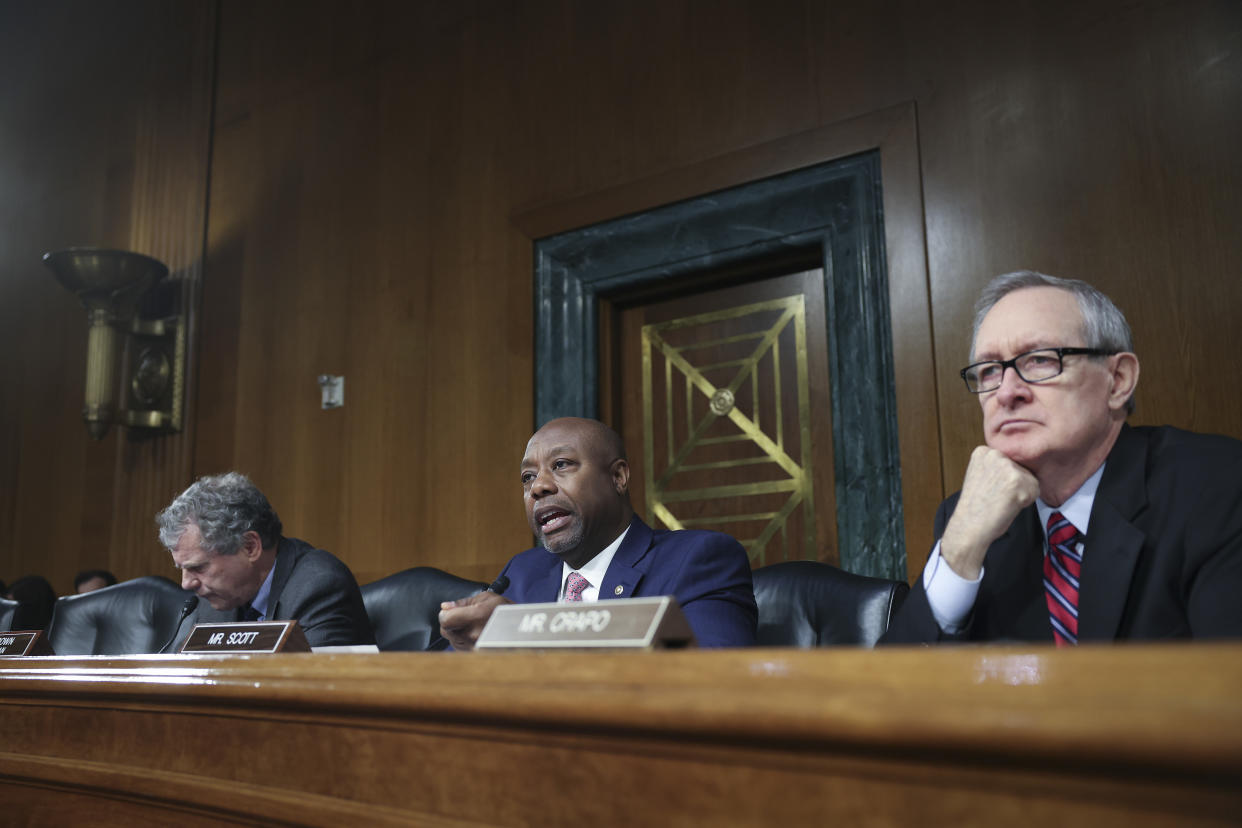

Lawmakers press US bank regulators on implicit risks of ‘bailouts’

U.S. senators grilled bank regulators Tuesday over their “extraordinary” decision to cover uninsured deposits held by customers of collapsed Silicon Valley Bank (SVB) and Signature Bank (SB), with one calling the controversial move a bailout.

During a hearing, members of the U.S. Senate Committee on Banking, Housing, and Urban Affairs probed representatives from the Federal Deposit Insurance Corporation (FDIC), the Board of Governors of the Federal Reserve System, and the Undersecretary for Domestic Finance, on concerns that the use of a legal exception to repay those banks' customers beyond the FDIC’s $250,000 limit may have introduced new risks to the financial system.

“Whether you guys meant to or not, I think the implication of what happened with SVB is that there are a lot of people who expect that their uninsured deposits are effectively insured at an unlimited level,” Sen. J.D. Vance (R-OH) said. “Or if you’re a banker…that if you’re systemically important enough, that your uninsured depositors are going to get bailed out.”

Lawmakers from both sides of the aisle pointed to worries that repayment of uninsured deposits would incentivize banks to take increased risks with customer deposits, knowing that the special exception could prop up banks when their business plans go south, and that costs to replenish the FDIC’s funds would ultimately fall on American taxpayers.

In response to the banking failures, the U.S. Treasury Secretary invoked the Systematic Risk Exemption (SRE), a single exception to banking law that otherwise caps protection for cash and cash equivalent deposits at $250,000.

The rule is a carve out to the 1991 Federal Deposit Insurance Corporation Improvement Act (FDICIA) that requires the FDIC to impose the “least cost” on taxpayers when it reaches into the coffers of its Deposit Insurance Fund (DIF) in winding down failed banks.

Michael Gruenberg, chair of the FDIC’s Board of Directors, testified during the hearing that any loss to the FDIC’s DIF would be repaid through special assessments on banks. President Joe Biden delivered the same message when announcing the decision in the wake of SVB’s implosion.

“The problem is…that position just doesn’t square with reality,” Sen. Bill Hagerty (R-TN) told Gruenberg, accusing regulators of “leaning” on the narrow legal exception. The DIF, he said, will be replenished by a special assessment on banks across the nation that had nothing to do with SVB.

“And as we all know, these banks will have to pass these costs along," Hagerty said. "Last I checked, those costs get passed along to the consumer. Those consumers are American taxpayers.”

The DIF — the fund that pays out depositor losses — is primarily funded through quarterly assessments on insured banks and, to a lesser extent, through interest earned on investments and assets recovered through liquidations.

Asked if banks with no involvement in the bank collapses could be exempt from a legal requirement to fund the DIF, Gruenberg said the FDIC is authorized to consider and have some discretion over the types of entities that must contribute.

Hon. Michael Barr, vice chairman for supervision for the Board of Governors of the Federal Reserve System, who also testified during the hearing, described the uninsured reimbursement decision as a judgment call that focused on risks to the broader financial system, rather than on the two banks’ particular depositors.

“It’s a difficult judgment, but one that at the end of the day a unanimous FDIC board, and a unanimous Federal Reserve Board, and the Treasury Secretary agreed that the risk to the system was one that was not worth taking,” Barr said.

Sen. Bob Menedez (D-NJ) questioned whether the SRE needs to further define “systemic risk,” noting that SVB was exempt from the Treasury's Financial Stability Oversight Council list of “systemically important” institutions, while at the same time regulators characterized its failure as a systematic risk in order to refund uninsured deposits.

“You all need to have an obligation to be clear with us, and with the American people, when you took extraordinary steps to insure uninsured depositors that could very well lead to increased fees charged to banks, and ultimately, to consumers,” Menedez said. The senator said the regulators “rightfully” invoked the SRE and raised the possibility of increasing DIF funds.

In addition to defending the use of the SRE, Barr repeatedly deflected blame from regulators, saying SVB’s collapse falls on the shoulders of its executives who failed to properly manage liquidity and interest rate risks.

"Executives at SVB and SB took wild risks and must be held accountable," Sen. Elizabeth Warren (D-MA) said. "But let's be clear: These collapses also represent a massive lack of supervision of our nation's banks."

“I think it’s important that we use the term bailout,” Vance said. “There were a lot of people, a lot of firms at SVB that had deposits of well over $1 million, well over $5 million. And what we did in practice…was bail them out.”

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on Twitter @alexiskweed.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Find live stock market quotes and the latest business and finance news