Lawmakers make another run at banning their colleagues from trading stocks

After an anticlimactic end to the issue in 2022, Congress is again setting up another debate over policing stock trading among lawmakers.

So far this year, three bills have been formally introduced to ban lawmakers from trading as the headlines keep coming. This week, it was the news that Paul Pelosi, husband of Speaker Emerita Nancy Pelosi (D-CA), sold 30,000 shares of Google just weeks before the Justice Department filed a lawsuit against the company.

So far, the efforts on the bill range from a partisan effort designed to provoke Pelosi to another proposing broad ethics reforms. But it's the reintroduction of a bipartisan effort that could be the most likely way to actually address the issue.

“I think their cynicism is well founded because Congress doesn't like to police itself," said Rep. Abigail Spanberger (D-VA), one the lead co-sponsors of the bipartisan effort, about Americans' skepticism. She sat down with Yahoo Finance Friday morning in her Capitol Hill office to discuss the campaign to get it enacted.

In conversations with her colleagues, she tells them: “I'm not impugning your integrity, I'm recognizing that the American people question our integrity."

This is a third go-around on the issue for Spanberger and her co-sponsor Rep. Chip Roy (R-TX). Their bill is called The TRUST in Congress Act that would require members of Congress as well as their family members to put their investments into a qualified blind trust during their time in Congress.

As of Friday, the bill had signed on nearly 50 lawmakers, including eight Republicans and 39 Democrats. Their approach is similar to a bill from Sens. Jon Ossof (D-GA) and Mark Kelly (D-AZ) that was introduced last year in the Senate.

Three efforts from across the ideological spectrum

In addition to the Spanberger/Roy effort, there’s also a bill from Sen. Josh Hawley (R-MO) that seems more focused on the former House Speaker than on finding bipartisan support. His bill is called the Preventing Elected Leaders from Owning Securities and Investments Act — the PELOSI act, for short.

“I don't know of any universe where dragging or trolling the former Speaker of the House is a path toward moving a bipartisan bill,” said Donald K. Sherman, who has testified before Congress about the issue and is a senior vice president at the group Citizens for Responsibility and Ethics in Washington. “I think troll bills are troll bills.”

Nevertheless, while Pelosi doesn’t trade stocks herself, the frequent activities of her husband, Paul, have continued to get notice — with online trackers popping up for traders to follow — and spurred calls for action. Pelosi has long denied that her husband trades stocks based on any inside information he receives from her.

People have asked why I named my stock trade ban the PELOSI Act. Now you know https://t.co/qMKDNx5buK

— Josh Hawley (@HawleyMO) January 25, 2023

Another effort comes from Rep. Angie Craig (D-MN) who re-introduced her bill on Wednesday called the Halt Unchecked Member Benefits with Lobbying Elimination (HUMBLE) Act.

Her bill would not only ban stock trading, but also prohibit lawmakers from becoming lobbyists after they leave office and other measures like forbidding the use of taxpayer money to buy first-class plane tickets. That bill had been cosponsored in years past by Rep. Katie Porter (D-CA) and Rep. Alexandria Ocasio-Cortez (D-NY).

‘We have to bring trust back to this institution’

This year’s efforts also come after the House approved a change for the coming session that will strongly limit the powers of the Office of Congressional Ethics, a bipartisan watchdog charged with the day-to-day work of policing lawmakers.

Asked whether the move could open the door to more abuse by lawmakers in the stock market, Spanberger said “a hundred percent” adding that “they have pulled back some of the teeth of what that office is supposed to do.”

The wave of efforts around the stock trading issue gained intense attention about a year ago following revelations that, in the lead-up to the pandemic, then-Sen. Kelly Loeffler (R-GA) and Sen. Richard Burr (R-NC) sold stocks soon after a private briefing on COVID-19. Burr faced a Justice Department investigation that eventually ended without charges, while Loeffler lost her election bid.

In addition, there have been ongoing trades from Paul Pelosi and media reports that have shined a light on the depth of the problem. An ongoing investigation from Business Insider found 78 members of Congress have violated provisions in a 2012 law that requires public disclosures of trades within 45 days. Meanwhile, a 2022 New York Times report found 97 lawmakers have reported stock trades overlapping with their work in Congress.

But in spite of the pressure throughout last year, the effort came to a frustrating end for advocates when then-Speaker Pelosi said leadership was on the cusp of a bill to bring to the floor but then — even amid overwhelming public support — no vote was ever held. Talks came apart largely over the question of how extensive to make a ban.

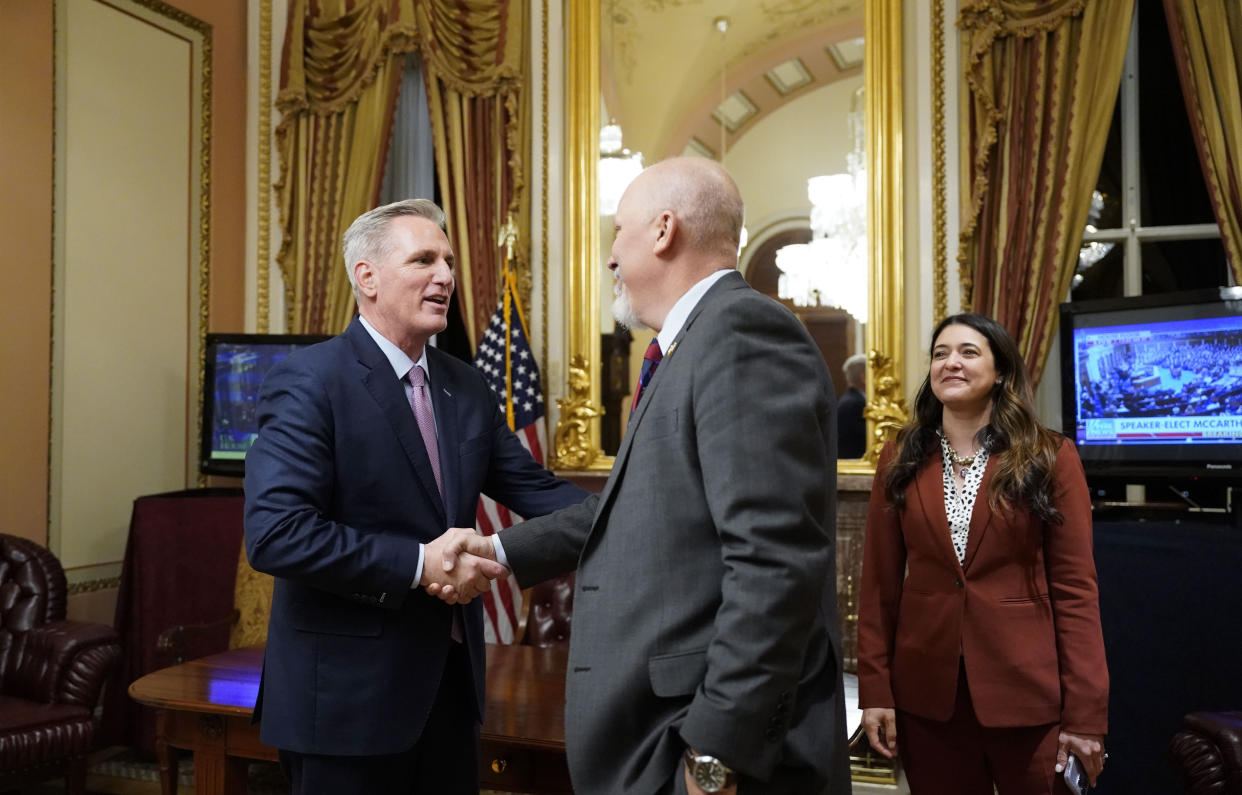

For his part, Kevin McCarthy spoke in support of a ban in 2022 and even promised to address the issue in 2023 during a press conference last July.

“This is something that we will do in the majority,” he said at the time. “We have to bring trust back to this institution.”

He hasn’t addressed the issue yet since taking power and it remains to be seen how highly GOP leadership prioritizes the effort amid everything else on the party's agenda.

Sherman acknowledged that the idea may have a bumpy road ahead, saying “getting Congress to regulate itself is one of the heaviest lifts you can imagine.” But, he added, the issue may be Congress’s best opportunity for a bipartisan win in the months ahead, a possible motivating factor.

As for Spanberger, during Friday’s conversation, she played down the objections that she continues to hear from lawmakers, many of whom maintain that a ban is unnecessary and overly burdensome.

Citing her previous life as a CIA case officer, she said: “I used to get strapped in a chair, I used to submit to a full scope polygraph” as part of that job. “I don't think it's particularly oppressive to not be allowed to trade individual stocks.”

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube