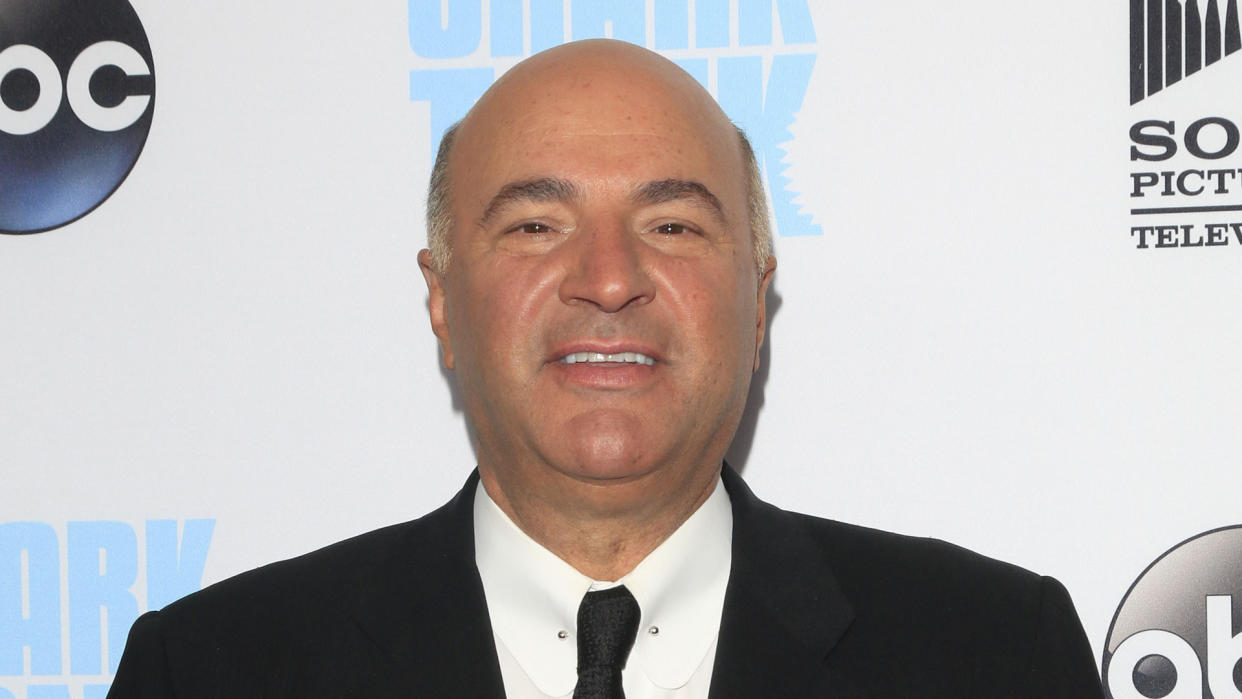

Kevin O’Leary Is Wrong About How Much You Need To Take Financial Risks, Experts Say

When your net worth is over $400 million, like Canadian businessman Kevin O’Leary, it’s all too easy to lose touch with what it takes for entrepreneurs to start up new businesses.

Read More: Charlie Munger: Why 95% of Investors Have No Chance of Beating the S&P 500 Index

Find Out: 4 Genius Things All Wealthy People Do With Their Money

The “Shark Tank” investor made a bold statement on X (formerly Twitter) that young entrepreneurs should not take any risks on a project until they have amassed a certain amount of money.

That amount? Around $5 million.

While there’s no doubt that the more money you have at the beginning of a venture, the better, 21% of business owners start up their businesses with $5,000 or less, according to Lending Tree.

Entrepreneurs explain why O’Leary is wrong in his assessment.

It Ignores Execution Risk

This kind of advice is typical for investors nudging entrepreneurs to fundraise and not focus on creating value, according to Paulo Andrez, author of “Zero Risk Startup: The Ultimate Entrepreneur’s Guide to Mitigating Risks When Starting or Growing a Business.”

“Such statements completely ignore the most important factor: execution risk. A $10 million investment can be less risky than a $1 million investment, depending on applied risk mitigation strategies,” Andrez said.

Furthermore, he said O’Leary’s advice doesn’t account for the specific risks of business.

“Why would someone need to accumulate $5 million for a business with a risk of only $50,000?”

It’s Inaccurate

O’Leary’s advice is also factually incorrect, as many successful entrepreneurs started small and took minimal risks without millions accumulated, Andrez pointed out.

“They prioritized acquiring clients over fundraising. For example, Steve Jobs and Steve Wozniak started Apple, not with money, but with a client order.”

Indeed, according to Russell Rosario, co-founder of Profit Leap, there have been numerous “cautionary tales” where substantial financial backing wasn’t a guarantee of success.

He gave two contrary examples. On the one hand, Juicero, which raised over $100 million but collapsed due to a lack of market understanding and customer alignment. On the other hand, Sara Blakely started Spanx with just $5,000 from her savings by focusing on solving a specific pain point for consumers.

“Her resilience and customer-centric approach turned Spanx into a billion-dollar empire. This underscores the notion that understanding market needs and responding effectively is often more critical than starting with a hefty sum,” Rosario said.

Discover More: I’m a Financial Advisor: Here’s Why My Rich Clients Identify With the Middle Class

You Can Scale Too Quickly

Moreover, Rosario pointed out that having a lot of money upfront can lead to scaling too quickly, which can undercut a company’s success.

“At Profit Leap, we emphasize the strategic approach to scaling, advising businesses on gradual and sustainable growth. Financial discipline and proper budget alignment with strategic goals can significantly impact business longevity. Encouraging young entrepreneurs to bootstrap and focus on MVPs (Minimum Viable Products) allows them to validate ideas “

It Ignores Other Risks

O’Leary’s advice also overlooks what Andrez called “intangible risks” that aspiring entrepreneurs face, “such as prestige, reputational risk, and potential family opposition.” In many cases, he said, intangible risks are the key obstacle even for people with $5 million in the bank.

Instead of focusing on amassing $5 million, entrepreneurs should concentrate on mitigating risks in five key areas, Andrez said: market, entrepreneur/team, financial, legal and operational.

Your Ideas Make Your Millions

Rob Brautigam, a multi-industry entrepreneur and executive consultant who has helped more than 2,000 entrepreneurs build companies, believes that your projects should make you your first $5 million.

He explained, “When I left my engineering career in NYC in 2016, I didn’t have millions in the bank. What I did have was a vision of life outside the nine to five, a willingness to learn, and the determination to take calculated risks. If I had never taken the entrepreneurial leap of faith, I would have never built multiple successful ventures and advised on the growth of over 2,000 entrepreneurs’ companies along the way.”

Waiting Stifles Innovation

In Brautigam’s experience, waiting to accumulate such a substantial amount of money via a day job or, say, for your crypto coins to explode in value, can stifle innovation and delay the realization of potentially groundbreaking ideas.

“Entrepreneurship is inherently risky, and while financial stability is crucial, the journey often requires a balance between caution and boldness.”

Leanness Teaches Lessons

In fact, Brautigam insisted, starting lean can teach invaluable lessons in resourcefulness and creativity.

“By working with tight budgets, young entrepreneurs are often forced to focus on what truly matters — creating actual value for their customers.”

Risks Don’t Always Require Money

Brautigam said that the most successful entrepreneurs he’s seen are those who push themselves outside of their comfort zone, have a burning desire to succeed and can adapt to whatever is thrown at them.

“A hefty bank account from the start is not required. They leverage their networks, continually seek knowledge, and remain flexible. Financial success follows those who are committed to solving real problems and delivering genuine value.”

Instead of a multimillion-dollar safety net, Brautigam urged, “Embrace the risks, learn from the journey, and let your passion drive you forward. Success is not solely about the money you start with, but about the impact you make and the value you create.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Kevin O’Leary Is Wrong About How Much You Need To Take Financial Risks, Experts Say