Jim Cramer: Why Gen Z Has To Learn To Be Frugal

Discussing money can be uncomfortable, but with so many people drowning in debt, most people are open to expanding their financial education.

Check Out: 6 Things Minimalists Never Buy — and You Shouldn’t Either

Read Next: 6 Genius Things All Wealthy People Do With Their Money

According to data published by Intuit Credit Karma, credit card debt for young Americans has grown at a faster pace than other generations. As of March 1, 2024, average credit card balances for Gen Z have increased 62% since the Federal Reserve started increasing rates in March 2022, rising from $2,000 to $3,300.

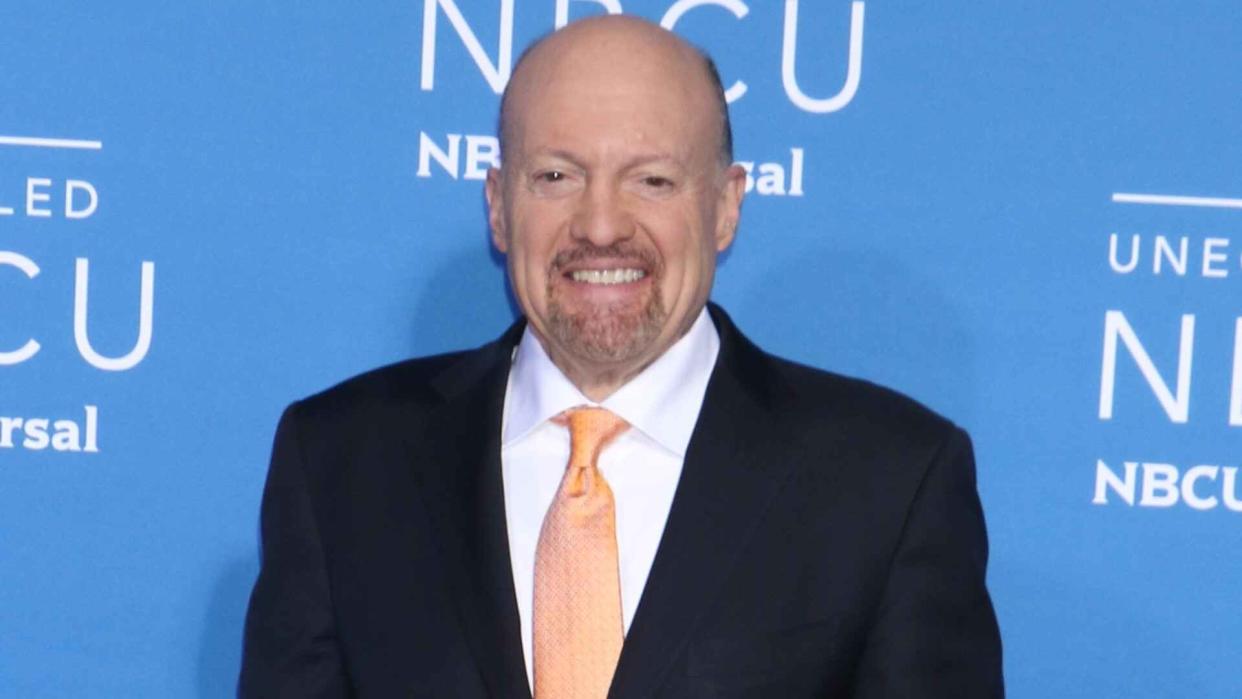

Although Gen Zers are clearly spending more, they might not be spending or investing wisely. That’s the thinking of Jim Cramer, former hedge fund investor, manager of CNBC’s Investing Club and host and anchor of the channel’s “Mad Money” and “Squawk on the Street” programs.

Seeing younger people at his New York Bar San Miguel restaurant spending money “as if it grew on a tree” prompted Cramer to proclaim that “Younger people have to learn to be more frugal.”

“On the one hand, you’re allowed to have all the margaritas you want. But on the other hand, you say, ‘I can’t invest, I have student loans,'” Cramer told CNBC Make It. “I think that’s counterintuitive. They have to change their thinking.”

Cramer knows of what he speaks. According to The New York Times, when he was in his 20s working as a crime reporter in California, his apartment was robbed, leaving him with no money or possessions. He had no choice but to live in his car until he eventually turned things around and landed on Wall Street.

However down and out he might have felt at the time, Cramer was still motivated enough to sock away $100 every month into a stock index fund. “I put that money away, and it made me a millionaire,” he said.

How Gen Zers May Best Invest Their Money

For the generation that allegedly puts experiences before money — prioritizing comfort, wellness and novelty — Gen Zers aren’t necessarily oblivious to investing. In fact, thanks to the rise of commission-free trading and user-friendly mobile investing apps, Gen Z investors have easier access to the stock market and other investments.

Here’s a few things to keep in mind if you’re looking to start investing your money instead of spending it on discretionary and impulse items, courtesy of Jim Cramer.

Learn More: 5 Frugal Habits of Mark Cuban

Consistent Investing

According to Cramer, consistent investing is the perfect place for Gen Z individuals to start their change in thinking. Because, “Over time, stocks have been proven to be an unbelievable asset,” Cramer knows that regular investing, even small amounts, will grow over time. Starting early and investing consistently will teach you accountability — and will encourage you as you watch your wealth build significantly over the years.

Index/Mutual Funds

When Cramer was on Farnoosh Torabi’s “So Money” podcast years ago, he recommended that young investors invest their first $10,000 in index funds, instead of putting their money into in four or five diverse stocks. “I want the first $10,000 in index funds because I feel that the market is so unforgiving, and that if you have two bad stocks out of five, you could get hurt,” he told Torabi. “But once you’ve saved $10,000, then you have some mad money, and then you can be diversified with some stocks.”

Cramer cautioned new investors to thoroughly research their mutual funds and choose those that have relative low costs (and fees) that won’t eat into your investments.

‘Buy What You Know’

During a previous episode of “Mad Money,” Cramer spoke about young investors’ tendency to buy what they don’t know — or jump aboard trendy picks like last year’s AMC and GameStop. “I’ve always told you to buy what you know,” Cramer said. “That doesn’t necessarily mean that you should just buy something like American Eagle because you like your jeans.”

“What I want you to do is say, ‘Hey, I like American Eagle’s jeans. Now let me delve into the stock. Is it cheap? How was the quarter? How’s that dividend? Do they have a problem with infrastructure?’ That’s the right way to buy what you know.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Jim Cramer: Why Gen Z Has To Learn To Be Frugal