Jim Cramer Says a Reddit IPO Is Bad for the Economy: Does That Mean You Shouldn’t Invest?

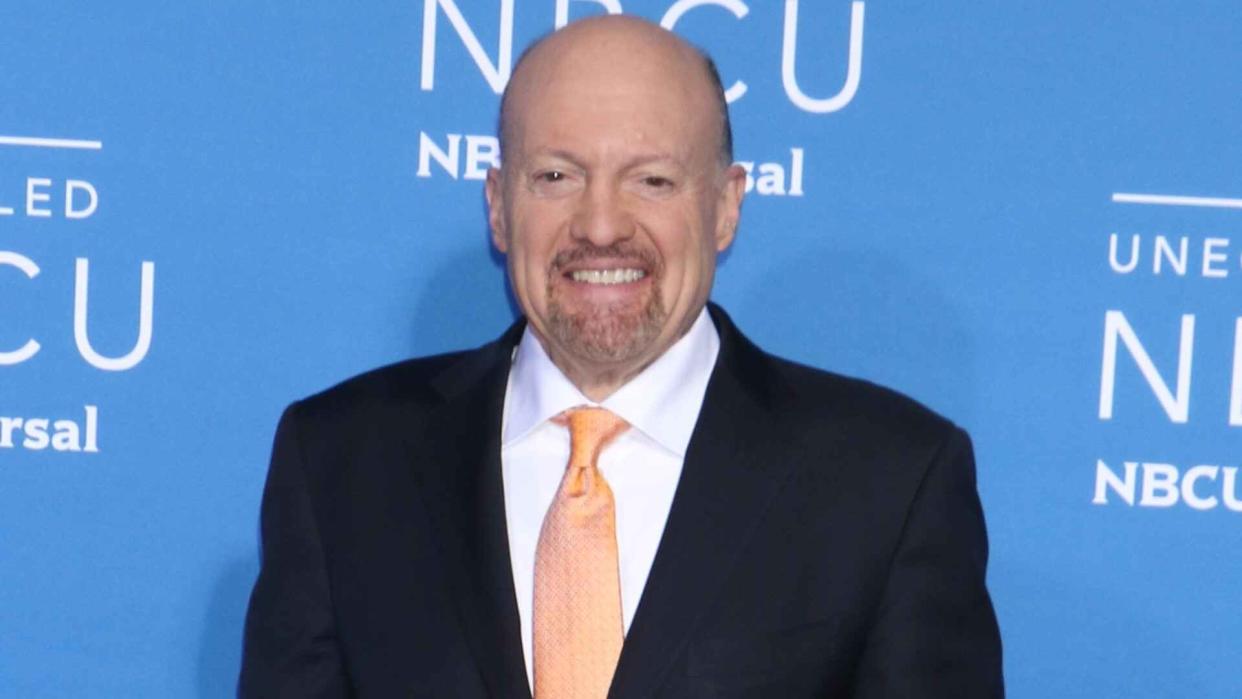

Reddit started trading on the New York Stock Exchange to much fanfare on March 21. The company priced its IPO (initial public offering) at $34, according to a statement at the time. Yet, some experts, such as CNBC’s Jim Cramer, argued pre-IPO that the IPO could bode poorly for the economy and markets.

Check Out: 7 Best Stocks To Buy Under $1

Read Next: 5 Genius Things All Wealthy People Do With Their Money

The company’s shares increased 48% on the day of the IPO, as CNBC reported at the time.

Reddit Earnings Beat Analysts’ Expections

And on May 7, Reddit reported its first earnings post-IPO, beating analysts’ expectations. Revenue was up 48% from a year earlier and stood at $243 million, according to the earnings release. This pushed the stock 11% higher, according to CNBC.

As of May 10, shares of Reddit were up 27% over the past month.

A few days before the IPO in early March, however, Cramer expressed his concern about the offering impacting the bull market. He said that, despite being in operation for 19 years, Reddit had never turned a profit, relying solely on adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), according to Benzinga.

Cramer further argued that whether the IPO were to be successful or not, it could impact the market’s supply and demand dynamics.

“I do know this: If Reddit rallies, there will be others to follow. If it doesn’t, we could see a continuation of the lack of share supply, which is a function of endless buybacks that drive down the natural supply,” Cramer said.

Not all experts agree with this premise.

Learn More: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Experts: The Success or Failure of the IPO Has no Impact on the Economy at Large, While Other Factors Do

“When it comes to the health and longevity of the bull market, tying its prospects to the outcome of a single or even a handful of IPOs is specious,” said Peter Earle, senior economist with the American Institute for Economic Research.

According to Earle, it may be true that a particular equity issue impacts either the propensity for institutional investors to bid in the primary market and/or the willingness of other companies to undertake IPOs in its wake.

“So what? Markets are a social mechanism for discovery, and market participants look at price signals to guide their future choices,” he continued.

Earle also noted that the U.S. economy is facing slowing disinflation, rising unemployment, geopolitical tensions in the Middle East, Southern Europe, and in the South Pacific — and what is certain to be a highly contentious election in the fall. In addition, he said, the first quarter GDP result was far lower than any survey anticipated.

“From that perspective stocks are priced for perfection, and whether a single or multiple IPOs perform well or poorly is a tiny piece of the overall market sentiment puzzle,” he added.

No Impact on the Economy? But, an Impact on Markets

Other experts argued that Reddit’s success or failure is not a signal for the broader economy, but could be a signal as to whether or not other companies should go public with richer stock valuations.

“The impact of a successful IPO on the stock market and future IPOs can be significant and far-reaching,” said Michael Collins, CFA and founder of WinCap Financial.

As Collins explained, overall, a successful IPO can have a positive impact on the stock market and future IPOs by boosting investor confidence. It does so by increasing demand for new stocks, providing companies with access to capital, and creating competition and potential for higher valuations.

“A successful IPO can also attract more companies to go public, especially in industries where there haven’t been many recent IPOs,” he said. “This can lead to a more diverse range of companies on the stock market, providing investors with more opportunities for investment.”

Should You Buy Reddit Stock?

According to Peter Cohan, associate professor of management practice at Babson College, Reddit competes in a mature industry, depends on free labor to keep users, and has an investor-unfriendly capital structure.

“Before the company went public I wrote that investors should wait to consider buying until after the company reports its first earnings as a public company,” he said. And this week, Reddit grew revenues faster than investors expected and lost a huge amount of money, he noted.

“In the last three months since the IPO, the stock is essentially flat,” said Cohan. “I do not see a problem with the company going public but I also do not see any compelling reason to buy the stock.”

He added that he is more interested in getting a chance to buy into a company tapping into the rapid growth of generative artificial intelligence (AI) than a small player in a mature industry.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Jim Cramer Says a Reddit IPO Is Bad for the Economy: Does That Mean You Shouldn’t Invest?