Jeff Bezos scooped up 3 mansions on this exclusive Florida island, spending nearly $250M in total — 3 ways to invest in multiple properties if you’re aren’t a 'Billionaire Bunker' resident

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

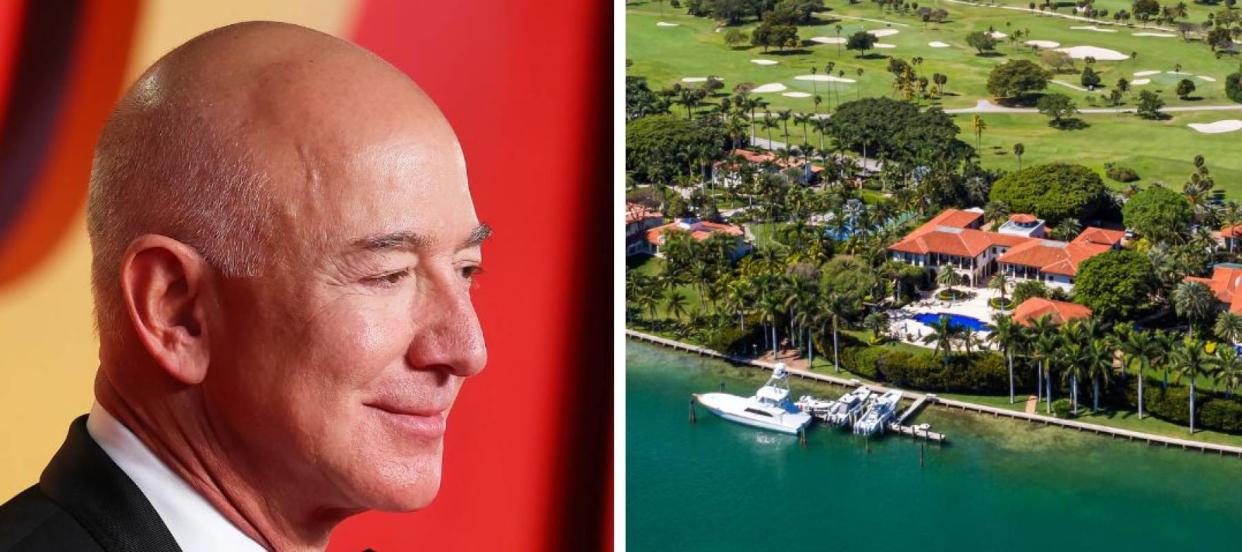

Billionaire Amazon founder Jeff Bezos recently dropped a cool $90 million on a mansion on the private man-made island dubbed the “Billionaire Bunker.”

He has already purchased two mansions on Florida’s Indian Creek Island — home to the likes of Tom Brady and Ivanka Trump — last summer for a whopping $147 million.

According to the Tampa Bay Times, The Florida native cited personal reasons, such as wanting to be closer to his family and his Blue Origins space company, for the move back to his home state.

Bezos isn’t alone in being drawn to the Sunshine State. A recent Business Insider article reported that Florida has seen an influx of hundreds of thousands new residents over the last few years due to its weather, lack of state income tax and job opportunities.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

While we may not yet know the full story behind Bezos’ gargantuan real estate moves, there is plenty of upside to investing in real estate — and not just in Florida.

Here are 3 smart ways you can invest in multiple properties even if the current housing market has made you hesitant to buy a home right now.

1. Crowdfunding platforms

Crowdfunding has become a popular investing method in recent years. It refers to the practice of funding a project by raising smaller amounts of money from many people.

Many crowdfunding investing platforms allow you to own a percentage of physical real estate — from rental properties and commercial buildings to parcels of land.

For example, with Arrived is a real estate investing platform backed by Jeff Bezos himself. You can invest in shares of rental homes and vacation rentals without taking on the responsibilities of property management or having Bezos-level zeros in your bank account.

It’s easy to browse their vetted selection of homes, and when you find a property you like, you can choose the number of shares you want to buy. Once you’ve signed off on it, you’ll begin receiving quarterly deposits from the property’s income.

There are also ways to invest in commercial real estate through crowdfunding platforms. For instance with First National Realty Partners, accredited investors have access to institutional-quality, grocery-anchored commercial real estate investments without the legwork of finding deals yourself.

Their team of experts manages every component of the investment life cycle. All you have to do to get started is fill in some information about yourself, your income and investment goals, and you can start earning extra cash through the real estate market without becoming a landlord or purchasing and taking out a mortgage on an expensive property.

2. REITs

Investing in a real estate investment trust (REIT) is a way to profit from the real estate market without having to buy physical real estate.

REITs are publicly traded companies that own income-producing real estate like apartment buildings, shopping centers and office towers. They collect rent from tenants and pass that rent to shareholders in the form of regular dividend payments.

Generally, REITs are described as investments that provide solid dividends and the potential for moderate, long-term capital appreciation.

If you’re an accredited investor, you can gain access to REITs with solid potential through DLP Capital — a private financial services and real estate investment firm —so you can potentially benefit from high-return investments and solid dividends without becoming a landlord.

Bezos isn’t the only one who sees the real estate potential in sunny Florida. Through a number of their tax-advantaged funds, DLP Capital puts a focus on making an impact on America’s housing crisis by investing in income-producing affordable rental housing in high-demand areas along the Sun Belt, primarily Texas and Florida.

Read more: Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

Unlike buying a house — where transactions can take weeks and even months to close — you can buy or sell shares in a REIT anytime you want throughout the trading day. That makes them one of the most liquid real estate investment options available.

Both accredited and non-accredited investors can also check out RealtyMogul, which offers an Income REIT and a Growth REIT that have paid a combined $44.5 million in distributions.

RealtyMogul’s innovative technology allows investors to do everything online. You can easily browse their professionally-vetted real estate opportunities for yourself, sign the legal documents and track your investment’s performance.

3. Diversify with other private assets

If you want to follow his example, Bezos is no stranger to investing in a variety of assets. His vast portfolio contains significant stakes in publishing, real estate and many high-profile tech companies, including Uber and AirBnB.

When it comes to diversification, sometimes you have to look outside the stock market.

With Fundrise you have access to an expansive portfolio of alternative investment opportunities spanning real estate, private tech, private debt and venture capital. With over two million investors, Fundrise is an accessible way to diversify your portfolio with the potential of yielding dividends every quarter.

If you want a shot to invest in the next Amazon or Reddit, the Fundrise Innovation Fund is making private tech investments accessible to everyday investors so you can take advantage of high-growth tech companies in their prime — before they go public.

With over two million investors Fundrise is an accessible investment platform that helps you build a portfolio using a wide range of private assets and offers a low minimum investment of $10. To get started, all you have to do is answer a few questions about your investing preferences and Fundrise will recommend a portfolio that aligns with your goals.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

You don't need to invest like Warren Buffett to get rich — this simple technique tops his returns without taking on more risk

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.