Jackson County voters face 2 marijuana sales tax questions in April. Don’t be confused | Opinion

Could two marijuana sales tax questions on the April 4 ballot confuse voters in Jackson County? We’re hopeful that is not the case. Potential tax revenue is at stake.

Missourians spent more than $100 million on all cannabis products during the first month adults 21 and over could legally purchase them in the state, according to officials. About $71 million of that was for recreational use.

Ching, ching.

Next month, voters in 32 municipalities in Jackson County will be asked to vote on separate marijuana sales tax initiatives. One measure would impose a 3% countywide sales tax on recreational marijuana sales only if approved.

The second would allow each municipality in Jackson County to collect an additional 3% on retail pot sales. Under the proposals, a county sales tax would not be charged on medical marijuana. Missouri taxes medical cannabis at 4%.

In November, 53% of Missouri voters approved recreational marijuana. The initiative imposed a 6% state tax on those sales. Under that law, cities and counties are allowed to impose their own additional local sales tax of up to 3%.

If Jackson County voters approve both measures, recreational pot consumers would pay a total of 12% in sales tax — a rate much lower than in states such as Colorado, California and Illinois, according to Lois McDonald, treasurer for Show Me Stronger Communities, a pro-marijuana sales tax political action committee.

We urge voters to study both measures before going to the ballot box. In short, a no vote means no local sales tax on pot would be collected. If approved, each city could bank hundreds of thousands of dollars in potential revenue annually, according to proponents representing those 32 Jackson County cities and municipalities.

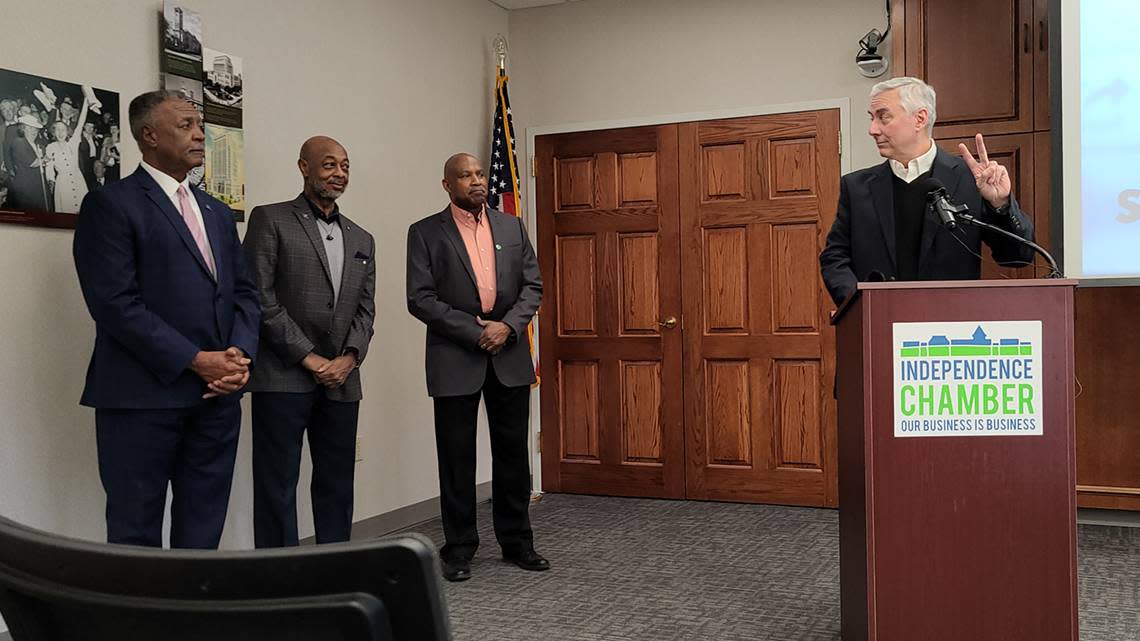

On Monday, mayors from Blue Springs, Grandview and Independence joined Jackson County Executive Frank White at a news conference at the Independence Chamber of Commerce. The group, along with McDonald, reminded voters that they will be asked about the marijuana sales tax twice — once for each city, and once for the county.

No matter your personal feelings about the drug, cannabis is legal in Missouri. If voters say no, cities would be leaving money on the table that could be used for capital improvements, improved public safety facilities or infrastructure needs.

Leaders in each city in Jackson County support both taxes, according to McDonald. Dispensaries and pot-related businesses have sprung up across the state and here locally. More than 40 marijuana dispensaries are licensed to operate in Jackson, Cass, Platte and Clay counties, according to area leaders.

Pot is regulated and should be taxed, proponents said — a point that’s hard to argue against.

“We tax pot roast, why not pot?” asked Independence Mayor Rory Rowland.

It’s a valid question.