Investors 'have to be more realistic' ahead of downbeat earnings: Morning Brief

A version of this article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Tuesday, January 10, 2022

Today's newsletter is by Julie Hyman, anchor and correspondent at Yahoo Finance. Follow Julie on Twitter @juleshyman. Read this and more market news on the go with the Yahoo Finance App.

Fourth-quarter earnings season begins in earnest this Friday with big banks reporting results, and investors are bracing themselves for disappointment. That's after they were greeted Monday by a handful of retailers offering cautious outlooks.

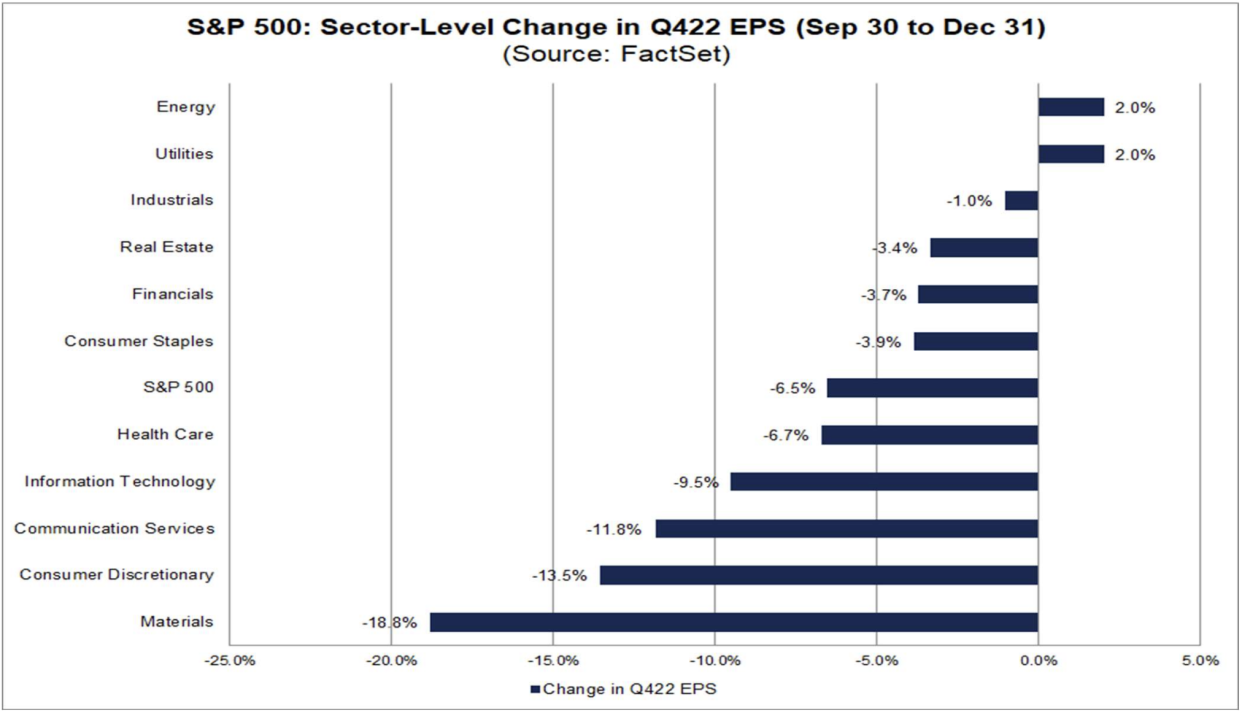

The forecasts are grim: S&P 500 companies may report the first decline in earnings since the third quarter of 2020, with an estimated drop of 4.1% in Q4, according to FactSet. Analysts have cut their projections by 6.5% since Sept. 30, more than 1.5 times the average decrease over the past twenty years.

And there are plenty of strategists who think those numbers haven't come down enough.

"I think we have to be more realistic," Miller Tabak chief market strategist Matt Maley told Yahoo Finance Live on Monday. "The Fed's started raising interest rates and we are starting to feel the impact of that in the economy. At some point soon, I think people are going to come to the full realization that the earnings are going to have to come down."

These downgrades flow from the expectations for a slowdown in economic growth.

Whether the U.S. economy tips into a recession or not, consumer and business spending is already slowing and being reflected in data as varied as the ISM services index in December, those aforementioned retail warnings, and big tech job cuts.

Where tech is concerned, analysts have been relatively aggressive with their earnings growth downgrades, cutting estimates for information technology by 9.5% in the past three months and by 11.5% for communications services, a group that includes Alphabet, Meta, Disney, and Netflix.

The materials sector has actually been hit hardest, with analysts slashing estimates for these companies by more than 18% during the quarter.

In tech, "last year was all about valuations being crushed, and earnings being resilient," eToro Global Markets Strategist Ben Laidler told Yahoo Finance Live.

“This year is going to be about earnings being crushed. We forget how cyclical some bits of tech are, that $50,000 Tesla or $1,000 iPhone is a discretionary purchase that many don’t need to make,” Laidler said. Eventually, though, valuations will come down enough to make tech attractive again, in Laidler's view.

The question is what effect all of this earnings weakness will have on stock prices, and whether strategists are getting right not just the direction, but also the magnitude of expected profit declines.

Deutsche Bank Chief Strategist Binky Chadha says estimates still haven’t come down far enough.

Analysts are projecting earnings declines will moderate, with drops of 0.1% and 0.5% for the first and second quarters, before a rebound in the second half of the year, according to FactSet.

Still, earnings are expected to rise in 2023 by 4.8% after a 4.7% increase in 2022.

On the other hand, Chadha is one of the more optimistic on the Street when it comes to stock returns this year.

"Is the bar for Q4 low enough? Not quite," Chadha wrote in a recent note to investors. "In our reading, consensus expectations for earnings growth are down in line with their historical drivers, but with beats the overwhelming norm outside of recessions, we expect continued cuts followed by reported earnings eventually beating in line with the historical average."

In other words, once analysts cut their estimates enough, companies will beat those estimates.

And as Chadha notes, stocks "have a long history of rallying during earnings seasons."

What to Watch Today

Economy

6:00 a.m. ET: NFIB Small Business Optimism, December (91.5 expected, 91.9 during prior month)

10:00 a.m. ET: Wholesale Trade Sales, month-over-month, November (0.2% expected, 0.4% during prior month)

10:00 a.m. ET: Wholesale Inventories, month-over-month, November Final (1.0% expected, 1.0% during previous month)

Earnings

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube