Investors absolutely love the Fed's soft landing

This is The Takeaway from today's Morning Brief, which you can sign up to receive in your inbox every morning along with:

The chart of the day

What we're watching

What we're reading

Economic data releases and earnings

The Federal Reserve called it on Wednesday — the US economy has achieved a soft landing.

Chair Jerome Powell resisted grand pronouncements at the briefing, telling the assembled press bluntly: "We're not declaring victory."

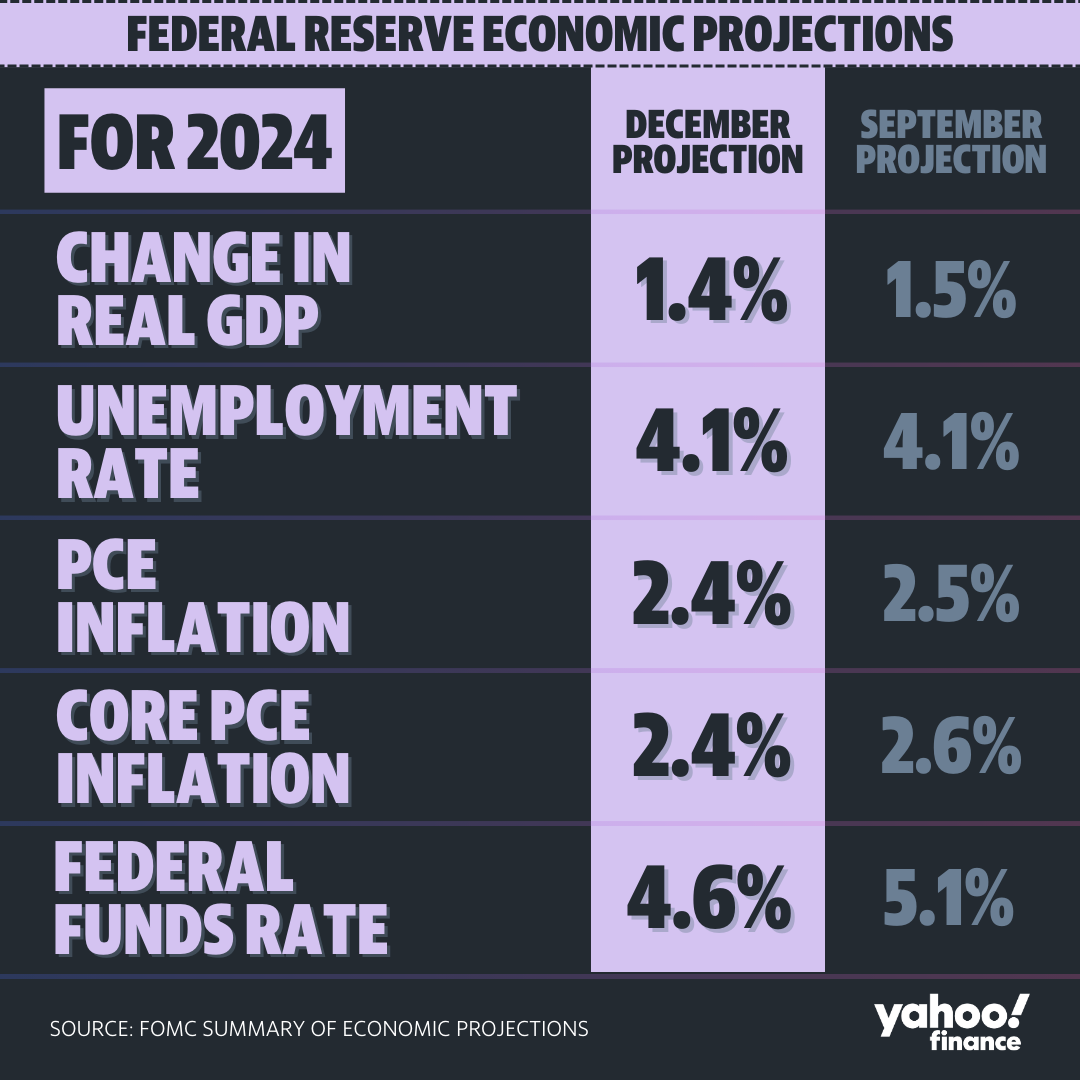

But new forecasts from the central bank showing Fed officials penciling in a further decline in inflation, no sharp rise in unemployment, a moderation in economic growth, and a 0.75% reduction in interest rates next year send a clear message.

Investors, unsurprisingly, loved this news.

Read more: What the Fed rate-hike pause means for bank accounts, CDs, loans, and credit cards

The euphoria in markets on Wednesday was largely spurred by the final element of this outlook, with the Fed's latest "dot plot" suggesting three rate cuts of 0.25% each will be coming in the year ahead. All else equal, lower interest rates are positive for risk assets.

But these expected lower interest rates don't come with the baggage that often encourages a central bank to ease its policy stance, which is a downturn in the economy.

Rather, the Fed expects the coming year to be, for the most part, a repeat of what Powell called "quite a performance" by the US economy.

Inflation is now expected to come down to 2.4% by the end of next year, just a touch above the Fed's 2% target. Unemployment will likely rise, but only to 4.1% from the 3.7% seen in November. As of October unemployment stood at 3.9%.

And while growth should moderate from a rate of 2.6% to 1.4% between 2023 and 2024, Powell took pains to note in the press conference on Wednesday this year's economic expansion was a "surprise to just about everybody."

Taken together, these forecasts suggest the Fed solidifying its view that it will achieve a "soft landing" through this economic cycle and, in turn, offer investors all of the good stuff (lower interest rates) without any of the bad stuff (mass layoffs, surging financing costs).

The Dow Jones Industrial Average (^DJI) closed at a record high on Wednesday.

The small-cap Russell 2000 (^RUT) rose more than 3%.

The Nasdaq Composite (^IXIC) is now up 40% for the year.

Even bonds rallied, too, with the yield on 10-year Treasury notes on Wednesday continuing a rapid descent towards 4% after reaching a 16-year high north of 5% just two months ago.

Add to this the rally we've seen in cryptocurrencies over the last month as bitcoin (BTC-USD) topped $45,000, a decline in oil prices that should bolster consumer balance sheets, and a rebound in dozens of stocks left for dead by investors during 2022's washout.

Just over a month ago, we similarly outlined the abundance of ways financial markets were offering investors a chance to make money with a nod towards the defining economic phrase of 2023: We are so back.

And in the view of the Powell Fed, we're not only back, but here to stay.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance