Inflation and Disney: What to watch this week

The stock market's pristine 2023 rally hit a rough patch as July turned to August.

The July jobs report showed the labor market continues to cool, Apple (AAPL) reported a mixed quarter, and Fitch Ratings hit the US government with a surprise debt downgrade during a week that saw the S&P 500 and Dow Jones Industrial Average snap three-week winning streaks while the tech-heavy Nasdaq Composite fell nearly 3%.

On the flip side, a strong earnings report from Amazon (AMZN) sent shares of the tech giant up 8% on Friday, the stock's biggest one-day gain since November 2022.

In the week ahead, inflation data for July and earnings out of Disney (DIS) will highlight the calendar, with the schedule showing clear signs of deceleration after investors have been deluged with key earnings and economic reports over the last three weeks.

Economists expect Thursday's Consumer Price Index (CPI) report to show headline inflation rose 3.3% over the prior year in July, an increase from the 3% jump seen in June, the smallest rise in consumer prices in over two years.

On a "core" basis, which strips out the costs of food and energy, economists expect that prices rose 4.8% from last year in July, unchanged from June's annual rise.

"We expect the disinflationary trend continued in July and estimate a 0.2% bump in both the headline and core measures over the month," economists at Wells Fargo wrote in a note on Friday. "Through the monthly noise, inflation appears set on a downward path. However, progress in the coming months is likely to be slower and noisier than June's print alone would suggest."

Wells Fargo expects to see that headline prices rose 3.3% and "core" inflation jumped 4.7% over last year.

This report will serve as the latest piece of what will be a robust set of data presented to the Fed before their next policy decision on September 20.

The July jobs report on Friday showed the US economy added 187,000 jobs last month, fewer than expected, while the unemployment rate fell to 3.5%. Wages were firmer than forecast, rising 4.4% over last year, but some economists expect that in light of increased worker productivity, the Fed is unlikely to see this as an additional inflation impulse.

Bob Schwartz, senior economist at Oxford Economics, said on Friday the jobs report had "something for everyone."

"Simply put, the latest jobs report is as close to a Goldilocks outcome as could be hoped," Schwartz added. "For one, it pushes recession fears further onto the back burner. ... For another, the jobs report provides encouraging news for inflation doves, who believe the Fed should take its finger off the rate-hiking trigger."

Outside of inflation data this week, the economic calendar will feature the NFIB's small business optimism report, the University of Michigan's check on consumer sentiment, and data on producer prices.

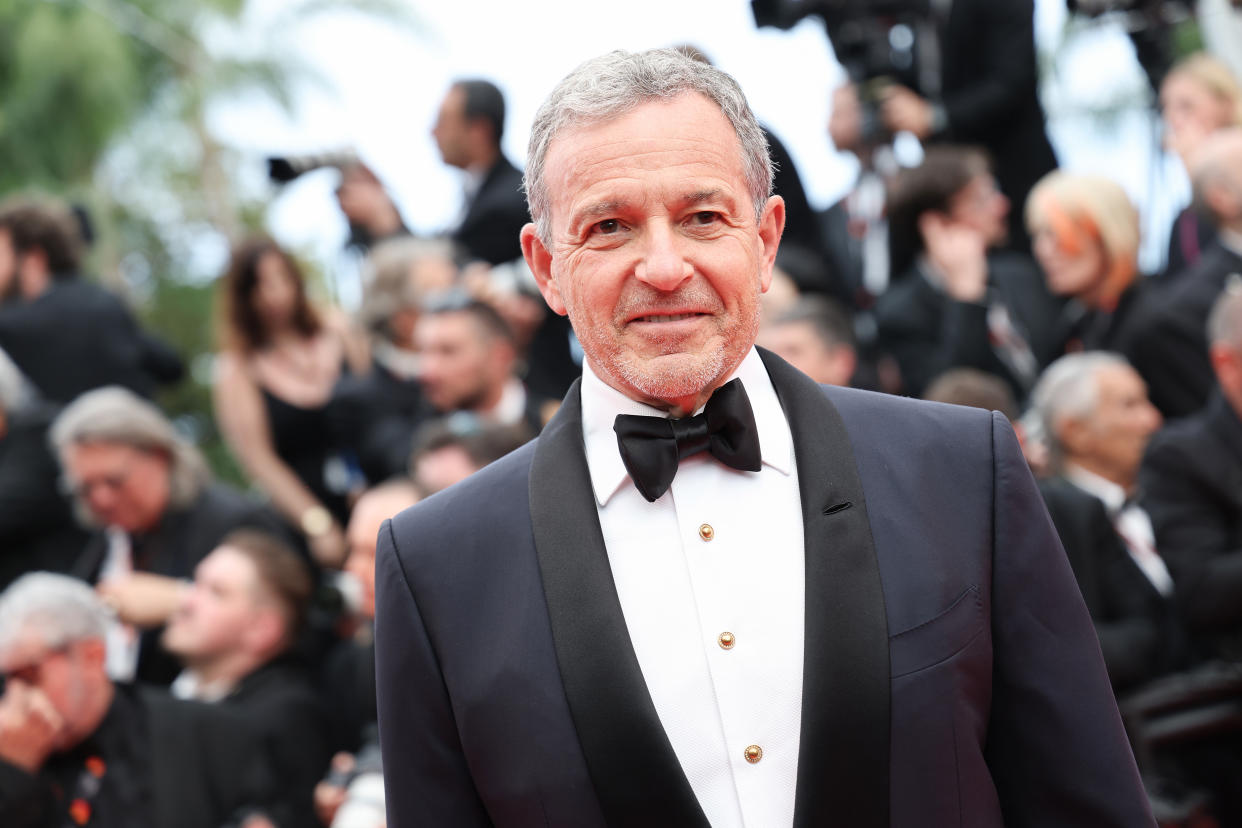

On the corporate side, Disney results will be the week's biggest earnings update, with investors asking tough questions about the streaming and TV business as subscriber growth slows while Hollywood strikes pressure production and bring the entertainment world into the AI fray.

As earnings season has rolled along, AI updates from across the corporate world have been abundant.

Yahoo Finance's Hamza Shaban noted Friday that with earnings for the biggest tech companies behind us, not all leaders took the same tactic toward hyping AI advances.

Meta (META), Alphabet (GOOG, GOOGL), and Amazon were the most forceful in touting their AI prospects, while Microsoft (MSFT) and Apple struck a more measured tone.

Apple CEO Tim Cook downplayed AI plans, telling analysts on Thursday, "We tend to announce things as they come to market, and that's our M.O. and I'd like to stick to that." Meanwhile, Amazon executives said "generative AI" no fewer than 20 times on their earnings call Thursday evening.

Apple stock fell 5% on Friday after a third straight quarter of revenue declines and a larger-than-expected drop in iPhone sales hit shares. Amazon gained more than 8% after results in its Amazon Web Services business showed revenue growth slowed less than expected.

Results from UPS (UPS), Palantir (PLTR), Eli Lilly (LLY), and Lyft (LYFT) will also feature this week as earnings season winds down.

Data from FactSet published Friday showed that through last week, 84% of S&P 500 companies had reported results with blended earnings for the index — which includes companies reporting and forecasts for those still to come — pointing to a 5.2% drop in earnings per share from last year. This will mark the third straight quarter of earnings declines.

And while 79% of companies that have released earnings are beating forecasts, which is more than the 10-year average of 73%, investors have judged results harshly this quarter.

FactSet's data showed companies reporting results better than forecasts during this earnings season are seeing their stock drop 0.5% during the period covering the two days before and after the report. Over the last five years, the average change for a company's stock over this period has been a 1% gain on positive numbers.

With the market having rallied so aggressively this year — and that rally broadening in June and July across all 11 sectors of the S&P 500 — second quarter earnings season has become a "sell the news" event.

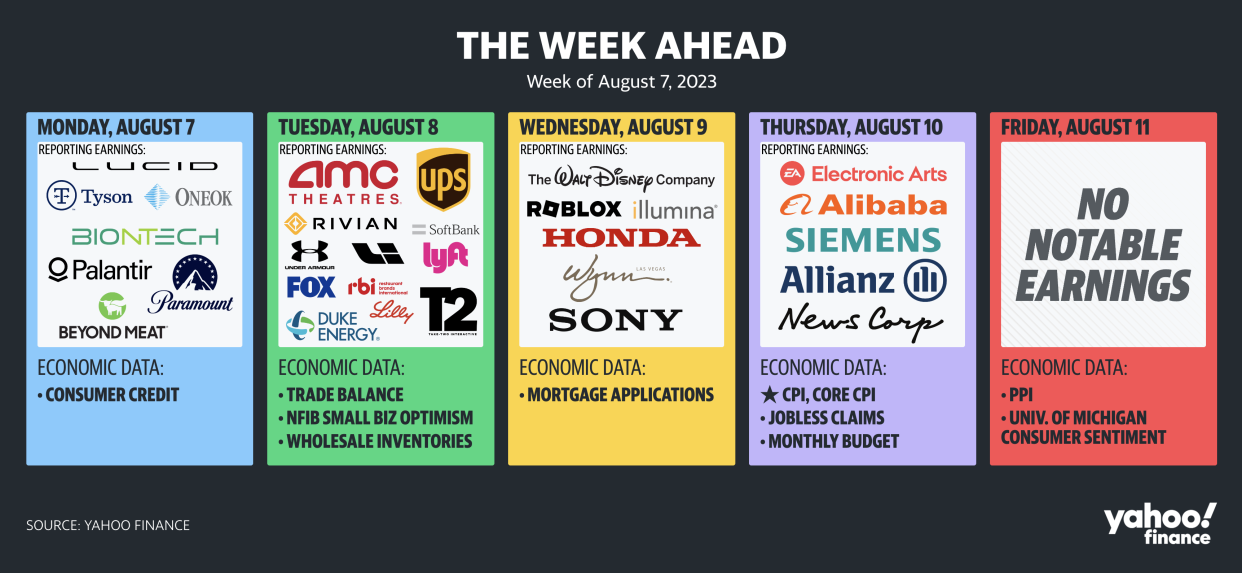

Weekly calendar

Monday

Earnings: Palantir (PLTR), Beyond Meat (BYND), Chegg (CHGG), Lucid Group (LCID), Paramount Global (PARA), RingCentral (RING), KKR (KKR), Tyson Foods (TSN), Skyworks (SWKS)

Economic data: Consumer credit, June (+$14 billion, $7.24 billion previously)

Tuesday

Earnings: UPS (UPS), Eli Lilly (LLY), Twilio (TWLO), Bumble (BMBL), Rivian (RIVN), Capri Holdings (CPRI), AMC Entertainment (AMC), Lyft (LYFT), Restaurant Brands (QSR), Novavax (NVAX), Under Armour (UAA), Warner Music Group (WMG), Li Auto (LI), Fox Corp (FOXA), Celsius (CELH), Blink Charging (BLNK), Duolingo (DUO), Dutch Bros (BROS)

Economic data: NFIB Small Business Optimism, July (90.5 expected, 91.0 previously); Trade balance, June (-$65 billion expected, -$69 billion previously); Wholesale trade sales, June (-0.2% previously); Wholesale trade inventories, June (-0.3% previously)

Wednesday

Earnings: Disney (DIS), Roblox (RBLX), Warby Parker (WRBY), The Trade Desk (TTD), Jack In The Box (JACK), GoodRx (GDRX), PENN Entertainment (PENN), Stratasys (SSYS), Valvoline (VVV), Reynolds (REYN) Illumina (ILMN)

Economic data: MBA Weekly Mortgage Applications (-3% previously)

Thursday

Earnings: Alibaba (BABA), Ralph Lauren (RL), YETI Holdings (YETI), Wolverine World Wide (WWW), Utz Brands (UTZ), Krispy Kreme (DNUT), Six Flags (SIX), Hanesbrands (HBI), Dillard's (DDS), Flowers Foods (FLO), News Corp. (NWSA)

Economic data: Consumer price index, year-over-year, July (+3.3% expected, +3% previously); Consumer price index, month-over-month, July (+0.2% expected; +0.2% previously); Core CPI, year-over-year, July (+4.8% expected, +4.8% previously); Core CPI, month-over-month, July (+0.2% expected, +0.2% previously); Initial jobless claims (230,000 expected, 227,000 previously)

Friday

Earnings: Spectrum Brands (SPB)

Economic data: Producer price index, year-over-year, July (+0.7% expected, +0.1% previously); Producer price index, month-over-month, July (+0.2% expected; +0.1% previously); Core PPI, year-over-year, July (+2.3% expected, +2.4% previously); Core PPI, month-over-month, July (+0.2% expected, +0.1% previously); University of Michigan consumer sentiment index, preliminary reading, August (71.6 previously)

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance