What You Need to Do if Your Identity Gets Stolen

Identity theft has become all too common, with as many as 1 in 10 Americans experiencing it each year — and about a fifth of those, multiple times. In these thefts, someone takes personal information such as a date of birth, Social Security number, and financial details, then imitates victims to commit fraud. Getting collection calls on loans you didn’t open or bills for items you didn’t buy are immediate red flags, or you may be denied a loan due to mysteriously poor credit. If your identity is stolen, you need to take steps immediately. Clearing your name and repairing your credit can be wearying and time consuming, but will be easier by following these steps.

Related: Credit Horror Stories That Will Keep You Up at Night

Call companies where you believe fraudulent transactions occurred to tell them, as well as the issuers of cards and accounts that were used or altered. This starts an internal fraud investigation and ensures you aren’t held responsible for the debts. Request letters confirming that sham accounts aren’t yours, you aren’t liable for them, and that they will be removed from your credit report. “Finding out your identity has been stolen can feel like a punch in the gut and cause a sense of panic,” says Jenn Behrens, a partner and executive vice president of privacy and security for global security and privacy firm Kuma. “Resist the urge to bury your head in the sand and ignore the situation.”

Related: Ways to Protect Your Identity and Data Online

If fraudulent charges appear on your credit card, zero-liability policies will likely protect you. The Fair Credit Billing Act also minimizes your liability. It dictates that you can be held accountable for a maximum of $50 in unauthorized credit card charges. The Electronic Fund Transfer Act governs ATM withdrawals, debit card transactions, and electronic transfers from banks. If a fraudulent withdrawal is made through one, you have two business days to report the loss to keep your liability to the $50 minimum. After that, the liability limit grows to $500 at 60 days, and becomes unlimited beyond 60 days.

Related: Watch Out for These Scams Targeting Seniors

You’ll need proof a theft has occurred. “Gather evidence that you are not the person using your accounts and print them in hard copy to make things easier for the authorities to access,” says lawyer David Clark, a partner at The Clark Law Office in Michigan. As you speak with the banks, credit card agencies, or other financial institutions, document your conversations. “Keep a record of who you called, when, and what the outcome was. This may help down the road when needing to reevaluate the impact of the fraud,” Behrens says.

Your next stop is reporting the fraud to the Federal Trade Commission. The FTC can’t file criminal charges, but the documentation and proof it provides may be essential when dealing with financial institutions. It issues pre-filled letters and documentation for filing police complaints and disputing false charges and will provide an individualized recovery plan to guide you through the process.

Next, file a police report to lodge a criminal complaint. You’ll need a copy of your FTC Identity Theft Report as well as proof of the identity theft. You should certainly report the fraud if you know the thief; the thief used your name in an interaction with the police such as a traffic stop; and if a financial institution requires a police report to investigate a fraud claim. You can choose to file it where you live or where the crime occurred. If police aren’t taking the incident seriously, the FTC provides a memo to law enforcement stressing the importance of police support for consumer victims. Get a copy of the completed report for your records.

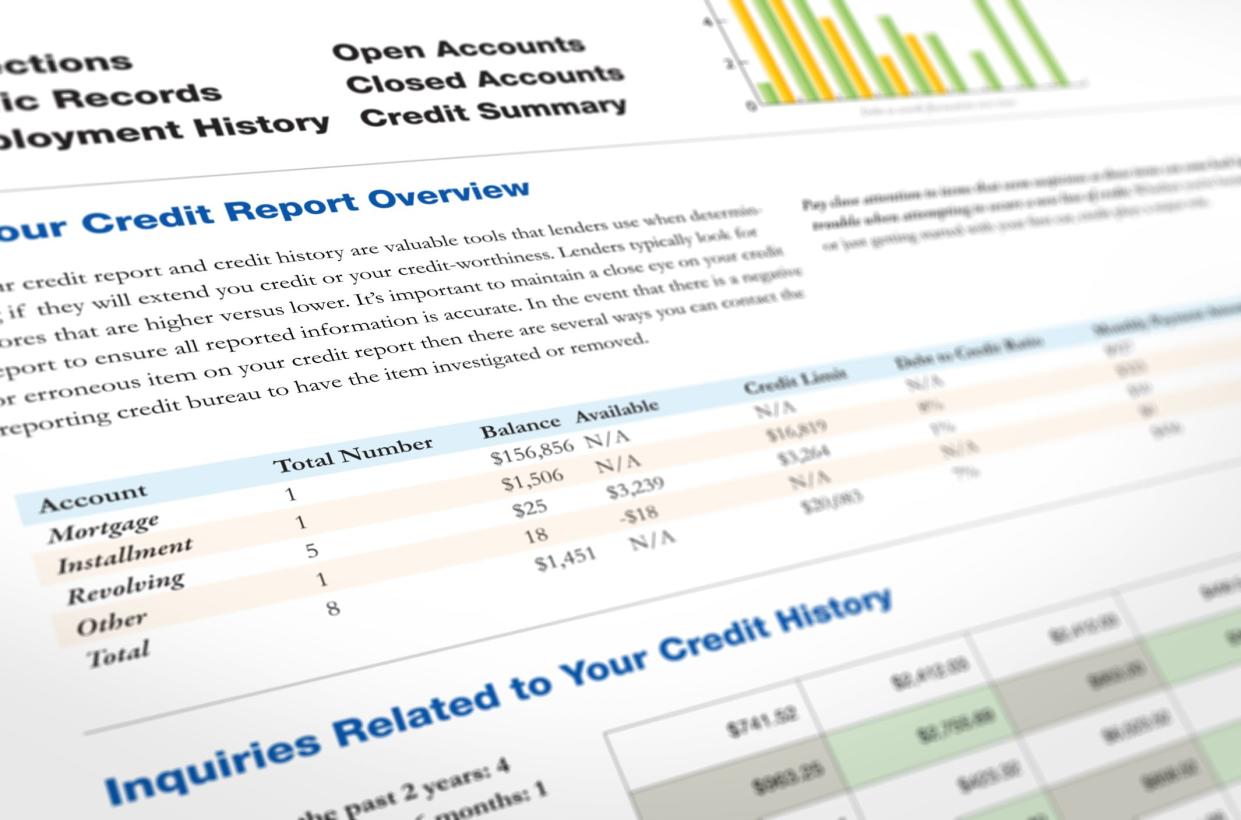

Financial fraud can affect your credit report and resulting credit score for a long time, affecting your ability to get a car loan, take out a credit card, or apply for a mortgage — so protecting your credit report should be a high priority. Get in touch with the a reporting agency from among Equifax, Experian, and TransUnion to request a fraud alert. (The one you contact must tell the other two.) Fraud alerts are free and last for a year, making it more difficult for someone to open a line of credit in your name, because now a business must verify the identity. If you’ve filed a report with the FTC and police, you’re eligible to ask for a free extended fraud alert that lasts for seven years.

In some cases, you may wish to freeze your credit rather than just placing an alert. “This is a more escalated step,” Behrens says. “It means you will have to re-contact the credit bureaus when you’re ready to unfreeze your credit, but it also offers the highest level of protection.” While the freeze is in place, no one may open a line of credit under your name. If you need to apply for a credit account, you can have the freeze temporarily lifted. It doesn’t affect other occasions when your credit may be checked, such as when you apply for a job or rent an apartment. The freeze is also free to use.

Ideally you are already tracking your credit reports regularly. “If not, this is a good time to start to monitor for any fraudulent activities that may occur,” Behrens says. Other accounts, loans, or lines of credit may continue to pop up on your report well after the initial incident. Unfortunately, even if the theft is stopped, your information might have been stolen by multiple people, and keeping fraudulent accounts off your report can become a game of whack-a-mole. You can access free credit reports online at annualcreditreport.com.

Each time a fake account occurs on your credit report, you must dispute it with the credit reporting agencies and ask for it to be removed. The FTC provides a template for a letter to send to the agencies. You’ll also need to include a copy of your FTC Identity Theft Report and/or police report, identifying information, and details about the fraudulent account. This will keep you from being held accountable for the debts and prevent the dishonest accounts from affecting your credit.

If you believe your Social Security number was compromised, file a Form 14039 Identity Theft Affidavit with the IRS. The form tells the agency that a theft has taken place. It can also reduce the risk of tax identity theft — when someone files a fake tax return in the hope of stealing a refund — and reduce your liability if it occurs.

It’s likely that your personal information was compromised online. Respond accordingly by changing all passwords for your major online accounts — not just the ones affected by the fraud. “One of the best ways to keep safe is to change your online passwords at least once a month,” says Peter Robert, chief executive and founder of Expert Computer Solutions. “Cybercriminals are becoming much more creative with the ways they are finding access to online consumer accounts, so consistently changing your passwords can help you stay one step ahead.” Password managers can be helpful in choosing secure passwords and keeping track of them.

If your Social Security card was stolen, order a replacement card. If you believe someone is using your number, notify the Social Security Administration and request a copy of your earnings statement to make sure it is accurate.

Identity theft monitoring services can help you detect if someone is using your personal information. In many data breach incidents, including the noteworthy Equifax data breach, the companies will offer free identity theft monitoring services to people whose information has been compromised. To take advantage of this free offering, you often need to sign up within a limited time frame.