Housing had a terrible 2022, and one report tells the whole story: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Tuesday, December 20, 2022

Today's newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Read this and more market news on the go with Yahoo Finance App.

The year can't end fast enough for folks in the housing market.

After a blockbuster 18 months that ran from mid-2020 through the end of last year, 2022 seemed like a year almost everything went wrong for housing.

And the monthly read on homebuilder sentiment released Monday served as the perfect coda on this year-long nightmare.

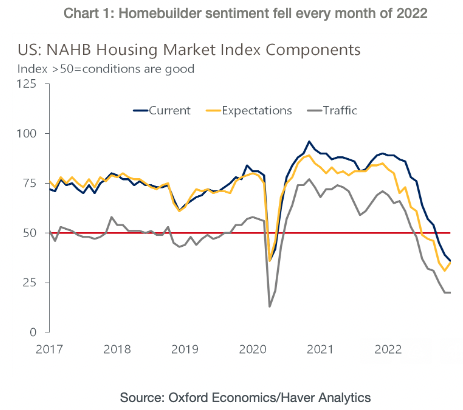

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index for December — more casually referred to as "homebuilder sentiment" — showed confidence among builders dropped this month for the 12th time this year.

Which means every month in 2022, optimism about housing from the people building houses got worse.

In December's report, NAHB chief economist Robert Dietz noted the decline in the index to 31 from 33 in November was the smallest in the last six months, "indicating that we are possibly nearing the bottom of the cycle for builder sentiment," Dietz said. Any read over 50 indicates a positive read on market conditions, reads below 50 reflect a negative view.

A recent pullback in mortgage rates, from north of 7% in November to around 6.3% as of last week, has helped in stabilizing the market.

But to see a smaller-than-expected drop to a level that marks the lowest read for the index since 2012 (outside of April 2020), is the perfect encapsulation of the housing market's journey this year.

One that follows much of the standard psychology that tracks a crash from denial, to anger, to bargaining, and, now, acceptance.

In January's homebuilder survey, there were calls for policymakers to take action to fix supply chain pressures.

By April, the housing market was at an "inflection point."

By July, homebuilders were halting work on projects as the costs of land, construction, and financing exceeded expected home value.

As 2022 wraps up, any housing market turnaround is now being talked about as a 2024 event.

"NAHB is expecting weaker housing conditions to persist in 2023," Dietz said, "and we forecast a recovery coming in 2024, given the existing nationwide housing deficit of 1.5 million units and future, lower mortgage rates anticipated with the Fed easing monetary policy in 2024."

Now, for public homebuilder stocks, the future has been the present for the last few months — since mid-June, the S&P Homebuilders ETF (XHB) is up 15% against a 5% gain for the S&P 500.

In the last few weeks, we've seen results from Toll Brothers (TOL) and Lennar (LEN) both beat expectations as builders manage their backlogs — i.e., homes they're building that buyers have made deposits on — and wait for better conditions to be more aggressive.

Most homebuilding and home construction, however, doesn't run through national builders.

Like politics, the vast majority of interactions with the real estate market are local. And smaller, local outfits are feeling the ebbs of this year's market acutely, with only a limited view on where the pain stops.

"We think home sales will find a floor by the end of the first quarter, helped by the near-[0.75%] decline in mortgage rates since late October," wrote Kieran Clancy, senior U.S. economist at Pantheon Macroeconomics, following Monday's report.

"But a meaningful recovery is still a long way off, and home prices have much further to fall."

What to Watch Today

Economy

8:30 a.m. ET: Housing Starts, November (1.400 million expected, 1.425 during prior month)

8:30 a.m. ET: Building Permits, November (1.480 million expected, 1.526 million during prior month, downwardly revised to 1.512 million)

8:30 a.m. ET: Housing Starts, month-over-month, November (-1.8% expected, -4.2% during prior month)

8:30 a.m. ET: Building Permits, month-over-month, November (-2.1% expected, -2.4% during prior month)

Earnings

Nike (NKE), General Mills (GIS), FedEx (FDX), FactSet (FDS), CalAmp Corp. (CAMP), Blackberry (BB), FuelCell Energy (FCEL), Neogen (NEOG), Worthington Industries (WOR)

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube