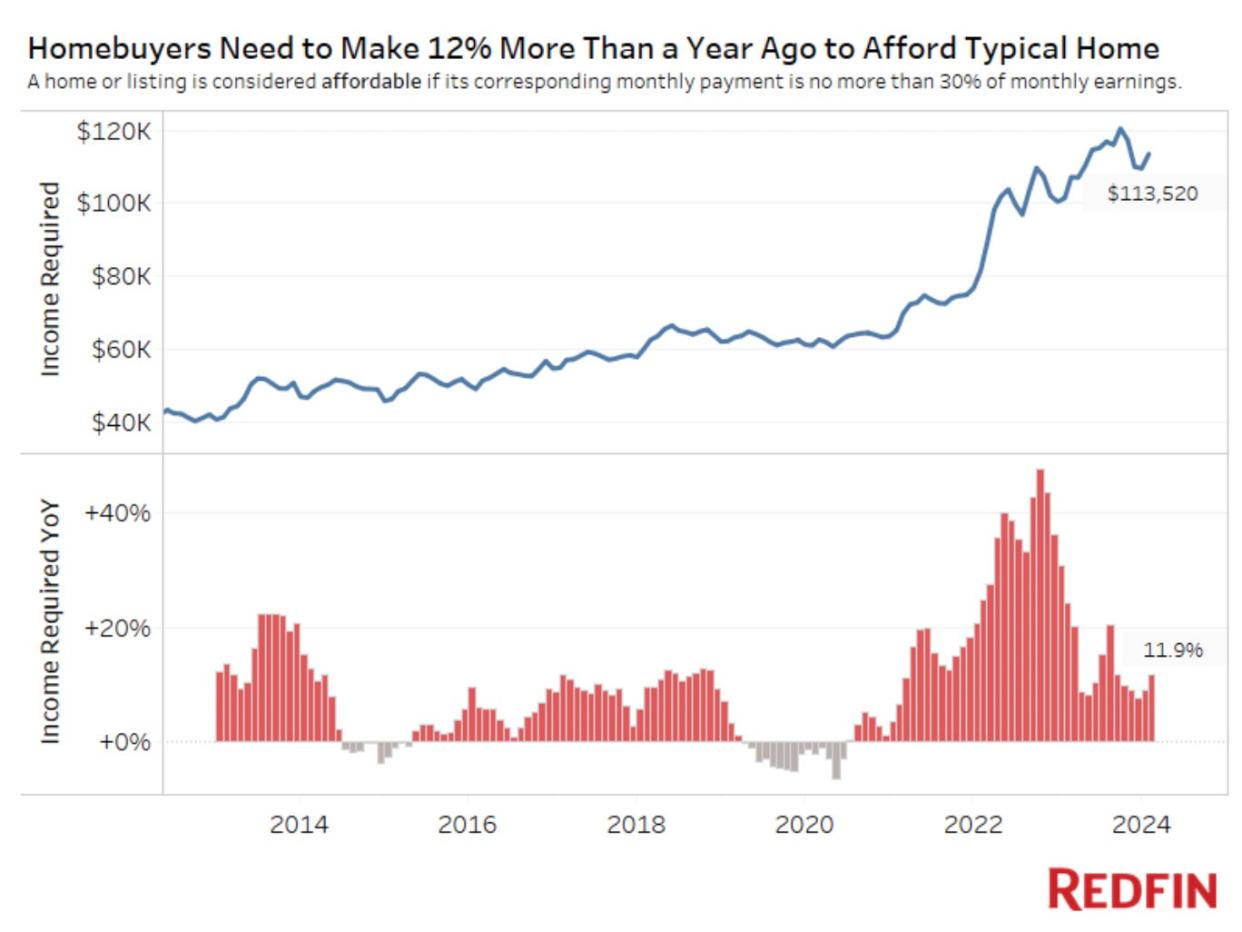

Housing affordability has improved, but not by much

US homebuyers need to make $114,000 a year to afford a median-priced home, Redfin says.

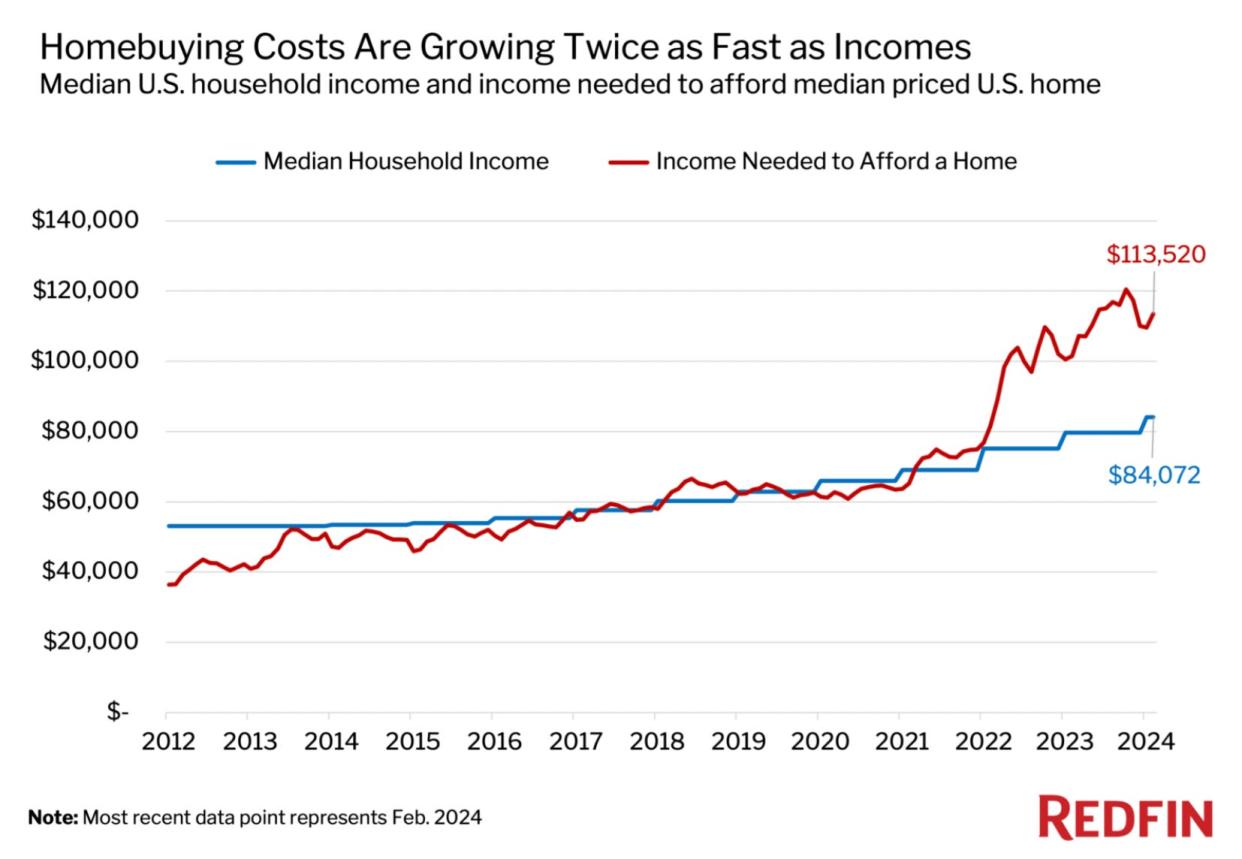

Analysts said median home prices have risen twice as fast as the increase in median household incomes in the last year.

The last time the typical household earned more than the median-priced home was in February 2021.

Mortgage rates have eased from multi-decade highs hit late last year, but housing affordability hasn't improved much in 2024.

According to Redfin, prospective buyers in the US need to make $114,000 a year to afford the median-priced home. That's 35% more than the typical US household median income of $84,072.

While that income level is an improvement from last October when buyers needed to earn $121,000, the latest number marks the biggest year-over-year surge since August. It's also a 39% jump from February 2022, and 74% higher than February 2021.

"For over a decade, America has been slowly marching toward a housing affordability crisis due to chronic underbuilding, and that crisis was kicked into overdrive when the pandemic homebuying boom fueled a meteoric rise in housing prices," said Redfin senior economist Elijah de la Campa.

In terms of location, buyers in San Antonio, Texas only needed to earn 1% more than last year to afford a typical home in February – the smallest increase among metro areas. On the flip side, buyers in Anaheim, California were hit by the nation's biggest housing affordability crunch, as they needed 20% more income compared to the previous year.

The median home price has climbed twice as much as the 6% rise in median household income over the past year. Redfin said.

"We're slowly climbing our way out of an affordability hole, but we have a long way to go. Rates have come down from their peak, and are expected to fall again by the end of the year, which should make homebuying a little more affordable and incentivize buyers to come off the sidelines," Campa said.

Read the original article on Business Insider