Should horse racing oversee Kentucky charitable gaming? These nonprofits don't think so

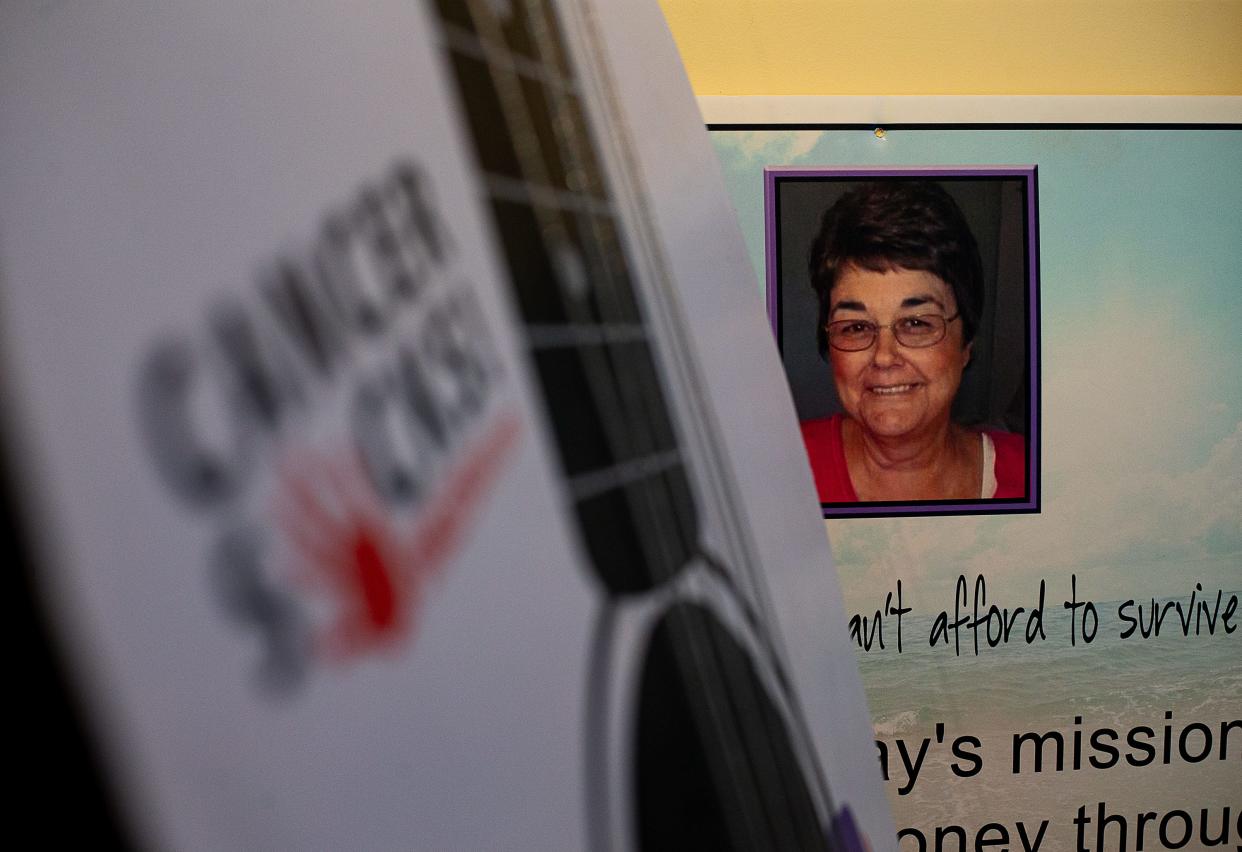

FRANKFORT — Mike Mulrooney is worried about Shirley's Way.

The Valley Station resident founded the nonprofit just over a decade ago to honor the memory of his mother, Shirley, after she died from cancer.

Since then, he's managed to grow the nonprofit into a well-known Louisville charity that has given away over $2.7 million, mostly to people needing help with expenses related to cancer.

Shirley's Way relies on revenue from what’s called “charitable gaming,” the proceeds from electronic pull tab machines, bingo nights and other games.

Now, Mulrooney, 53, is worried his charity's main income source is under threat from a bill Kentucky lawmakers rushed through at the end of this year's legislative session.

While seemingly having little to do with the world of Kentucky horse racing, the charitable gaming sector could soon be governed by a new horse racing corporation that would be created under Senate Bill 299.

Lawmakers passed that bill during the frenzied final few days before the legislature broke for the veto period in late March, and it now awaits a decision from Gov. Andy Beshear.

Mulrooney and leaders of other nonprofit groups that rely on charitable gaming think putting charitable gaming under the aegis of a horse-racing-dominated body could threaten the existence of the entire sector — and the work they do for the community.

What changes would SB 299 make?

The 282-page bill has the backing of two powerful Republican leaders with ties to Kentucky’s horse racing industry: Senate majority floor leader Damon Thayer of Georgetown and House Speaker David Osborne of Prospect.

SB 299 would change the horse racing commission into an independent corporation, similar to the state lottery corporation. Right now, the horse racing commission is an independent agency that is part of the state’s Public Protection Cabinet. It oversees live horse racing, historical horse racing and sports betting.

Under SB 299, charitable gaming regulation would be added to the powers of the new corporation beginning on July 1, 2025. Currently, charitable gaming has its own department within the Public Protection Cabinet.

'A pretty radical change in the balance of power'

SB 299 includes language that says "charitable gaming … is an important method of raising funds for legitimate charitable purposes and is in the public interest," and Osborne denied the move would harm the charitable gaming sector.

The bill’s goal is to “ensure that Kentucky gaming, regardless of what form, is operated at the highest level of integrity, and is in its most accountable form,” Osborne said during a March floor debate.

“The fact of the matter is, with one small exception, this will have no impact on charitable gaming,” Osborne said.

But putting charitable gaming under the same body that regulates horse racing has nonprofit leaders worried that their voices and interests will be diluted.

If SB 299 takes effect, the new horse racing corporation would be governed by a 15-member board. Just two seats would be reserved for representatives of the charitable gaming sector, while eight members would have to come from horse racing backgrounds and three from the gaming industry.

Right now, the charitable gaming department has a staff of 35, including its own commissioner. It also has an advisory board with up to nine members, with seats reserved for representatives from groups that rely on charitable gaming, like Catholic and veterans’ organizations.

“This is a pretty radical change in the balance of power, I would say, in terms of how charitable gaming is regulated and licensed,” said Jason Hall, the executive director of the Catholic Conference of Kentucky.

He is concerned the charitable gaming sector will lose out whenever there's a conflict over regulations.

“Under the new system, if the horse tracks, horse racing interests, want to restrict charitable poker tournaments, or whatever it might be, and have fewer licenses in the future or something like that, we will lose that vote at the board,” Hall said.

He’s also concerned the new structure might impose regulations on charitable gaming that are tough for volunteers and small nonprofits to handle.

“If you have required too high of a level of administrative burden, then ... it doesn't become feasible for a school or a parish to have a raffle to raise money for something,” Hall said.

“Of course, it would be in the for-profit gaming industry's interest to do that, because the less gaming happening outside of their direct control and profit structure would benefit them,” Hall added.

One-year moratorium on new electronic pull tab locations

Another change that concerns Mulrooney, the founder of Shirley’s Way, is a one-year moratorium on licensing new electronic pull tab locations starting on July 1, 2024.

With the decline of in-person games like bingo, Shirley’s Way has turned to electronic pull tabs, a game of chance, as a way to raise money for the community, Mulrooney said.

Shirley’s Way currently operates electronic pull tab machines at 32 locations in the Louisville area and has plans to set up machines at five new locations soon, Mulrooney said.

The electronic pull tab machines are a win-win for the community, Mulrooney said, and Shirley’s Way regularly gets requests from bars and restaurants to set up new machines.

The electronic pull tab machines draw customers into restaurants and bars and give people something fun to do — while raising money for charitable activities, he said.

“Them stopping us is going to hurt a lot of people,” Mulrooney told The Courier Journal.

Brian Stinnett is the executive director of Options Unlimited, which uses electronic pull tab machines and bingo to help fund services for people with disabilities.

Like Mulrooney, Stinnett fears the bill is the beginning of the end of electronic pull tab machines for charitable fundraising.

“If we lose those machines, then, you know, we're going to have to look at other ways of basically, you know, continuing to be able to provide our services,” Stinnett said. “It's going to be tough without these machines.”

Is charitable gaming a threat to other forms of gaming?

Osborne, the bill’s House sponsor, said one of the motivations for moving charitable gaming to the new Horse Racing Corporation is to ensure that charitable gaming, like other gaming sectors, has a professional oversight board that requires criminal background checks and strict ethics rules.

He pointed to a dramatic increase in charitable gaming receipts over the past few years, and that’s backed up by numbers from the Department of Charitable Gaming.

In 2018, total (gross) receipts for charitable gaming were around $434 million, while in 2023 the number is up to $794 million, according to annual reports from the Charitable Gaming department analyzed by The Courier Journal.

Still, in 2023, that was just a small fraction of the state’s total gaming business — only 6% according to the annual reports.

In 2018-19, charitable gaming made up a much higher proportion of all legal gaming receipts in the state, around 20%.

Charitable gaming regulations require at least 40% of net receipts go to charitable purposes, and in 2023, just over 64% of net receipts from across the industry went to charitable purposes.

Rush job?

Hall, the executive director of the Catholic Conference, is disappointed that so little time was given for discussion of a bill that, from his point of view, makes a big change. He said he first learned about the bill on a Tuesday night, and it had gained full legislative approval by Thursday.

Hall said he signed up to testify during a House committee hearing but was not given the opportunity to speak before the committee voted to approve the bill.

“I've been around for a long time; I understand that sometimes legislation moves quickly,” Hall said. “But, typically, you at least know what's being discussed, and you have some draft of the legislation that's on topic and gives you a sense of where things are headed.

“I had no idea that charitable gaming was going to be put under the horse racing corporation, no idea, until Tuesday morning,” when the bill was first heard by a joint House and Senate committee, Hall said. “And that does completely eliminate any chance … of giving it a careful analysis and participating in feedback.”

Hall said he thinks the rushed timeline was deliberate.

“I think that created the impression that there was no opposition to this,” Hall said. “I think that's why it was done this way … to prevent the ability for people to organize any kind of opposition or even to really understand what was happening to what was already done.”

Mulrooney shared that concern, saying he had no idea the change was coming and that he, like many others, lacked time to read the 282-page document before it was passed.

The bill started its journey as a “shell bill” introduced by Sen. Thayer in late February. A shell bill is a short, placeholder bill that lawmakers later fill in with the real version.

The actual version of the 282-page bill got its first airing in a joint committee hearing on March 26, and, two days later, was ready to send to the governor for consideration.

The bill's main sponsor, Thayer, rejected concerns about transparency and the timeline.

"I do feel like the topic has been in the public domain now for a couple of weeks," Thayer said, pointing to news stories, pointing to an earlier, different version of the proposal that had been attached to a different bill that is now stalled. "So, the concept — it has started its transparent journey a while back."

The bill is now awaiting a decision from Beshear. Last week, he said that he’s concerned about an independent body having full regulatory and enforcement authority, but did not state whether he would veto it or not.

Correction: An earlier version of this story misstated the number of employees in the Department of Charitable Gaming.

Reach Rebecca Grapevine at rgrapevine@courier-journal.comor follow her on X, formerly known as Twitter, at @RebGrapevine.

This article originally appeared on Louisville Courier Journal: Horse racing bill to change how Kentucky charitable gaming is governed