Homebuying in Central KY gets even tougher as prices hit new all-time high, report says

It’s a tough time to be a homebuyer in Central Kentucky.

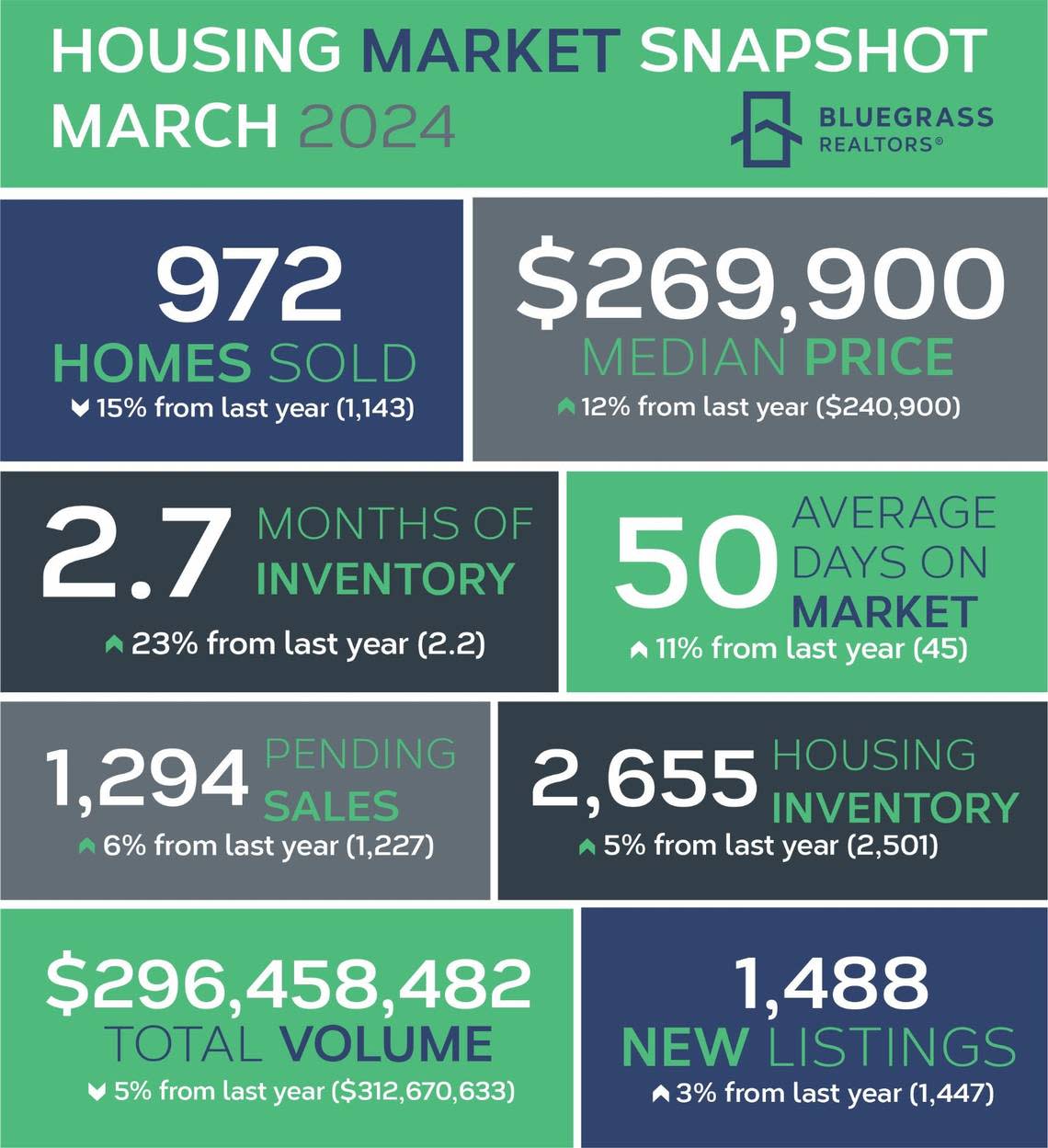

In a new market analysis from Bluegrass Realtors, published Monday, the organization reports median home prices in the region hit an all-time high in March, rising to $269,900.

That marks a 12% jump from last year’s $240,900, and according to the realtors association, and it’s the 61st consecutive month of year-over-year home price growth. The previous record-high median home price of $269,300 was set just last year in July.

Still, from the perspective of Bluegrass Realtors President Randy Newsome, it’s not wise to wait on buying a home.

“Buyers run the risk of being priced out of the market if they wait to purchase as there’s no indication that prices will fall. We’ve had over 5 years of year-over-year price appreciation and, even though price increases may slow, we don’t see any indication that they will come down,” Newsome said in emailed comments to the Herald-Leader.

In Fayette County, the median home price rose even higher, to $315,287 in March, up from $275,000 in March 2023. That rise in the median price, which is the middle-of-the-road purchase price of a home, equates to a roughly 15% price increase since this time last year.

Other sources put Fayette County’s median home price lower, though not by much.

Figures provided by the office of Fayette County Property Valuation Administrator David O’Neill put the median home price at $311,050 for the month of March. Compare that to March 2023, when the agency reported a median home price of $262,000.

Redfin, a real estate website, puts Lexington-Fayette County’s median home sale price at $314,910, a year-over-year price increase of more than 15%.

Lexington is among 10 ‘most difficult’ cities in US for Gen Z homebuyers, analysis claims

Why are home prices so high in Central Kentucky?

Several factors are pushing up the price of homes in Lexington and Central Kentucky.

For one, the cost of financing a home remains high. In March, the average rate for a 30-year mortgage was 7.01%, according to a lender survey by Bankrate. High interest rates also make many homeowners reluctant to sell, which in turn curbs the inventory of homes and keeps prices high.

Realtor.com says Lexington is very much a seller’s market, meaning there are more people looking to buy than there are homes available.

Redfin rates the Lexington-Fayette County housing market as “very competitive,” with a score of 72 out of a possible 100. The website states the average home here sells just 1% below its listing price with a pending sale in around 25 days. The most competitive homes on the market sell 1% above asking and go pending in as little as four days.

Fayette County’s hot housing market has also been a draw for investors in recent years.

In 2022, a Herald-Leader analysis found 235 investors controlled 1 in every 10 Lexington home sales since 2019. Many choose to flip the homes for high prices, rent them to tenants or convert them into weekend vacation stays via websites like Airbnb and Vrbo. What’s more, investors often get tax breaks for purchasing homes in low-income “opportunity zones,” the Herald-Leader found.

It’s unlikely buyers looking for homes in Lexington will see relief anytime soon.

Fayette County PVA figures show the median home price here grew between January and March, and once home-buying season peaks this summer, we could see another record-breaking high.

Note: This article has been updated to reflect the realtors association’s most recent name, which is Bluegrass Realtors.

Do you have a question or story idea about real estate in Kentucky for our service journalism team? Send us an email at ask@herald-leader.com or submit your comments via the form below.