Hints of 1982 have one strategist saying the bear market is over: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Tuesday, August 2, 2022

Today's newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn.

When the closing bell rang last Friday, the S&P 500 registered its best monthly gain since November 2020.

The apparent enthusiasm from investors in July may be perplexing given the economic and earnings backdrop facing the markets.

But for Tom Lee, co-founder and head of research at Fundstrat, the market's recent rally makes perfect sense. Furthermore, Lee argues, history suggests that we may be at the beginning of a more forceful push higher into the end of 2022.

"The biggest takeaway for me on events of this week?" Lee asked in a note published on Friday, "Convincing and arguably decision evidence the 'bottom is in' — the 2022 bear market is over."

Last week, the Fed raising interest rates by another 0.75%. GDP data that showed a second-straight quarter of negative GDP growth. Recent housing data showed a notable slowdown in arguably the economy's most important sector. And looking abroad, news broke that Russia further cut the flow of gas to Germany as Europe prepares for a potentially frigid winter amid Russia's war in Ukraine.

And yet markets rose.

"When bad news doesn't take down markets," Lee added, "it is time for investors to assess."

This week began with data from FactSet out Monday showing analysts making larger-than-normal cuts to third quarter estimates. In other words, analysts are more bearish than normal on corporate profits. And this aggregate downgrade to earnings expectations comes amid high-profile flops from the likes of Meta Platforms (META) and Intel (INTC) over the last week.

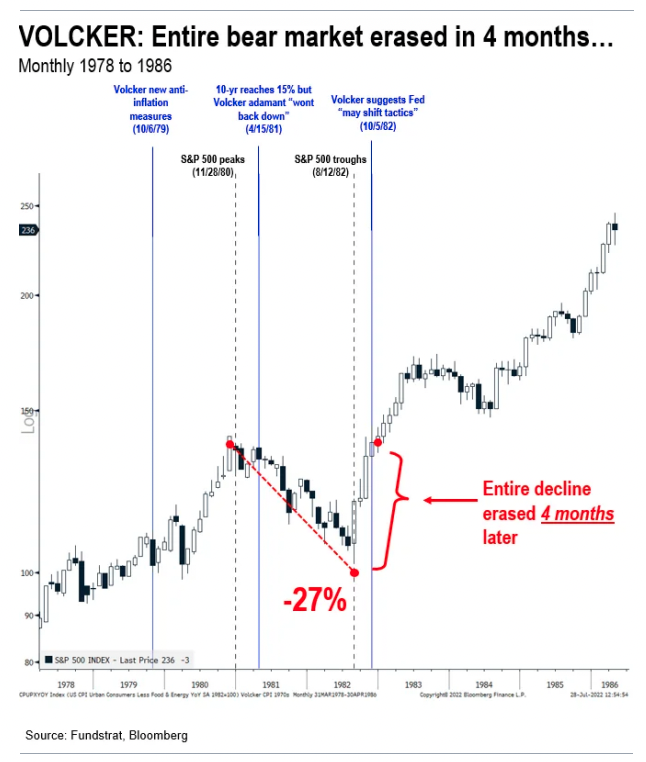

Fundstrat's optimism, however, extends beyond a view that hinges on the worst of the news flow being over for investors. Over the last several weeks, Fundstrat has been arguing the market setup is similar to what investors were presented in August 1982 — a moment that preceded a fierce rally in equity markets amid a pivot from the Fed.

In the summer of '82, the U.S. economy was in the throes of recession and then-Fed Chair Paul Volcker had not yet signaled whether the Fed would ease up in its campaign to slow inflation.

In October of that year, Volcker signaled the Fed could temper efforts to slow inflation. "The forces are there that would push the economy toward recovery," the New York Times reported Volcker said in a speech. "I would think that the policy objective should be to sustain that recovery."

For investors, "sustain that recovery" kicked off a nearly 20-year bull market in stocks. Two months before the pivot, markets sniffed out the Fed's plans — and in just four months erased all losses from a 22-month bear market that saw the S&P 500 fall 27%.

And this 40-year-old rally is why, in Lee's view, the S&P 500 could be headed back above 4,800 and new record highs by the end of this year. Last week, Lee notes the bond market erased over 0.5% of expected interest rate increases from the Fed through next spring.

"The bond market made a serious 'dovish pivot' in pricing Fed funds into 2023," Lee said. "Is it any wonder that equity markets have found footing in July?"

Moreover, Lee sees the market pricing in a growth scare as opposed to a full-blown recession.

As was widely discussed during the spring, the S&P 500 falls 32%, on average, during a typical U.S. recession. Peak-to-trough, the S&P 500's drop during the current drop from record highs reached 23%. And if recession is avoided, the 30%+ drop many investors have been bracing for may never materialize.

Last week's GDP data ignited a spirited conversation about whether the U.S. economy was already in — or would fall into — recession. Two negative quarters of GDP growth, at the very least, meets the criteria of a "technical" recession. Though as we highlighted on Friday, economists at Bank of America outlined why a formal recession call isn't likely in the offing anytime soon.

Data from the manufacturing sector out Monday also added evidence to the case for a growth slowdown but not necessarily an outright recession.

Manufacturing growth in the U.S. fell to a two-year low in July, according to the Institute for Supply Management's latest purchasing managers' index (PMI). The PMI showed the largest one-month decline in the pace of price increases on record but still came in at came in at 52.8 — and any reading over 50 shows expansion in the sector.

Survey data from S&P Global similarly showed a slowdown in manufacturing growth amid a notable downtick in inflation pressures, but this is a trade-off the Federal Reserve made clear last week that they are willing to make.

"Supply chain problems remain a major concern but have eased, taking some pressure off prices for a variety of inputs," wrote Chris Williamson, chief business economist at S&P Global Market Intelligence. "This has fed through to the smallest rise in the price of goods leaving the factory gate seen for nearly one and a half years, the rate of inflation cooling sharply to add to signs that inflation has peaked."

What to Watch Today

Economic calendar

10:00 a.m. ET: JOLTS job openings, June (11.000 million expected, 11.254 million during prior month)

Wards Total Vehicle Sales (13.4 million expected, 13 million during prior month)

Earnings

Post-market

Airbnb (ABNB), Arconic (ARNC), Assurant (AIZ), Caterpillar (CAT), Caesars Entertainment (CZR), Camping World Holdings (CWH), CenterPoint Energy (CNP), Cirrus Logic (CRUS), Cummins (CMI), CoreCivic (CXW), DuPont (DD), Electronic Arts (EA), Evoqua Water Technologies (AQUA), Exact Sciences (EXAS), FMC (FMC), Gilead Sciences (GILD), Herbalife Nutrition (HLF), Henry Schein (HSIC), Huntsman (HUN), Incyte (INCY), JetBlue Airways (JBLU), Lear (LEA), Leidos Holdings (LDOS), Marathon Petroleum (MPC), Marriott International (MAR), Molson Coors Beverage (TAP), Match Group (MTCH), Microchip Technology (MCHP), MicroStrategy (MSTR), Occidental Petroleum (OXY), PayPal Holdings (PYPL), Prudential Financial (PRU), Solaredge Technologies (SEDG), SunPower (SPWR), Solarwinds (SWI), Starbucks (SBUX), TrueCar (TRUE), Uber Technologies (UBER), Wynn Resorts (WYNN), Zebra Technologies (ZBRA)

Yahoo Finance Highlights

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube