Hims & Hers Health Shares Climb After News of Double-Digit Revenue Growth. Is It Too Late to Buy the Stock?

Shares of Hims & Hers Health (NYSE: HIMS) jumped following the company's first-quarter earnings report that once again announced surging revenue growth. That performance has helped the stock perform well this year, up about 40%.

Let's look at some recent comments from the CEO that caused the stock to dip, the company's recent quarterly results, and whether it's too late to buy the stock.

Controversial comments sink stock ahead of earnings

Hims & Hers CEO Andrew Dudum caused some controversy ahead of the company's earnings report when he came out on social media in support of pro-Palestinian college protests, while saying his company would be willing to hire the protesters.

He walked that back in conjunction with the company's earnings report, writing on X (formerly Twitter) that he does not condone violence or anti-semitism, but does support peaceful protest and how it has helped drive change.

Investors generally don't like companies or their management teams taking sides on political or controversial issues. Regardless of which side a company takes, it can alienate or anger a meaningful percentage of its customers. That can cause them to lose sales if people become angry enough.

While Dudum's comments were not helpful for the stock, these controversies usually blow over, and clarifying his remarks should help ease the issue.

Image source: Getty Images.

Strong Q1 results and increased guidance

Hims & Hers shares bounced back after the company reported strong Q1 results that saw its revenue grow 46% to $278.2 million. That was above the high end of the company's $267 million to $272 million guidance. Its net orders climbed 20% to 2.46 million, while average order value (AOV) jumped 21% to $109.

The company said its women's categories, including dermatology, weight loss, and mental health, were strong, being among the fastest-growing parts of the business. However, it said this is a very small, under-penetrated business, with only about 2% share of a large market.

Subscribers soared 41% year over year to 1.71 million, as the company added 172,000 net new subscribers. Importantly, the company said that the number of subscribers choosing personalized subscriptions has nearly tripled to 600,000 subscribers. This is important, as these customers tend to be more sticky and thus have a longer lifetime value.

Hims & Hers also saw solid marketing leverage in the quarter, with this metric improving 400 basis points. It said it was able to acquire customers through lower-cost channels. The combination of getting less churn through personalization and improved customer acquisition costs is leading to improving profitability and cash flow at the company.

The company saw its adjusted EBITDA increase by more than 5x to $32.6 million from $6.1 million a year ago. Net income flipped from a loss to $11.1 million, or 5 cents per share. Operating cash flow, meanwhile, soared to $25.9 million from $9.5 million a year ago, while free cash flow came in at $11.9 million.

Given its strong momentum, Hims & Hers increased its full-year guidance. It now expects revenue of between $1.20 billion to $1.23 billion, up from a prior view of $1.17 billion to $1.20 billion. It is now forecasting adjusted EBITDA of between $120 million to $135 million, up from a previous outlook of $100 million to $120 million. The company added that its strong results reinforce its belief that it will hit 20% adjusted EBITDA margins by 2030.

Is it too late to buy the stock?

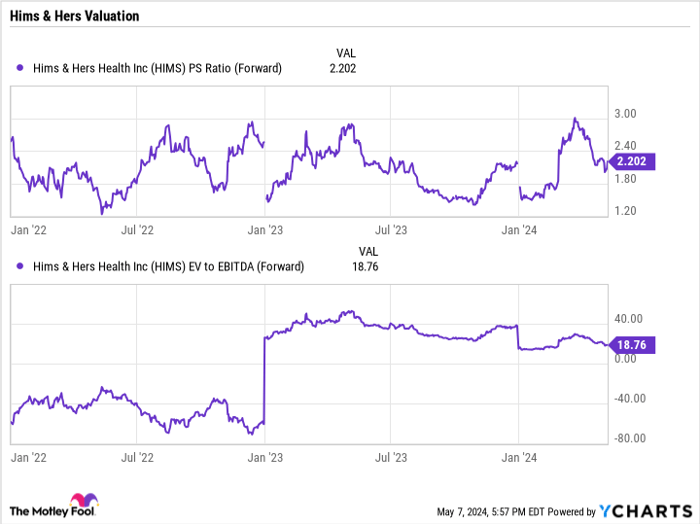

Despite the stock's strong year-to-date performance, it is still well off its highs hit earlier this year, and the stock's valuation is quite cheap. Hims & Hers trades at just over 2x forward sales for a largely recurring business with over 80% gross margins. Meanwhile, its enterprise-value-to-adjusted-EBITDA multiple is only about 18x. For a company growing revenue over 40%, this is one of the cheapest high-margin growth stocks around.

HIMS PS Ratio (Forward) data by YCharts

One knock on Hims is that it does not have a wide moat. However, its increased use of personalization is helping create one. It also already faces large challengers in the space, including an offering from Amazon. However, Amazon's entry into the space in November 2022 has not slowed Hims & Hers' strong growth.

Meanwhile, Hims & Hers has been able to nicely fill a large niche, especially among men. With 28% of men not having a primary care doctor and about 60% not going to a doctor regularly, Hims is filling an important health need for men.

For investors looking for an inexpensive high-growth, under-the-radar stock with a lot of upside potential, Hims & Hers is a great option to consider.

Should you invest $1,000 in Hims & Hers Health right now?

Before you buy stock in Hims & Hers Health, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hims & Hers Health wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Geoffrey Seiler has positions in Hims & Hers Health. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.