'You guys have lost your minds': Philadelphia man asks Dave Ramsey if he and his wife should borrow money — they make $180K/year but spend $80K on the kids. Here's Ramsey's scathing reply

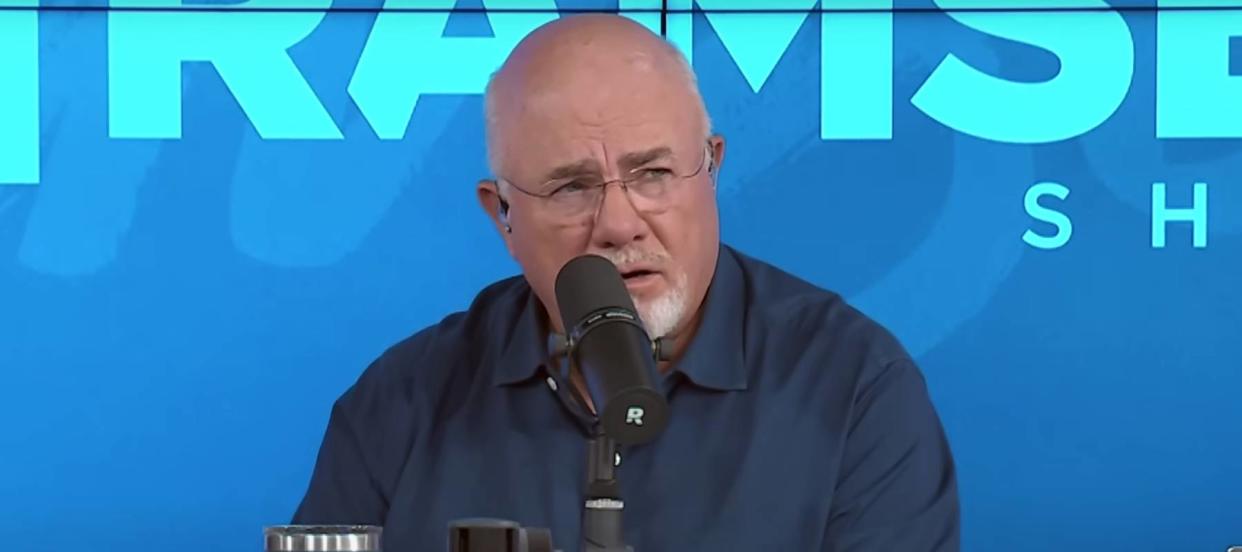

Dave Ramsey couldn't contain himself recently when responding to a caller on his show.

A man named Dave from Philadelphia told the finance guru on The Ramsey Show that he was “barely making it” on a family income of $180,000. He was unsure whether to save more or take out a loan to make ends meet.

Don't miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

‘A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

The family's household income is set to rise once his wife finishes medical school (she was making $70K as a resident at the time of the call and set to finish school with no student debt), but in the meantime they struggle with his student debt and child expenses.

Rather than pick either of the presented options, Ramsey, as per his trademark style, suggested a different route.

“Option C, work more,” he said. Ramsey then asked: “Can you explain to me why you can’t get by with income at $180,000?”

The caller revealed he and his wife spend around $80,000 a year solely on their kids.

“I’m going to be as nice as I can,” Ramsey replied. “You guys have lost your minds.”

The (expense) monster under the kids’ beds

Asked to dig deeper, Dave from Philadelphia revealed some eyebrow-raising kiddo expenses: at least $50,000 in daycare tuition for two, plus before- and after-school care, along with paying a nanny in the summer months.

Maybe you’re thinking what Ramsey said: “Are they going to Harvard? What the crap!”

The caller admitted it was a pretty fancy school, especially given that his kids were still pre-school age. The average cost of child care in Philadelphia is just above $17,000 per child, slightly more in the suburbs, according to child care website TOOTRiS.

“We’re going to take out student loans for the four-year-old,” Ramsey teased. “That’s what we’re coming down to.”

Budgeting for cost-effective child care is even more critical considering the expenses many Americans can’t readily escape, such as gas, insurance, groceries and utilities. Budgets can play a crucial role in bringing things under control — especially if you start by tallying your last three months of spending. What’s costing the most? What are the non-negotiables? Where can painless, sensible cuts be made?

Read more: Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

What about Ramsey’s ‘Option C’?

As Ramsey suggested, income from added work can countervail the dollar figure of a loan. He recommends staying away from loans in general, as taking on a side hustle or even a part-time job while you create an emergency fund can turn the numbers in your favor.

These days, a side hustle can be as simple as renting out an empty room in your home, an unused shed as storage space or even a parking space you might have but don't need.

When to consider a loan

Dave from Philadelphia clearly needed a reality check on his children’s child care costs. His family's $180,000 income has relatively little financial drag, and represents more than twice the median income of nearly $71,000 nationwide as of 2021, according to the Census Bureau.

Would a combination of cost cutting and a smaller loan make sense for the time being, then? Perhaps — but only if you avoiding borrowing at a high interest rate. If it’s a personal loan you have in mind, shop around. Banks and other loaning agencies want your business, so make them compete to give you the best rate by comparing at least three to five different offers.

Of course, married people who sit down with a neutral party — in this case, a professional financial adviser — will get a much clearer picture in terms of separating needs from wants and waste. After all, no one wants to stay stuck in financial pre-school.

What to read next

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Rising prices are throwing off Americans' retirement plans — here's how to get your savings back on track

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.