Growth is putting major stress on Tri-Cities fire districts. 3 are asking for help

Every city wants to see growth, but Washington’s property tax laws are leaving fire protection districts struggling to keep up with the demands that come from it.

Combined with the rising cost of fighting fires, providing EMS services and a population boom, that’s left Tri-Cities area fire agencies turning to voters for help.

From car wrecks to massive wildfires, these agencies are responsible for both fire and EMS services for large swaths of the region.

Three agencies, whose primary coverage zones create a buffer around the Tri-Cities, have seen their collection rates drop at a staggering pace due to levy compression. Unlike city fire departments, these agencies don’t receive other money aside from grants.

Benton County Fire District 2, Franklin County Fire District 3 and Walla Walla Fire District 5 have placed levy lid lift measures on the Aug. 6 primary election ballots. Walla Walla Fire District 4 is also seeking a levy lid lift.

Levy ‘compression’

Levy compression happens when growth outpaces the 1% levy collection increase limit set by the state.

Washington taxing authorities don’t collect the full amount of a levy every year. They set a total levy based on the tax rate at the time it is passed and can only collect an additional 1% without voter approval.

That 1% amounts to just $10,000 to $15,000 for the budget of an agency the size of Benton District 2. It collected $1.02 million on their $1.50 rate per $1,000 of assessed property value in 2021.

Benton District 2 spent $44,000 on fuel alone last year. That was a 22% increase year-over-year.

Last fall these districts asked voters to build in an inflation increase, allowing them to collect up to 6% over the previous year’s total. They believe confusion around the wording may have sunk them as voters rejected the levies.

This time they’re asking voters to “reset” their levies.

The chiefs told the Tri-City Herald that the confusion seems to have stemmed from voters seeing the rate increase and mistakenly thinking the entire levy amount would increase 6% every year.

But the reality is that your home’s assessed value can go up 40%, but taxing districts can collect only the same amount as the year before plus 1%. Voters would need to approve any change to that.

The inflation adjustment would have just allowed them to remain closer to the rate they originally passed.

The more new homes that are added to an area, the more that total levy collection is spread out among all the taxpayers.

That means when a new levy is passed, the first year will see a bump and then compression will set in.

Rising costs and challenges

Inflation has hit fire agencies particularly hard.

Benton District 2 Chief Dennis Bates told the Herald that a bond they passed in 2013 paid for several engines, water tenders and construction of two new fire stations. By 2018 that same amount of money was only enough to cover replacing aging vehicles.

FireTruckLeasing.com estimates that delaying the purchase of a $716,000 engine for just three years would cost an agency more than $100,000, given current inflation rates in the industry. A 10-year delay would raise the cost more than $500,000 for the same engine.

Also, calls for service have skyrocketed as the population in the region grows.

Pasco is the fastest growing city in the state, with much of its growth coming along the city’s urban growth area boundary.

While Benton City has seen slower growth than some areas of the Tri-Cities, Bates said their calls are up more than 60% over the past five years.

In addition to fire and emergency medical services, the districts are responsible for fighting wildland fires.

These types of events, and major fires like the one at the Lineage cold storage warehouse in Finley last month, are all-hands-on-deck events with multiple agencies working together.

The state Legislature says an average of 86,000 acres of wildland burned annually in the 1990s and then grew to more than 800,000 acres each year by 2020.

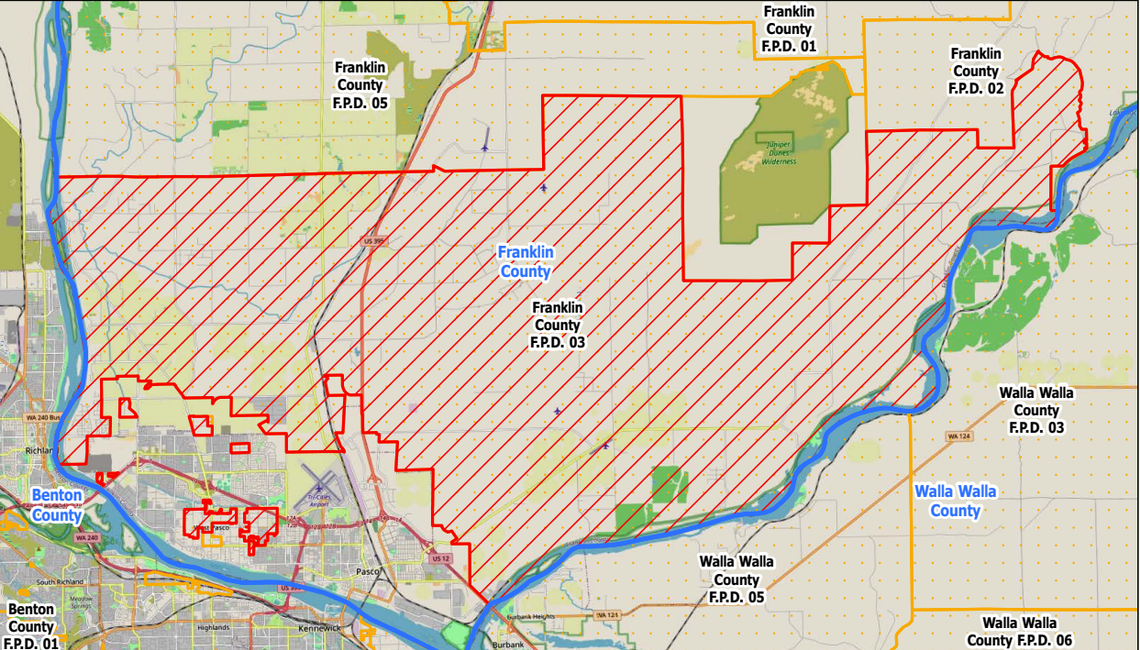

Franklin Fire District 3

Franklin County Fire District 3 is returning to voters, asking them to approve an increase back to their original rate to help bring their budget in line with the county’s booming population.

Chief Mike Harris told the Herald that their effective rate, which was passed at $1.27 in 2018, already has shrunk to 88 cents per $1,000 of value.

That’s a compression of almost 40 cents in just six years. They’re asking voters for a reset to put their collection at $1.28.

That 40-cent difference is only going to cost taxpayers an estimated $10 a month on their tax bill for a home valued at $300,000.

If it passes, they hope to use the money to pay for one new full-time firefighter, two seasonal firefighters for wildland fire season and to build up reserves for future capital improvements at Fire Station 33 on Selph Landing Road.

If the measure fails, Harris said they’re going to have to start dipping into reserves just to cover their operating costs.

They’re responsible for the areas surrounding Pasco, as well as unincorporated “donut holes” of county land.

Those unincorporated areas within the city itself are home to a large population, mostly between Argent Road and Court Street to the south, from Road 80 to Road 40. It’s often referred to as the Riverview neighborhood.

Their coverage area outside the city covers growing neighborhoods and industrial zones, with manufacturers such as Lamb Weston’s Pasco plant and Granite Construction.

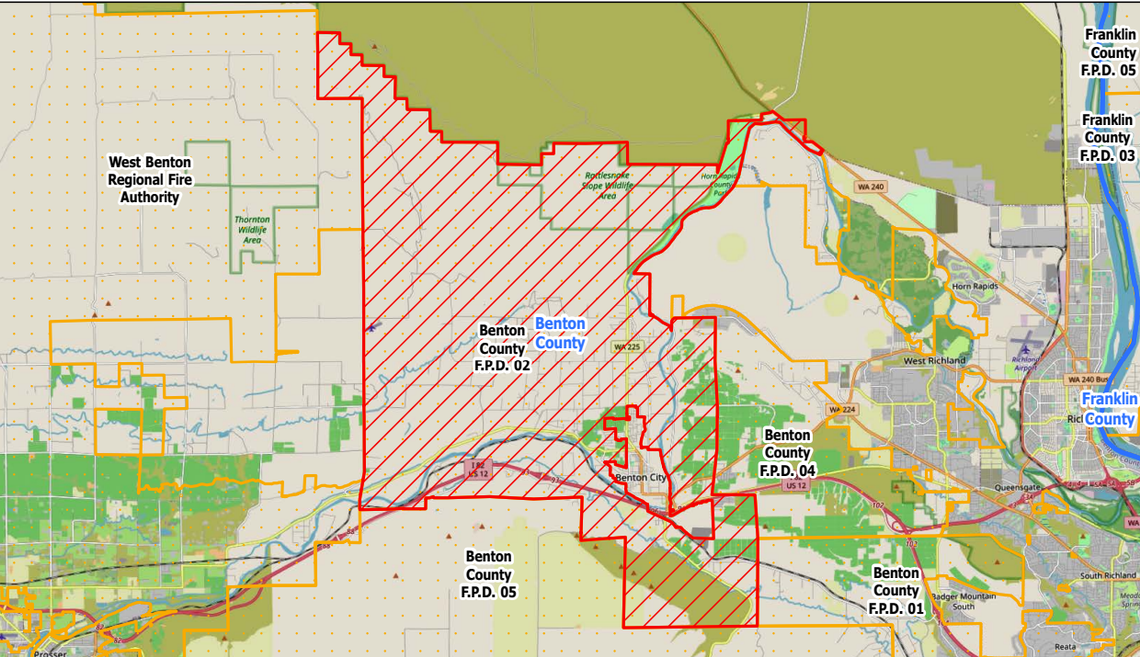

Benton Fire District 2

Benton District 2 isn’t asking voters for a higher rate either, they’re just hoping to win reapproval of their current rate in order to fight the compression problem.

They’re currently at $1.50 for every $1,000 in property value. They want to keep that rate the same, but by asking voters to renew the tax every six years, they’re able to keep the rate closer to current collections.

Due to increases in population, their current $1.50 is actually collecting around $1.47 and dropping each year.

Bates said that while there may have been some confusion about the inflation request included in the last vote, this time he’s making sure to get out and answer questions voters might have.

“I’ve been out here having coffee with folks,” He said. “That’s one nice thing about living in a small community like this, word of mouth works.”

Approval would mean the district could keep up better with inflation without the need for the 6% annual collection increase voters previously rejected.

In neighboring Benton County Fire District 4, which covers West Richland, they’re throwing support behind the ballot measures.

“We are all connected and have one goal – save lives and property,” District 4 Chief Paul Carlyle said in a news release. “At the point a fire district is unable to fund an adequate amount of personnel, reliable apparatus and equipment, it impacts all residents in the Tri-Cities.”

Benton District 4 most recently passed a levy increase for EMS services, which account for about two-thirds of its calls.

Walla Walla fire districts

Two Walla Walla fire districts also are going out for levy increases.

Walla Walla Fire District 5 serves the Burbank area and the confluence of the Snake and Columbia Rivers.

District 4 serves unincorporated portions of the city of Walla Walla and areas around the city to the south.

District 4 is asking for their first lid lift in nearly 40 years. They want voters to approve an increase from 88 cents to $1.26 cents per $1,000 in taxable value.

They estimate that will result in a tax bill increase of $12.67 a month on a $400,000 home.

Last fall Walla Walla district 5 asked for their first increase in three decades, but voters narrowly rejected raising the 24-cent increase request.

Chief Mike Wickstrom told the Herald in an email that the measure failed by just 22 votes, which trickled in after election night results.

He said that he believes the inflator also was the sticking point for voters.

This time they’ll ask for the same $1.38, but without the inflator. Their current rate is $1.22.

Wickstrom estimates it’ll cost $4 a month more on a home valued at $300,000.

Ballots for the Aug. 6 primary will be mailed out by July 19.