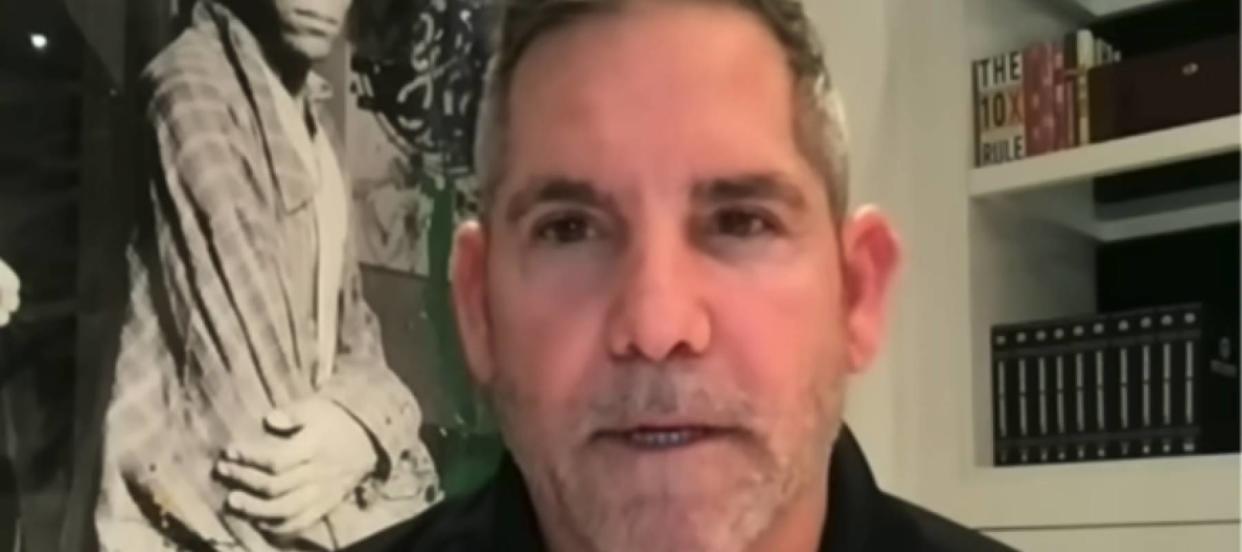

‘The greatest real estate correction in my lifetime’: Grant Cardone sees doom and gloom ahead for US real estate — but here’s how savvy investors can use it to ‘grab trophy real estate’

High interest rates have already cast a dark shadow over the U.S. real estate market. And according to real estate mogul Grant Cardone, the slump is just getting started.

“I just want to say that we’re entering the greatest real estate correction in my lifetime,” he said in a recent interview with FOX & Friends.

Don’t miss

Finish 2023 stronger than you started: 5 money moves you should make before the end of the year

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

The impact may vary across different types of properties.

“It will not include single-family homes, but it will include office where we're already seeing that damage, and we're going to see it across the entire apartment complex,” Cardone explained.

A massive real estate correction can be devastating to property owners who’ve already been grappling with higher mortgage payments as a result of the U.S. Federal Reserve’s aggressive interest rate hikes. However, for people with dry powder to deploy, Cardone believes the incoming setback could present an unprecedented opportunity.

“It’s going to be a great opportunity for individuals, regular everyday people to actually grab trophy real estate from institutions. This has never happened in this country. It’s going to be at epic levels,” he added.

Indeed, it’s now easier than ever for everyday Americans to access real estate properties that were once considered off-limits to retail investors. Here’s a look at three simple strategies to “grab trophy real estate.”

Invest in publicly traded REITs

Real estate investment trusts, or REITs, are companies that own income-producing real estate like apartment buildings, shopping centers and office towers.

You can think of a REIT as a giant landlord: It owns a large number of properties, collects rent from tenants, and passes that rent to shareholders in the form of regular dividend payments.

To qualify as a REIT, a company must pay out at least 90% of its taxable income to shareholders as dividends each year. In exchange, REITs pay little to no income tax at the corporate level.

It’s easy to invest in REITs because many are publicly traded.

Unlike buying a house — where transactions can take weeks and even months to close — you can buy or sell shares in a REIT anytime you want throughout the trading day. That makes REITs one of the most liquid real estate investment options available.

Read more: This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Invest on a crowdfunding platform

Crowdfunding has become a buzzword in recent years. It refers to the practice of funding a project by raising small amounts of money from a large number of people.

These days, many crowdfunding investing platforms allow you to own a percentage of physical real estate — from rental properties and commercial buildings to parcels of land.

Because of the greater risks involved in real estate crowdfunding, some platforms are targeted for accredited investors, sometimes with minimum investments that can reach into the tens of thousands of dollars. To be an accredited investor, you need to have a net worth of over $1 million or an earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the past two years.

If you’re not an accredited investor, many platforms let you invest small sums if you like — even $100.

Such platforms make real estate investing more accessible to the general public by simplifying the process and lowering the barriers to entry.

Sponsors of crowdfunded real estate deals usually charge fees to investors — typically in the range of 0.5% to 2.5% of whatever you’ve invested.

Invest in ETFs

Picking the right REIT or crowdfunded deal requires plenty of due diligence on your part. If you’re looking for an easier, more diversified way to invest in real estate, consider exchange-traded funds.

You can think of an ETF as a portfolio of stocks. And as the name suggests, ETFs trade on major exchanges, making them convenient to buy and sell.

Investors use ETFs to gain access to a diversified portfolio. You don’t need to worry about which stocks to buy and sell. Some ETFs passively track an index, while others are actively managed. They all charge a fee — referred to as the management expense ratio — in exchange for managing the fund.

The Vanguard Real Estate ETF (VNQ), for example, provides investors with broad exposure to U.S. REITs. The fund holds 163 stocks and has total net assets of $59.9 billion. Over the past 10 years, VNQ has delivered an average annual return of 6.4%. Its management expense ratio is 0.12%.

You can also check out the Real Estate Select Sector SPDR Fund (XLRE), which aims to replicate the real estate sector of the S&P 500 Index. It currently has 31 holdings and has an expense ratio of 0.10%. Since the fund’s inception in October 2015, it has delivered an average annual return of 6.2%.

What to read next

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

'A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.