What Is a Good Credit Score?

A credit score is a three-digit number between 300 and 850 that’s based on your credit history. Lenders use it to gauge your ability to pay back a loan. A good credit score is often considered to be 670 or higher, but it depends on the credit-scoring model used.

Read: What Is a Good Credit Score for Your Financial Goal?

Full vs. Partial Payments: Which Is Best for Your Credit Score?

Learn what’s considered a good credit score and what it takes to achieve it.

Different Types of Credit Scores

It’s important to know that there are several different credit scores. The two main scores are the FICO Score and the VantageScore. Many companies use one of these to determine creditworthiness.

However, some industries have their own ways of calculating credit scores according to factors they deem important. For example, a mortgage company typically weighs credit factors differently than an auto loan company.

If you are denied credit, ask the loan company for specifics. By getting details about what factors it weighs the most heavily, you can create a targeted credit improvement strategy.

Factors that impact your credit are typically the same across all industries; they are just calculated differently. Instead of focusing on different industries, focus on improving the factors as a whole. This will increase your chances of approval with any lender.

Check Out: 10 Things To Do Now If You Have a 500 Credit Score

What Is a Good Credit Score?

To determine what is considered a good credit score, look at each type of credit-scoring method. They each have their own algorithms.

Good FICO Score

FICO stands for Fair Isaac Corporation. It is one of the most common credit-scoring models today. Here’s the FICO Score scale to help you understand what’s considered a good FICO Score.

Score | Rating | Indication |

|---|---|---|

800 or higher | Exceptional | Easy approval, lowest rates |

740-799 | Very good | Good chance of acceptance, lower rates |

670-739 | Good | Considered acceptable borrowers |

580-669 | Fair | Subprime borrowers with higher rates and less chance of approval |

579 or lower | Poor | Considered risky borrowers; lenders may require deposits to access credit |

Good VantageScore

VantageScore bases individual credit scores heavily on payment history and outstanding balances. Here’s a look at the VantageScore scale.

Score | Rating | Indication |

|---|---|---|

781-850 | Superprime | Easy approval, lowest rates |

661-780 | Prime | Good chance of acceptance, lower rates |

601-660 | Near prime | Considered acceptable borrowers |

300-600 | Subprime | Higher rates and less chance of approval |

What Factors Affect Your Credit Score?

Both FICO and VantageScore get calculated according to their own algorithms. Below is a breakdown of each.

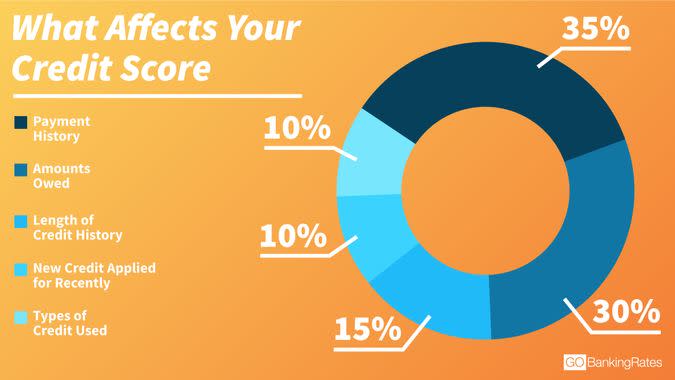

FICO Factors

According to the Fair Isaac Corp., the company that created the FICO credit-scoring algorithm, these are the factors that can result in a bad credit score:

Payment history: 35%

Amounts owed: 30%

Length of credit history: 15%

New credit: 10%

Credit mix: 10%

VantageScore Factors

Here is the breakdown for how the VantageScore is calculated so that you can compare the two:

Payment history: 40%

Depth of credit: 21%

Utilization: 20%

Balances: 11%

Recent credit: 5%

Available credit: 3%

Find Out: How It’s Possible to Have a Perfect Payment History and Bad Credit

Understanding Key Factors

Let’s take a deeper look at how these factors work.

Payment History

With both FICO and VantageScore, your payment history is the most crucial factor. It gives lenders an insight into your ability to make payments on time. It also includes details on missed payments, late payments, days past due and collection accounts.

Credit Utilization

Credit utilization is how much debt you have available compared to how much you are using. When your credit utilization climbs above 30%, you can be flagged as a high-risk borrower.

Credit Applications

A flurry of new credit applications — or hard inquiries — is a sign of financial stress and can dent your credit score.

Length of Credit History

The length of your credit history also affects your score. A long track record of making payments on time and responsibly managing your accounts is a positive signal to lenders.

Credit Mix

Credit mix shows the number of revolving accounts like credit cards versus how many are installment loans like mortgages or car loans. A good mix between the two is ideal.

Factors Not Considered in Your Credit Score

Your credit score is based on how you use credit extended to you. It does not include the following factors:

Gender, race, relationship status, education, religion, sexuality, political affiliation, national origin or age

Residence

Income or job title (though income is considered in a credit application, it does not affect your credit score)

Being denied credit

Checking your credit report

Why Is a Good Credit Score Important?

The truth is that your credit score can impact your entire life. For example, a low credit score can:

Prevent you from getting certain jobs and housing, as it can be seen as a sign of irresponsibility.

Lead to high interest rates on mortgages, car loans and other types of loans. This can mean you are paying double or more for a product than those with higher credit scores.

Keep you from getting approved at furniture or appliance stores. When you desperately need a new fridge, you might find yourself paying steep prices through a rent-to-own store.

While these are just a few examples, they are excellent illustrations of how a bad credit score can cost you a lot over time. A good credit score opens the door for opportunities to have lower payments, lower interest, better jobs and housing, and more.

Also See: The Best Ways To Pay Off Every Kind of Debt

Steps To Check, Monitor and Improve Your Credit

Take the following steps to take control of your credit.

Step 1: Get Your Credit Report

Start by getting a copy of your credit report from one of the following places.

Credit Bureaus

According to the Fair Credit Reporting Act, each of the three major credit bureaus — Equifax, Experian and TransUnion — is required to give you a free copy of your credit report upon request once a year.

You can request your free credit report at AnnualCreditReport.com. Beginning in 2020, you can get at least six more free credit reports each year through 2026. To get started, visit Equifax or call 866-349-5191.

During the COVID-19 pandemic, all three of the major credit bureaus are offering free weekly credit reports, which you can request and review online.

Credit Card Companies

Many credit card issuers provide access to credit scores along with updates to cardholders. Check with your card issuer to see whether it provides this benefit.

Credit Counselors

A nonprofit credit counselor can often provide you with a free copy of your credit report to discuss it with you. You can find such organizations through the National Foundation for Credit Counseling.

Step 2: Check Your Credit Report for Errors

Check each report for errors, such as fraudulent activity, accounts that don’t belong to you or payments marked as late that you made on time. Dispute any mistakes directly through each credit bureau.

Step 3: Prioritize On-Time Payments

Going forward, do your best to avoid late payments. Try to lower outstanding balances as much as possible. This is the clearest indication to lenders that you are not a risk, and it will have the most significant impact on your score.

Step 4: Don’t Apply for New Credit Unless Absolutely Necessary

Don’t apply for new credit unless you absolutely need it. New credit applications will temporarily lower your score.

Step 5: Develop Good Financial Habits

Some good financial habits include paying bills on time, paying off your credit card in full every month and avoiding making several credit applications over a short period.

Step 6: Keep an Eye on Your Credit

Sign up for a credit monitoring program that can alert you when changes are made. Even if you do this, however, it is important that you monitor your credit manually.

At least once a month, pull your report through a company like Credit Karma or Experian. It’s free to do and gives you an overview of any changes.

More From GoBankingRates

Brandy Woodfolk contributed to the reporting for this article.

Last updated: July 9, 2021

This article originally appeared on GOBankingRates.com: What Is a Good Credit Score?