GM reports 1st quarter earnings increased on retail sales of trucks, improved EV sales.

General Motors on Tuesday reported improved first-quarter earnings on strong retail sales of gasoline-powered pickups and SUVs; lower raw material costs and improved production of battery cell modules, which helped it increase deliveries of its new electric vehicles.

The momentum in the quarter was so positive that GM is raising its estimated total year profit guidance.

GM reported an adjusted pretax profit of $3.9 billion in the first quarter, a slim 1.8% increase compared with the year-ago period at $3.8 billion. Its revenue soared nearly 8% to $43 billion, beating Wall Street expectations.

The automaker said it delivered the gains on stronger retail sales of its trucks, a 36% improvement in delivering its new EVs, led by the Cadillac Lyriq, as well as keeping incentives low and pricing steady. CFO Paul Jacobson told reporters Monday evening that GM also logged $300 million in cost savings in the quarter primarily in marketing and engineering spending. The company is on track to hit its total cost savings target of $2 billion by year-end. He said GM remains on track to achieve profits from its EV sales by the end of the year. GM plans to build 200,000 to 300,000 EVs for the year.

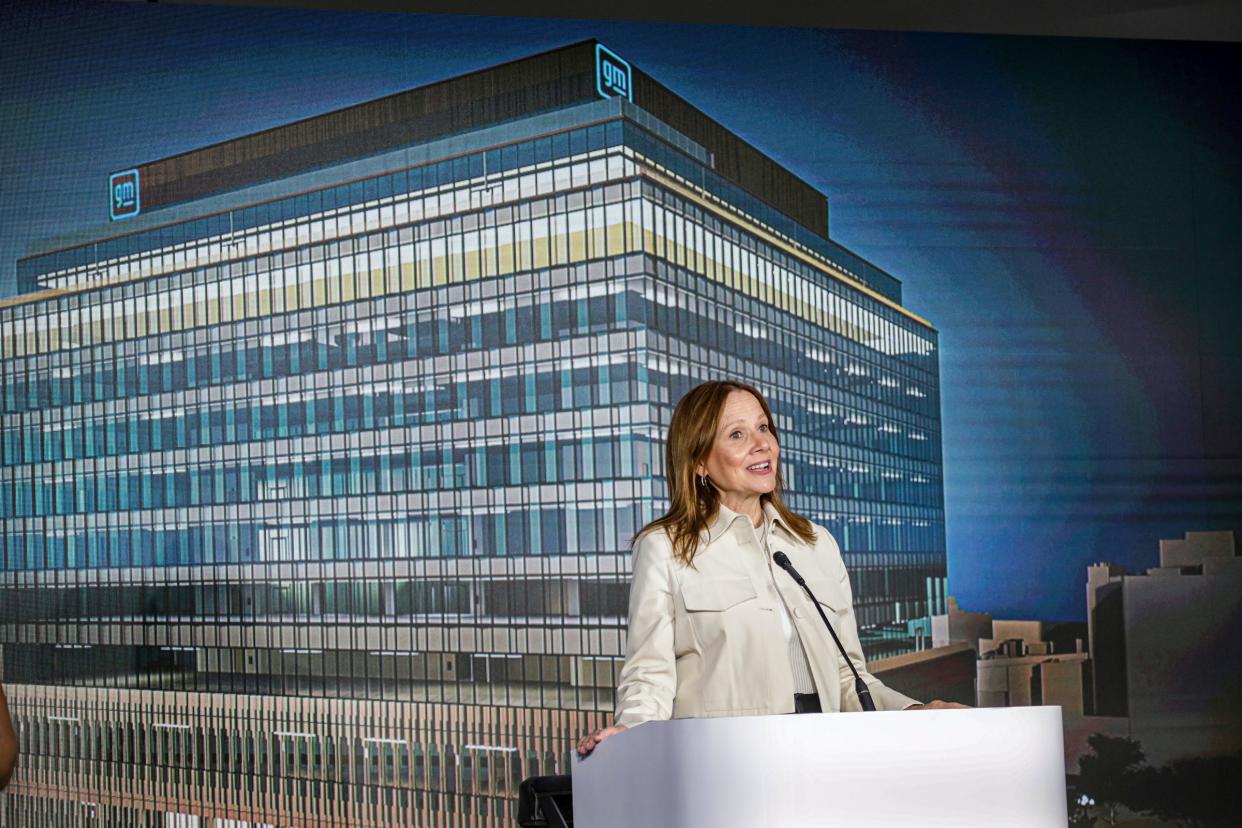

But GM continues to face pressure with a shrinking market share in China and higher labor costs from last fall's new 4 1/2-year contract with the UAW. Still, in a letter to shareholders, GM CEO Mary Barra wrote that GM anticipates a strong year ahead.

"In January, we outlined clear priorities for GM in 2024," Barra wrote. "They are to leverage the strength of our winning ICE (internal combustion engine) portfolio, grow our EV business profitably, advance our software-defined vehicle capability, and relaunch Cruise safely while delivering strong margins and cash flows. I’m very pleased to share that the team is executing well and making progress across the board."

Barra told analysts Tuesday that GM's estimated range for total capital spending this year across its entire business, including EVs and gasoline vehicles investments, is $10.5 billion to $11.5 billion. That's about the same as last year.

What's happening at Cruise?

GM's self-driving subsidiary, Cruise, has a team "back on the road in Phoenix updating mapping andgathering more road information," Barra wrote. GM had to halt Cruise operations nationally last year after a self-driving vehicle hit a pedestrian in San Francisco, leaving her critically injured. As the Free Press has reported, GM has invested about $8 billion in Cruise since 2016. Cruise leaders had at one point promised to deliver $1 billion in annual revenue by 2025, but the subsidiary has not made any money yet.

Jacobson said the company expects to spend $1.7 billion on Cruise operations this year, down slightly from GM’s spend on Cruise in previous years of around $2 billion.

GM's new outlook for 2024

Jacobson said, “This strong start, our operating discipline, the commitment of our team and the new products we’re launching are giving us the confidence to raise" guidance. GM's new full-year adjusted pretax profit guidance is in the range of $12.5 billion to $14.5 billion, up from $12 billion to $14 billion. It raised its net income guidance to a range of $10.1 billion to $11.5 billion, up from $9.8 billion to $11.2 billion.

GM's new products launching this year include the Chevrolet Blazer EV, Chevy Equinox EV, Chevy Silverado EV RST, GMC Sierra EV, Cadillac Escalade IQ and Cadillac Celestiq. Also the new Chevrolet Traverse and gas engine Equinox SUVs also.

Asked if GM may delay the launch of other EVs, including a yet-to-be named Buick EV, Jacobson said, "We have a number of launches this year that we need to focus on making sure that we get right. So we'll be markedly more deliberate in how we're rolling vehicles out to make sure we can get them out with the quality our customers can expect. As we continue to ramp up module production, we're going to pace ourselves with the customer."

He added that the retail demand for EVs “is holding” strong.

In a Tuesday morning call with analysts, Barra said that based on dealer feedback and consumer interest, “We’re confident that continuing to scale EV production is the right move.”

Barra said GM’s spending was above historic levels for many years to get EVs designed and built, but now that the launches are happening, GM can return to “capital efficiency” and lower costs.

She said the Chevrolet Bolt, which GM stopped building in December, will be an example of how GM can deliver a redesigned EV at an efficient cost when GM puts its Ultium technology in it. GM will relaunch the Bolt with the Ultium powertrain in late 2025.

First-quarter highlights

GM reported global revenue rose 7.6% to $43 billion compared with $39.9 billion last year, topping Wall Street expectations. According to Seeking Alpha, Wall Street analysts expected GM revenue to rise 4.5% to $41.78 billion during the quarter.

GM reported net income soared 24% to $3 billion compared with $2.4 billion a year ago. Its earnings before interest and taxes (EBIT) inched up 1.8% to $3.9 billion compared with $3.8 billion a year ago.

In China, GM's second most important market, GM and its joint ventures recorded a $106 million loss for the quarter in equity income compared to an $83 million gain in the year-ago quarter. GM's market share declines in China started years ago and have proliferated with rising economic and political tensions between China and the United States as well as complicated consumer sentiment regarding EVs and growing competition from government-backed Chinese carmakers.

GM said in the fourth quarter that it would have a rough first quarter in China. Jacobson said the $106 million loss is "actually slightly better than we were thinking. The team has really worked through significant inventory build that happened in the back end of 2023. With that largely behind us, things should normalize a little bit and turn back to profit."

GM Financial, GM's captive lender, recorded an adjusted earnings before taxes of $737 million, down 4.4% from a year ago when it had an exceptionally strong period, GM spokesman David Caldwell said.

GM new vehicle pricing

GM reported a 6% gain in retail sales of its new vehicles, but its fleet sales plummeted 23% in the quarter in part due to the temporary production constraints of midsize pickups and cargo vans, which GM said are now fixed. In February, as the Free Press was first to report, GM had to halt sales of its 2024 midsize pickups to fix software problems, but it resumed sales within 24 hours.

GM's pricing on its vehicles is holding up. Caldwell said as of midmonth, GM's average transaction price was about $49,500, consistent with the same period last year. Jacobson said GM ended the quarter with dealers having an average of about 63 days of inventory, which he said is a good level for going into the spring. A healthy inventory is about a 60-day supply.

Earlier this month GM reported its total first-quarter U.S. sales dropped 1.5% to 594,233 vehicles sold compared with the year-ago quarter.

What the analysts say

Daniel Ives, managing director and senior equity analyst at Wedbush Securities, said after difficulties with launching its newer EVs, stop-sales and parts shortages in recent years, this was the quarter for GM to turn things around.

"This was a major flex-the-muscles quarter for GM and shows the turnaround is now happening in Detroit after a rocky few years," Ives told the Free Press in an email. "Solid numbers across the board with a guidance raise is music to the ear for the GM bulls."

Morningstar auto analyst David Whiston told the Free Press ahead of GM's results that it would come down to if GM's higher sales volumes and lower materials costs could offset slightly lower pricing. He got said the results indicate the automaker had "a geat quarter with ... more good results coming later this year. Guidance increase shows continued strong confidence in 2024’s performance. China is a sore spot but volumes may improve there after Q1."

GM appears to be disciplined in its production planning and marketing spending, said Erin Keating, executive editor at Cox Automotive. In an email to the Free Press, Keating also said GM has been, "thoughtful in which products they are bringing to market in order to have a balance for what the customers are looking for, this will pay off for them if they can remain focused. If the market starts to soften, I do think we’ll see them (and everyone else) need to pull more levers to bring affordability in line."

Some management shake-ups lead to bullish outlook

GM did some housekeeping in the quarter. It had to resolve the stop-sale of theo Blazer EV it had ordered on Dec. 22 as engineers worked to fix owner-reported software problems. On March 8, GM lifted the sale when it found a fix.

Then there was a management shake-up when GM announced its Executive Vice President of Global of Manufacturing and Sustainability Gerald Johnson, 61, is retiring after 44 years with GM. The company is bringing in a former Tesla executive, Jens Peter (JP) Clausen, 52, to replace Johnson. Also, GM's relatively new Chief Digital Office Edward Kummer left citing health issues. Donald Chesnut, vice president of customer experience, elected to leave GM too.

Still, Jacobson told reporters that going forward, GM is bullish noting, "Our consumer has been remarkably resilient in this period of higher interest rates and we've seen that in all our transaction prices and our strong go-to-market strategies. We think in this environment we can continue to perform."

More: GM Energy now selling products to allow people to power their home with a GM EV

More: GM reports Q1 pretax profit decline of 6%, but raises yearly guidance

Contact Jamie L. LaReau: jlareau@freepress.com. Follow her on Twitter @jlareauan. Read more on General Motors and sign up for our autos newsletter. Become a subscriber.

This article originally appeared on Detroit Free Press: GM reports first quarter gains and boosts its full-year outlook