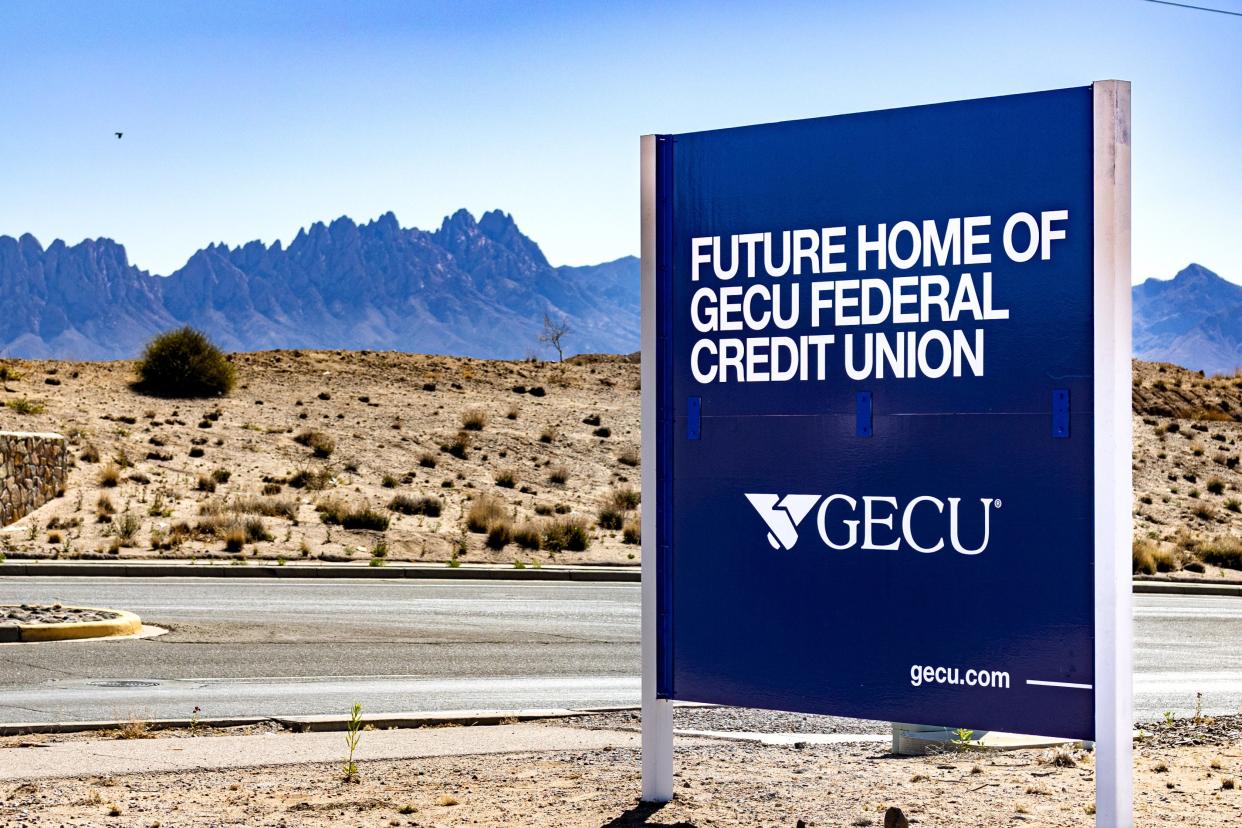

GECU putting first branch outside El Paso in Las Cruces as it also expands virtually

GECU, El Paso’s oldest credit union and largest locally owned financial institution, is expanding beyond its home by building its first branch outside El Paso and expanding virtually.

The branch in Las Cruces, New Mexico will be GECU’s 27th public branch. It also has three high school branches open only to students. The current branches are all in El Paso County.

The physical expansion comes after GECU just over a year ago began expanding virtually to other areas of Texas and New Mexico to further fuel membership growth, now at 434,000 customers. Becoming a federally regulated credit union in late 2022 allows it to expand outside its home market.

While financial transactions are shifting from in-branch to online, “one of the things that we found through our research, consumers still feel comfort knowing that there’s a branch in their community,” Alex Rascon, GECU chief financial officer, said in a phone interview after GECU’s April 10 groundbreaking ceremony in Las Cruces.

GECU officials want to put branches in other areas outside El Paso, but where has yet to be decided.

“Branches demonstrate our investment into the communities we serve,” Rascon said. “The Las Cruces branch is another way for us to contribute to that community” where GECU already has thousands of members, he said.

GECU expands virtually in Texas, New Mexico

GECU, through its virtual expansion, is aiming to draw members from 95 other Texas counties besides El Paso, as far east as the Austin area, and 31 counties in New Mexico, as far west as Raton.

It has about 12,000 more members today than it had when its virtual expansion was launched in March 2023.

It has 34,500 New Mexico members, with just over half in Doña Ana County, bordering El Paso in some areas. It was allowed to draw members from some areas of that county, including Sunland Park and Santa Teresa, when it operated under its state charter.

The number of members in other areas outside El Paso County was not disclosed.

Construction of GECU’s future Las Cruces branch at 3275 Rinconda Drive, near a Walmart Supercenter, is to begin soon. It's expected to open in early 2025. The construction cost was not disclosed.

It will look similar to most of GECU’s existing branches, featuring virtual tellers and drive-through ATMs. The small branches employ five to six staffers, who are available for some services.

New Mexico's Nusenda challenges GECU in El Paso

The Las Cruces expansion comes as Nusenda Credit Union, New Mexico’s largest credit union, recently entered GECU’s home territory after buying Western Heritage Bank, with four El Paso branches.

“The (credit union) landscape is changing, and so we’re very cognizant of that. That’s why we put an emphasis on our online channels to make sure that we’re able to serve our members 24/7. Whether it’s opening an account, transferring money,” and other services, Rascon said.

At the same time, physical branches are important, he said.

More: Meta completes $8.5M purchase of El Paso land for proposed data center

GECU change to federal credit union allows expansion

GECU, for most of its 91 years in business, had a state charter limiting where it could get members and where it could operate.

That changed in late 2022, when GECU became federally chartered and regulated by the National Credit Union Administration, a federal agency.

The change allows it to go not only into New Mexico, but in other parts of Texas to get members.

Years ago, GECU, formerly known as Government Employees Credit Union, rebranded itself as have other local credit unions.

Credit unions' net income declines

GECU has $4.4 billion in assets, largely loans, Rascon reported — up 4.7% from 2022. It has 950 employees, making it a major El Paso employer.

By contrast, Albuquerque-based Nusenda has $4.8 billion in assets, 260,000 members (far less than GECU's 434,000), and 800 employees, a Nusenda spokesperson reported in March.

GECU’s net income decreased in the last two years — going from $57.9 million in 2021 to $42.6 million in 2023, a 26% decrease.

Nusenda’s net income also declined from $33.1 million in 2021 to $24.2 million in 2023, a 27% decrease.

Credit unions are not-for-profit organizations, so profits go back to members in the form of lower loan rates, higher deposit rates, and helping pay for various services, Rascon said.

GECU's profit decrease was because of many factors, including the higher cost of money due to Federal Reserve Bank interest rate increases, he said. It's something seen across the credit union and banking industry, he said.

Nonetheless, Rascon deemed GECU's financial health as "very strong."

Vic Kolenc may be reached at 915-546-6421; vkolenc@elpasotimes.com; @vickolenc on Twitter, now known as X.

This article originally appeared on El Paso Times: GECU's Las Cruces branch will be credit union's first outside El Paso