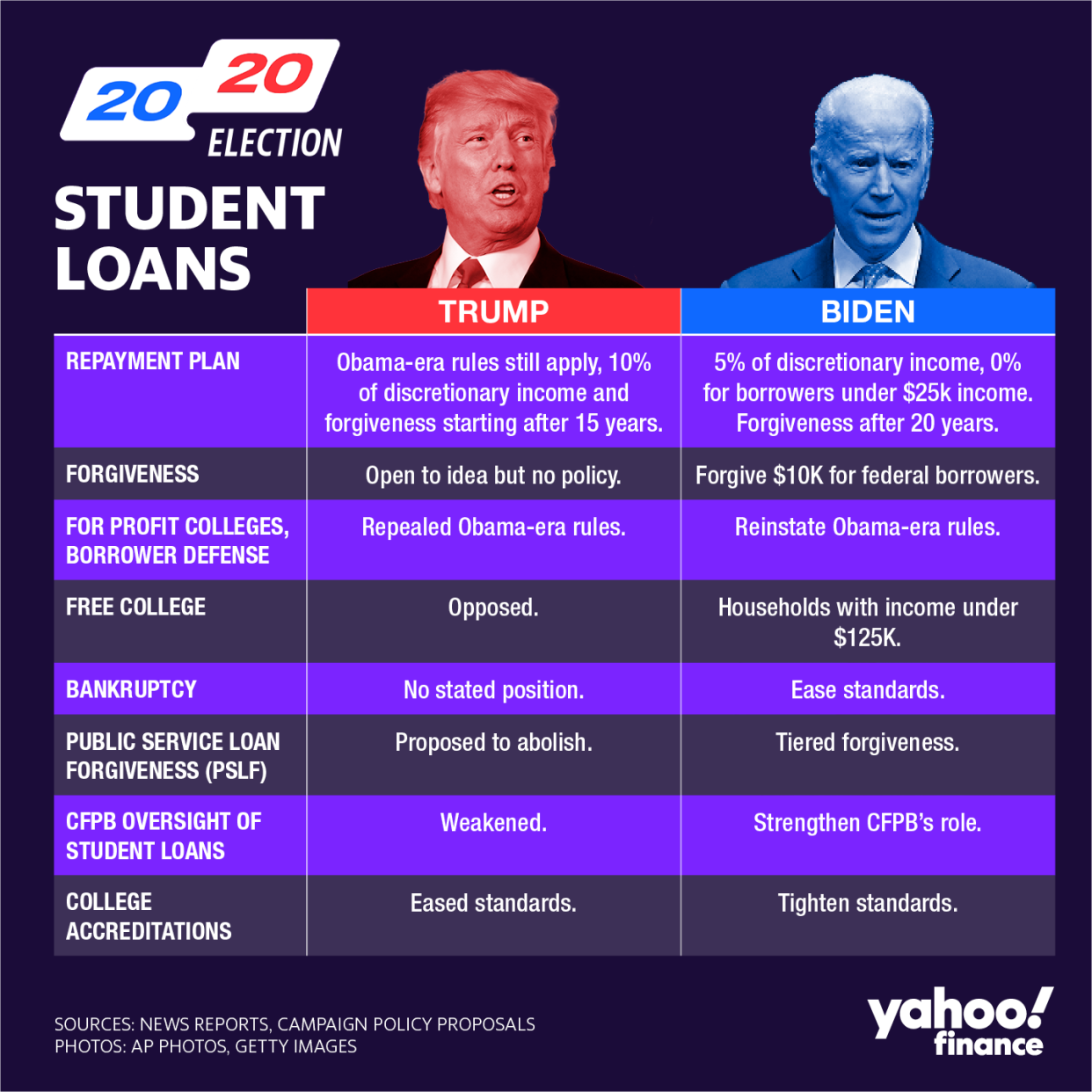

Trump v. Biden: Here's what's at stake for student loan borrowers

Both presidential candidates are proposing changes to the student loan system but differ widely on implementation.

While the Trump administration is looking to simplify the existing system and is hinting at possible forgiveness amid the coronavirus pandemic, a future Biden administration plans to wipe out $10,000 in debt and lower monthly payments dramatically in addition to reining in for-profit colleges.

“Biden's proposal does more to treat the actual issue, but the fact of the matter is: Student loans are the symptom,” Betsy Mayotte, president and founder of the Institute of Student Loan Advisors, told Yahoo Finance. “The problem is the cost of higher education.”

The former vice president’s plan “is an expensive proposal,” Mayotte added. The Committee for a Responsible Federal Budget (CRFB) estimated that Biden’s student loan policy would increase the national debt by $5.6 trillion over the next 10 years compared to $4.95 trillion for Trump’s plans.

Here’s a look at the details of the individual policies:

Repayment plan

Trump

Simplification.

New borrowers would pay at the most 12.5% of their discretionary income. For those with undergraduate student loan debt, their balance is forgiven after 15 years, and for graduates, after 30 years of repayment.

This is compared to the current system of borrowers on income-driven repayment plans paying 10% of their income for 20 years or 25 years — undergraduate and graduate respectively — before the remainder is forgiven.

Biden

Simplification.

Borrowers earning less than $25,000 a year would pay $0 on their undergrad federal loans, and those loans wouldn’t accrue interest until borrowers surpass that threshold. After that, they pay 5% of their discretionary income a month. After 20 years, the remainder is forgiven.

Expert notes

In any case, there are some kinks in the current system that need to be ironed out.

For instance, there are some issues regarding how income-driven repayments are verified — i.e. the potential for people to make mistakes. For instance, a recent U.S. Government Accountability Office (GAO) report found that as of June 2019, around 11% of the plans included borrowers making no monthly payments, despite having enough income to pay something.

“There's just very little accountability in the IDR income reporting rules,” Jason Delisle of the American Enterprise Institute told Yahoo Finance. This is a “high risk problem,” he added, because if “I don't want to use my tax return, I can just send in some paystubs — or just snap a picture of them on my phone and email to the servicer. Then that's it. They'll ‘calculate’ my income from me and away we go. There's no verification, etc. Same with family size.”

Forgiveness

Trump

Unclear.

In one proposal to House Speaker Nancy Pelosi (D-Calif.), as obtained by NBC News, he offered $25 billion in loan forgiveness as part of a $1.8 trillion proposal. She has rejected it, calling it “sadly inadequate.”

Biden

Cancel/forgive $10,000 in debt cancellation for all student loan borrowers. That eliminates student debt completely for about 34% of borrowers, Mark Kantrowitz of Savingforcollege.com estimates.

And for borrowers that come from families making less than $125,000 and who went to a public university, they’ll also have their debt eliminated, Forbes contributor Adam Minsky reported.

Expert notes

“I’m very sympathetic to broader proposals to cancel debt,” Sheila Bair, former chair of the Federal Deposit Insurance Corporation (FDIC), told Yahoo Finance’s On The Move (video above). “I wish Congress would do it… forgiving $10,000 of debt would be hugely beneficial to the economy.”

The government needs to be “realistic and honest” about borrowers’ inability to repay, she added.

She advised the federal government simply to “write it off and move on” because “we’re never going to collect that money — so just cancel it now … [and] give them some relief.”

Additionally, “the people that tend to default owe less than 10 grand and that's because in most scenarios they haven't completed their degree,” Mayotte noted. “So forgiving $10,000 of debt for every student loan borrower certainly would make a big impact on those borrowers that are struggling for that reason.”

Read more about Bair’s proposal in a Yahoo Finance op-ed here.

For-profit colleges, borrower defense, gainful employment

Trump

Repealed laws; status quo.

Yahoo Finance reached out to Career Education Colleges & Universities, which represents thousands of for-profit schools, for comment. The group has yet to respond.

Biden

Reinstate Obama-era rules.

Reinstate borrower defense to help defrauded students of predatory schools to have debt forgiven, as well as standards to monitor career placement performance.

Also plans to close the 90/10 loophole that for-profit schools use to recruit military veterans.

Biden’s VP pick, Sen. Kamala Harris (D-Calif.), has also touted her efforts to take on for-profit colleges. For instance, as California’s attorney general, Harris obtained a $1.1 billion judgement against the now-defunct Corinthian Colleges for its predatory and unlawful practices in 2016.

Free college

Trump

Opposed.

Promotes vocational programs and proposes more funding for career education (also removed the requirement to have a degree for jobs in the federal government via Executive Order.)

Also wants to freeze the maximum Pell Grant award and reduce reserve funds by $2 billion.

Biden

Proposed.

Proposes making four-year degrees at public colleges tuition-free for students who come from families making less than $125,000 a year.

Also proposes to double the maximum yearly Pell Grant to more than $12,000.

Bankruptcy

Trump

Unclear, likely status quo.

But there is a bill in Congress — which has bipartisan support — proposing to make it easier to discharge student loans in bankruptcy.

It’s also worth noting that Trump himself has declared bankruptcy six times.

Biden

Ease standards.

Proposes making private student loan debt easier to discharge in bankruptcy.

Expert notes

“Over the past 32 years, many cases have pinned on Brunner punitive standards,” Chief U.S. Bankruptcy Judge Cecelia G. Morris wrote in one case where a navy vet was discharged of $220,000 in student loan debt. The case is currently being appealed.

Morris stated that judges sometimes required proof of “hopelessness” — a far more difficult standard to establish than proving hardship.

These interpretations were “applied and reapplied so frequently” and have “become a quasi-standard of mythic proportions so much so that most people… believe it impossible to discharge student loans,” the judge stated.

Public Service Loan Forgiveness (PSLF)

Trump

Abolish.

Proposes to abolish PSLF, as per his budget proposal.

Biden

Tiered forgiveness.

Borrowers would get $10,000 a year forgiven for each of the first five years on the job (so $50,000), and the remainder will be forgiven tax-free.

CFPB oversight of student loans

Trump

Status quo.

Biden

Strengthen the Consumer Financial Protection Bureau’s (CFPB) role in supervising and regulating student lenders — especially private ones.

Expert notes

“It’s CFPB’s role to be the watchdog” for all student loans. As part of the Dodd-Frank Act, “certain large companies… fell under the CFPB’s supervision,” Michael Martinez of Democracy Forward, a watchdog group, told Yahoo Finance.

This includes Navient, PHEAA, and others.

Supervising these servicers is important, Martinez said, as the government can act as a check on their power. This could, for instance, affect how PHEAA — and FedLoan — approves Public Service Loan Forgiveness for borrowers.

CFPB Director Kathy Kraninger said on the Hill that she has not pursued supervision of the loan servicers, citing a lack of the Memorandum of Understanding (MoU). She later said this year that the MoU was created.

“She made it seem at the hearing that they were finally going to start the supervision again,” Martinez said.

But the Education Department later responded in a written statement that no such agreement existed, and that it was more of a “pilot.” Martinez’s group has sued both the agencies.

“If Biden were to win, he could replace Director Kraninger… [and] that could be a resumption of these examinations of these big companies that service student loans,” Martinez stated.

Caps on borrowing

Trump

Establish new caps on loans.

The White House proposed caps on federal student loans taken out by parents as well as graduate students back in 2019. Parents will be limited to borrowing $26,500 for undergrad students, while grad students will be limited to borrowing $50,000 annually, the Center for American Progress noted.

Additionally, Trump also plans to eliminate subsidized Stafford Loans, which are used by students who come from low-income and middle-class households.

Biden

Unclear.

Accreditation

Trump

Ease standards.

Given the administration’s repeal of borrower defense and gainful employment, it seems likely it’s loosening federal oversight of college accreditation by, for instance, allowing more higher ed institutions to access federal student aid dollars, the Washington Post reported.

Biden

Tighten standards.

Proposes to “require higher education accreditors to provide increased transparency in their processes.”

Expert notes

Depending on who Biden picks for his Education Department, his policies could go a lot further than stated.

Former Obama administration official at ED, Bob Shireman, now at the Century Foundation, has extensively chronicled incidents of how for-profit colleges are trying to gain nonprofit status, which he believes is a red flag, among other concerns. Shireman has been picked by an ED panel looking into college accreditation (the panel advises Betsy DeVos on those issues), by House Democrats.

Regardless of whether Shireman is picked to be on Biden’s team, House Democrats’ actions indicate that there may be further scrutiny on for-profit colleges in their relationship with college accreditors.

Special mention: Next Gen

The Trump administration has been slowly building a new modernized one-stop shop for student loans called Next Gen. The initiative, by Federal Student Aid, is taking some time but once complete is meant to look like a single portal for borrowers to see details about how much they owe, and more.

Underlying problems of the student loan machinery

Trump extended the interest-free payment pause for student loan borrowers until the end of the year amid the pandemic. But Bair, the former FDIC chair, noted that when these payments restart, much more could be done to help borrowers.

“We need to look specifically at very distressed student borrowers and the collection efforts of the government, and some of the abuses that occur there,” Bair stated. “There’s no statute of limitations on debt collection, so the government really does pursue people to the grave.”

On top of debt collection by the federal government — which is conducted by a variety of government contractors — there is also the issue of negative amortization, which Bair thinks should be done away with.

“They actually let your loan balance get bigger and bigger if you’re not paying down your interest,” she explained. “Just tackling those two… and some cap on how much debt they can accumulate… would be huge.”

And “what I’m suggesting really wouldn’t cost anything,” Bair said, “because this debt’s uncollectible — it’s called extend and pretend. … When somebody hasn’t been able to pay their loans for three or four years, chances are they’re never going to be able to repay it.”

Still, forgiveness is “just putting a bandaid on it,” Mayotte contended. “Unless you actually address the cost of higher ed, you're not actually fixing the problem.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

'The federal government is AWOL’ on student loan protections, California attorney general says

Warren and Schumer urge student debt cancellation of up to $50,000 for all federal borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.