Used car prices tumble 7% in 2023, though still elevated compared to pre-pandemic

Used car prices tumbled 7.0% in 2023, the second year in a row of falling prices in the sector after a massive pandemic-era run-up.

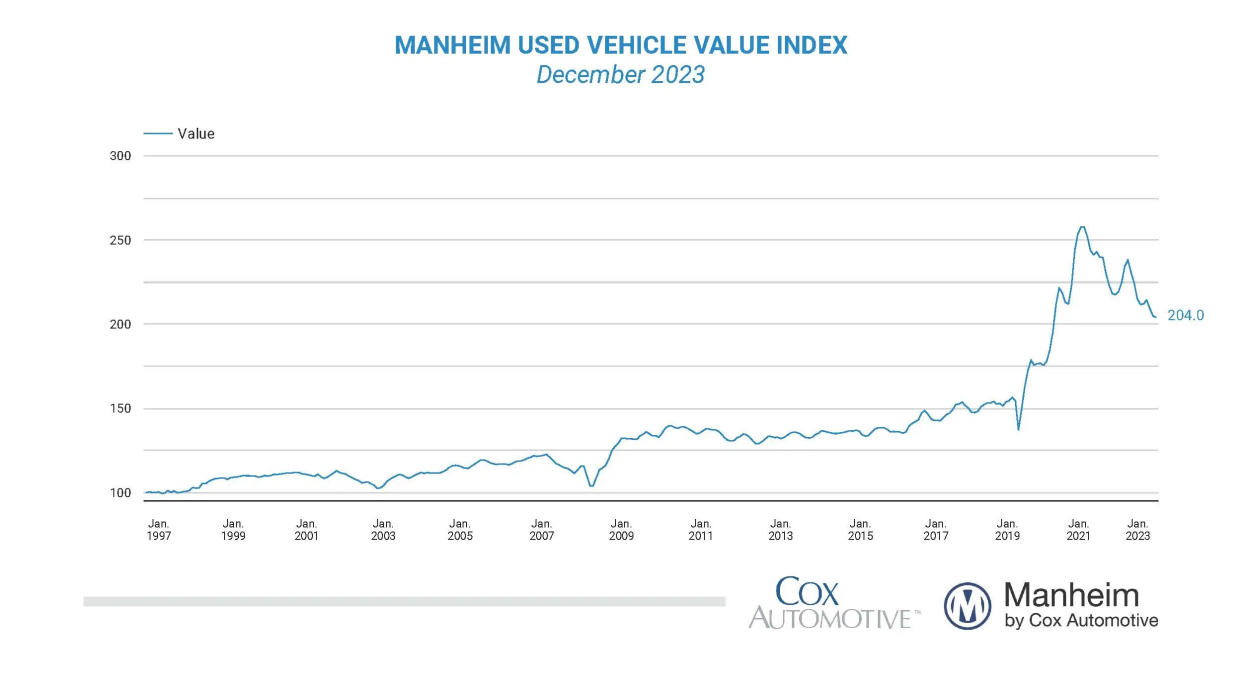

The Manheim Used Vehicle Value Index (MUVVI), which tracks used vehicle prices paid at wholesale auctions on a seasonally adjusted basis in the US, ended the month of December down 0.5% compared to November. For the year, used prices fell 7.0% compared to a year ago to a 204.0 reading, and are now down 21% compared to December of 2021.

“December’s decline brought a volatile year to a close,” said Jeremy Robb, senior director of economic and industry insights for Manheim parent company Cox Automotive. “The spring bounce was much more pronounced than expected in 2023, and prices slid just as rapidly after that bounce, finishing more calmly in December as expected. The 7.0% year-over-year loss was larger than our original forecast, but it pales in comparison to the nearly 15% decline we had a year earlier.”

When backing out seasonal adjustments, used vehicle purchase prices in December fell even more, down 2.0% in the month and 7.7% year over year. Though the MUVVI dropped to 204.0 in the month, it is still much higher than the pre-pandemic December 2019 reading of 151.5.

Despite drops in prices, Manheim said the average daily sales conversion rate increased by 53.8%, indicating improving and relatively strong demand. Manheim analysts note that broader measures of consumer confidence like the Conference Board index and University of Michigan consumer sentiment index improved in December as well, indicating improving conditions for the market and used car buyer.

Looking across different types of used vehicles compared to a year ago, the Manheim index found that luxury cars, pickups, and SUVs lost less than the overall market, down 6.9%, 6.5%, and 6.1%, respectively. Smaller cars like hatchbacks were the worst performer, down 11.7% for the year, followed by midsize cars, losing 8.1%, and vans, sliding 7.9%.

The MUVVI is also tracking broader trends seen in used vehicles at the government level, with November’s CPI (Consumer Price Index) showing used vehicle prices falling 3.8% year over year, but up 1.6% in the month. December’s CPI report is slated for release on Jan. 11.

Looking ahead to 2024, Cox Automotive analysts are predicting a less volatile year than 2023 in terms of prices, though they caution that they’ve been “taught to expect the unexpected in the wholesale market.”

Cox believes the market for new vehicle sales will improve as well. Cox reports December total new-light-vehicle sales in the US were up 13.0% for the year, good for a seasonally adjusted annual rate of 15.8 million for the industry, an increase of 16.8% from last year’s 13.5 million figure.

Recent sales reports for December and the full year from GM, Ford, and even Tesla indicate the market still remains strong for new vehicles, even in the face of higher interest rates and geopolitical tensions. Earlier on Monday Rolls-Royce reported a record 2023, showing even the highest end of the market remains resilient.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance