Used-car market in ‘uncharted territory’ as high prices remain sticky, Edmunds says

With spring car-buying season in full swing, those looking for a deal in the used-car market are not likely going to find one.

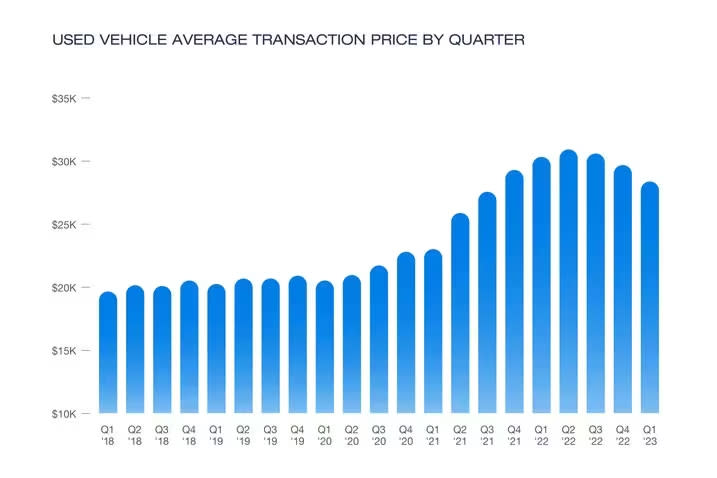

According to a new report, “Used Market Enters Uncharted Territory Post-Pandemic,” released from car-shopping site Edmunds.com, though used car prices softened a bit recently they still remain historically high. Edmunds’ data scoured from dealer retail pricing finds that the average used vehicle transaction price in Q1 slipped 6.4% year-over-year, but is still up 44% from five years ago.

“After experiencing a meteoric rise in value, used-vehicle prices have slightly inched back toward Earth with the return of price drops and seasonal depreciation but remain significantly higher than they were pre-pandemic,” Edmunds Analyst Ivan Drury wrote in the research report.

At $28,381, the average transaction price in Q1 is considerably higher than the $19,657 level five years ago. Even more troubling for buyers looking for used cars is that the available pool of cheap vehicles is dwindling. Edmunds says the share of used vehicles sold for under $20,000 was only 30.6% in Q1, compared to 60.5% in the same period five years ago.

Edmunds cites factors like low lease volume in general, which means fewer off-lease cars coming to market, low trade-in volume compared to 5 years ago, and fewer off-rental vehicles being turned over and sold in used market as reasons why the pool of used vehicles has been shrinking.

With used cars being the primary way for most buyers to get into the entry-level car market, it seems most people earning at the lower end of the pay scale will have a tough time getting a car.

“Not long ago, $20,000 was seen as an acceptable amount to spend on a used car to get an optimal blend of miles and age,” Drury writes. “In today’s market $20,000 puts consumers into a much older vehicle or a piece of inventory that is approaching the 100,000-mile mark.”

The only bright spot in the report for consumers is that those shoppers who currently own a used car, even those that have gotten older and incurred more miles, haven’t lost that much value as compared to pre-pandemic. An an example, Edmunds finds that the average mileage on a 2018 Toyota Camry has risen by 130% between Q1 2020 and Q1 2023, but stunningly the average transaction price has also increased by 8.0%.

And for those looking to get into a used car in the not too distant future, there might be some relief via the new car market. Edmunds says if new car sales stall out this year, automakers will have to use incentives to move new cars off of dealer lots, which would then but pressure on the used market.

But even that may be unlikely, as the automakers have learned a lesson from the pre-pandemic era and are no longer flooding dealer lots with inventory. Instead they have been attempting to “align supply and demand,” meaning they’re making fewer vehicles, making more built-to-order vehicles, meaning heavy incentives may become a thing of the past.

—

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Read the latest financial and business news from Yahoo Finance