US economic output reaches a 13-month high in May

The US economy is growing at the fastest pace since April 2022.

That's according to new data from S&P Global released Tuesday morning.

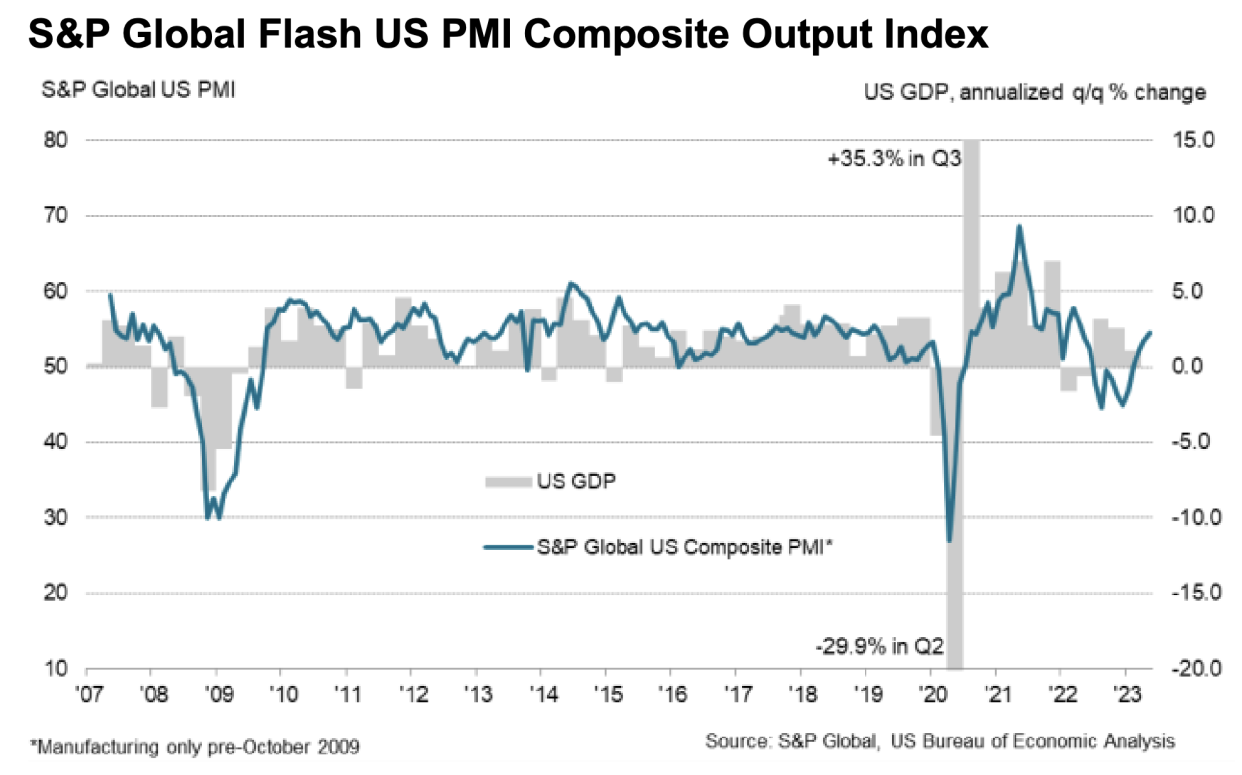

S&P Global's flash US composite PMI, which captures activity in both the services and manufacturing sectors, came in at 54.5 in May, up from 53.4 in April and better than the 53.0 that had been expected by economists. This marked a 13-month high for the index.

This increase was entirely driven by an uptick in the services sector. The services component of S&P's report showed the index registered 55.1 this month, up from 53.6 in April. Manufacturing activity, however, contracted in May with the index registering 48.5, the lowest in two months.

Any reading above 50 for these indexes represents expansion in the sector; readings below 50 indicate contraction.

"The US economic expansion gathered further momentum in May, but an increasing dichotomy is evident," wrote Chris Williamson, chief business economist at S&P Global Market Intelligence.

"While service sector companies are enjoying a surge in post-pandemic demand, especially for travel and leisure, manufacturers are struggling with over-filled warehouses and a dearth of new orders as spending is diverted from goods to services."

Elsewhere on Tuesday, a manufacturing reading from Richmond Federal Reserve Bank showed a contraction in activity in May.

In S&P's report, demand in the manufacturing sector weakened "notably" in May, with new orders dropping by the most in three months and overseas sales falling by the most since May 2009, with the exception of the initial pandemic-related drop.

On both the services and manufacturing side, however, S&P's report showed the labor market remains strong. In the services sector, hiring hit a 10-month high in May. On the manufacturing side, hiring this month was the strongest since September 2022.

The latest jobs report showed there were 253,000 nonfarm payroll jobs created in April while the unemployment rate fell to 3.4%, matching the lowest level since May 1969. The May jobs report will be released on Friday, June 2.

And while these signals augur well for the health of the US economy, they potentially pose a problem for investors hoping a softening in the US economy will urge the Federal Reserve to pause its rate hiking campaign, which has pushed interest rates to their highest levels since 2007.

"Jobs growth has accelerated as service providers companies seek to meet demand, but this tightening labor market amid strong demand will be a concern as a fuel of further inflationary pressures," Williamson added.

Read the latest financial and business news from Yahoo Finance