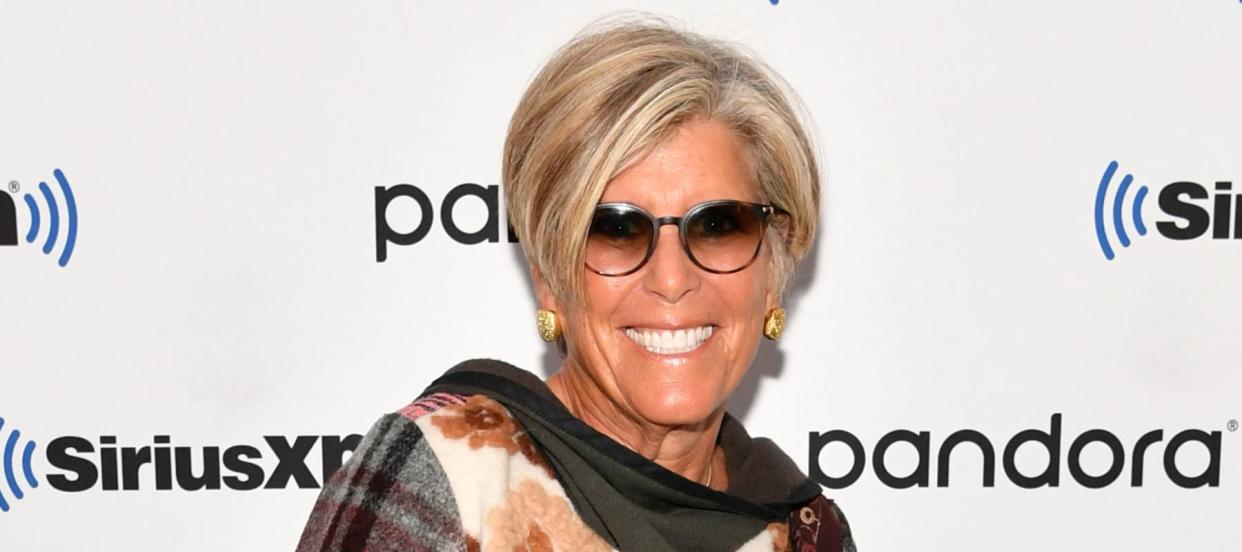

Suze Orman says 'no decision is bigger' in retirement than this Social Security move — here's what she wants Americans to do

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Popular finance personality Suze Orman says perhaps “no decision is bigger” than deciding when to take your Social Security benefits.

Soon-to-be retirees can start receiving their benefits as early as 62 if they so choose — but Orman advises that it’s better to wait to max out your monthly checks and benefit your future older self in the long term.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“I encourage you to keep returning to this thought exercise,” Orman wrote in a recent LinkedIn post. What are the financial steps you might take today to be kindest to your future older self? The 88-year-old, the 90-year-old, the 95-year-old?”

As Suze Orman emphasizes the importance of timing when it comes to Social Security benefits, she urges people approaching retirement to think deeply about the financial decisions that will benefit their future selves.

Here are some things she wants you to consider.

Do good things really come to those who wait?

A recent study from life insurance company MassMutual found that 40% of Americans aged 55 to 65 believe Social Security will be their biggest source of income in retirement, ahead of 401(k) plans, investments, and pensions.

Orman explains that for every month past your 62nd birthday that you don’t claim Social Security, you’ll snag a slightly larger payout when you do start receiving your benefits.

For example, according to the Social Security Administration, folks born in 1960 or later whose full retirement age is 67 would see their benefits reduced by about 30% if they start claiming them at 62. Extending your retirement means you have more time to contribute to your retirement accounts. And Suze Orman has long touted Roth IRAs as an optimal retirement savings vehicle. But there are other IRAs you can consider.

By opening a Gold IRA with the help of Goldco, you can benefit from the tax and other advantages of an IRA as well as the inflation-resistant properties of investing in gold. A gold IRA gives you the opportunity to diversify your portfolio finances by investing directly in physical precious metals.

Goldco is one of the most trusted platforms for buying precious metals, with an A+ rating from the Better Business Bureau and over 4,500 5-star customer ratings online. If you’re curious whether this is the right alternative investment, you can order a free gold IRA kit today to learn more.

Read more: 'Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

Orman says you need to start planning now

Orman encourages prospective retirees to consider waiting to optimize their benefits — but adds that they need to start planning and decide earlier rather than later.

"This is not a decision you can just shelve until you are 61," Orman warned in her post. "If you haven't made plans to delay claiming your Social Security at that point, chances are you will just go ahead and start at 62."

The other option is to tap into your retirement savings — but you must plan for a substantial nest egg long before you enter your golden years. Once you’re gone, life insurance can offer a versatile solution for your family, providing coverage to potentially replace lost income or settle outstanding debts.

By opting for term life insurance through a provider like Ethos, you are helping to ensure that your family will be taken care of after you’re gone. Term life insurance offers flexibility when you're seeking affordable coverage while balancing other financial responsibilities.

Ethos offers an easy online process that allows you to get up to $2 million in coverage with terms ranging from 10 to 30 years.

To get a free quote, all you have to do is answer a few questions about yourself. Then, you can compare coverage and choose the right policy that best suits your needs.

Real estate as a retirement vehicle

Buying a property outright is a lot more difficult as mortgage rates continue to hover around the 7% mark and home prices remain high. Investing in shares of real estate can be another avenue to help you grow your nest egg and bolster your retirement savings.

On a recent episode of her podcast, Suze Orman commented on the importance of understanding your local real estate market when purchasing property. “When it comes to real estate, you have to know more about it. You have to know about what real estate is doing in the area that you happen to live in,” she said.

Of course, your local residential market is just a tiny fraction of the real estate opportunities available to you as an investor. With First National Realty Partners (FNRP), you can invest in commercial properties across the country chosen for their income potential and necessity to the local community. FNRP allows investors to access their portfolio of vetted grocery-backed real estate investments featuring top national brands like Kroger, Whole Foods and Target.

To get started, fill in some information about yourself, your income and investment goals. From there, FNRP’s team of experts manages the entire investment process so once you find a deal you love you can sit back and monitor its performance and potential for distribution income.

But if you don’t have accredited status and still want to break into the real estate market, Arrived can be your solution. Backed by iconic investors like Jeff Bezos, Arrived allows all types of investors to invest fractional shares of vacation homes and rental properties without the burden of property management.

You can start by browsing their curated selection of properties vetted for their potential appreciation and income generation. Then, you can choose the number of shares you want to invest in and make an allocation with as little as $100.

What to read next

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.