Student loan forgiveness: $238 million in beauty school debt erased for defrauded students

In the Biden administration's latest act of student loan forgiveness, the Education Department (ED) is cancelling $238 million in student loan debt for 28,000 former beauty school students who had been defrauded.

Affected borrowers attended Marinello Schools of Beauty from 2009 to its abrupt closure in February 2016. The cancellation fall under the Borrower Defense Loan Discharge program and is not the type of broad-based forgiveness that President Joe Biden is reportedly considering.

Nevertheless, the move is still notable: ED told Yahoo Finance that this is the first time the Biden administration is erasing the debt for a group of borrowers based on borrower defense findings, instead of doing so on a case by case basis.

“Marinello preyed on students who dreamed of careers in the beauty industry, misled them about the quality of their programs, and left them buried in unaffordable debt they could not repay,” Education Secretary Miguel Cardona said in a statement. “Today’s announcement will streamline access to debt relief for thousands of borrowers caught up in Marinello’s lies."

$2.1 billion discharged under borrower defense

U.S. citizens and eligible non-citizens with federally-backed student debt can apply for borrower defense if their college or career school education misled them "or engaged in other misconduct in violation of certain state laws," according to the ED's Federal Student Aid office.

Borrower defense applications surged after the Obama administration cracked down on predatory for-profit colleges in 2015 and created new regulations, but the mechanism for defrauded borrowers seeking debt relief broke down during the Trump administration.

According to ED, the total number of debt relief under borrower defense rules is now $2.1 billion for 132,000 borrowers.

Marinello was found by the department to have made "widespread, substantial misrepresentations" about how it was instructing students on its campuses, according to ED. The school failed to train students as part of the cosmetology program on basic tasks such as how to cut hair and left students without instructors for weeks or months at a time.

The agency said it would begin informing students who are approved for discharge in the following months and that borrowers did not have to take additional action.

'The tip of the iceberg'

The department still has a long way to go with claims that defrauded students have filed over the years.

According to publicly available data from ED, as of December 31, 2021, the department had received 423,000 debt relief claims under borrower defense rules. Around 116,000 claims have been approved, and 110,000 pending and awaiting adjudication.

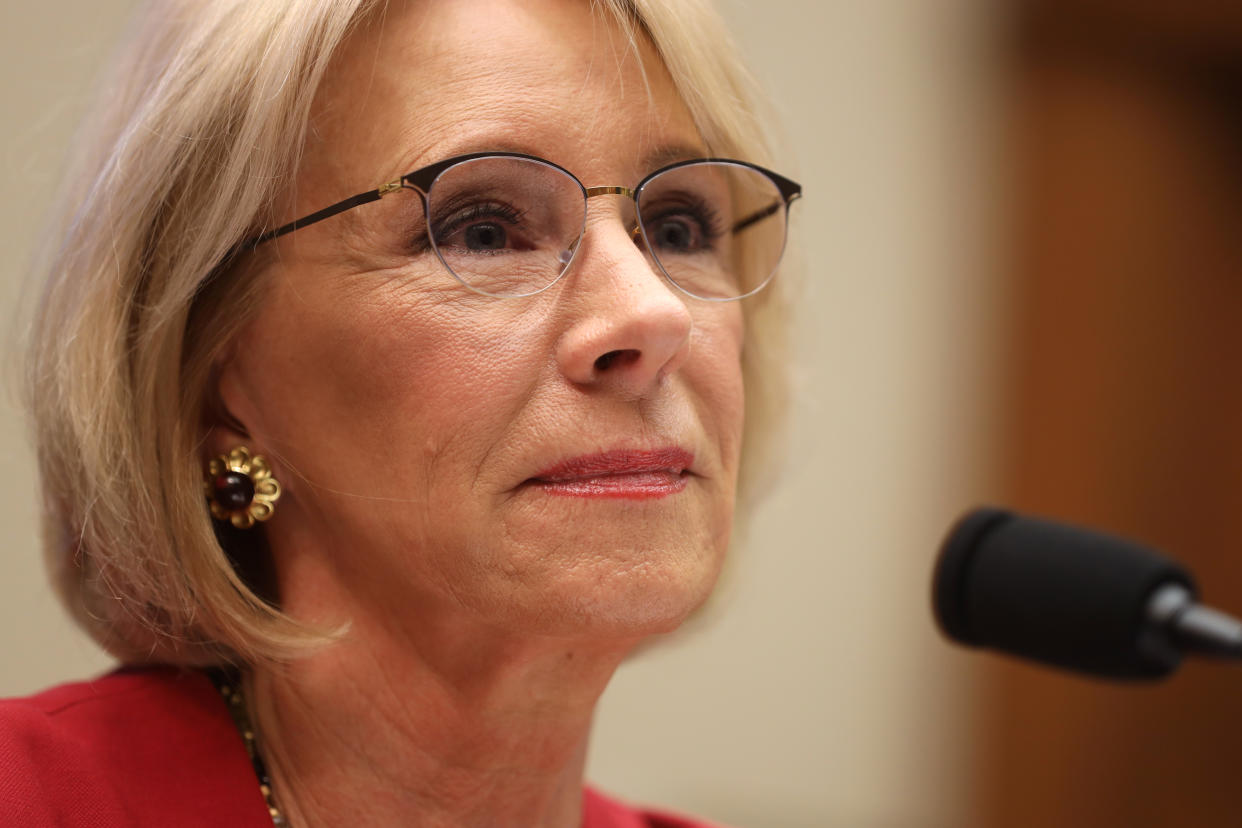

Many claims stalled during the Trump administration. Then-Education Secretary Betsy DeVos was very reluctant to approve discharges, leading to a barrage of lawsuits and various efforts intended to force the process to move.

Advocacy groups said that Cardona's ED could do a lot more than the announcement made today on Marinello, and that the administration should do the same for other defrauded students of various schools.

"As many advocates have said for years, Marinello students are among the groups of defrauded borrowers who have waited far too long for the relief they deserve," National Student Legal Defense Network President Aaron Ament told Yahoo Finance. "So this move is welcome and overdue, but it should just be the tip of the iceberg."

Ament added that the backlog of borrower defense claims "is long and growing — it’s bigger now than it was under the Trump Administration — and this move shows there is no reason the Department can’t rule on group claims right now," he added."

In an exclusive interview with Yahoo Finance (video above), Federal Student Aid Chief Operating Officer Richard Cordray said he planned to address the backlog.

"We have our borrower defense authority, where a school defrauds students, maybe lies to them about the job placement rates ... graduation rates ... on any number of levels that cause that student to decide to enroll, and then find later that they will be cheated — they're entitled to have their student debt forgiven," Cordray said. "The prior administration ... hadn't processed any of those claims for a period of years. We now have a backlog that we're working through, to try to catch up on."

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn