A strong GDP report helps Biden. It may complicate things for the Fed.

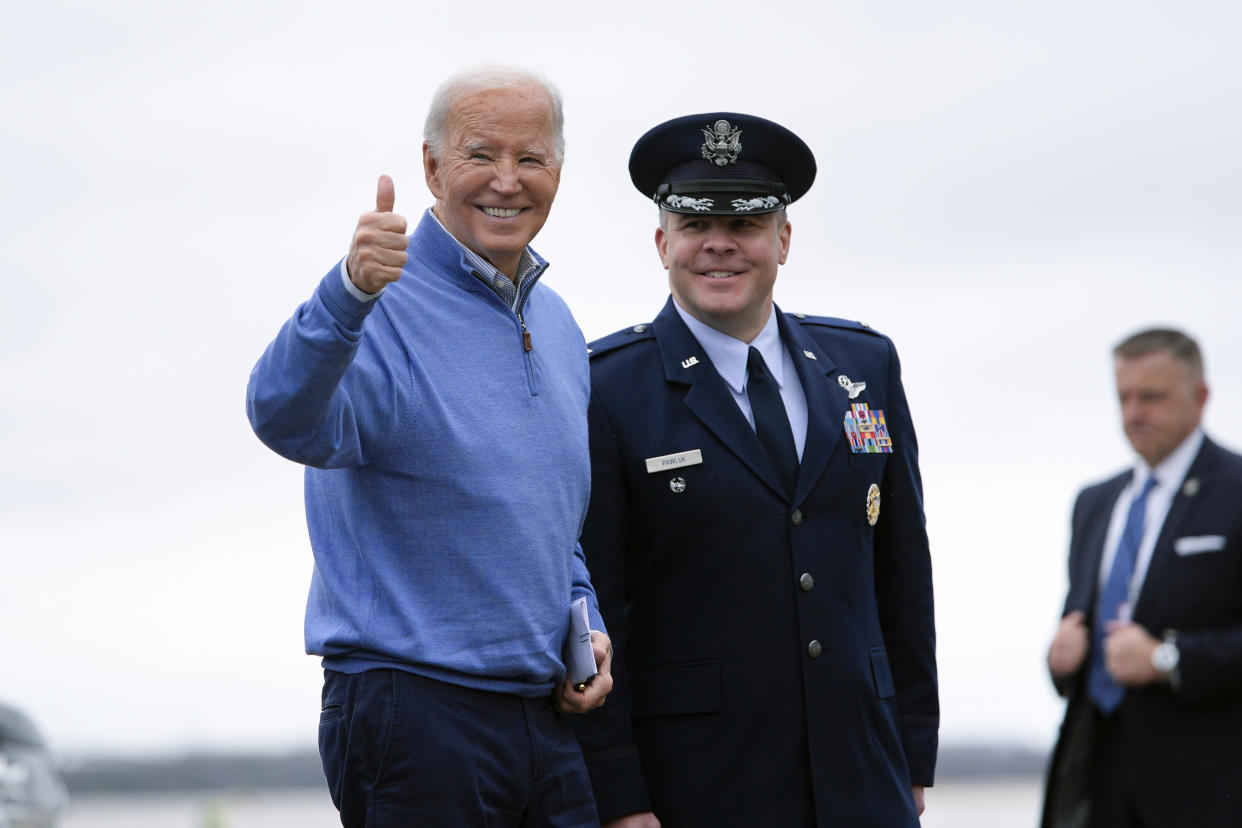

President Biden and other Democrats were largely exultant Thursday after an economic reading showed the US economy grew at a faster-than-expected rate to cap off 2023.

The advance estimate of fourth quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 3.3% during the period. It blew out consensus forecasts that the number from the Bureau of Economic Analysis would come in at 2%.

"That is three years in a row of growing the economy from the middle out and the bottom up on my watch," Biden said in a statement Thursday morning.

While the news was a clear political win for the White House, it does make things more complicated for central bank officials located a few blocks away at the Federal Reserve as they consider whether to cut benchmark interest rates in 2024.

Fed officials have predicted three cuts this year, but policymakers have been pushing back on market expectations for a loosening as early as March, cautioning that they need more data to be sure about such a pivot.

The hotter-than-expected growth could support an argument for pushing any cuts beyond March.

"The economy fared noticeably better than expected in the final three months of last year, reinforcing our view that market expectations for the Federal Reserve to cut interest rates as early as March is premature," Oxford Economics chief US economist Ryan Sweet wrote in a note to clients on Thursday.

But the report also included good news on inflation, showing that the Fed's preferred measure of price increases jumped on a quarter-to-quarter basis at a 2% annualized rate. It was the second quarter in a row at that pace and in line with the central bank's target of 2%.

That news could give the Fed more flexibility to consider an earlier cut.

"The Fed will have to ease unless they have very good reasons to think the economy is about to re-strengthen or inflation somehow will rebound," Pantheon Macroeconomics' Ian Shepherdson wrote in a note to clients. "We doubt those arguments can be made with confidence, so we expect the first easing in March or May."

David Doyle, the Macquarie Group head of economics, was less optimistic on immediate cuts in a Yahoo Finance Live appearance Thursday morning.

"I don’t think that will be enough to move the needle for them towards a March cut," he said. "I think they need to see more evidence that core inflation is heading back towards the 2% target on a year-over-year basis."

Investors will also get another reading on core inflation Friday when the numbers for the month of December are released. Economists had been expecting that monthly reading to show a 3% gain.

Overall good economic news

The overall news for the economy from Thursday's report appeared to be strong, another positive note to cap a 2023 that economic prognosticators had expected to end in recession.

For all of 2023, the US economy grew at an annualized rate of 2.5%, an increase from 1.9% in 2022.

"But despite the robust growth, inflation was tame," wrote Mark Zandi, chief economist at Moody's Analytics, on X. "Feels very good."

It was also another strong indicator for the White House as the president turns toward a 2024 that appears set to bring a head-to-head reelection showdown with Donald Trump. Allies of Biden from his 2024 campaign to his cabinet took to social media to tout the news.

The overall numbers were "good news for American families and American workers," Biden said in his statement with Treasury Secretary Janet Yellen, adding, "Our economy continues to grow."

The tone was echoed by Democrats on Capitol Hill. Sen. Martin Heinrich (D-N.M.), chairman of the US Congress Joint Economic Committee, noted that "all signs continue to point to a stable and growing economy" as Democrats face the coming election season.

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance