These Stores Let You Buy Now and Pay Later

If you’ve done any online shopping lately, chances are you’ve seen something new popping up at checkout: an enticing offer to “buy now, pay later.” This slick payment option aims to eliminate the headaches associated with credit cards and other loans, and it’s skyrocketing in popularity. But as the industry grows, the major credit bureaus are taking notice and starting to include them in their reporting — a move that could mean either good or bad news for your credit score. Here’s an overview of the major buy-now, pay-later services, their pros and cons, and which retailers are making it easier than ever to spread out payments, often without pesky interest and fees.

Related: Mistakes to Avoid When Applying For a Personal Loan

Buy now, pay later is exactly what it sounds like: an installment loan (albeit with a catchier name). You’ll pay part of your purchase price upfront — often 25% — and the rest in equal installments over a set period. What makes these services particularly enticing is that many don’t charge interest or late fees, and users often find they have an easier time getting approved to use them compared with traditional credit cards.

Related: The Weirdest Reasons People Have Gone Into Debt

Yes. Until now, many buy-now, pay-later users could fly under the radar of the credit bureaus, but those days are over. Equifax is becoming the first major credit bureau to track usage of these services on credit reports, and the other two major players, Experian and TransUnion, are preparing to make similar moves, The Wall Street Journal reports. Of course, this is a double-edged sword. Responsible users of the services will have one more credit-building tool, while those who overuse them or, perhaps worse, miss payments will see their credit scores sink.

Related: Things You Can’t Do With a Low Credit Score

Users lured by a promise of no late fees may become cavalier about on-time payments, which can ultimately lead to run-ins with debt collectors and — especially now — damage to credit scores. And the temptingly low down payments and promises of no interest can encourage overspending, especially considering these services are typically used for discretionary purchases, not necessities. The industry has also attracted unwelcome attention from the Consumer Finance Protection Bureau, which recently opened an investigation into how rapidly users can rack up debt, and how the companies use customers' personal data.

Related: Money Mistakes You're Probably Making and How to Avoid Them

Affirm offers no-interest loans as well as more traditional loans with interest rates up to 30%. There are no late fees.

Afterpay offers no-interest loans only. Users pay a fee if they miss a payment, and those are capped at 25% of the purchase price.

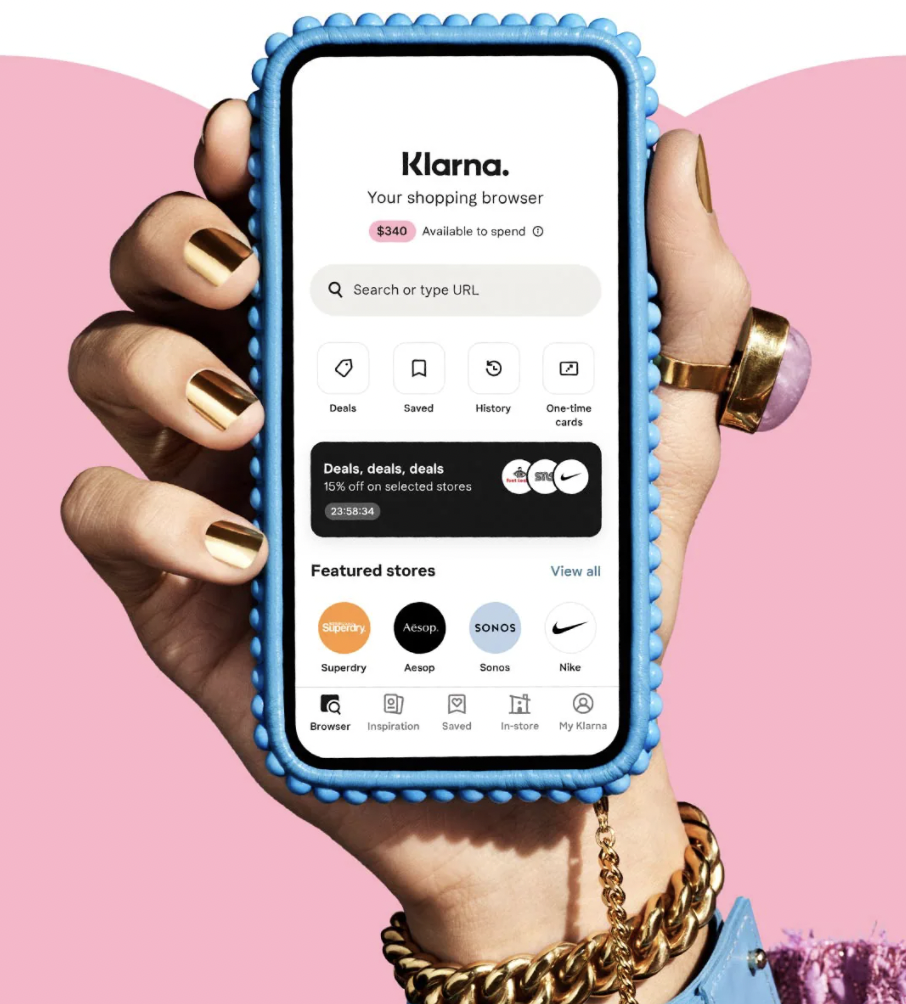

Klarna offers no-interest loans as well as more traditional loans with interest rates up to 30%. It does charge late fees of up to $7 for shorter-term loans, or $35 for longer-term loans.

PayPal offers a no-interest “Pay in 4” service for existing users on select transactions. The transaction amount is divided into four equal chunks. There are no late fees.

Sezzle is similar to Afterpay, offering short-term no-interest loans with no upfront fees. Users pay a $10 fee if they miss a payment.

Related: Money Myths You Need to Ignore

Short answer: Lots of them. What follows is by no means an exhaustive list — simply a roundup of the most prominent retailers that have partnered with buy now, pay later services. And even if a retailer hasn’t partnered directly with such a service, you may still be able to use one by initiating your purchase through the service’s app or website. Another option is to use PayPal’s Pay in 4 service at the many retailers that accept PayPal.

Related: Secrets for International Online Shopping

Until recently, Walmart was one of the last remaining big retailers with a traditional layaway program. But it recently announced it would be axing layaway altogether in favor of Affirm, which it will accept as payment for items including electronics such as TVs and computers, furniture, and larger toys. A full list of items is here. Affirm is also a payment option at Walmart-owned Sam’s Club.

Related: Here's What the First Walmart Stores Actually Sold

Amazon only recently struck a buy-now, pay-later deal with Affirm. It is testing the service with select customers and aims to add more soon, according to The New York Times. Purchases of $50 or more will be eligible, but there will be exceptions, including grocery orders and digital media.

Related: I Stopped Shopping on Amazon and This Is What Happened

Target added two buy-now, pay-later options for customers ahead of the holidays: Affirm, for purchases over $100, and Sezzle, an option for smaller purchases.

Related: Insider Secrets for Big Savings at Target

Macy’s signed on with Klarna this year and allows customers to use the service on in-store and online purchases between $10 and $1,000, except for gift cards and beauty boxes.

Related: Companies That Changed American Culture for Better or Worse

Looking for more personal, handmade purchases? Most Etsy shops accept Klarna. For orders between $50 and $250, four interest-free installment payments are available; for orders over $250, it’s Klarna financing with a personalized interest rate and payment schedule.

For more smart personal-finance tips, please sign up for our free newsletters.

Buy now, pay later has been an option at Gap, Old Navy, Athleta, and Banana Republic since late 2020, when the sister brands struck a deal with Afterpay. The service is available for purchases between $35 and $1,000, excluding gift cards and back-ordered items. Except for a few Old Navy and Gap Factory stores, it’s not available in stores.

Related: Where to Find Cheap Plus-Size Clothing Online

Getting some pricey furniture and want to even out the budgetary pain? The home goods retailer offers financing options through Klarna and Affirm, but the latter is offered only through Wayfair Financing.

Related: Best Places to Buy Cheap Furniture Online

Any beauty buff knows it’s possible to rack up quite a bill in no time at high-end cosmetics retailer Sephora. The retailer allows customers to pay through Klarna on orders up to $1,000, except for gift cards and subscription services.

Whatever you need at Bed Bath & Beyond, the home-focused retailer offers two buy-now, pay-later services: Afterpay and Klarna.

Related: The Craziest Things You Can Buy for Your Kitchen

If you need to make a pricey purchase for Fido, PetSmart has partnered with Affirm and offers the service online and in store on most purchases, though for gift cards.

Related: Can't Get It on Amazon? Where to Shop Instead

Dick’s Sporting Goods offers Affirm online and in select stores.