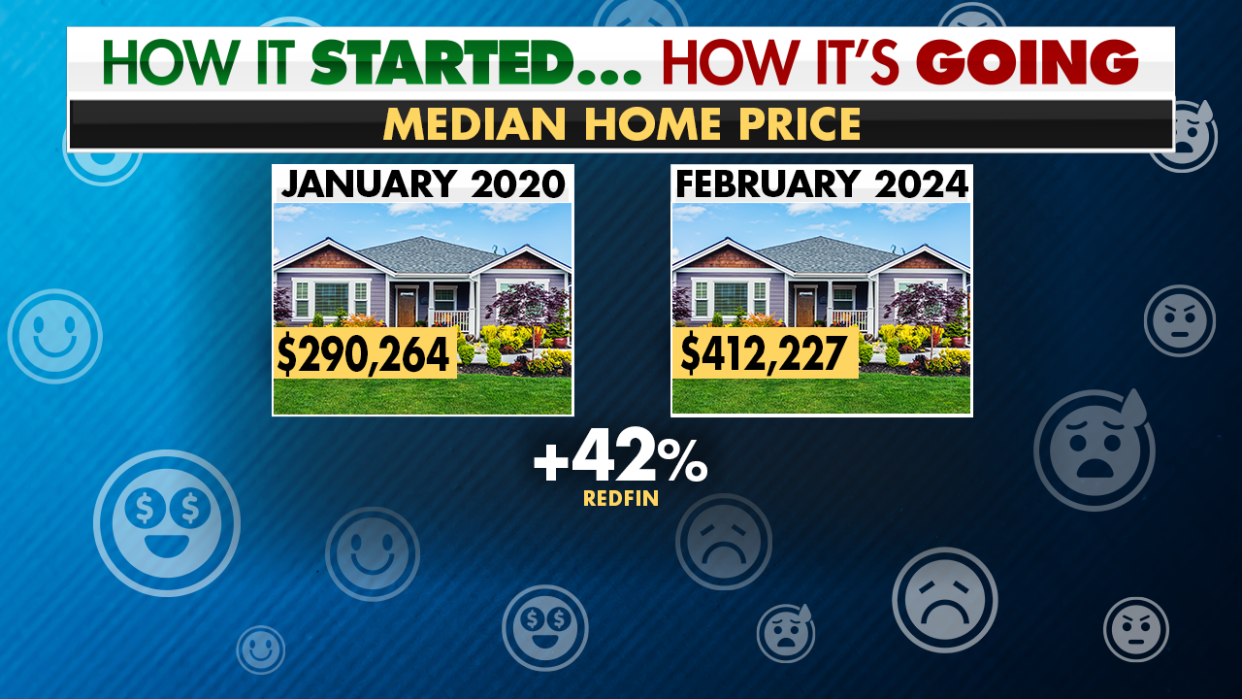

How It Started... How It's Going: Homes have become less affordable since Biden took office

Homes in the United States have become increasingly unaffordable during President Biden’s term in office, with one study showing that buyers in nearly half of the 50 states needed a six-figure salary to afford a median-priced home in January.

While the Biden administration touts how it has "made progress" toward delivering the reality of homeownership for Americans nationwide, it also acknowledges that housing costs are still too high for many potential homeowners, calling it an "inherited" issue.

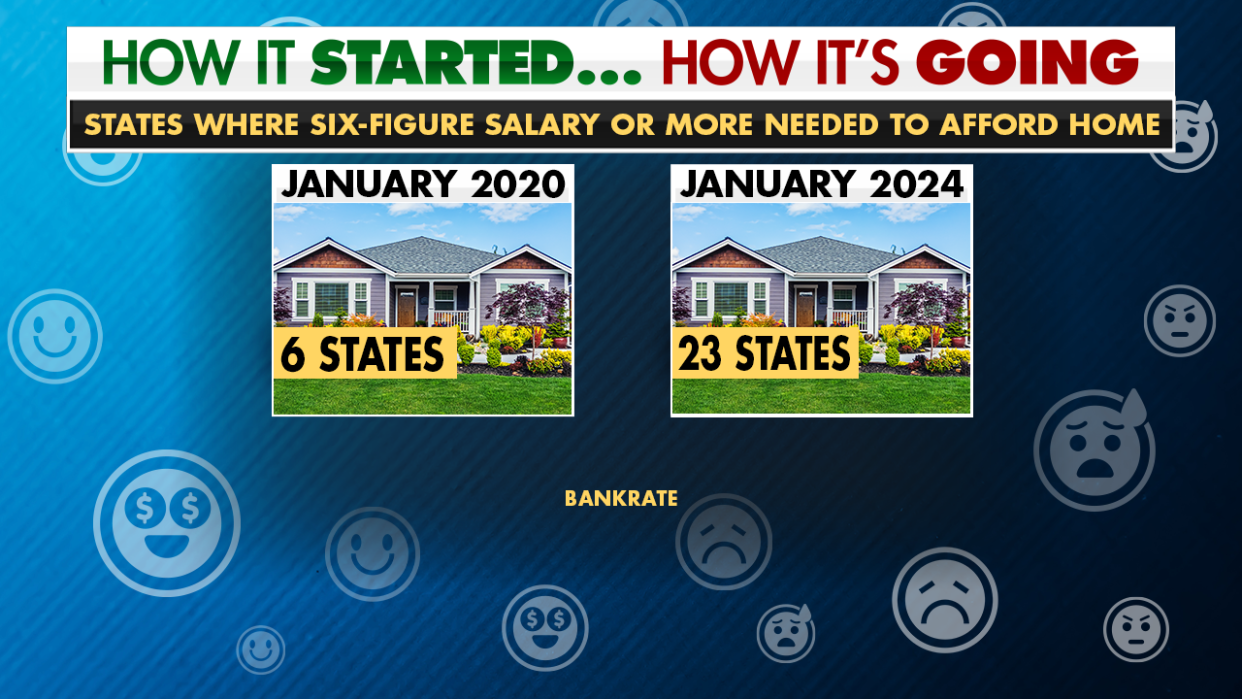

As Biden nears the end of his term, however, a study by Bankrate shows that the number of states that require a six-figure salary to own a median-priced home has increased from six, plus Washington, D.C., in January 2020 – a full year before Biden took office – to 22 states plus the nation’s capital in January 2024. The study listed a median-priced home at $402,343 per real-estate brokerage Redfin.

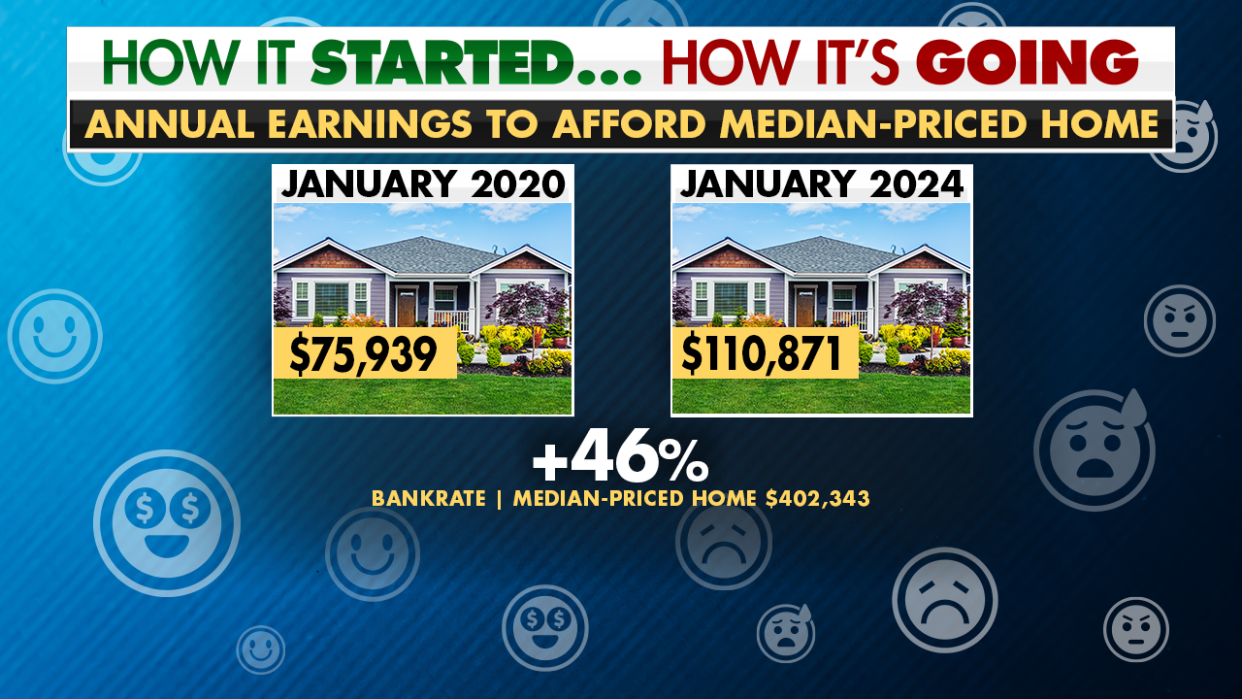

To afford such a home, aspiring homeowners must earn $110,871 annually, a 46% increase from January 2020, according to the report.

"Affordability is the biggest issue – finding a home that’s in your budget," said Bankrate housing market analyst Jeff Ostrowski. "The higher the price of a home, the harder it is to come up with the down payment or to qualify for the monthly payment."

The states that have seen the highest increases in required annual income are Montana (+77.7%), Utah (+70.3%), Tennessee (+70.1%), South Carolina (+67.3%), and Arizona (+65.3%), according to the report.

The five states that have seen the lowest rises are North Dakota (+9.2%), the District of Columbia (+24.6%), Louisiana (+24.9%), Illinois (+27.2%), and Kansas (+29.3%).

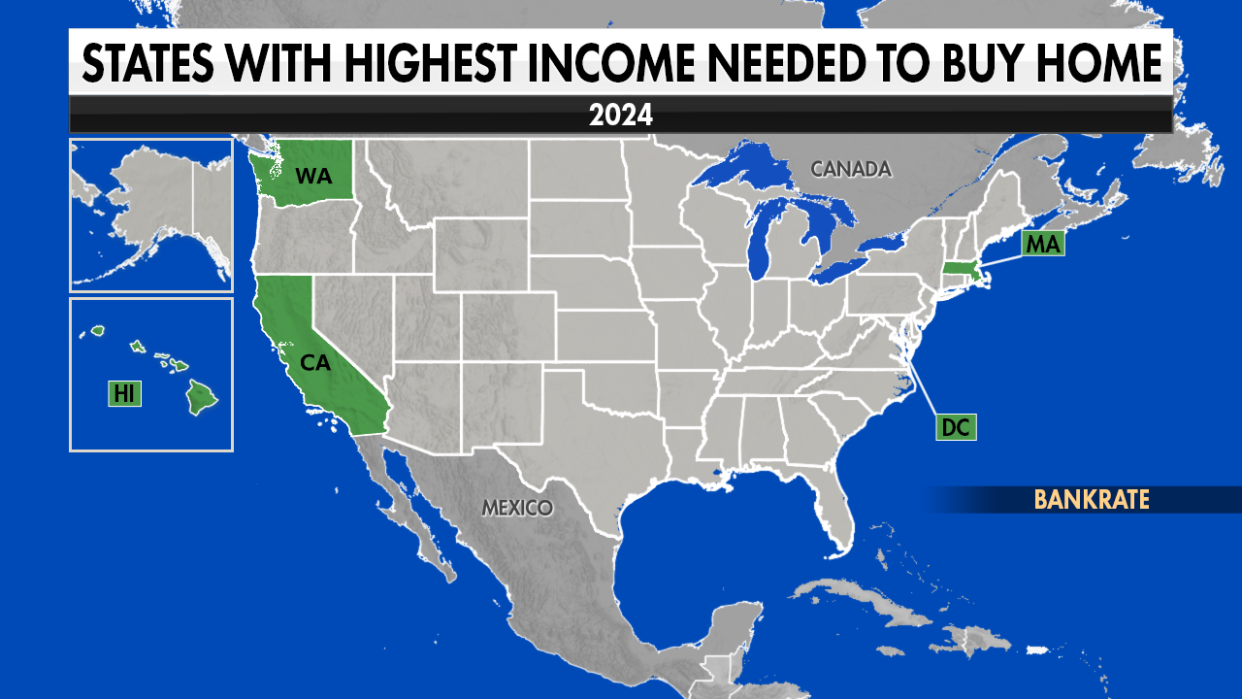

The study also found the states that require the most annual income to purchase a typical home in 2024 are largely located in the West and Northeast. The top five are California ($197,057), Hawaii ($185,829), D.C. ($167,871), Massachusetts ($162,471), and Washington ($156,814).

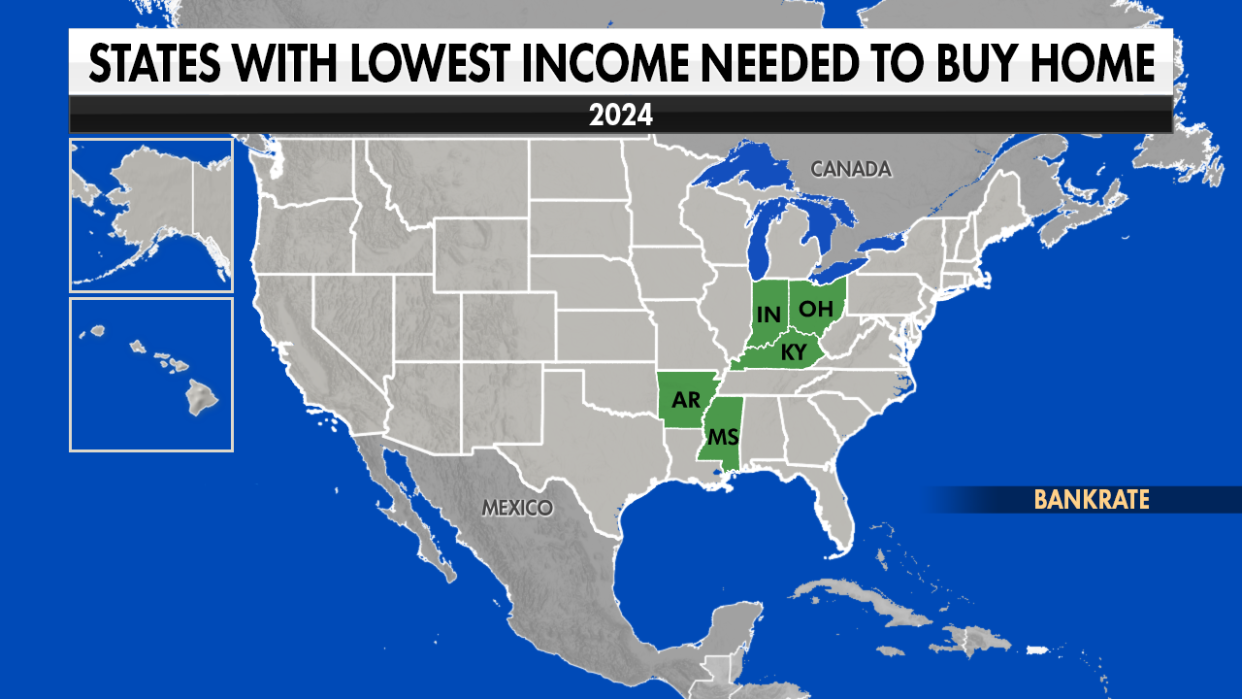

Meanwhile, the five states that require the least annual income to afford a typical home in 2024 are: Mississippi ($63,043), Ohio ($64,071), Arkansas ($64,714), Indiana ($65,143), and Kentucky ($65,186).

Despite wages growing 4.3% in February, rising home prices are still outpacing what Americans can afford.

HOME FORECLOSURES ARE SOARING NATIONWIDE – AND RISING FASTEST IN THESE 5 STATES

"Homes have become less affordable because home price appreciation has so far outpaced wage growth," Ostrowski said.

Ostrowski says supply and demand are factors in the quick rise of home prices.

"Over the past few years, the supply of homes has been constrained by a number of factors, including muted homebuilding and the lock-in effect," Ostrowski said. "But demand for homes has been growing, and there are more buyers than sellers."

Elevated mortgage rates are also limiting supply as potential sellers who are locked into a 2% or 3% mortgage rate are hesitant to sell and take on a higher mortgage rate for a new home purchase.

When Biden took office in January 2021, the average interest rate on a 30-year fixed-rate mortgage reached a new low of 2.5%. As of March 20, Bankrate's survey of large lenders showed these rates reached 7.07%.

VOTERS WILL CAREFULLY CONSIDER HOUSING AFFORDABILITY IN 2024

Housing affordability could be a focus for voters heading into the 2024 presidential election. A recent survey from Redfin found that more than half of the 3,000 participating homeowners and renters admitted that the issue will impact who they vote for in November.

Last month, Biden unveiled a slate of initiatives to try and improve affordability as he seeks re-election.

Part of his efforts include calling on Congress to pass a mortgage relief credit that would provide middle-class first-time homebuyers with an annual tax credit of $5,000 a year for two years. He is also calling on Congress to provide a one-year tax credit of up to $10,000 to middle-class families who sell their starter home.

The Biden administration is also calling on Congress to pass legislation to build and renovate more than 2 million homes to close the housing supply gap and lower costs for renters and buyers.

Fox Business’ Daniella Genovese contributed to this report.

Original article source: How It Started... How It's Going: Homes have become less affordable since Biden took office